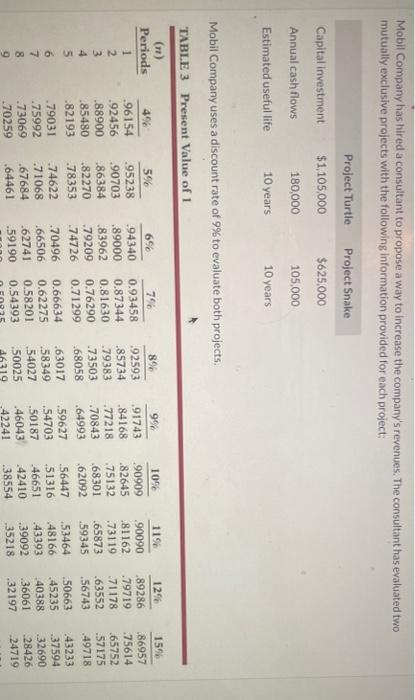

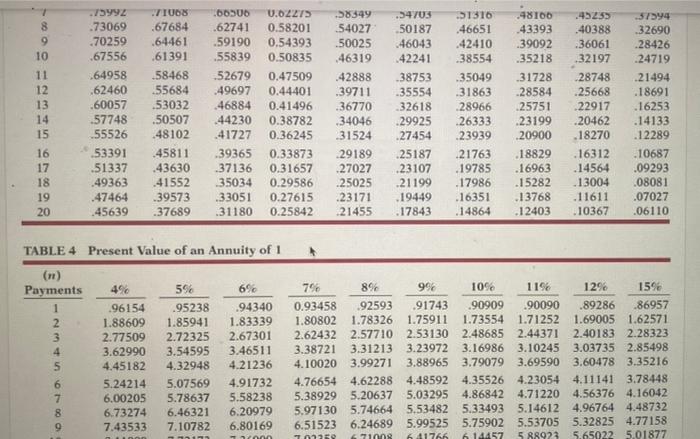

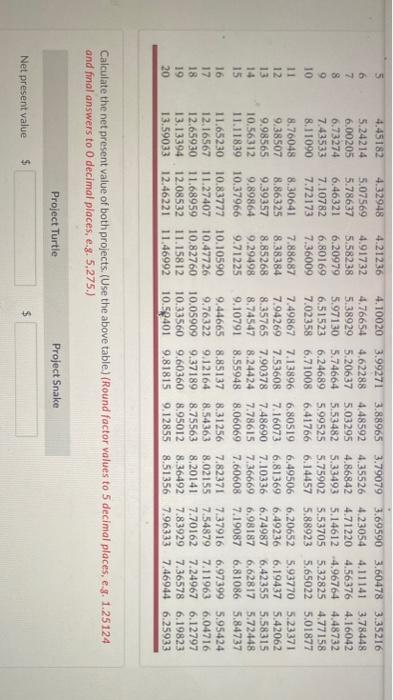

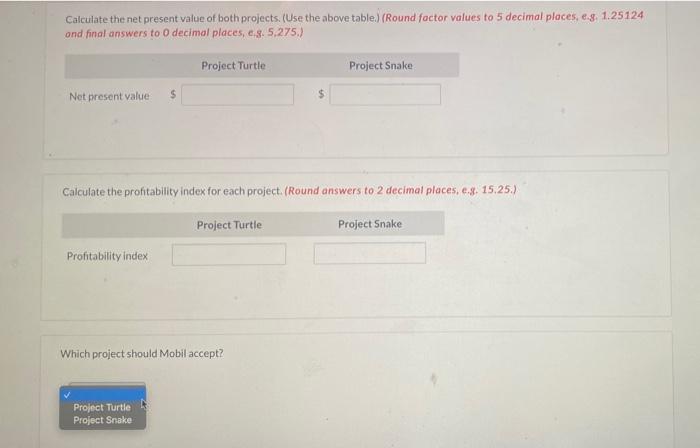

Mobil Company has hired a consultant to propose a way to increase the company's revenues. The consultant has evaluated two mutually exclusive projects with the following information provided for each project: Capital investment Project Turtle $1,105,000 180,000 Project Snake $625.000 105.000 Annual cash flows Estimated useful life 10 years 10 years Mobil Company uses a discount rate of 9% to evaluate both projects. TABLE 3 Present Value of 1 (n) 596 Periods 1 2 3 4 496 .96154 .92456 .88900 .85480 82193 -79031 75992 .73069 -70259 .95238 .90703 86384 .82270 .78353 74622 .71068 .67684 .64461 696 94340 .89000 .83962 .79209 74726 .70496 .66506 .62741 -59190 79 0.93458 0.87344 0.81630 0.76290 0.71299 0.66634 0.62275 0.58201 0.54393 8% 92593 .85734 .79383 .73503 .68058 .63017 58349 54027 50025 16210 99 91743 .84168 .77218 .70843 .64993 59627 .54703 .50187 .46043 42241 10% 90909 .82645 .75132 68301 .62092 56447 -51316 -46651 42410 .38554 1196 90090 .81162 -73119 .65873 59345 .53464 .48166 .43393 -39092 .35218 1296 .89286 .79719 .71178 .63552 56743 -50663 .45235 40388 .36061 .32197 15 86957 75614 .65752 -57175 49718 43233 .37594 32690 28426 24719 6 7 8 9 00 :. 8 9 10 11 12 13 14 15 .73069 .70259 .67556 .64958 .62460 .60057 ..57748 55526 53391 .51337 .49363 .47464 .45639 ZIUS .67684 .64461 .61391 .58468 .55684 .53032 50507 48102 45811 .43630 .41552 .39573 .37689 200306 .62741 .59190 .55839 .52679 -49697 .46884 44230 41727 39365 .37136 35034 33051 31180 0.02273 0.58201 0.54393 0.50835 0.47509 0.44401 0.41496 0.38782 0.36245 0.33873 0.31657 0.29586 0.27615 0.25842 38349 54027 .50025 46319 .42888 -39711 .36770 .34046 31524 .29189 .27027 25025 23171 21455 .34705 .50187 446043 42241 38753 -35554 32618 .29925 .27454 25187 .23107 .21199 .19449 .17843 .31316 46651 42410 -38554 .35049 .31863 .28966 .26333 23939 21763 .19785 -17986 .16351 .14864 .48100 .43393 .39092 .35218 31728 .28584 .25751 23199 .20900 .18829 .16963 .15282 .13768 .12403 45255 40388 36061 .32197 28748 .25668 22917 .20462 .18270 .16312 .14564 13004 .11611 .10367 .57544 .32690 .28426 .24719 .21494 .18691 .16253 .14133 .12289 .10687 .09293 08081 .07027 .06110 16 17 18 19 20 TABLE4 Present Value of an Annuity