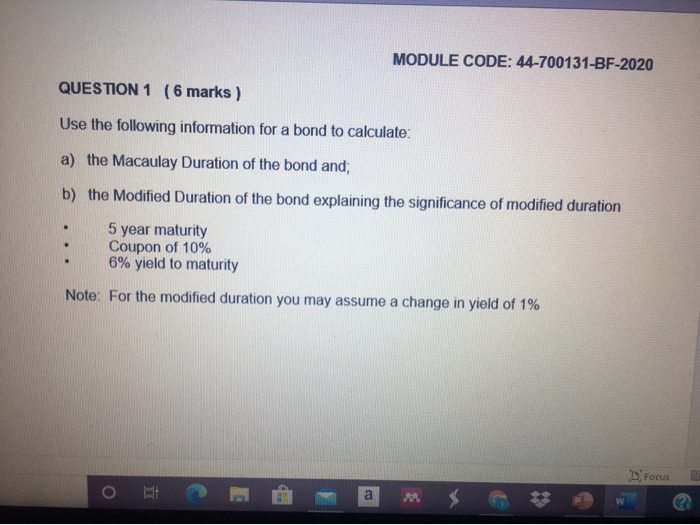

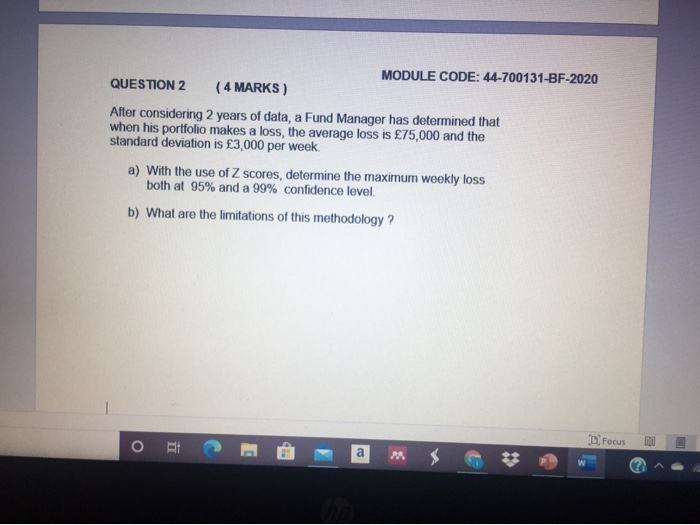

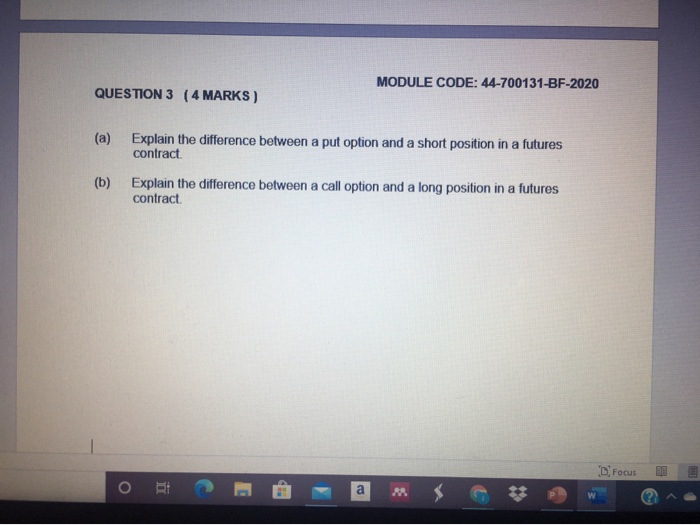

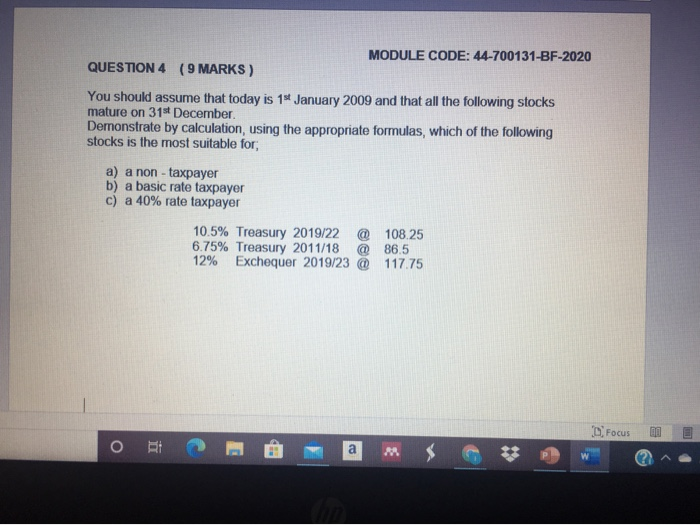

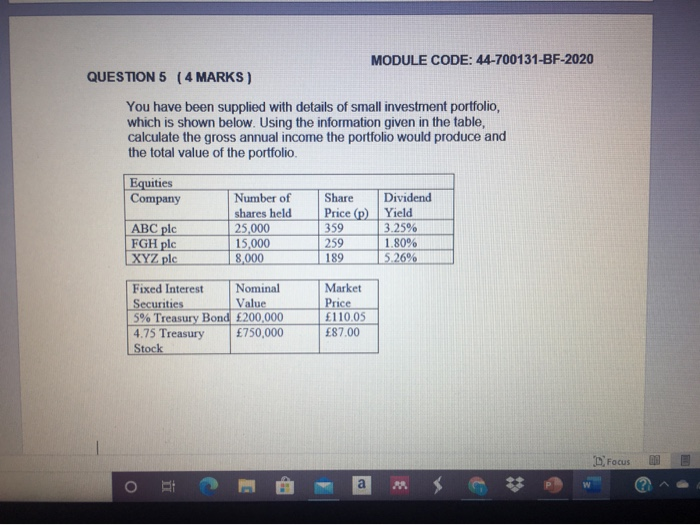

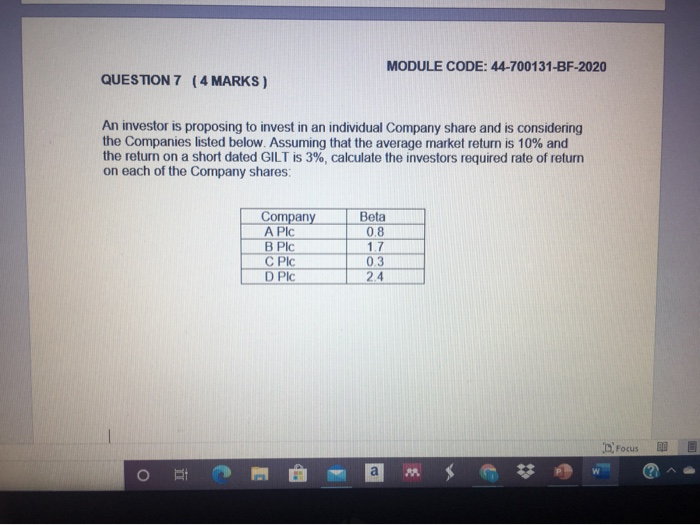

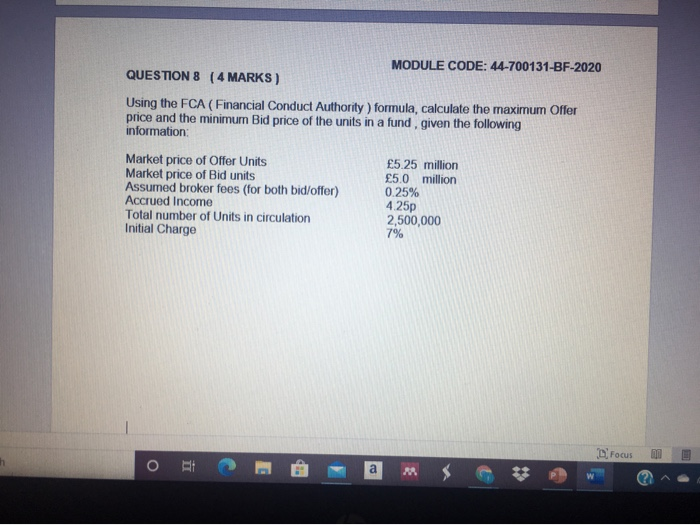

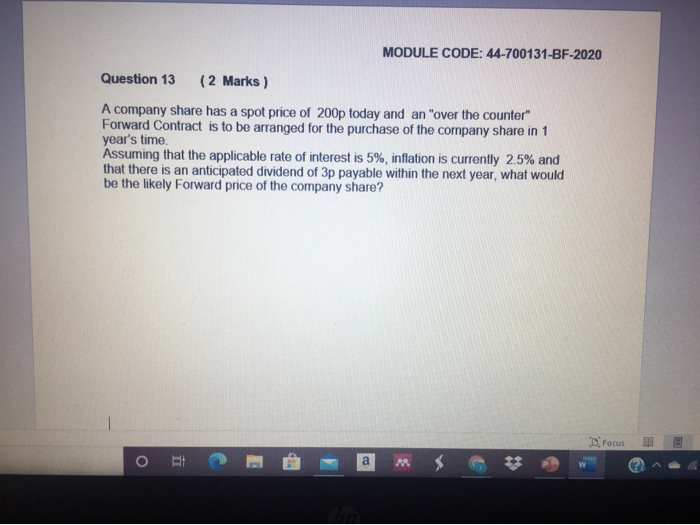

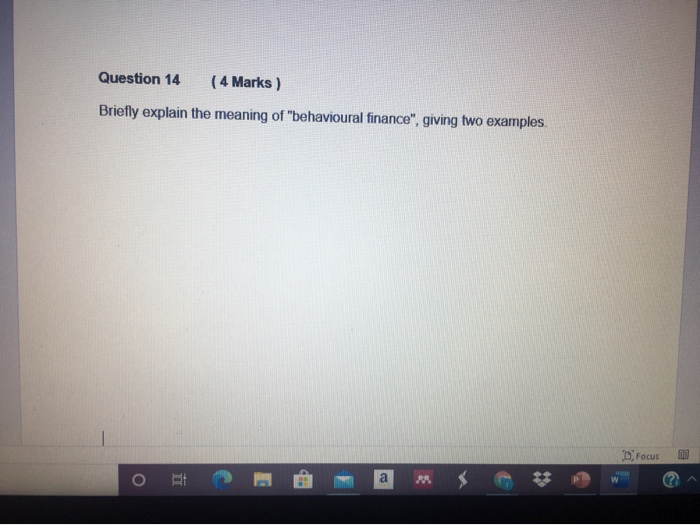

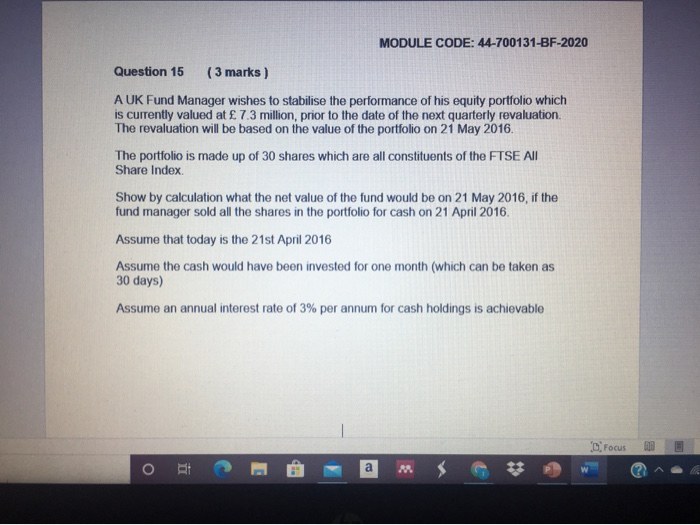

MODULE CODE: 44-700131-BF-2020 QUESTION 1 (6 marks) Use the following information for a bond to calculate: a) the Macaulay Duration of the bond and; b) the Modified Duration of the bond explaining the significance of modified duration 5 year maturity Coupon of 10% 6% yield to maturity Note: For the modified duration you may assume a change in yield of 1% Focus $ MODULE CODE: 44-700131-BF-2020 QUESTION 2 (4 MARKS) After considering 2 years of data, a Fund Manager has determined that when his portfolio makes a loss, the average loss is 75,000 and the standard deviation is 3,000 per week. a) With the use of Z scores, determine the maximum weekly loss both at 95% and a 99% confidence level b) What are the limitations of this methodology ? o D. Focus E ** a $ * MODULE CODE: 44-700131-BF-2020 QUESTION 3 ( 4 MARKS) (a) Explain the difference between a put option and a short position in a futures contract (b) Explain the difference between a call option and a long position in a futures contract D. Focus a MODULE CODE: 44-700131-BF-2020 QUESTION 4 ( 9 MARKS) You should assume that today is 18 January 2009 and that all the following stocks mature on 31st December Demonstrate by calculation, using the appropriate formulas, which of the following stocks is the most suitable for, a) a non-taxpayer b) a basic rate taxpayer c) a 40% rate taxpayer 10.5% Treasury 2019/22 @ 108.25 6.75% Treasury 2011/18 @ 86.5 12% Exchequer 2019/23 @ 