Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Module 25) Suppose the First Bank of Burgin knows that the Central Bank has specified a required reserve ratio of 10%. Currently the bank

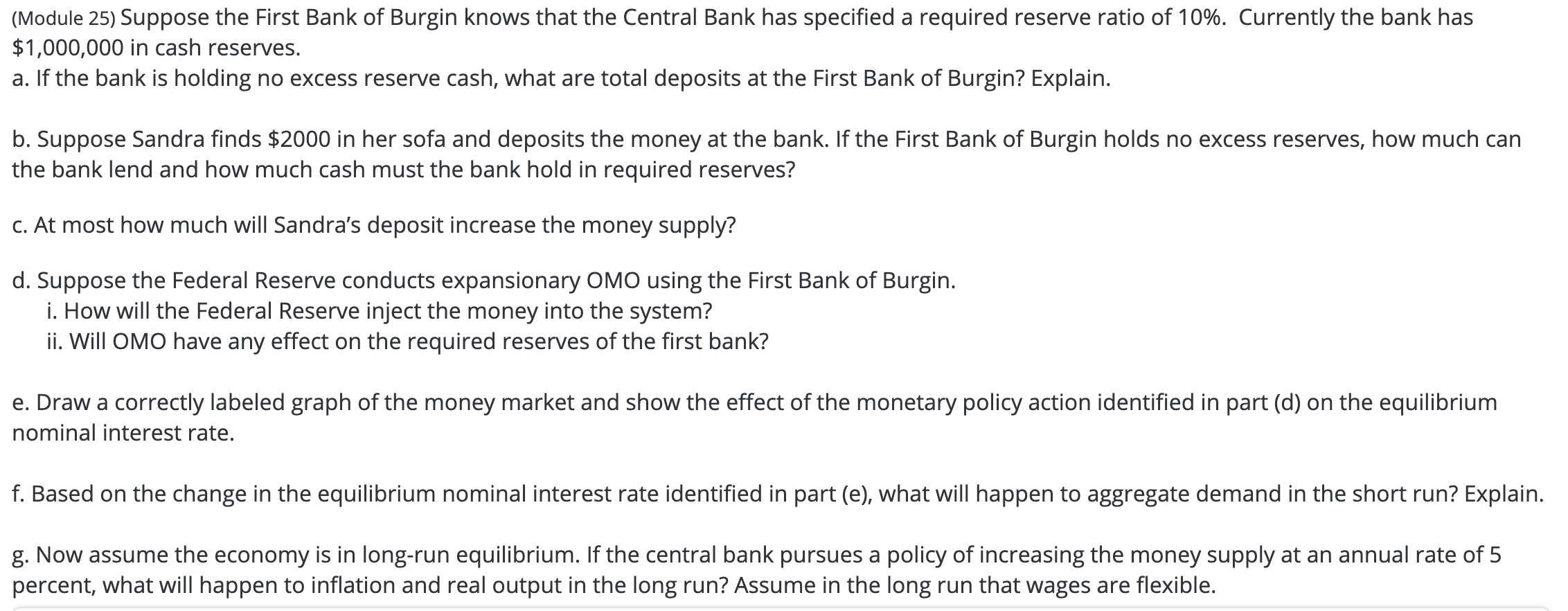

(Module 25) Suppose the First Bank of Burgin knows that the Central Bank has specified a required reserve ratio of 10%. Currently the bank has $1,000,000 in cash reserves. a. If the bank is holding no excess reserve cash, what are total deposits at the First Bank of Burgin? Explain. b. Suppose Sandra finds $2000 in her sofa and deposits the money at the bank. If the First Bank of Burgin holds no excess reserves, how much can the bank lend and how much cash must the bank hold in required reserves? c. At most how much will Sandra's deposit increase the money supply? d. Suppose the Federal Reserve conducts expansionary OMO using the First Bank of Burgin. i. How will the Federal Reserve inject the money into the system? ii. Will OMO have any effect on the required reserves of the first bank? e. Draw a correctly labeled graph of the money market and show the effect of the monetary policy action identified in part (d) on the equilibrium nominal interest rate. f. Based on the change in the equilibrium nominal interest rate identified in part (e), what will happen to aggregate demand in the short run? Explain. g. Now assume the economy is in long-run equilibrium. If the central bank pursues a policy of increasing the money supply at an annual rate of 5 percent, what will happen to inflation and real output in the long run? Assume in the long run that wages are flexible.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a If the required reserve ratio is 10 and the bank has 1000000 in cash reserves the total deposits a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started