of 1 6% (n) Payments 1 2 3 4 5 WN 4% 96154 1.88609 2.77509 3.62990 4.45182 5.24214 6.00205 6.73274 7.43533 596 .95238 1.85941 2.72325 3.54595 4.32948 5.07569 5.78637 6.46321 7.10782 .94340 1.83339 2.67301 3.46511 4.21236 4.91732 5.58238 6.20979 6.80169 790 896 99 10% 11% 129 15% 0.93458 92593 .91743 .90909 .90090 .89286 .86957 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 10259 671008 641766614457 5 88923 5.650225.01877 000 6 7 8 9 - 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 4.45182 4.32948 4.21236 5.24214 5.07569 4.91732 6.00205 5.78637 5.58238 6.73274 6.46321 6.20979 7.43533 7.10782 6.80169 8.11090 7.72173 7.36009 8.76048 8.30641 7.88687 9.38507 8.86325 8.38384 9.98565 9.39357 8.85268 10.56312 9.89864 9.29498 11.11839 10.37966 9.71225 11.65230 10.83777 10.10590 12.16567 11.27407 10.47726 12.65930 11.68959 10.82760 13.13394 12.08532 11.15812 13.59033 12.46221 11.46992 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 4.76654 4,62288 4.48592 4.35526 4.23054 4.11141 3.78448 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 7.02358 6.710086.417666.14457 5.88923 5.65022 5.01877 7.49867 7.13896 6.80519 6.49506 6,20652 5.93770 5.23371 7.94269 7.53608 7.16073 6,81369 6.49236 6.19437 5.42062 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315 8.74547 8.24424 7.78615 7.36669 6.98187 6,62817 5.72448 9.10791 8.55948 8.06069 7,60608 7.19087 6.81086 5.84737 9.446658.85137 8.31256 7.82371 7.37916 6.97399 5.95424 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 6.04716 10.059099.37189 8.755638,20141 7.70162 7.24967 6.12797 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 10.52401 9.81815 9.12855 8.51356 7.96333 7.46944 6.25933 . Calculate the net present value of both projects. (Use the above table.) (Rourd factor values to 5 decimal places, eg. 1.25124 and final answers to 0 decimal places, e.g. 5,275.) Project Turtle Project Snake Net present value $ $ Calculate the net present value of both projects. (Use the above table.) (Round factor values to 5 decimal places, e.3. 1.25124 ond final answers to o decimal places, eg. 5,275.) Project Turtle Project Snake Net present value $ $ Calculate the profitability index for each project. (Round answers to 2 decimal places, e.g. 15.25.) Project Turtle Project Snake Profitability index Which project should Mobil accept? Project Turtle Project Snake