Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Laguna Bhd. is a company incorporated in Malaysia. The company involved in manufacturing, packaging and marketing of frozen food and beverages products

Old MathJax webview

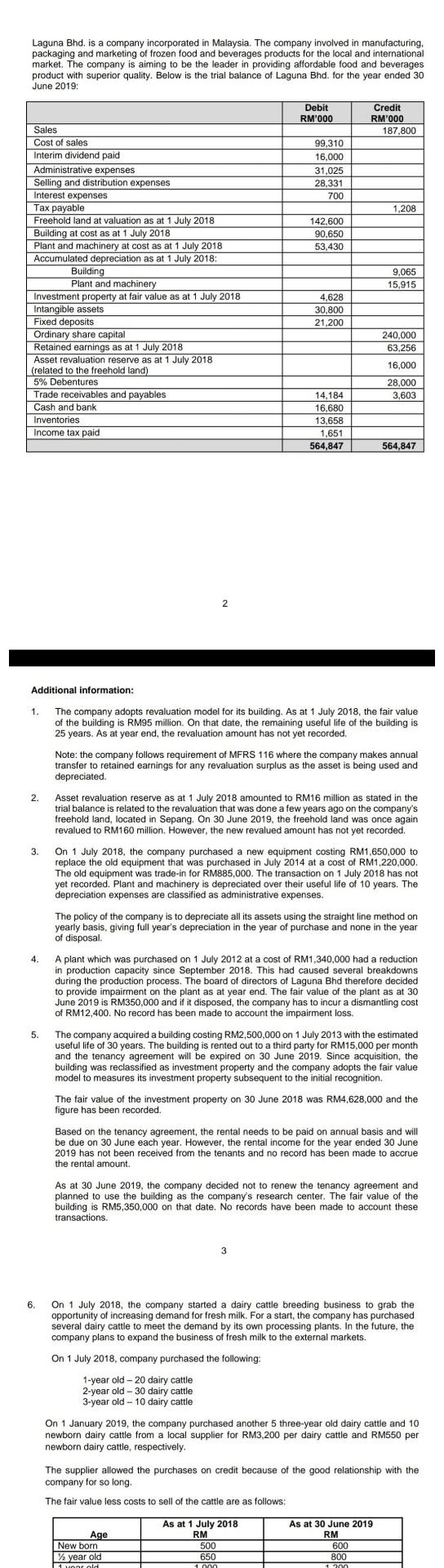

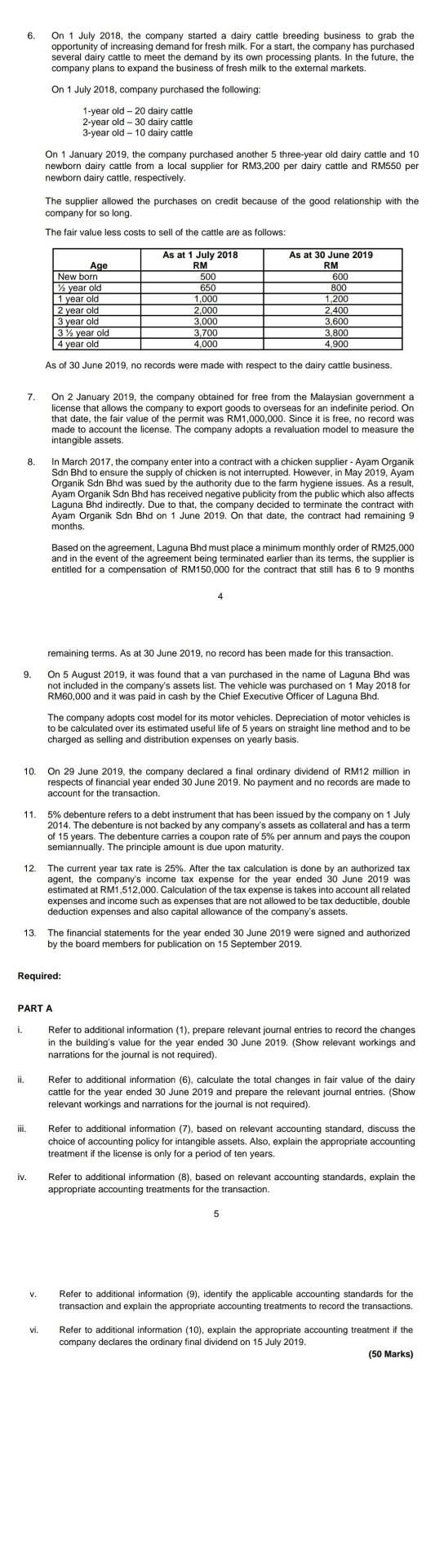

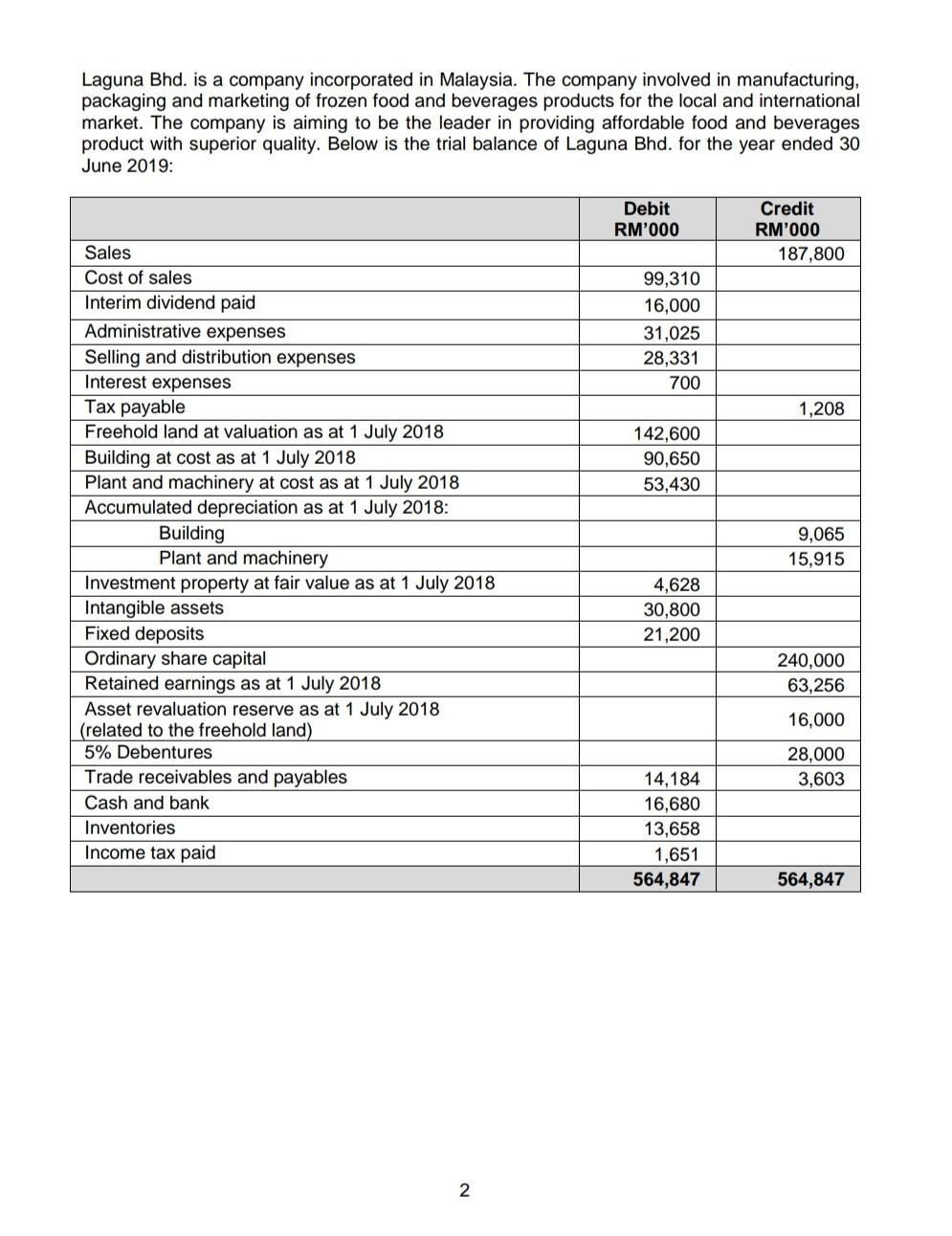

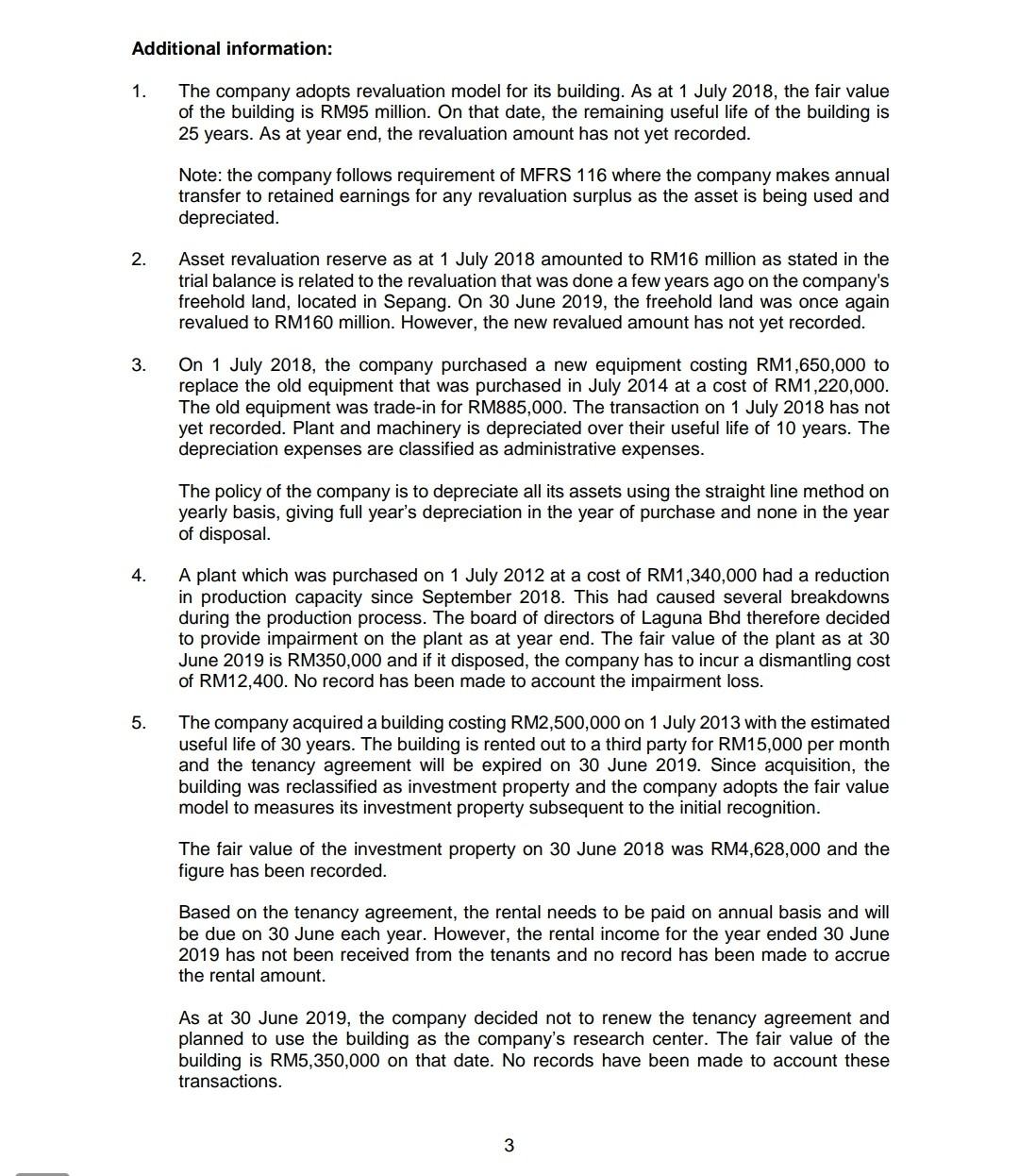

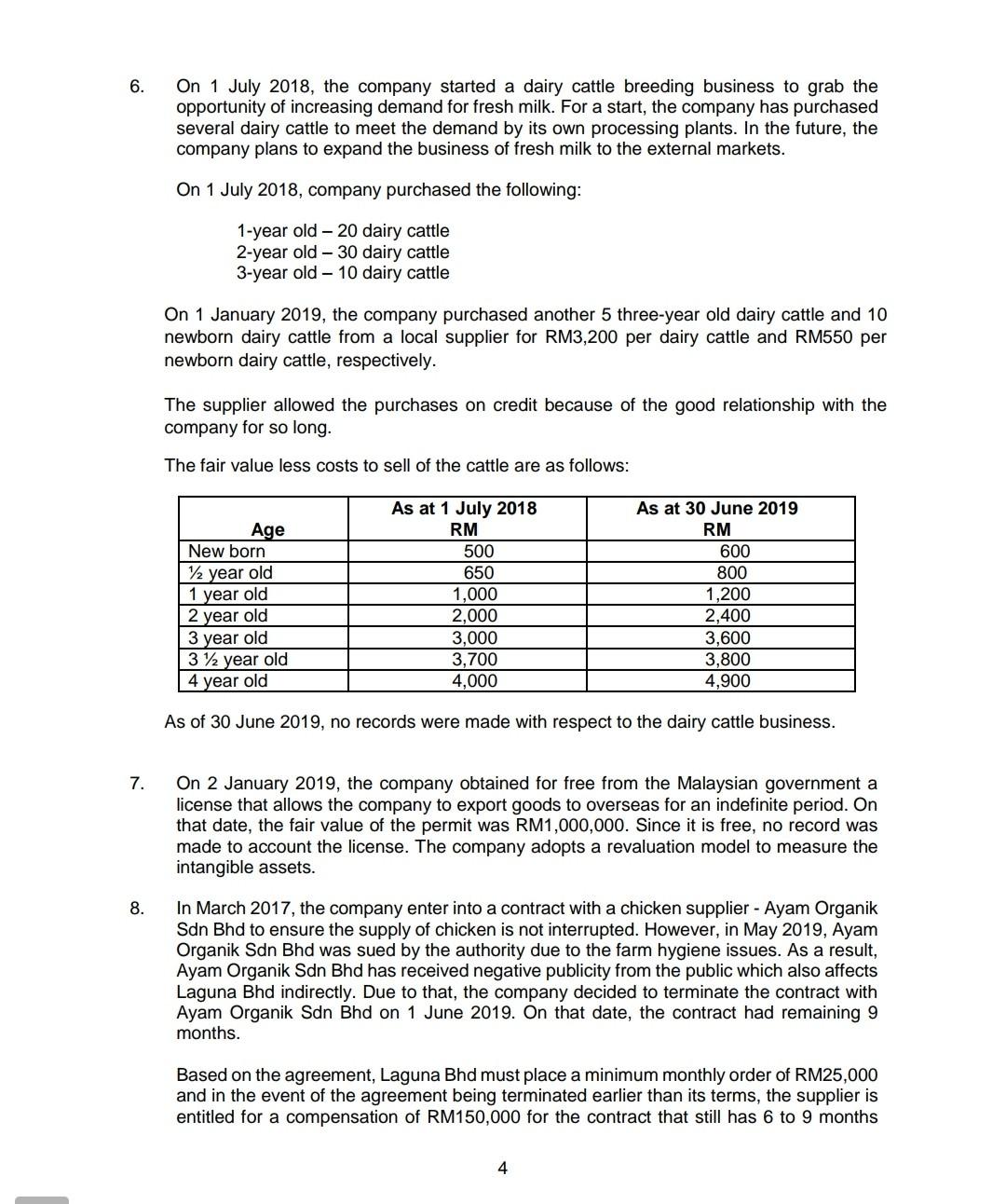

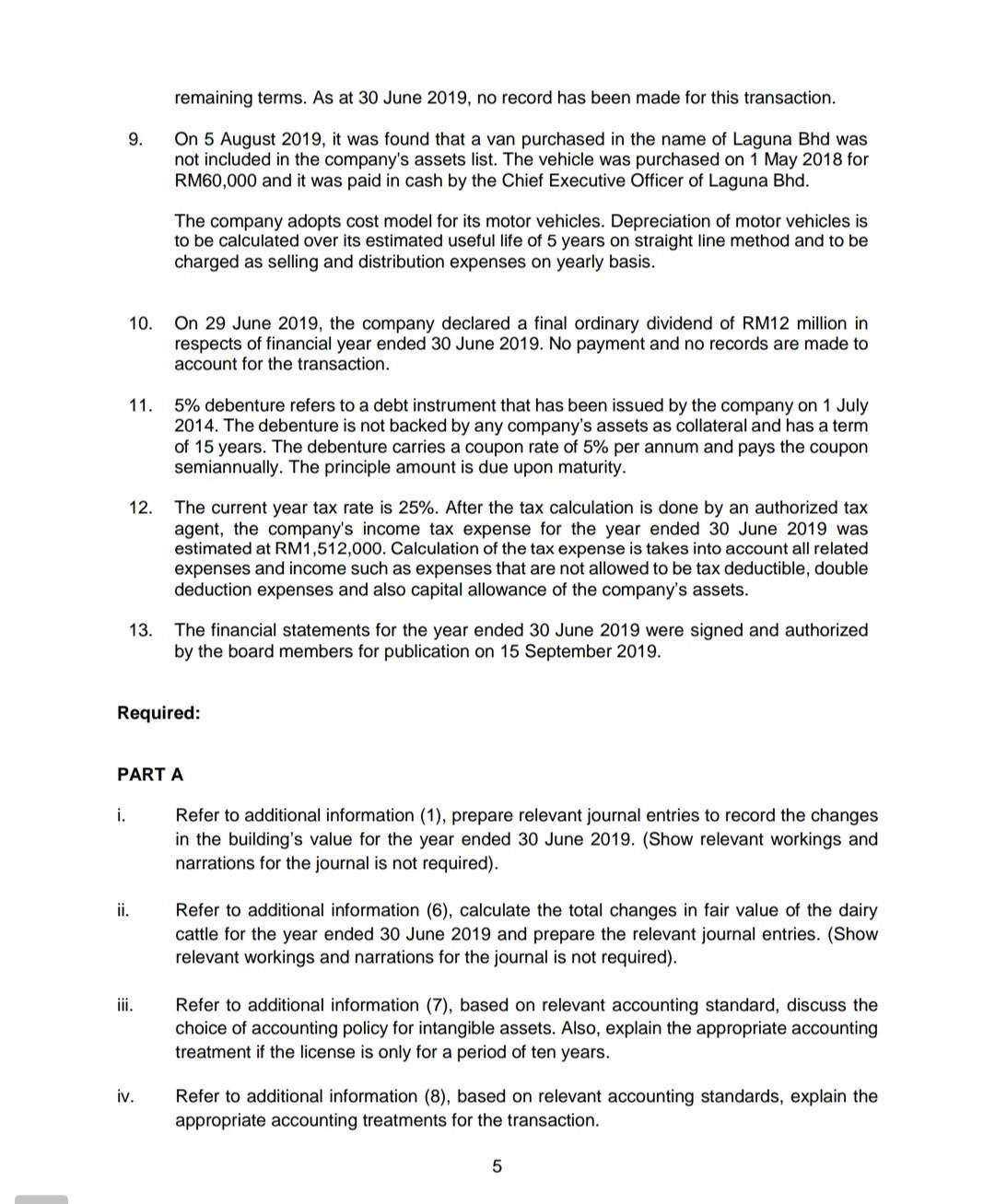

Laguna Bhd. is a company incorporated in Malaysia. The company involved in manufacturing, packaging and marketing of frozen food and beverages products for the local and international market. The company is aiming to be the leader in providing affordable food and beverages product with superior quality. Below is the trial balance of Laguna Bhd. for the year ended 30 June 2019: Debit RM'000 Credit RM'000 187,800 99,310 16,000 31,025 28,331 700 1,208 142,600 90.650 53,430 Sales Cost of sales Interim dividend paid Administrative expenses Selling and distribution expenses Interest expenses Tax payable Freehold land at valuation as at 1 July 2018 Building at cost as at 1 July 2018 Plant and machinery at cost as at 1 July 2018 Accumulated depreciation as at 1 July 2018: Building plan! Plant and machinery Investment property at fair value as at 1 July 2018 Intangible assets Fixed deposits Ordinary share capital Retained earnings as at 1 July 2018 Asset revaluation reserve as at 1 July 2018 (related to the freehold land) 5% Debentures Trade receivables and payables Cash and bank Inventories Income tax paid 9,065 15,915 4,628 30,800 21,200 240,000 63,256 16,000 28,000 3,603 14.184 16,680 13,658 1,651 564,847 564,847 2. Additional information: 1. The company adopts revaluation model for its building. As at 1 July 2018, the fair value of the building is RM95 million. On that date, the remaining useful life of the building is 25 years. As at year end, the revaluation amount has not yet recorded. Note: the company follows requirement of MFRS 116 where the company makes annual transfer to retained earnings for any revaluation surplus as the asset is being used and depreciated. 2. 3. 4. Asset revaluation reserve as at 1 July 2018 amounted to RM16 million as stated in the trial balance is related to the revaluation that was done a few years ago on the company's freehold land, located in Sepang. On 30 June 2019, the freehold land was once again revalued to RM160 million. However, the new revalued amount has not yet recorded. On 1 July 2018, the company purchased a new equipment costing RM1,650,000 to replace the old equipment that was purchased in July 2014 at a cost of RM1,220,000 The old equipment was trade-in for RM885,000. The transaction on 1 July 2018 has not yet recorded. Plant and machinery is depreciated over their useful life of 10 years. The depreciation expenses are classified as administrative expenses. The policy of the company is to depreciate all its assets using the straight line method on yearly basis, giving full year's depreciation in the year of purchase and none in the year of disposal A plant which was purchased on 1 July 2012 at a cost of RM1,340,000 had a reduction in production capacity since September 2018. This had caused several breakdowns during the production process. The board of directors of Laguna Bhd therefore decided to provide impairment on the plant as at year end. The fair value of the plant as at 30 June 2019 is RM350,000 and if it disposed, the company has to incur a dismantling cost of RM12,400. No record has been made to account the impairment loss. The company acquired a building costing RM2,500,000 on 1 July 2013 with the estimated useful life of 30 years. The building is rented out to a third party for RM15,000 per month and the tenancy agreement will be expired on 30 June 2019. Since acquisition, the building was reclassified as investment property and the company adopts the fair value model to measures its investment property subsequent to the initial recognition. The fair value of the investment property on 30 June 2018 was RM4,628,000 and the figure has been recorded. 5. Based on the tenancy agreement, the rental needs to be paid on annual basis and will be due on 30 June each year. However, the rental income for the year ended 30 June 2019 has not been received from the tenants and no record has been made to accrue the rental amount. As at 30 June 2019, the company decided not to renew the tenancy agreement and planned to use the building as the company's research center. The fair value of the building is RM5,350,000 on that date. No records have been made to account these transactions 3 6. On 1 July 2018, the company started a dairy cattle breeding business to grab the opportunity of increasing demand for fresh milk. For a start, the company has purchased several dairy cattle to meet the demand by its own processing plants. In the future, the company plans to expand the business of fresh milk to the external markets. On 1 July 2018, company purchased the following: 1-year old - 20 dairy cattle 2-year old - 30 dairy cattle 3-year old - 10 dairy cattle On 1 January 2019, the company purchased another 5 three-year old dairy cattle and 10 newborn dairy cattle from a local supplier for RM3,200 per dairy cattle and RM550 per newborn dairy cattle, respectively. The supplier allowed the purchases on credit because of the good relationship with the company for so long. The fair value less costs to sell of the cattle are as follows: Age New born % year old 1 or old As at 1 July 2018 RM 500 650 1 on As at 30 June 2019 RM 600 800 1 200 000 6. On 1 July 2018, the company started a dairy cattle breeding business to grab the opportunity of increasing demand