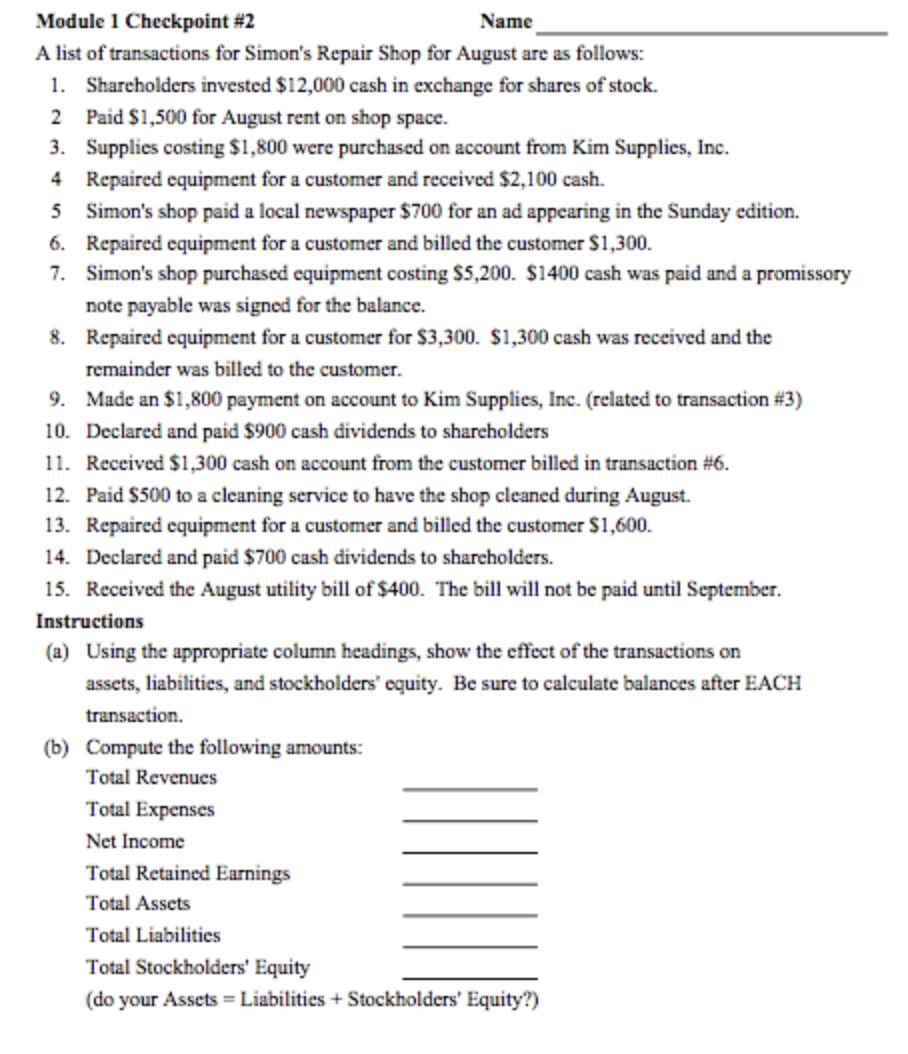

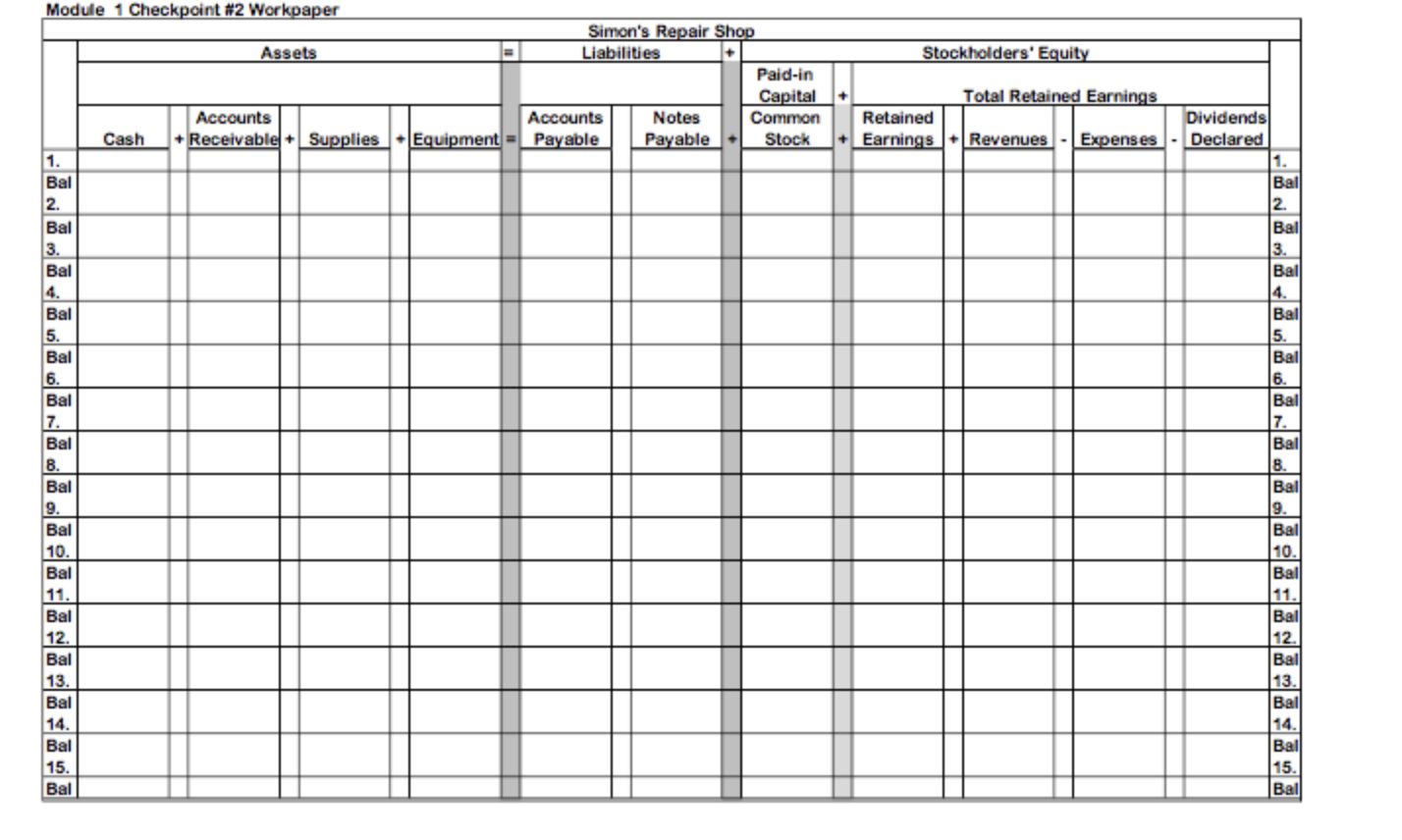

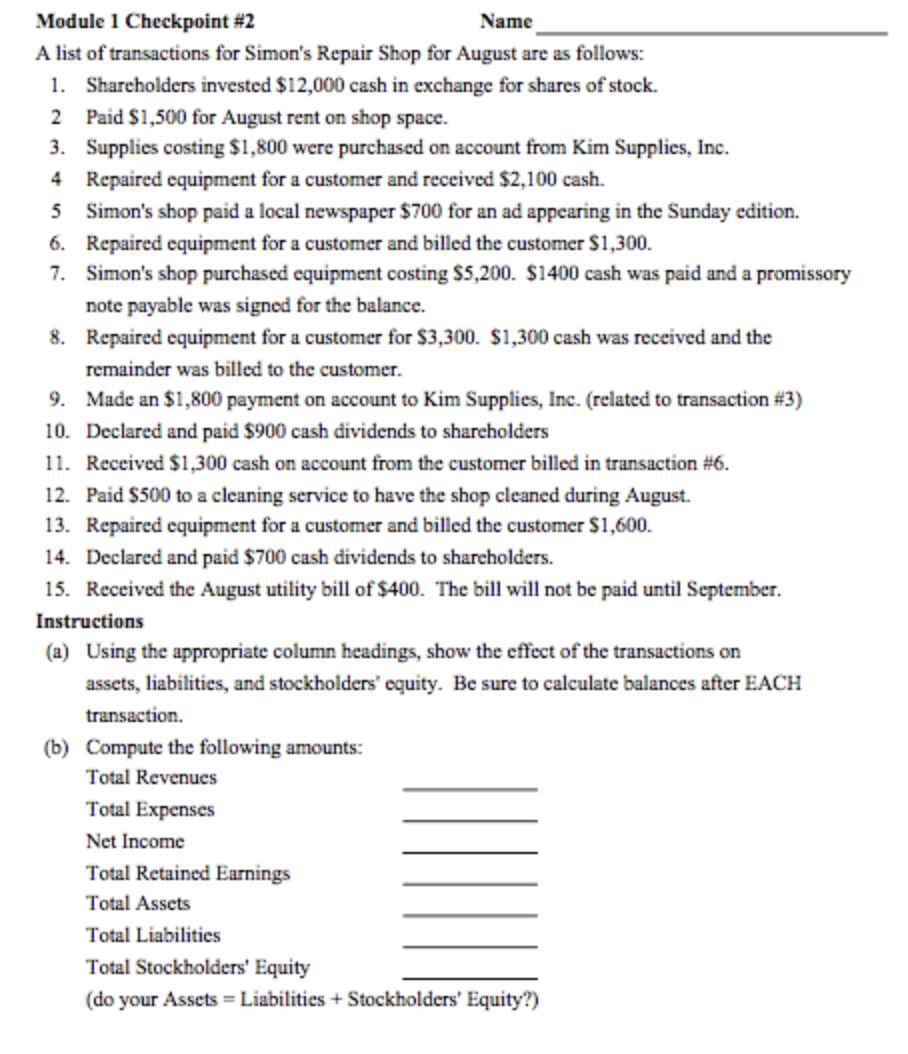

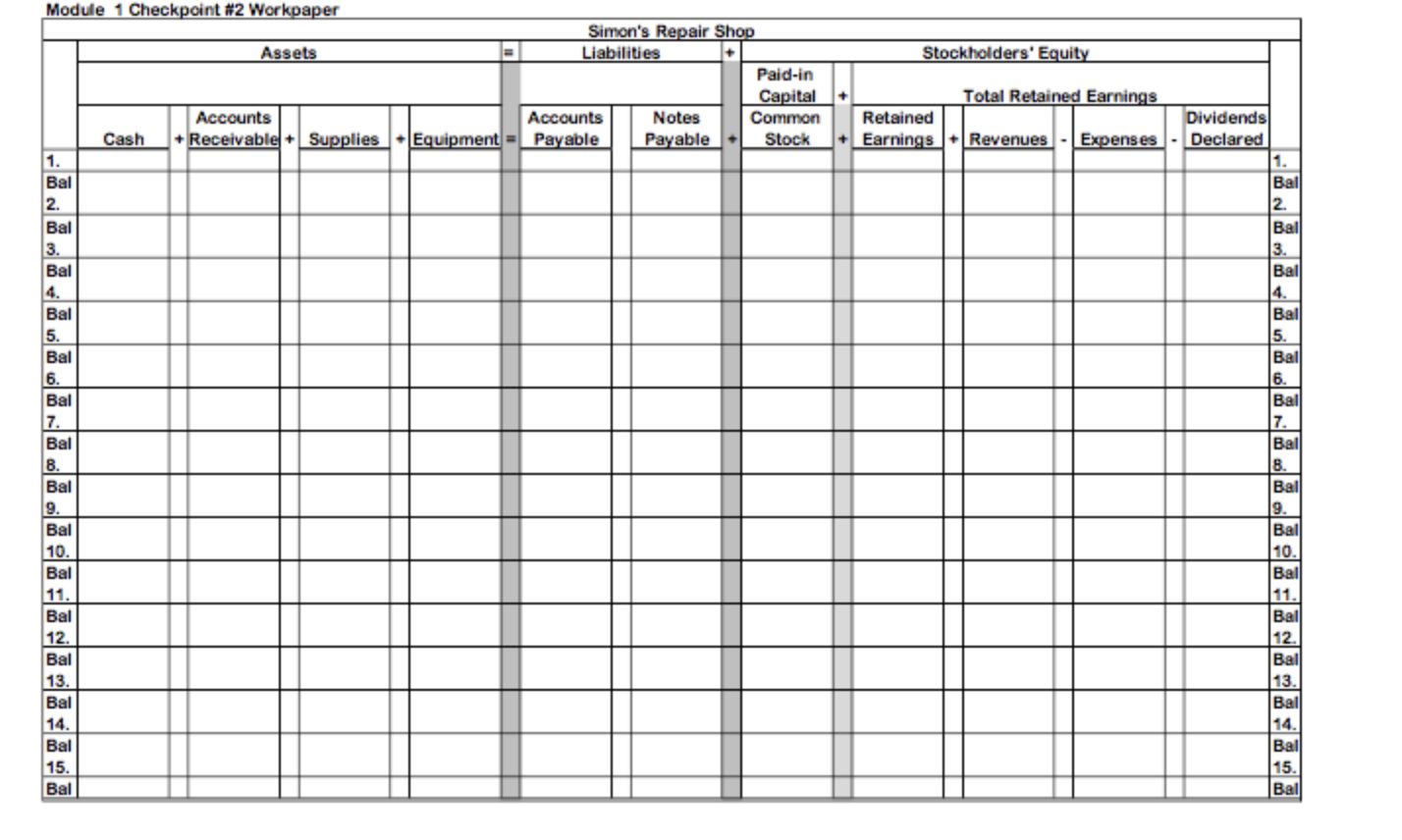

Module 1 Checkpoint #2 Name A list of transactions for Simon's Repair Shop for August are as follows: 1. Shareholders invested $12,000 cash in exchange for shares of stock. 2 Paid $1,500 for August rent on shop space. 3. Supplies costing $1,800 were purchased on account from Kim Supplies, Inc. 4 Repaired equipment for a customer and received $2,100 cash. 5 Simon's shop paid a local newspaper $700 for an ad appearing in the Sunday edition. 