Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, Hodge, Shelton, Reld and Sims Co. began operations. The company manufacturers personal protective equipment for colleges and universities to address

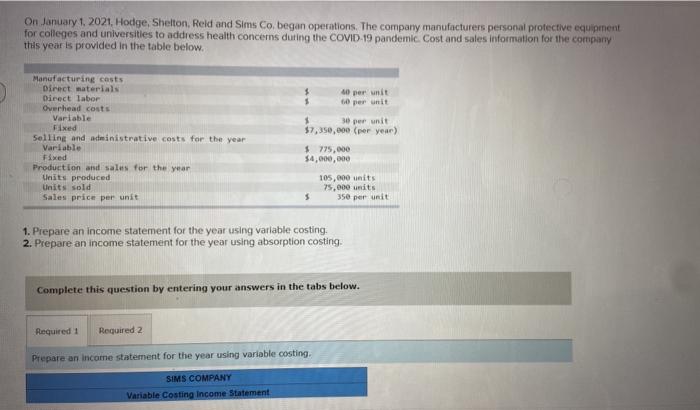

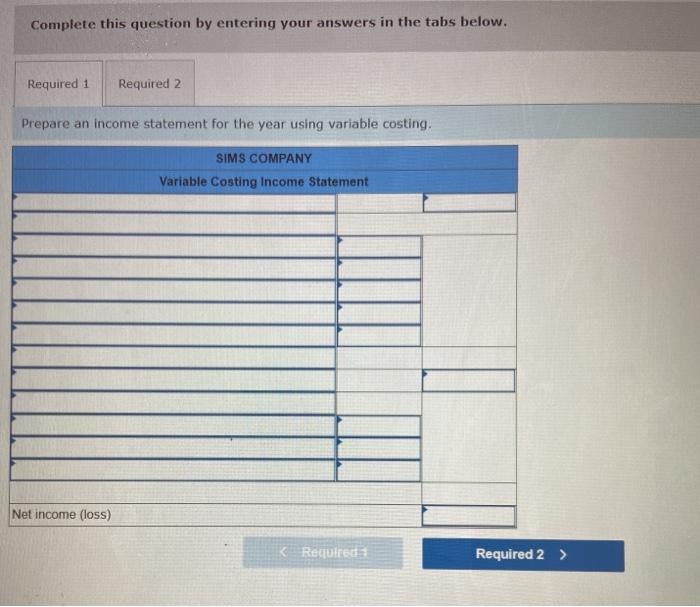

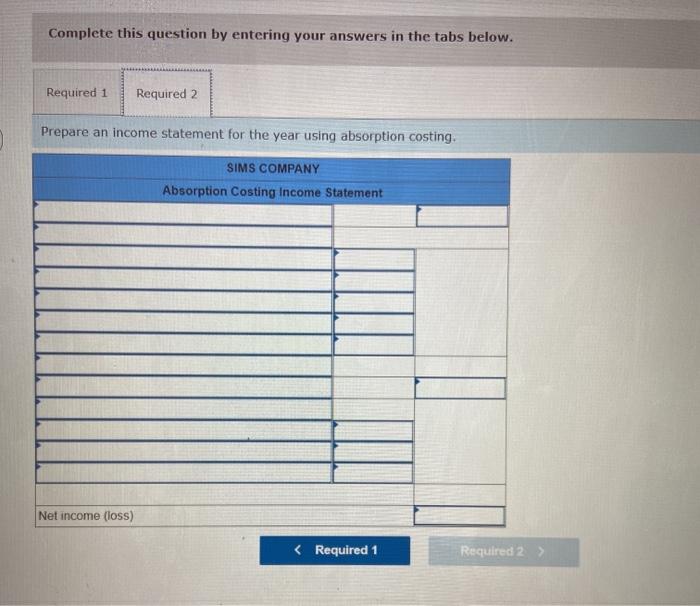

On January 1, 2021, Hodge, Shelton, Reld and Sims Co. began operations. The company manufacturers personal protective equipment for colleges and universities to address health concerns duting the COVID-19 pandemic. Cost and sales information for the company this year is provided in the table below. Manufacturing costs Direct materials Direct labor Overhead costs Variable 40 per unit 60 per unit 30 per unit $7,350,000 (per year) paxt Selling and administrative costs for the year Variable Fixed $775,000 $4,000, 000 Production and sales for the year Units produced Units sold Sales price per unit 105, 00 units 75,000 units 350 per unit 1. Prepare an income statement for the year using variable costing. 2. Prepare an income statement for the year using absorption costing. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for the year using variable costing. SIMS COMPANY Variable Costing Income Statement Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for the year using variable costing. SIMS COMPANY Variable Costing Income Statement Net income (loss) K Required Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for the year using absorption costing. SIMS COMPANY Absorption Costing Income Statement Net income (loss) < Required 1 Required 2 On January 1, 2021, Hodge, Shelton, Reld and Sims Co. began operations. The company manufacturers personal protective equipment for colleges and universities to address health concerns duting the COVID-19 pandemic. Cost and sales information for the company this year is provided in the table below. Manufacturing costs Direct materials Direct labor Overhead costs Variable 40 per unit 60 per unit 30 per unit $7,350,000 (per year) paxt Selling and administrative costs for the year Variable Fixed $775,000 $4,000, 000 Production and sales for the year Units produced Units sold Sales price per unit 105, 00 units 75,000 units 350 per unit 1. Prepare an income statement for the year using variable costing. 2. Prepare an income statement for the year using absorption costing. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for the year using variable costing. SIMS COMPANY Variable Costing Income Statement Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for the year using variable costing. SIMS COMPANY Variable Costing Income Statement Net income (loss) K Required Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for the year using absorption costing. SIMS COMPANY Absorption Costing Income Statement Net income (loss) < Required 1 Required 2 On January 1, 2021, Hodge, Shelton, Reld and Sims Co. began operations. The company manufacturers personal protective equipment for colleges and universities to address health concerns duting the COVID-19 pandemic. Cost and sales information for the company this year is provided in the table below. Manufacturing costs Direct materials Direct labor Overhead costs Variable 40 per unit 60 per unit 30 per unit $7,350,000 (per year) paxt Selling and administrative costs for the year Variable Fixed $775,000 $4,000, 000 Production and sales for the year Units produced Units sold Sales price per unit 105, 00 units 75,000 units 350 per unit 1. Prepare an income statement for the year using variable costing. 