Answered step by step

Verified Expert Solution

Question

1 Approved Answer

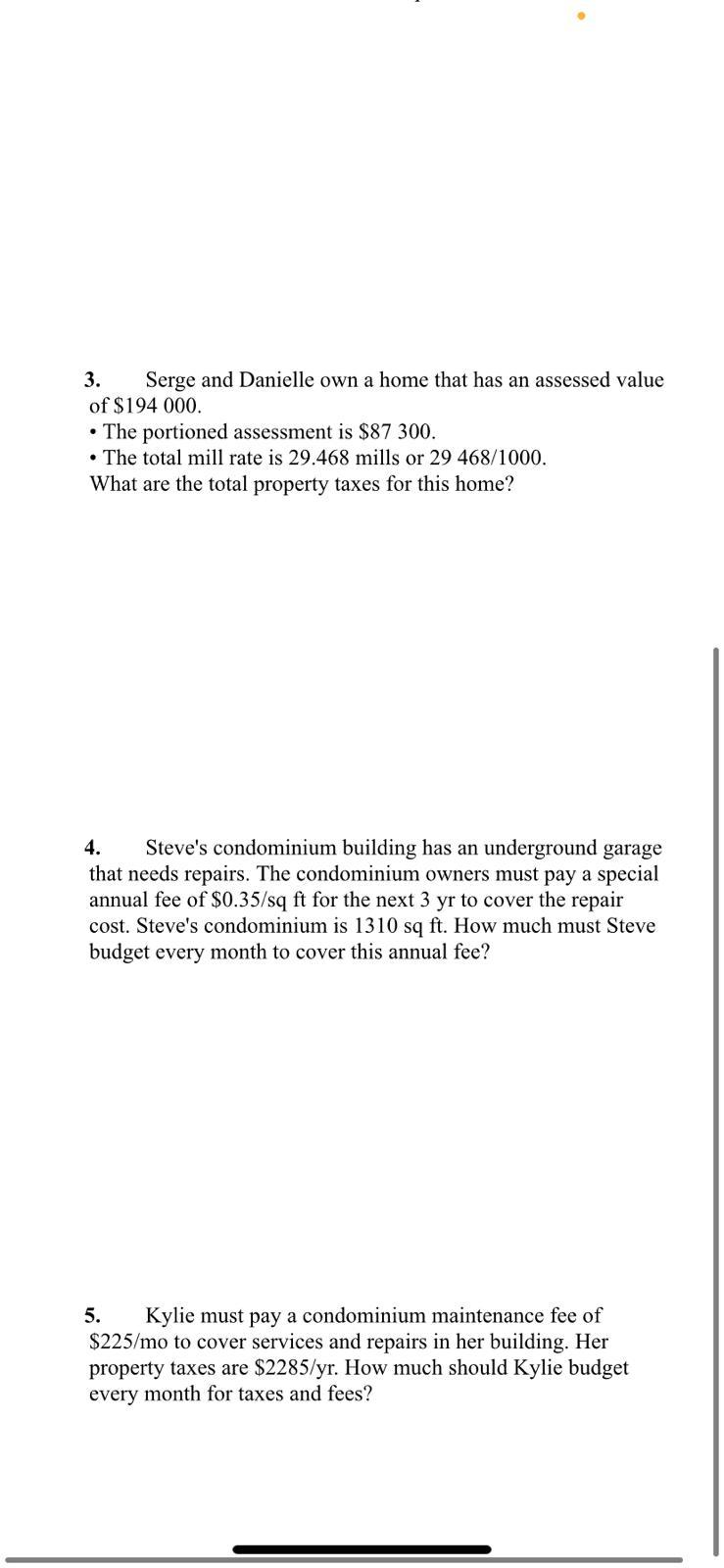

3. Serge and Danielle own a home that has an assessed value of $194 000. The portioned assessment is $87 300. The total mill

3. Serge and Danielle own a home that has an assessed value of $194 000. The portioned assessment is $87 300. The total mill rate is 29.468 mills or 29 468/1000. What are the total property taxes for this home? Steve's condominium building has an underground garage that needs repairs. The condominium owners must pay a special annual fee of $0.35/sq ft for the next 3 yr to cover the repair cost. Steve's condominium is 1310 sq ft. How much must Steve 4. budget every month to cover this annual fee? Kylie must pay a condominium maintenance fee of $225/mo to cover services and repairs in her building. Her property taxes are $2285/yr. How much should Kylie budget every month for taxes and fees? 5.

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Q3 Mill rate 29468 Assessed Value 87300 Property tax Mil Rate x Assessed Value10...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started