Answered step by step

Verified Expert Solution

Question

1 Approved Answer

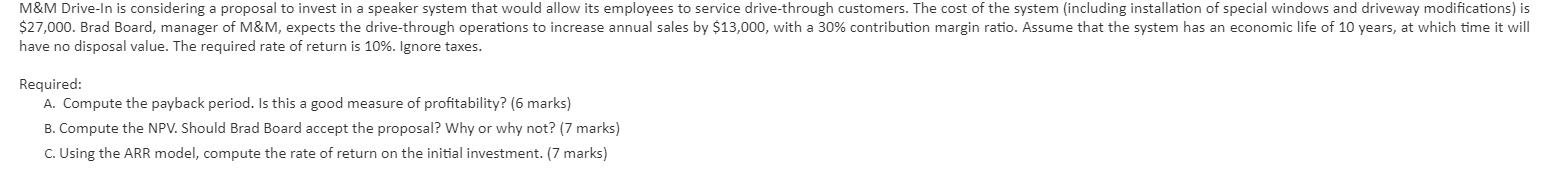

M&M Drive-In is considering a proposal to invest in a speaker system that would allow its employees to service drive-through customers. The cost of

M&M Drive-In is considering a proposal to invest in a speaker system that would allow its employees to service drive-through customers. The cost of the system (including installation of special windows and driveway modifications) is $27,000. Brad Board, manager of M&M, expects the drive-through operations to increase annual sales by $13,000, with a 30% contribution margin ratio. Assume that the system has an economic life of 10 years, at which time it will have no disposal value. The required rate of return is 10%. Ignore taxes. Required: A. Compute the payback period. Is this a good measure of profitability? (6 marks) B. Compute the NPV. Should Brad Board accept the proposal? Why or why not? (7 marks) C. Using the ARR model, compute the rate of return on the initial investment. (7 marks)

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

A Payback period 692 years Payback period tells the how much it would take to recover th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started