2. Prepare an income statement for the year using absorption costing. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for the year using variable costing. SIMS COMPANY Variable Costing Income Statement Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for the year using variable costing. SIMS COMPANY Variable Costing Income Statement Net income (loss) K Required Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for the year using absorption costing. SIMS COMPANY Absorption Costing Income Statement Net income (loss) < Required 1 Required 2 On January 1, 2021, Hodge, Shelton, Reld and Sims Co. began operations. The company manufacturers personal protective equipment for colleges and universities to address health concerns duting the COVID-19 pandemic. Cost and sales information for the company this year is provided in the table below. Manufacturing costs Direct materials Direct labor Overhead costs Variable 40 per unit 60 per unit 30 per unit $7,350,000 (per year) paxt Selling and administrative costs for the year Variable Fixed $775,000 $4,000, 000 Production and sales for the year Units produced Units sold Sales price per unit 105, 00 units 75,000 units 350 per unit 1. Prepare an income statement for the year using variable costing. 2. Prepare an income statement for the year using absorption costing. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for the year using variable costing. SIMS COMPANY Variable Costing Income Statement Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for the year using variable costing. SIMS COMPANY Variable Costing Income Statement Net income (loss) K Required Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for the year using absorption costing. SIMS COMPANY Absorption Costing Income Statement Net income (loss) < Required 1 Required 2 On January 1, 2021, Hodge, Shelton, Reld and Sims Co. began operations. The company manufacturers personal protective equipment for colleges and universities to address health concerns duting the COVID-19 pandemic. Cost and sales information for the company this year is provided in the table below. Manufacturing costs Direct materials Direct labor Overhead costs Variable 40 per unit 60 per unit 30 per unit $7,350,000 (per year) paxt Selling and administrative costs for the year Variable Fixed $775,000 $4,000, 000 Production and sales for the year Units produced Units sold Sales price per unit 105, 00 units 75,000 units 350 per unit 1. Prepare an income statement for the year using variable costing. 2. Prepare an income statement for the year using absorption costing. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for the year using variable costing. SIMS COMPANY Variable Costing Income Statement Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for the year using variable costing. SIMS COMPANY Variable Costing Income Statement Net income (loss) K Required Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for the year using absorption costing. SIMS COMPANY Absorption Costing Income Statement Net income (loss) < Required 1 Required 2

Step by Step Solution

★★★★★

3.46 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

1 Sims Comapany Income statement using Variable costing sales 75000350 26250000 Less Variabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started