117.75 D. Focus 2 MODULE CODE: 44-700131-BF-2020 QUESTION 5 (4 MARKS) You have been supplied with details of small investment portfolio, which is shown below. Using the information given in the table, calculate the gross annual income the portfolio would produce and the total value of the portfolio Equities Company ABC plc FGH plc XYZ plc Number of shares held 25,000 15,000 8,000 Share Price (p) 359 259 189 Dividend Yield 3.25% 1.80% 5.26% Fixed Interest Nominal Securities Value 5% Treasury Bond 200,000 4.75 Treasury 750,000 Stock Market Price 110.05 87.00 Focus a MODULE CODE: 44-700131-BF-2020 QUESTION 6 (6 MARKS) Efficient Market Hypothesis (EMH) is a controversial financial theory. Explain the three forms of EMH and their significance to an investor. D. Focus > O i a ? MODULE CODE: 44-700131-BF-2020 QUESTION 7 ( 4 MARKS) An investor is proposing to invest in an individual Company share and is considering the Companies listed below. Assuming that the average market return is 10% and the return on a short dated GILT is 3%, calculate the investors required rate of return on each of the Company shares: Company B PIC C PIC D PIC Beta 0.8 1.7 0.3 2.4 D Focus ED o 3 MODULE CODE: 44-700131-BF-2020 QUESTION 8 ( 4 MARKS) Using the FCA ( Financial Conduct Authority ) formula, calculate the maximum Offer price and the minimum Bid price of the units in a fund, given the following information Market price of Offer Units 5.25 million Market price of Bid units 5.0 million Assumed broker fees (for both bid/offer) 0.25% Accrued Income 425p Total number of Units in circulation 2,500,000 Initial Charge 7% Focus O i a MODULE CODE: 44-700131-BF-2020 QUESTION 9 ( 6 MARKS) Identify two comparative advantages in investing in each of the following: Investment trusts a b. Open-end investment funds: Individual stocks and bonds: C Focus o * a MODULE CODE: 