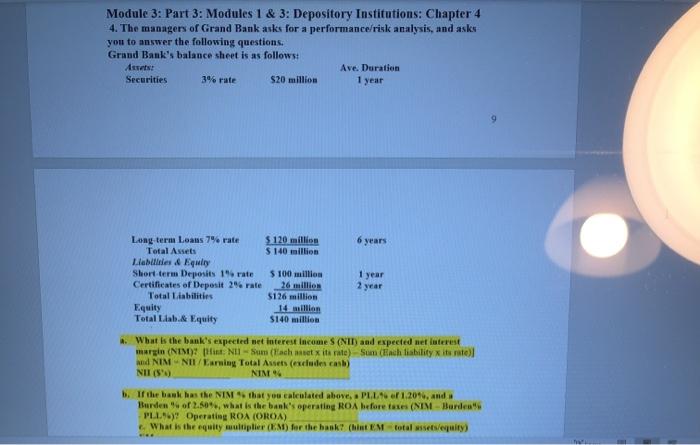

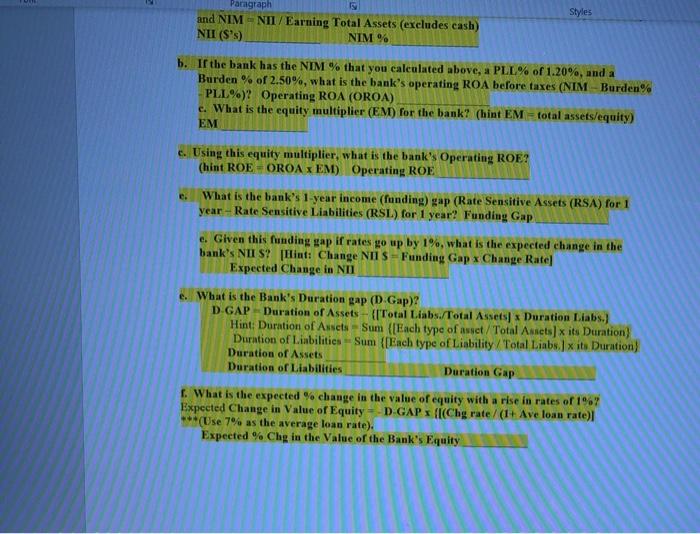

Module 3: Part 3: Modules 1 & 3: Depository Institutions: Chapter 4 4. The managers of Grand Bank asks for a performance/risk analysis, and asks you to answer the following questions. Grand Bank's balance sheet is as follows: Arr: Ave. Duration Securities 3% rate $20 million 1 year 1 year Long term Loans 7% rate $ 120 million 6 years Total Assets $ 140 million Llabilities & Equity Short term Deposits 19 rate $ 100 million Certificates of Deposit 2% rale 26 million Total Liabilities $126 million Equity 14 million Total Lab & Equity 5140 million * What is the bank's expected net interest income S (NIT) and expected net laterest mar (NIM)? Hur NII - Sum (Tachmut its rate) Sum (Each liability wittel and NIM- NII/Earning Total Assets (excludes cash) NII() NIM b. If the back has the NIM that you calculated above, PLL4 1.2046, and a Burden of 2.So, what is the bank's operating ROA before taxes (NIM - Bordea PLL)? Operating ROA (OROA) What is the equity multiplier (EM) for the bank? (EMtotal sets/equity) Styles Paragraph and NIM - NII/Earning Total Assets (excludes cash) NIM% NII (S'S) b. If the bank has the NIM% that you calculated above, a PLL% of 1.20%, and a Burden % of 2.50%, what is the bank's operating ROA before taxes (NIM - Burden% PLL%)? Operating ROA (OROA) e. What is the equity multiplier (EM) for the bank? (hint EM-total assets/equity) EM c. Using this equity multiplier, what is the bank's Operating ROE? (hint ROE -OROA XEM) Operating ROE What is the bank's 1 year income (funding) gap (Rate Sensitive Assets (RSA) for 1 year-Rate Sensitive Liabilities (RSL) for 1 year? Funding Gap c. Given this funding wap if rates go up by 1%, what is the expected change in the bank's NII S? [Hint: Change NII S = Funding Gap * Change Rate] Expected Change in NII & What is the Bank's Duration gap (D.Gap)? D GAP Duration of Assets - (Total Liabs./Total Assets) * Duration Liabs.) Hint: Duration of Assets - Sum {[Each type of auct/Total Assets) x its Duration) Duration of Liabilities - Sum {[Each type of Liability/Total Liabs.]xit Duration Duration of Assets Duration of Liabilities Duration Gap 1. What is the expected % change in the value of equity with a rise in rates of 1%? Expected Change in Value of Equity D GAP = {[(Chg rate/(t+ Ave loan rate) ***(Use 7% as the average loan rate). Expected %Chg in the value of the Bank's Equity Module 3: Part 3: Modules 1 & 3: Depository Institutions: Chapter 4 4. The managers of Grand Bank asks for a performance/risk analysis, and asks you to answer the following questions. Grand Bank's balance sheet is as follows: Arr: Ave. Duration Securities 3% rate $20 million 1 year 1 year Long term Loans 7% rate $ 120 million 6 years Total Assets $ 140 million Llabilities & Equity Short term Deposits 19 rate $ 100 million Certificates of Deposit 2% rale 26 million Total Liabilities $126 million Equity 14 million Total Lab & Equity 5140 million * What is the bank's expected net interest income S (NIT) and expected net laterest mar (NIM)? Hur NII - Sum (Tachmut its rate) Sum (Each liability wittel and NIM- NII/Earning Total Assets (excludes cash) NII() NIM b. If the back has the NIM that you calculated above, PLL4 1.2046, and a Burden of 2.So, what is the bank's operating ROA before taxes (NIM - Bordea PLL)? Operating ROA (OROA) What is the equity multiplier (EM) for the bank? (EMtotal sets/equity) Styles Paragraph and NIM - NII/Earning Total Assets (excludes cash) NIM% NII (S'S) b. If the bank has the NIM% that you calculated above, a PLL% of 1.20%, and a Burden % of 2.50%, what is the bank's operating ROA before taxes (NIM - Burden% PLL%)? Operating ROA (OROA) e. What is the equity multiplier (EM) for the bank? (hint EM-total assets/equity) EM c. Using this equity multiplier, what is the bank's Operating ROE? (hint ROE -OROA XEM) Operating ROE What is the bank's 1 year income (funding) gap (Rate Sensitive Assets (RSA) for 1 year-Rate Sensitive Liabilities (RSL) for 1 year? Funding Gap c. Given this funding wap if rates go up by 1%, what is the expected change in the bank's NII S? [Hint: Change NII S = Funding Gap * Change Rate] Expected Change in NII & What is the Bank's Duration gap (D.Gap)? D GAP Duration of Assets - (Total Liabs./Total Assets) * Duration Liabs.) Hint: Duration of Assets - Sum {[Each type of auct/Total Assets) x its Duration) Duration of Liabilities - Sum {[Each type of Liability/Total Liabs.]xit Duration Duration of Assets Duration of Liabilities Duration Gap 1. What is the expected % change in the value of equity with a rise in rates of 1%? Expected Change in Value of Equity D GAP = {[(Chg rate/(t+ Ave loan rate) ***(Use 7% as the average loan rate). Expected %Chg in the value of the Bank's Equity