for fresh milk. For a start, the company has purchased several dairy cattle to meet the demand by its own processing plants. In the future, the company plans to expand the business of fresh milk to the external markets. On 1 July 2018, company purchased the following: 1-year old -20 dairy cattle 2-year old - 30 dairy cattle 3-year old - 10 dairy cattle On 1 January 2019, the company purchased another 5 three-year old dairy cattle and 10 newborn dairy cattle from a local supplier for RM3,200 per dairy cattle and RM550 per newborn dairy cattle, respectively, The supplier allowed the purchases on credit because of the good relationship with the company for so long. The fair value less costs to sell of the cattle are as follows: Age New born % year old 1 year old 2 year old 3 year old 3 year old 4 year old As at 1 July 2018 RM 500 650 1,000 2.000 3,000 3,700 4,000 As at 30 June 2019 RM 600 800 1,200 2,400 3,600 3,800 4,900 As of 30 June 2019, no records were made with respect to the dairy cattle business. 7. On 2 January 2019, the company obtained for free from the Malaysian government a license that allows the company to export goods to overseas for an indefinite period. On that date, the fair value of the permit was RM1,000,000. Since it is free, no record was made to account the license. The company adopts a revaluation model to measure the intangible assets 8. In March 2017, the company enter into a contract with a chicken supplier - Ayam Organik Sdn Bhd to ensure the supply of chicken is not interrupted. However, in May 2019, Ayam Organik Sdn Bhd was sued by the authority due to the farm hygiene issues. As a result, Ayam Organik Sdn Bhd has received negative publicity from the public which also affects Laguna Bhd indirectly. Due to that, the company decided to terminate the contract with Ayam Organik Sdn Bhd on 1 June 2019. On that date, the contract had remaining 9 months. Based on the agreement, Laguna Bhd must place a minimum monthly order of RM25,000 and in the event of the agreement being terminated earlier than its terms, the supplier is entitled for a compensation of RM150,000 for the contract that still has 6 to 9 months remaining terms. As at 30 June 2019, no record has been made for this transaction. 9. On 5 August 2019, it was found that a van purchased in the name of Laguna Bhd was not included in the company's assets list. The vehicle was purchased on 1 May 2018 for RM60,000 and it was paid in cash by the Chief Executive Officer of Laguna Bhd. The company adopts cost model for its motor vehicles. Depreciation of motor vehicles is to be calculated over its estimated useful life of 5 years on straight line method and to be charged as selling and distribution expenses on yearly basis. 10. On 29 June 2019, the company declared a final ordinary dividend of RM12 million in respects of financial year ended 30 June 2019. No payment and no records are made to account for the transaction. 11 5% debenture refers to a debt instrument that has been issued by the company on 1 July 2014. The debenture is not backed by any company's assets as collateral and has a term of 15 years. The debenture carries a coupon rate of 5% per annum and pays the coupon semiannually. The principle amount is due upon maturity. The current year tax rate is 25%. After the tax calculation is done by an authorized tax agent, the company's income tax expense for the year ended 30 June 2019 was estimated at RM1,512,000. Calculation of the tax expense is takes into account all related expenses and income such as expenses that are not allowed to be tax deductible, double deduction expenses and also capital allowance of the company's assets. 12. 13 The financial statements for the year ended 30 June 2019 were signed and authorized by the board members for publication on 15 September 2019. Required: PARTA i. Refer to additional information (1), prepare relevant journal entries to record the changes in the building's value for the year ended 30 June 2019. (Show relevant workings and narrations for the journal is not required). ii. Refer to additional information (6), calculate the total changes in fair value of the dairy cattle for the year ended 30 June 2019 and prepare the relevant journal entries. (Show relevant workings and narrations for the journal is not required). iii. Refer to additional information (7), based on relevant accounting standard, discuss the choice of accounting policy for intangible assets. Also, explain the appropriate accounting treatment if the license is only for a period of ten years. iv. Refer to additional information (8), based on relevant accounting standards, explain the appropriate accounting treatments for the transaction. 5 V. Refer to additional information (9), identify the applicable accounting standards for the transaction and explain the appropriate accounting treatments to record the transactions, vi. Refer to additional information (10), explain the appropriate accounting treatment if the company declares the ordinary final dividend on 15 July 2019. (50 Marks) 10. On 29 June 2019, the company declared a final ordinary dividend of RM12 million in respects of financial year ended 30 June 2019. No payment and no records are made to account for the transaction. 11 12 5% debenture refers to a debt instrument that has been issued by the company on 1 July 2014. The debenture is not backed by any company's assets as collateral and has a term of 15 years. The debenture carries a coupon rate of 5% per annum and pays the coupon semiannually. The principle amount is due upon maturity. The current year tax rate is 25%. After the tax calculation is done by an authorized tax agent, the company's income tax expense for the year ended 30 June 2019 was estimated at RM1,512,000. Calculation of the tax expense is takes into account all related expenses and income such as expenses that are not allowed to be tax deductible, double deduction expenses and also capital allowance of the company's assets. 