Answered step by step

Verified Expert Solution

Question

1 Approved Answer

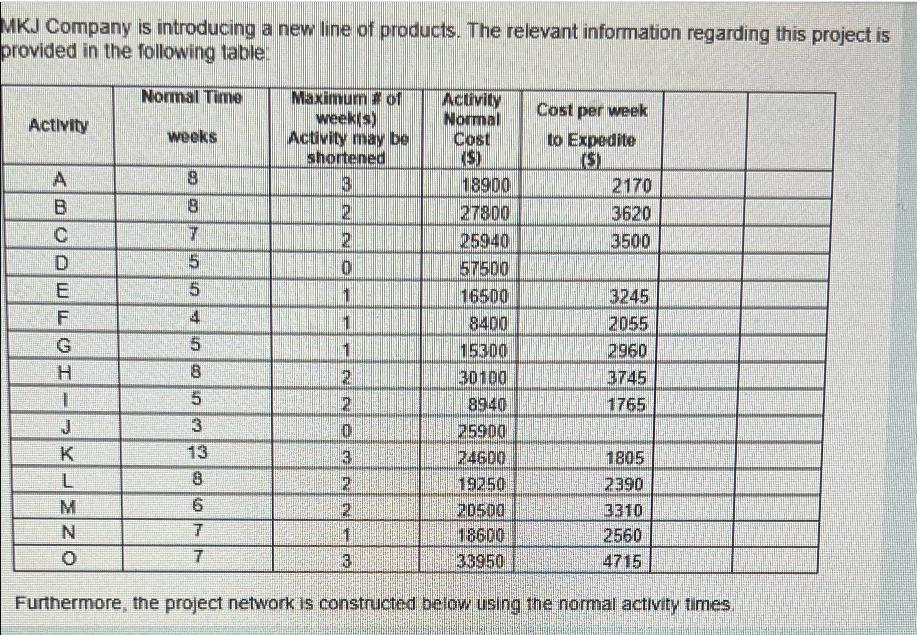

MKJ Company is introducing a new line of products. The relevant information regarding this project is provided in the following table: Activity A TMUSEY

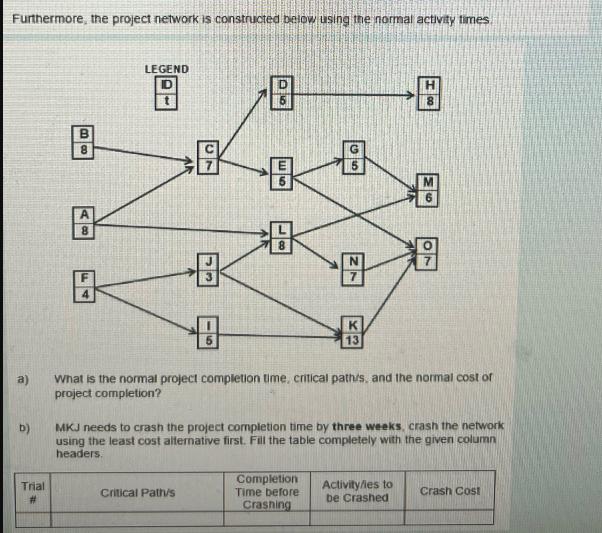

MKJ Company is introducing a new line of products. The relevant information regarding this project is provided in the following table: Activity A TMUSEY C D F G H 1 J K L M N Normal Time weeks 8 187 CO 5 54 5 8 5 13 8 00 4.0 6 7 7 Maximum of Activity weekls) Normal Activity may be Cost shortened ($) 3 NNO 2 0 1 NWONN 2 2 0 2 2 1 18900 27800 25940 57500 16500 8400 15300 30100 8940 25900 74600 19250 20500 18600 33950 Cost per week to Expedite ($) 2170 3620 3500 3245 2055 2960 3745 1765 1805 2390 3310 2560 4715 Furthermore, the project network is constructed below using the normal activity times Furthermore, the project network is constructed below using the normal activity times a) b) Trial B 8 A 8 4 LEGEND D B + 5 B Critical Path/s D6 E5 G5 N # 7 Completion Time before Crashing K 13 What is the normal project completion time, critical pathis, and the normal cost of project completion? H MKJ needs to crash the project completion time by three weeks, crash the network using the least cost alternative first. Fill the table completely with the given column headers. B B Activity/les to be Crashed Crash Cost

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To answer part a of the question we need to determine the normal project completion time the critical paths and the normal cost of project completion ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started