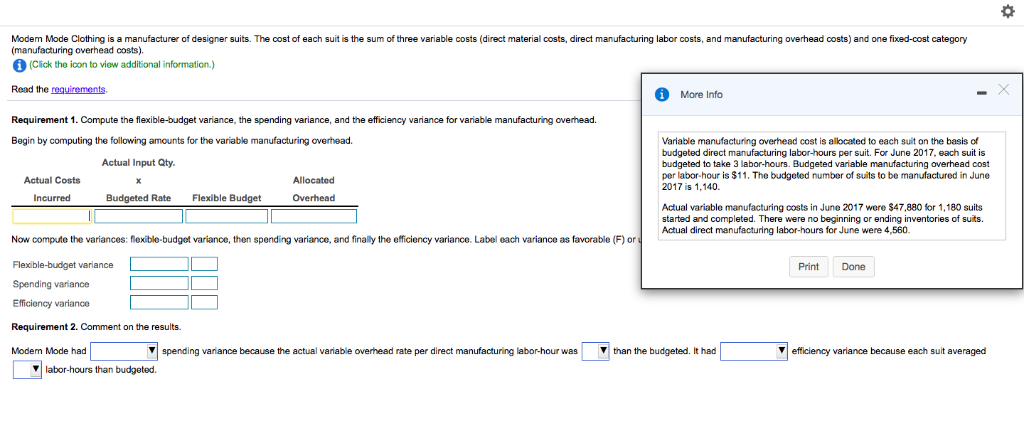

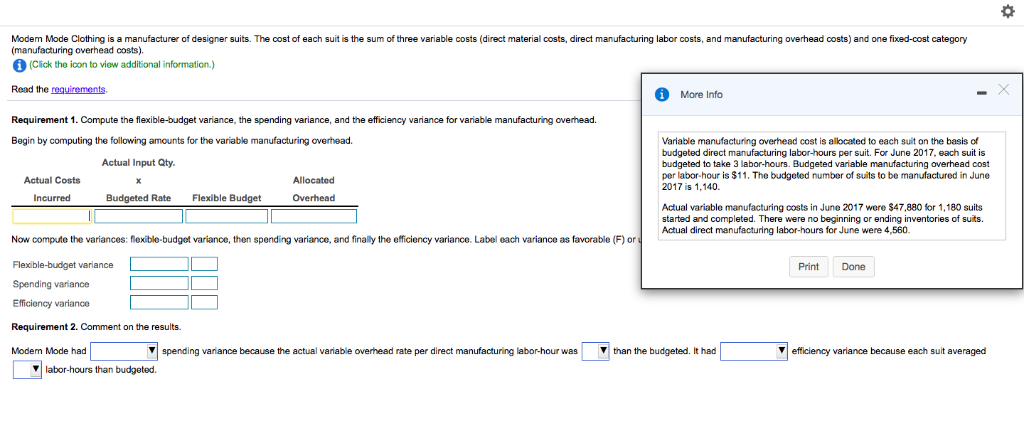

Modern Mode Clothing is a manufacturer of designer suits. The cost of each suit is the sum of three variable costs (direct material costs, direct manufacturing labor costs, and manufacturing overhead costs) and one fixed-cost category (manufacturing overhead costs). (Click the icon to view additional information.) Read the requirements. Requirement 1. Compute the flexible-budget variance, the spending variance, and the efficiency variance for variable manufacturing overhead. Begin by computing the following amounts for the variable manufacturing overhead. More Info Variable manufacturing overhead cost is allocated to each suit on the basis of budgeted direct manufacturing labor-hours per suit. For June 2017, each suit is budgeted to take 3 labor-hours. Budgeted variable manufacturing overhead cost per labor-hour is $11. The budgeted number of suits to be manufactured in June 2017 is 1,140. Actual Input Qty. Actual Costs Allocated Budgeted Rate Flexible Budget Overhead Incurred Actual variable manufacturing costs in June 2017 were $47,880 for 1,180 suits started and completed. There were Actual direct manufacturing labor-hours for June were 4,560. no beginning or ending inventories of suits. Now compute the variances: flexible-budget variance, then spending variance, and finally the efficiency variance. Label each variance as favorable (F) or Print Done Spending variance Efficiency variance Requirement 2. Comment on the results Modem Mode had | spending vanance because the actual variable overhead rate per direct manufacturing labor-hour was than the budgeted. It had efficiency variance because each suit averaged labor-hours than budgeted. Modern Mode Clothing is a manufacturer of designer suits. The cost of each suit is the sum of three variable costs (direct material costs, direct manufacturing labor costs, and manufacturing overhead costs) and one fixed-cost category (manufacturing overhead costs). (Click the icon to view additional information.) Read the requirements. Requirement 1. Compute the flexible-budget variance, the spending variance, and the efficiency variance for variable manufacturing overhead. Begin by computing the following amounts for the variable manufacturing overhead. More Info Variable manufacturing overhead cost is allocated to each suit on the basis of budgeted direct manufacturing labor-hours per suit. For June 2017, each suit is budgeted to take 3 labor-hours. Budgeted variable manufacturing overhead cost per labor-hour is $11. The budgeted number of suits to be manufactured in June 2017 is 1,140. Actual Input Qty. Actual Costs Allocated Budgeted Rate Flexible Budget Overhead Incurred Actual variable manufacturing costs in June 2017 were $47,880 for 1,180 suits started and completed. There were Actual direct manufacturing labor-hours for June were 4,560. no beginning or ending inventories of suits. Now compute the variances: flexible-budget variance, then spending variance, and finally the efficiency variance. Label each variance as favorable (F) or Print Done Spending variance Efficiency variance Requirement 2. Comment on the results Modem Mode had | spending vanance because the actual variable overhead rate per direct manufacturing labor-hour was than the budgeted. It had efficiency variance because each suit averaged labor-hours than budgeted