13 The financial statements for the year ended 30 June 2019 were signed and authorized by the board members for publication on 15 September 2019. Required: PARTA i. Refer to additional information (1), prepare relevant journal entries to record the changes in the building's value for the year ended 30 June 2019. (Show relevant workings and narrations for the journal is not required) ii. Refer to additional information (6), calculate the total changes in fair value of the dairy cattle for the year ended 30 June 2019 and prepare the relevant journal entries. (Show relevant workings and narrations for the journal not required) lii. Refer to additional information (7), based on relevant accounting standard, discuss the choice of accounting policy for intangible assets. Also, explain the appropriate accounting treatment if the license is only for a period of ten years. iv. Refer to additional information (8), based on relevant accounting standards, explain the appropriate accounting treatments for the transaction. 5 Refer to additional information (9), identify the applicable accounting standards for the transaction and explain the appropriate accounting treatments to record the transactions, vi. Refer to additional information (10), explain the appropriate accounting treatment if the company declares the ordinary final dividend on 15 July 2019. (50 Marks) PART B Prepare the Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2019. ii. Prepare the Statement of Changes in Equity for the year ended 30 June 2019. Prepare the Note to Property Plant and Equipment for the year ended 30 June 2019. iv. Prepare the Statement of Financial Position as at 30 June 2019. v. Based on the financial statements prepared above, calculate and explain the following ratios: a. Profitability ratios - Gross Profit Margin and Return on capital employed (ROCE) b. Liquidity ratios - Current Ratio and Quick Ratio C. Efficiency ratios - Asset turnover and Receivables days Note: for items (i), (ii), (iii) and (iv), write your answers in RM"000. (50 marks) [END OF QUESTIONS] Laguna Bhd. is a company incorporated in Malaysia. The company involved in manufacturing, packaging and marketing of frozen food and beverages products for the local and international market. The company is aiming to be the leader in providing affordable food and beverages product with superior quality. Below is the trial balance of Laguna Bhd. for the year ended 30 June 2019: Debit RM'000 Credit RM'000 187,800 99,310 16,000 31,025 28,331 700 1,208 142,600 90,650 53,430 Sales Cost of sales Interim dividend paid Administrative expenses Selling and distribution expenses Interest expenses Tax payable Freehold land at valuation as at 1 July 2018 Building at cost as at 1 July 2018 Plant and machinery at cost as at 1 July 2018 Accumulated depreciation as at 1 July 2018: Building Plant and machinery Investment property at fair value as at 1 July 2018 Intangible assets Fixed deposits Ordinary share capital Retained earnings as at 1 July 2018 Asset revaluation reserve as at 1 July 2018 (related to the freehold land) 5% Debentures Trade receivables and payables Cash and bank Inventories Income tax paid 9,065 15,915 4,628 30,800 21,200 240,000 63,256 16,000 28,000 3,603 14,184 16,680 13,658 1,651 564,847 564,847 2 Additional information: 1. The company adopts revaluation model for its building. As at 1 July 2018, the fair value of the building is RM95 million. On that date, the remaining useful life of the building is 25 years. As at year end, the revaluation amount has not yet recorded. Note: the company follows requirement of MERS 116 where the company makes annual transfer to retained earnings for any revaluation surplus as the asset is being used and depreciated. 2. Asset revaluation reserve as at 1 July 2018 amounted to RM16 million as stated in the trial balance is related to the revaluation that was done a few years ago on the company's freehold land, located in Sepang. On 30 June 2019, the freehold land was once again revalued to RM160 million. However, the new revalued amount has not yet recorded. 3. On 1 July 2018, the company purchased a new equipment costing RM1,650,000 to replace the old equipment that was purchased in July 2014 at a cost of RM1,220,000. The old equipment was trade-in for RM885,000. The transaction on 1 July 2018 has not yet recorded. Plant and machinery is depreciated over their useful life of 10 years. The depreciation expenses are classified as administrative expenses. The policy of the company is to depreciate all its assets using the straight line method on yearly basis, giving full year's depreciation in the year of purchase and none in the year of disposal. 4. A plant which was purchased on 1 July 2012 at a cost of RM1,340,000 had a reduction in production capacity since September 2018. This had caused several breakdowns during the production process. The board of directors of Laguna Bhd therefore decided to provide impairment on the plant as at year end. The fair value of the plant as at 30 June 2019 is RM350,000 and if it disposed, the company has to incur a dismantling cost of RM12,400. No record has been made to account the impairment loss. 5. The company acquired a building costing RM2,500,000 on 1 July 2013 with the estimated useful life of 30 years. The building is rented out to a third party for RM15,000 per month and the tenancy agreement will be expired on 30 June 2019. Since acquisition, the building was reclassified as investment property and the company adopts the fair value model to measures its investment property subsequent to the initial recognition. The fair value of the investment property on 30 June 2018 was RM4,628,000 and the figure has been recorded. Based on the tenancy agreement, the rental needs to be paid on annual basis and will be due on 30 June each year. However, the rental income for the year ended 30 June 2019 has not been received from the tenants and no record has been made to accrue the rental amount. As at 30 June 2019, the company decided not to renew the tenancy agreement and planned to use the building as the company's research center. The fair value of the building is RM5,350,000 on that date. No records have been made to account these transactions. 