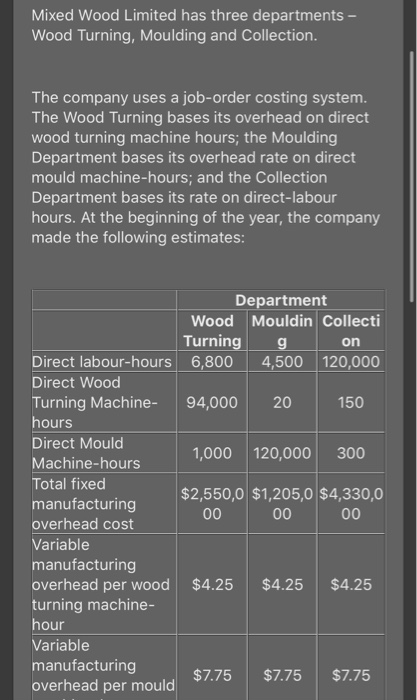

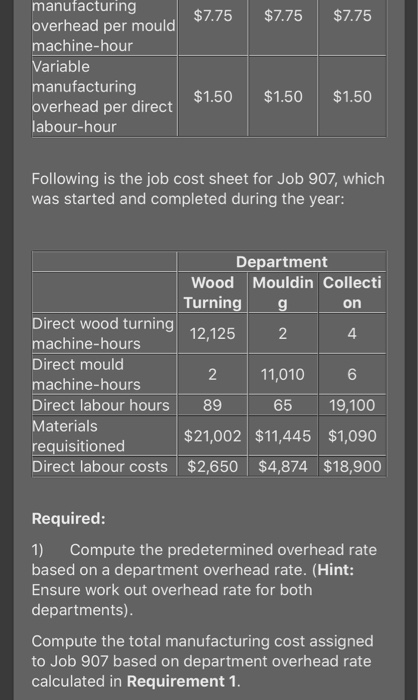

Mixed Wood Limited has three departments - Wood Turning, Moulding and Collection. The company uses a job-order costing system. The Wood Turning bases its overhead on direct wood turning machine hours; the Moulding Department bases its overhead rate on direct mould machine-hours; and the Collection Department bases its rate on direct-labour hours. At the beginning of the year, the company made the following estimates: 20 Department Wood Mouldin Collecti Turning g on Direct labour-hours 6,800 4,500 120,000 Direct Wood Turning Machine 94,000 150 hours Direct Mould 1,000 120,000 300 Machine-hours Total fixed $2,550,0 $1,205,0 $4,330,0 manufacturing 00 00 00 overhead cost Variable manufacturing overhead per wood $4.25 $4.25 $4.25 turning machine- hour Variable manufacturing $7.75 $7.75 $7.75 overhead per mould $7.75 $7.75 $7.75 manufacturing overhead per mould machine-hour Variable manufacturing overhead per direct labour-hour $1.50 $1.50 $1.50 Following is the job cost sheet for Job 907, which was started and completed during the year: Department Wood Mouldin Collecti Turning g on Direct wood turning machine-hours 12,125 2 4 Direct mould 2 machine-hours 11,010 6 Direct labour hours 89 65 19,100 Materials requisitioned $21,002 $11,445 $1,090 Direct labour costs $2,650 $4,874 $18,900 Required: 1) Compute the predetermined overhead rate based on a department overhead rate. (Hint: Ensure work out overhead rate for both departments). Compute the total manufacturing cost assigned to Job 907 based on department overhead rate calculated in Requirement 1. Mixed Wood Limited has three departments - Wood Turning, Moulding and Collection. The company uses a job-order costing system. The Wood Turning bases its overhead on direct wood turning machine hours; the Moulding Department bases its overhead rate on direct mould machine-hours; and the Collection Department bases its rate on direct-labour hours. At the beginning of the year, the company made the following estimates: 20 Department Wood Mouldin Collecti Turning g on Direct labour-hours 6,800 4,500 120,000 Direct Wood Turning Machine 94,000 150 hours Direct Mould 1,000 120,000 300 Machine-hours Total fixed $2,550,0 $1,205,0 $4,330,0 manufacturing 00 00 00 overhead cost Variable manufacturing overhead per wood $4.25 $4.25 $4.25 turning machine- hour Variable manufacturing $7.75 $7.75 $7.75 overhead per mould $7.75 $7.75 $7.75 manufacturing overhead per mould machine-hour Variable manufacturing overhead per direct labour-hour $1.50 $1.50 $1.50 Following is the job cost sheet for Job 907, which was started and completed during the year: Department Wood Mouldin Collecti Turning g on Direct wood turning machine-hours 12,125 2 4 Direct mould 2 machine-hours 11,010 6 Direct labour hours 89 65 19,100 Materials requisitioned $21,002 $11,445 $1,090 Direct labour costs $2,650 $4,874 $18,900 Required: 1) Compute the predetermined overhead rate based on a department overhead rate. (Hint: Ensure work out overhead rate for both departments). Compute the total manufacturing cost assigned to Job 907 based on department overhead rate calculated in Requirement 1