Answered step by step

Verified Expert Solution

Question

1 Approved Answer

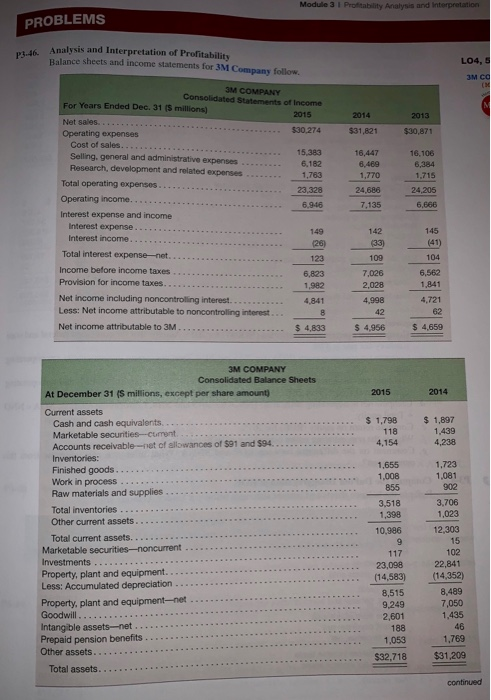

Module 3 1 Profitability Analysis and PROBLEMS 6 Analysis and Interpretation of Profitability Balance sheets and income statements for 3M Company follow. LO4, Consolidated Statements

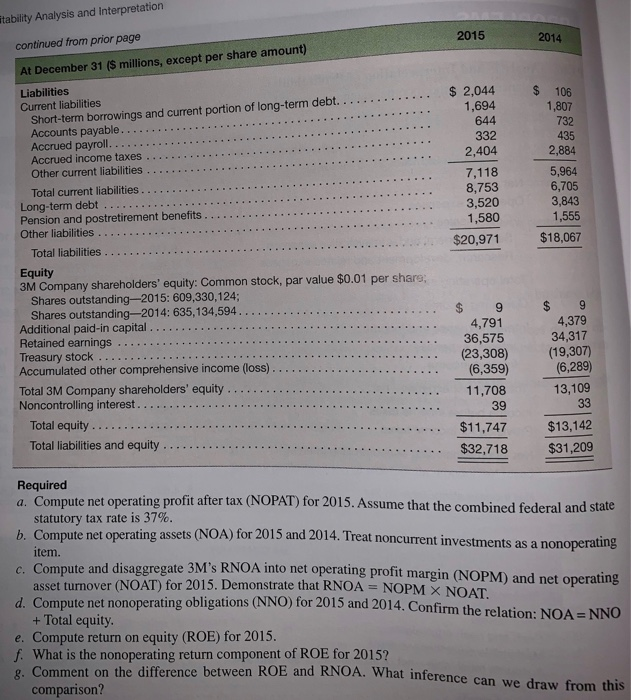

Module 3 1 Profitability Analysis and PROBLEMS 6 Analysis and Interpretation of Profitability Balance sheets and income statements for 3M Company follow. LO4, Consolidated Statements of Income Years Ended Dec. 31 (S millions) 2015 2014 2013 Net sales Operating expenses 31,821$30,871 16,106 6,384 1,715 Cost of sales Selling, general and administrative expenses Research, development and related expenses 15,383 6.182 1,763 1,770 Total operating expenses. Operating income Interest expense and income 23.328 24688 24205 7.135 6,666 Interest expense.- Interest income 149 142 145 109 104 6,562 1,841 4,721 123 Income before income taxes Provision for income taxes.... 7,026 2,028 1,982 Net income including noncontrolling interest. Less: Net income attributable to noncontrolling interest Net income attributable to 3M 4,841 S 4.833 $ 4,956 S 4,659 Balance Sheets t December 31 (S millions, except per share amount 2014 Current assets Cash and cash equivalents Marketable securities-cument 1,798 1,897 1,439 118 4,154 4,238 Inventories 1,723 1,655 1,008 855 3,518 ,398 10,986 Work in process Raw materials and supplies. 3,706 1,023 Total Inventories Other current assets Total current assets. 12,303 15 102 Investments Property, plant and equipment. Less: Accumulated depreciation ..(14,583) (14,352) 8,489 7,050 1,435 46 1,769 Property, plant and equipment-net. 9,249 2,601 188 1,053 $32,718 $31,209

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started