3 6. On 1 July 2018, the company started a dairy cattle breeding business to grab the opportunity of increasing demand for fresh milk. For a start, the company has purchased several dairy cattle to meet the demand by its own processing plants. In the future, the company plans to expand the business of fresh milk to the external markets. On 1 July 2018, company purchased the following: 1-year old - 20 dairy cattle 2-year old - 30 dairy cattle 3-year old - 10 dairy cattle On 1 January 2019, the company purchased another 5 three-year old dairy cattle and 10 newborn dairy cattle from a local supplier for RM3,200 per dairy cattle and RM550 per newborn dairy cattle, respectively. The supplier allowed the purchases on credit because of the good relationship with the company for so long. The fair value less costs to sell of the cattle are as follows: Age New born 12 year old 1 year old 2 year old 3 year old 3 12 year old 4 year old As at 1 July 2018 RM 500 650 1,000 2,000 3,000 3,700 4,000 As at 30 June 2019 RM 600 800 1,200 2,400 3,600 3,800 4,900 As of 30 June 2019, no records were made with respect to the dairy cattle business. 7. On 2 January 2019, the company obtained for free from the Malaysian government a license that allows the company to export goods to overseas for an indefinite period. On that date, the fair value of the permit was RM1,000,000. Since it is free, no record was made to account the license. The company adopts a revaluation model to measure the intangible assets. 8. In March 2017, the company enter into a contract with a chicken supplier - Ayam Organik Sdn Bhd to ensure the supply of chicken is not interrupted. However, in May 2019, Ayam Organik Sdn Bhd was sued by the authority due to the farm hygiene issues. As a result, Ayam Organik Sdn Bhd has received negative publicity from the public which also affects Laguna Bhd indirectly. Due to that, the company decided to terminate the contract with Ayam Organik Sdn Bhd on 1 June 2019. On that date, the contract had remaining 9 months. Based on the agreement, Laguna Bhd must place a minimum monthly order of RM25,000 and in the event of the agreement being terminated earlier than its terms, the supplier is entitled for a compensation of RM150,000 for the contract that still has 6 to 9 months 4 remaining terms. As at 30 June 2019, no record has been made for this transaction. 9. On 5 August 2019, it was found that a van purchased in the name of Laguna Bhd was not included in the company's assets list. The vehicle was purchased on 1 May 2018 for RM60,000 and it was paid in cash by the Chief Executive Officer of Laguna Bhd. The company adopts cost model for its motor vehicles. Depreciation of motor vehicles is to be calculated over its estimated useful life of 5 years on straight line method and to be charged as selling and distribution expenses on yearly basis. 10. On 29 June 2019, the company declared a final ordinary dividend of RM12 million in respects of financial year ended 30 June 2019. No payment and no records are made to account for the transaction. 11. 5% debenture refers to a debt instrument that has been issued by the company on 1 July 2014. The debenture is not backed by any company's assets as collateral and has a term of 15 years. The debenture carries a coupon rate of 5% per annum and pays the coupon semiannually. The principle amount is due upon maturity. 12. The current year tax rate is 25%. After the tax calculation is done by an authorized tax agent, the company's income tax expense for the year ended 30 June 2019 was estimated at RM1,512,000. Calculation of the tax expense is takes into account all related expenses and income such as expenses that are not allowed to be tax deductible, double deduction expenses and also capital allowance of the company's assets. 13. The financial statements for the year ended 30 June 2019 were signed and authorized by the board members for publication on 15 September 2019. Required: PARTA i. Refer to additional information (1), prepare relevant journal entries to record the changes in the building's value for the year ended 30 June 2019. (Show relevant workings and narrations for the journal is not required). ii. Refer to additional information (6), calculate the total changes in fair value of the dairy cattle for the year ended 30 June 2019 and prepare the relevant journal entries. (Show relevant workings and narrations for the journal is not required). iii. Refer to additional information (7), based on relevant accounting standard, discuss the choice of accounting policy for intangible assets. Also, explain the appropriate accounting treatment if the license is only for a period of ten years. iv. Refer to additional information (8), based on relevant accounting standards, explain the appropriate accounting treatments for the transaction. 