44-700131-BF-2020 Question 10 (3 marks ) Explain what is systernatic risk and unsystematic risk and which of the two risks can be mitigated by diversification? D. Focus @ a o * Question 11 (2 marks) The nominal rate of return of an account is 3% and the annual rate of inflation during the same period is 1.1%. Calculate an accurate measure of the real rate of return. Page 11 of 18 MODULE CODE: 44-700131-BF-2020 D. Focus MODULE CODE: 44-700131-BF-2020 Question 12 (4 marks) Explain what is the difference between Fundamental analysis and Technical analysis? 1 Focus MODULE CODE: 44-700131-BF-2020 Question 13 (2 Marks ) A company share has a spot price of 200p today and an "over the counter" Forward Contract is to be arranged for the purchase of the company share in 1 year's time. Assuming that the applicable rate of interest is 5%, inflation is currently 2.5% and that there is an anticipated dividend of 3p payable within the next year, what would be the likely Forward price of the company share? Focus 3D a & Question 14 ( 4 Marks ) Briefly explain the meaning of "behavioural finance", giving two examples. Focus a MODULE CODE: 44-700131-BF-2020 Question 15 (3 marks) A UK Fund Manager wishes to stabilise the performance of his equity portfolio which is currently valued at 7.3 million, prior to the date of the next quarterly revaluation The revaluation will be based on the value of the portfolio on 21 May 2016. The portfolio is made up of 30 shares which are all constituents of the FTSE All Share Index Show by calculation what the net value of the fund would be on 21 May 2016, if the fund manager sold all the shares in the portfolio for cash on 21 April 2016, Assume that today is the 21st April 2016 Assume the cash would have been invested for one month (which can be taken as 30 days) Assume an annual interest rate of 3% per annum for