Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Moana is a single taxpayer who operates a sole proprietorship. She expects her taxable income next year to be $250,000, of which $200,000 is attributed

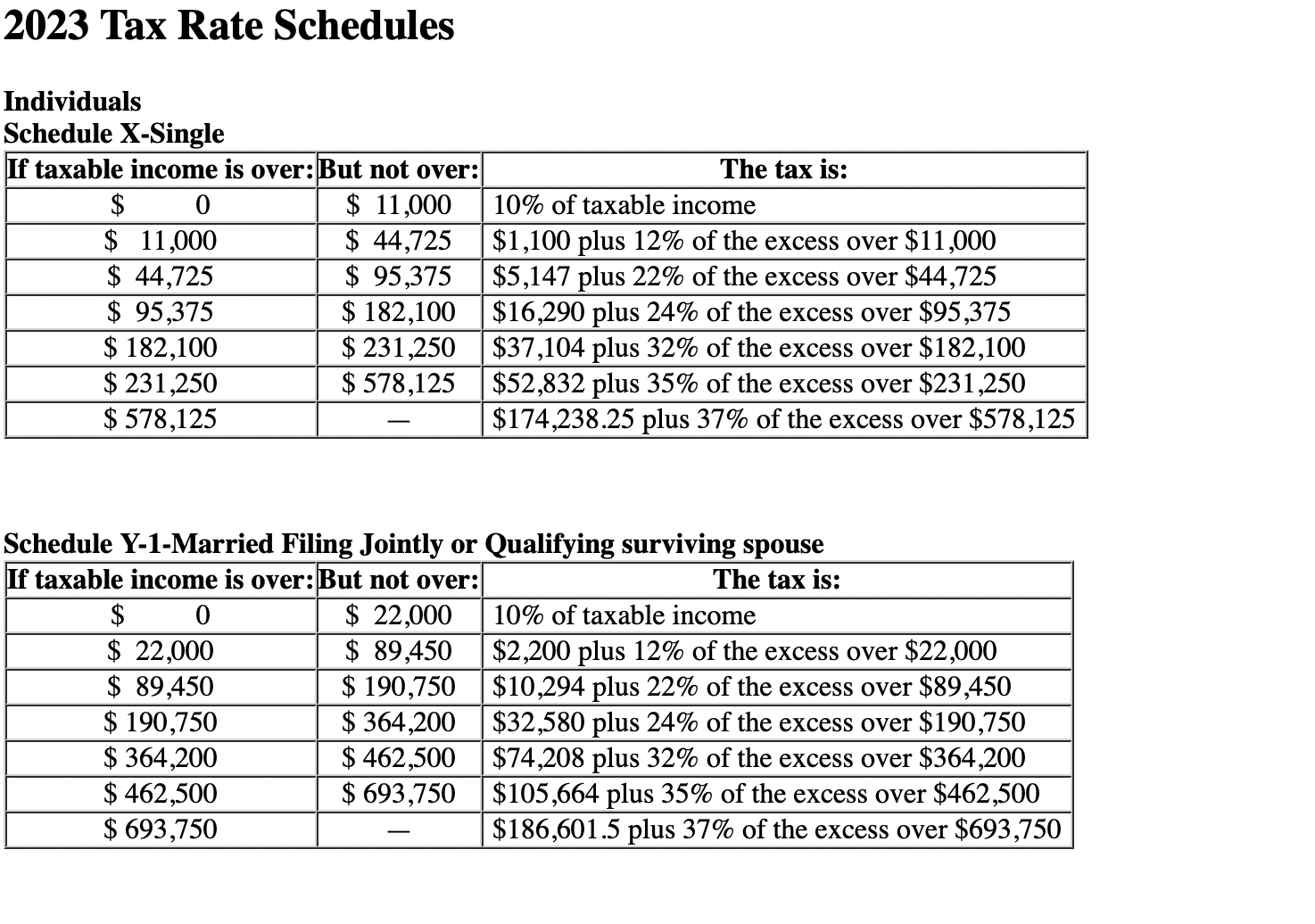

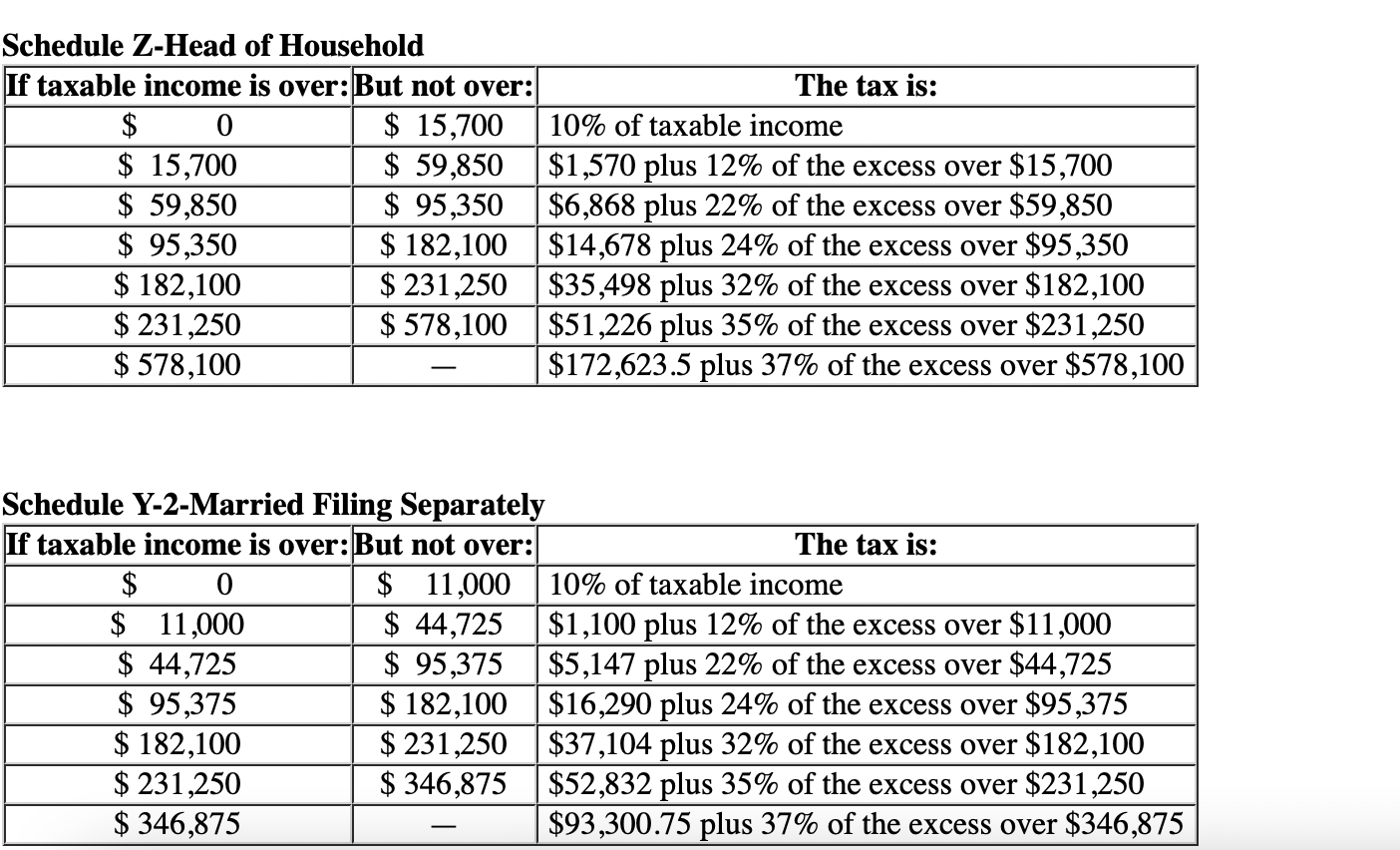

Moana is a single taxpayer who operates a sole proprietorship. She expects her taxable income next year to be $250,000, of which $200,000 is attributed to her sole proprietorship. Moana is contemplating incorporating her sole proprietorship. (Use the tax rate schedule.)

Required:

- Using the single individual tax brackets and the corporate tax rate, find out how much current tax this strategy could save Moana (ignore any Social Security, Medicare, or self-employment tax issues).

- How much income should be left in the corporation?

2023 Tax Rate Schedules Individuals Conoduln V Cimol Schedule Z-Head of Household \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$0 & $15,700 & 10% of taxable income \\ \hline$15,700 & $59,850 & $1,570 plus 12% of the excess over $15,700 \\ \hline$59,850 & $95,350 & $6,868 plus 22% of the excess over $59,850 \\ \hline$95,350 & $182,100 & $14,678 plus 24% of the excess over $95,350 \\ \hline$182,100 & $231,250 & $35,498 plus 32\% of the excess over $182,100 \\ \hline$231,250 & $578,100 & $51,226 plus 35\% of the excess over $231,250 \\ \hline$578,100 & - & $172,623.5 plus 37% of the excess over $578,100 \\ \hline \multicolumn{3}{|c}{} \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$10 & $11,000 & 10% of taxable income \\ \hline$11,000 & $44,725 & $1,100 plus 12% of the excess over $11,000 \\ \hline$44,725 & $95,375 & $5,147 plus 22% of the excess over $44,725 \\ \hline$95,375 & $182,100 & $16,290 plus 24% of the excess over $95,375 \\ \hline$182,100 & $231,250 & $37,104 plus 32% of the excess over $182,100 \\ \hline$231,250 & $346,875 & $52,832 plus 35% of the excess over $231,250 \\ \hline$346,875 & - & $93,300.75 plus 37% of the excess over $346,875 \\ \hline \end{tabular}

2023 Tax Rate Schedules Individuals Conoduln V Cimol Schedule Z-Head of Household \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$0 & $15,700 & 10% of taxable income \\ \hline$15,700 & $59,850 & $1,570 plus 12% of the excess over $15,700 \\ \hline$59,850 & $95,350 & $6,868 plus 22% of the excess over $59,850 \\ \hline$95,350 & $182,100 & $14,678 plus 24% of the excess over $95,350 \\ \hline$182,100 & $231,250 & $35,498 plus 32\% of the excess over $182,100 \\ \hline$231,250 & $578,100 & $51,226 plus 35\% of the excess over $231,250 \\ \hline$578,100 & - & $172,623.5 plus 37% of the excess over $578,100 \\ \hline \multicolumn{3}{|c}{} \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$10 & $11,000 & 10% of taxable income \\ \hline$11,000 & $44,725 & $1,100 plus 12% of the excess over $11,000 \\ \hline$44,725 & $95,375 & $5,147 plus 22% of the excess over $44,725 \\ \hline$95,375 & $182,100 & $16,290 plus 24% of the excess over $95,375 \\ \hline$182,100 & $231,250 & $37,104 plus 32% of the excess over $182,100 \\ \hline$231,250 & $346,875 & $52,832 plus 35% of the excess over $231,250 \\ \hline$346,875 & - & $93,300.75 plus 37% of the excess over $346,875 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started