5 V. Refer to additional information (9), identify the applicable accounting standards for the transaction and explain the appropriate accounting treatments to record the transactions. vi. Refer to additional information (10), explain the appropriate accounting treatment if the company declares the ordinary final dividend on 15 July 2019. (50 Marks) Laguna Bhd. is a company incorporated in Malaysia. The company involved in manufacturing, packaging and marketing of frozen food and beverages products for the local and international market. The company is aiming to be the leader in providing affordable food and beverages product with superior quality. Below is the trial balance of Laguna Bhd. for the year ended 30 June 2019: Debit RM'000 Credit RM'000 187,800 99,310 16,000 31,025 28,331 700 1,208 142,600 90.650 53,430 Sales Cost of sales Interim dividend paid Administrative expenses Selling and distribution expenses Interest expenses Tax payable Freehold land at valuation as at 1 July 2018 Building at cost as at 1 July 2018 Plant and machinery at cost as at 1 July 2018 Accumulated depreciation as at 1 July 2018: Building plan! Plant and machinery Investment property at fair value as at 1 July 2018 Intangible assets Fixed deposits Ordinary share capital Retained earnings as at 1 July 2018 Asset revaluation reserve as at 1 July 2018 (related to the freehold land) 5% Debentures Trade receivables and payables Cash and bank Inventories Income tax paid 9,065 15,915 4,628 30,800 21,200 240,000 63,256 16,000 28,000 3,603 14.184 16,680 13,658 1,651 564,847 564,847 2. Additional information: 1. The company adopts revaluation model for its building. As at 1 July 2018, the fair value of the building is RM95 million. On that date, the remaining useful life of the building is 25 years. As at year end, the revaluation amount has not yet recorded. Note: the company follows requirement of MFRS 116 where the company makes annual transfer to retained earnings for any revaluation surplus as the asset is being used and depreciated. 2. 3. 4. Asset revaluation reserve as at 1 July 2018 amounted to RM16 million as stated in the trial balance is related to the revaluation that was done a few years ago on the company's freehold land, located in Sepang. On 30 June 2019, the freehold land was once again revalued to RM160 million. However, the new revalued amount has not yet recorded. On 1 July 2018, the company purchased a new equipment costing RM1,650,000 to replace the old equipment that was purchased in July 2014 at a cost of RM1,220,000 The old equipment was trade-in for RM885,000. The transaction on 1 July 2018 has not yet recorded. Plant and machinery is depreciated over their useful life of 10 years. The depreciation expenses are classified as administrative expenses. The policy of the company is to depreciate all its assets using the straight line method on yearly basis, giving full year's depreciation in the year of purchase and none in the year of disposal A plant which was purchased on 1 July 2012 at a cost of RM1,340,000 had a reduction in production capacity since September 2018. This had caused several breakdowns during the production process. The board of directors of Laguna Bhd therefore decided to provide impairment on the plant as at year end. The fair value of the plant as at 30 June 2019 is RM350,000 and if it disposed, the company has to incur a dismantling cost of RM12,400. No record has been made to account the impairment loss. The company acquired a building costing RM2,500,000 on 1 July 2013 with the estimated useful life of 30 years. The building is rented out to a third party for RM15,000 per month and the tenancy agreement will be expired on 30 June 2019. Since acquisition, the building was reclassified as investment property and the company adopts the fair value model to measures its investment property subsequent to the initial recognition. The fair value of the investment property on 30 June 2018 was RM4,628,000 and the figure has been recorded. 5. Based on the tenancy agreement, the rental needs to be paid on annual basis and will be due on 30 June each year. However, the rental income for the year ended 30 June 2019 has not been received from the tenants and no record has been made to accrue the rental amount. As at 30 June 2019, the company decided not to renew the tenancy agreement and planned to use the building as the company's research center. The fair value of the building is RM5,350,000 on that date. No records have been made to account these transactions 3 6. On 1 July 2018, the company started a dairy cattle breeding business to grab the opportunity of increasing demand for fresh milk. For a start, the company has purchased several dairy cattle to meet the demand by its own processing plants. In the future, the company plans to expand the business of fresh milk to the external markets. On 1 July 2018, company purchased the following: 1-year old - 20 dairy cattle 2-year old - 30 dairy cattle 3-year old - 10 dairy cattle On 1 January 2019, the company purchased another 5 three-year old dairy cattle and 10 newborn dairy cattle from a local supplier for RM3,200 per dairy cattle and RM550 per newborn dairy cattle, respectively. The supplier allowed the purchases on credit because of the good relationship with the company for so long. The fair value less costs to sell of the cattle are as follows: Age New born % year old 1 or old As at 1 July 2018 RM 500 650 1 on As at 30 June 2019 RM 600 800 1 200 000 6. On 1 July 2018, the company started a dairy cattle breeding business to grab the opportunity of increasing demand for fresh milk. For a start, the company has purchased several dairy cattle to meet the demand by its own processing plants. In the future, the company plans to expand the business of fresh milk to the external markets. On 1 July 2018, company purchased the following: 1-year old -20 dairy cattle 2-year old - 30 dairy cattle 3-year old - 10 dairy cattle On 1 January 2019, the company purchased another 5 three-year old dairy cattle and 10 newborn dairy cattle from a local supplier for RM3,200 per dairy cattle and RM550 per newborn dairy cattle, respectively, The supplier allowed the purchases on credit because of the good relationship with the company for so long. The fair value less costs to sell of the cattle are as follows: Age New born % year old 1 year old 2 year old 3 year old 3 year old 4 year old As at 1 July 2018 RM 500 650 1,000 2.000 3,000 3,700 4,000 As at 30 June 2019 RM 600 800 1,200 2,400 3,600 3,800 4,900 As of 30 June 2019, no records were made with respect to the dairy cattle business. 