6. Repaired equipment for a customer and billed the customer $1,300. 7. Simon's shop purchased equipment costing $5,200. $1400 cash was paid and a promissory note payable was signed for the balance. 8. Repaired equipment for a customer for $3,300. $1,300 cash was received and the remainder was billed to the customer. 9. Made an $1,800 payment on account to Kim Supplies, Inc. (related to transaction #3) 10. Declared and paid $900 cash dividends to shareholders 11. Received $1,300 cash on account from the customer billed in transaction #6. 12. Paid $500 to a cleaning service to have the shop cleaned during August. 13. Repaired equipment for a customer and billed the customer $1,600. 14. Declared and paid $700 cash dividends to shareholders. 15. Received the August utility bill of $400. The bill will not be paid until September. Instructions (a) Using the appropriate column headings, show the effect of the transactions on assets, liabilities, and stockholders' equity. Be sure to calculate balances after EACH transaction. (b) Compute the following amounts: Total Revenues Total Expenses Net Income Total Retained Earnings Total Assets Total Liabilities Total Stockholders' Equity (do your Assets = Liabilities + Stockholders' Equity?) Module 1 Checkpoint #2 Workpaper Assets Stockholders' Equity Simon's Repair Shop Liabilities Paid-in Capital Accounts Notes Common Equipment = Payable Payable Stock Accounts + Receivable Supplies Cash 1. Bal 2. Bal 3. Bal Bal 5. Bal 6. Bal 7. Bal 8. Bal 9. Total Retained Earnings Retained Dividends + Earnings +Revenues - Expenses - Declared 1. Bal 2. Bal 3. Bal 4. Ball 5. Bal 6. Ball 7. Bal 8. Bal 9. Bal 10. Bal 11. Ball 12. Bal 13. Bal 14. Bal 15. Bal Bal 10. Bal 11. Bal 12. Bal 13. Bal 14. Bal 15. Bal