7. On 2 January 2019, the company obtained for free from the Malaysian government a license that allows the company to export goods to overseas for an indefinite period. On that date, the fair value of the permit was RM1,000,000. Since it is free, no record was made to account the license. The company adopts a revaluation model to measure the intangible assets 8. In March 2017, the company enter into a contract with a chicken supplier - Ayam Organik Sdn Bhd to ensure the supply of chicken is not interrupted. However, in May 2019, Ayam Organik Sdn Bhd was sued by the authority due to the farm hygiene issues. As a result, Ayam Organik Sdn Bhd has received negative publicity from the public which also affects Laguna Bhd indirectly. Due to that, the company decided to terminate the contract with Ayam Organik Sdn Bhd on 1 June 2019. On that date, the contract had remaining 9 months. Based on the agreement, Laguna Bhd must place a minimum monthly order of RM25,000 and in the event of the agreement being terminated earlier than its terms, the supplier is entitled for a compensation of RM150,000 for the contract that still has 6 to 9 months remaining terms. As at 30 June 2019, no record has been made for this transaction. 9. On 5 August 2019, it was found that a van purchased in the name of Laguna Bhd was not included in the company's assets list. The vehicle was purchased on 1 May 2018 for RM60,000 and it was paid in cash by the Chief Executive Officer of Laguna Bhd. The company adopts cost model for its motor vehicles. Depreciation of motor vehicles is to be calculated over its estimated useful life of 5 years on straight line method and to be charged as selling and distribution expenses on yearly basis. 10. On 29 June 2019, the company declared a final ordinary dividend of RM12 million in respects of financial year ended 30 June 2019. No payment and no records are made to account for the transaction. 11 5% debenture refers to a debt instrument that has been issued by the company on 1 July 2014. The debenture is not backed by any company's assets as collateral and has a term of 15 years. The debenture carries a coupon rate of 5% per annum and pays the coupon semiannually. The principle amount is due upon maturity. The current year tax rate is 25%. After the tax calculation is done by an authorized tax agent, the company's income tax expense for the year ended 30 June 2019 was estimated at RM1,512,000. Calculation of the tax expense is takes into account all related expenses and income such as expenses that are not allowed to be tax deductible, double deduction expenses and also capital allowance of the company's assets. 12. 13 The financial statements for the year ended 30 June 2019 were signed and authorized by the board members for publication on 15 September 2019. Required: PARTA i. Refer to additional information (1), prepare relevant journal entries to record the changes in the building's value for the year ended 30 June 2019. (Show relevant workings and narrations for the journal is not required). ii. Refer to additional information (6), calculate the total changes in fair value of the dairy cattle for the year ended 30 June 2019 and prepare the relevant journal entries. (Show relevant workings and narrations for the journal is not required). iii. Refer to additional information (7), based on relevant accounting standard, discuss the choice of accounting policy for intangible assets. Also, explain the appropriate accounting treatment if the license is only for a period of ten years. iv. Refer to additional information (8), based on relevant accounting standards, explain the appropriate accounting treatments for the transaction. 5 V. Refer to additional information (9), identify the applicable accounting standards for the transaction and explain the appropriate accounting treatments to record the transactions, vi. Refer to additional information (10), explain the appropriate accounting treatment if the company declares the ordinary final dividend on 15 July 2019. (50 Marks) 10. On 29 June 2019, the company declared a final ordinary dividend of RM12 million in respects of financial year ended 30 June 2019. No payment and no records are made to account for the transaction. 11 12 5% debenture refers to a debt instrument that has been issued by the company on 1 July 2014. The debenture is not backed by any company's assets as collateral and has a term of 15 years. The debenture carries a coupon rate of 5% per annum and pays the coupon semiannually. The principle amount is due upon maturity. The current year tax rate is 25%. After the tax calculation is done by an authorized tax agent, the company's income tax expense for the year ended 30 June 2019 was estimated at RM1,512,000. Calculation of the tax expense is takes into account all related expenses and income such as expenses that are not allowed to be tax deductible, double deduction expenses and also capital allowance of the company's assets. 13 The financial statements for the year ended 30 June 2019 were signed and authorized by the board members for publication on 15 September 2019. Required: PARTA i. Refer to additional information (1), prepare relevant journal entries to record the changes in the building's value for the year ended 30 June 2019. (Show relevant workings and narrations for the journal is not required) ii. Refer to additional information (6), calculate the total changes in fair value of the dairy cattle for the year ended 30 June 2019 and prepare the relevant journal entries. (Show relevant workings and narrations for the journal not required) lii. Refer to additional information (7), based on relevant accounting standard, discuss the choice of accounting policy for intangible assets. Also, explain the appropriate accounting treatment if the license is only for a period of ten years. iv. Refer to additional information (8), based on relevant accounting standards, explain the appropriate accounting treatments for the transaction. 5 Refer to additional information (9), identify the applicable accounting standards for the transaction and explain the appropriate accounting treatments to record the transactions, vi. Refer to additional information (10), explain the appropriate accounting treatment if the company declares the ordinary final dividend on 15 July 2019. (50 Marks) PART B Prepare the Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2019. ii. Prepare the Statement of Changes in Equity for the year ended 30 June 2019. Prepare the Note to Property Plant and Equipment for the year ended 30 June 2019. iv. Prepare the Statement of Financial Position as at 30 June 2019. v. Based on the financial statements prepared above, calculate and explain the following ratios: a. Profitability ratios - Gross Profit Margin and Return on capital employed (ROCE) b. Liquidity ratios - Current Ratio and Quick Ratio C. Efficiency ratios - Asset turnover and Receivables days Note: for items (i), (ii), (iii) and (iv), write your answers in RM"000. (50 marks) [END OF QUESTIONS] Laguna Bhd. is a company incorporated in Malaysia. The company involved in manufacturing, packaging and marketing of frozen food and beverages products for the local and international market. The company is aiming to be the leader in providing affordable food and beverages product with superior quality. Below is the trial balance of Laguna Bhd. for the year ended 30 June 2019: Debit RM'000 Credit RM'000 187,800 99,310 16,000 31,025 28,331 700 1,208 142,600 90,650 53,430 Sales Cost of sales Interim dividend paid Administrative expenses Selling and distribution expenses Interest expenses Tax payable Freehold land at valuation as at 1 July 2018 Building at cost as at 1 July 2018 Plant and machinery at cost as at 1 July 2018 Accumulated depreciation as at 1 July 2018: Building Plant and machinery Investment property at fair value as at 1 July 2018 Intangible assets Fixed deposits Ordinary share capital Retained earnings as at 1 July 2018 Asset revaluation reserve as at 1 July 2018 (related to the freehold land) 5% Debentures Trade receivables and payables Cash and bank Inventories Income tax paid 9,065 15,915 4,628 30,800 21,200 240,000 63,256 16,000 28,000 3,603 14,184 16,680 13,658 1,651 564,847 564,847 2 Additional information: 1. The company adopts revaluation model for its building. As at 1 July 2018, the fair value of the building is RM95 million. On that date, the remaining useful life of the building is 25 years. As at year end, the revaluation amount has not yet recorded. Note: the company follows requirement of MERS 116 where the company makes annual transfer to retained earnings for any revaluation surplus as the asset is being used and depreciated. 2. Asset revaluation reserve as at 1 July 2018 amounted to RM16 million as stated in the trial balance is related to the revaluation that was done a few years ago on the company's freehold land, located in Sepang. On 30 June 2019, the freehold land was once again revalued to RM160 million. However, the new revalued amount has not yet recorded. 3. On 1 July 2018, the company purchased a new equipment costing RM1,650,000 to replace the old equipment that was purchased in July 2014 at a cost of RM1,220,000. The old equipment was trade-in for RM885,000. The transaction on 1 July 2018 has not yet recorded. Plant and machinery is depreciated over their useful life of 10 years. The depreciation expenses are classified as administrative expenses. The policy of the company is to depreciate all its assets using the straight line method on yearly basis, giving full year's depreciation in the year of purchase and none in the year of disposal. 4. A plant which was purchased on 1 July 2012 at a cost of RM1,340,000 had a reduction in production capacity since September 2018. This had caused several breakdowns during the production process. The board of directors of Laguna Bhd therefore decided to provide impairment on the plant as at year end. The fair value of the plant as at 30 June 2019 is RM350,000 and if it disposed, the company has to incur a dismantling cost of RM12,400. No record has been made to account the impairment loss. 5. The company acquired a building costing RM2,500,000 on 1 July 2013 with the estimated useful life of 30 years. The building is rented out to a third party for RM15,000 per month and the tenancy agreement will be expired on 30 June 2019. Since acquisition, the building was reclassified as investment property and the company adopts the fair value model to measures its investment property subsequent to the initial recognition. The fair value of the investment property on 30 June 2018 was RM4,628,000 and the figure has been recorded. Based on the tenancy agreement, the rental needs to be paid on annual basis and will be due on 30 June each year. However, the rental income for the year ended 30 June 2019 has not been received from the tenants and no record has been made to accrue the rental amount. As at 30 June 2019, the company decided not to renew the tenancy agreement and planned to use the building as the company's research center. The fair value of the building is RM5,350,000 on that date. No records have been made to account these transactions. 3 6. On 1 July 2018, the company started a dairy cattle breeding business to grab the opportunity of increasing demand for fresh milk. For a start, the company has purchased several dairy cattle to meet the demand by its own processing plants. In the future, the company plans to expand the business of fresh milk to the external markets. On 1 July 2018, company purchased the following: 1-year old - 20 dairy cattle 2-year old - 30 dairy cattle 3-year old - 10 dairy cattle On 1 January 2019, the company purchased another 5 three-year old dairy cattle and 10 newborn dairy cattle from a local supplier for RM3,200 per dairy cattle and RM550 per newborn dairy cattle, respectively. The supplier allowed the purchases on credit because of the good relationship with the company for so long. The fair value less costs to sell of the cattle are as follows: Age New born 12 year old 1 year old 2 year old 3 year old 3 12 year old 4 year old As at 1 July 2018 RM 500 650 1,000 2,000 3,000 3,700 4,000 As at 30 June 2019 RM 600 800 1,200 2,400 3,600 3,800 4,900 As of 30 June 2019, no records were made with respect to the dairy cattle business. 7. On 2 January 2019, the company obtained for free from the Malaysian government a license that allows the company to export goods to overseas for an indefinite period. On that date, the fair value of the permit was RM1,000,000. Since it is free, no record was made to account the license. The company adopts a revaluation model to measure the intangible assets. 8. In March 2017, the company enter into a contract with a chicken supplier - Ayam Organik Sdn Bhd to ensure the supply of chicken is not interrupted. However, in May 2019, Ayam Organik Sdn Bhd was sued by the authority due to the farm hygiene issues. As a result, Ayam Organik Sdn Bhd has received negative publicity from the public which also affects Laguna Bhd indirectly. Due to that, the company decided to terminate the contract with Ayam Organik Sdn Bhd on 1 June 2019. On that date, the contract had remaining 9 months. Based on the agreement, Laguna Bhd must place a minimum monthly order of RM25,000 and in the event of the agreement being terminated earlier than its terms, the supplier is entitled for a compensation of RM150,000 for the contract that still has 6 to 9 months 4 remaining terms. As at 30 June 2019, no record has been made for this transaction. 9. On 5 August 2019, it was found that a van purchased in the name of Laguna Bhd was not included in the company's assets list. The vehicle was purchased on 1 May 2018 for RM60,000 and it was paid in cash by the Chief Executive Officer of Laguna Bhd. The company adopts cost model for its motor vehicles. Depreciation of motor vehicles is to be calculated over its estimated useful life of 5 years on straight line method and to be charged as selling and distribution expenses on yearly basis. 10. On 29 June 2019, the company declared a final ordinary dividend of RM12 million in respects of financial year ended 30 June 2019. No payment and no records are made to account for the transaction. 11. 5% debenture refers to a debt instrument that has been issued by the company on 1 July 2014. The debenture is not backed by any company's assets as collateral and has a term of 15 years. The debenture carries a coupon rate of 5% per annum and pays the coupon semiannually. The principle amount is due upon maturity. 12. The current year tax rate is 25%. After the tax calculation is done by an authorized tax agent, the company's income tax expense for the year ended 30 June 2019 was estimated at RM1,512,000. Calculation of the tax expense is takes into account all related expenses and income such as expenses that are not allowed to be tax deductible, double deduction expenses and also capital allowance of the company's assets. 13. The financial statements for the year ended 30 June 2019 were signed and authorized by the board members for publication on 15 September 2019. Required: PARTA i. Refer to additional information (1), prepare relevant journal entries to record the changes in the building's value for the year ended 30 June 2019. (Show relevant workings and narrations for the journal is not required). ii. Refer to additional information (6), calculate the total changes in fair value of the dairy cattle for the year ended 30 June 2019 and prepare the relevant journal entries. (Show relevant workings and narrations for the journal is not required). iii. Refer to additional information (7), based on relevant accounting standard, discuss the choice of accounting policy for intangible assets. Also, explain the appropriate accounting treatment if the license is only for a period of ten years. iv. Refer to additional information (8), based on relevant accounting standards, explain the appropriate accounting treatments for the transaction. 5 V. Refer to additional information (9), identify the applicable accounting standards for the transaction and explain the appropriate accounting treatments to record the transactions. vi. Refer to additional information (10), explain the appropriate accounting treatment if the company declares the ordinary final dividend on 15 July 2019. (50 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started