cash holdings is achievable D Focus a MODULE CODE: 44-700131-BF-2020 QUESTION 1 (6 marks) Use the following information for a bond to calculate: a) the Macaulay Duration of the bond and; b) the Modified Duration of the bond explaining the significance of modified duration 5 year maturity Coupon of 10% 6% yield to maturity Note: For the modified duration you may assume a change in yield of 1% Focus $ MODULE CODE: 44-700131-BF-2020 QUESTION 2 (4 MARKS) After considering 2 years of data, a Fund Manager has determined that when his portfolio makes a loss, the average loss is 75,000 and the standard deviation is 3,000 per week. a) With the use of Z scores, determine the maximum weekly loss both at 95% and a 99% confidence level b) What are the limitations of this methodology ? o D. Focus E ** a $ * MODULE CODE: 44-700131-BF-2020 QUESTION 3 ( 4 MARKS) (a) Explain the difference between a put option and a short position in a futures contract (b) Explain the difference between a call option and a long position in a futures contract D. Focus a MODULE CODE: 44-700131-BF-2020 QUESTION 4 ( 9 MARKS) You should assume that today is 18 January 2009 and that all the following stocks mature on 31st December Demonstrate by calculation, using the appropriate formulas, which of the following stocks is the most suitable for, a) a non-taxpayer b) a basic rate taxpayer c) a 40% rate taxpayer 10.5% Treasury 2019/22 @ 108.25 6.75% Treasury 2011/18 @ 86.5 12% Exchequer 2019/23 @ 117.75 D. Focus 2 MODULE CODE: 44-700131-BF-2020 QUESTION 5 (4 MARKS) You have been supplied with details of small investment portfolio, which is shown below. Using the information given in the table, calculate the gross annual income the portfolio would produce and the total value of the portfolio Equities Company ABC plc FGH plc XYZ plc Number of shares held 25,000 15,000 8,000 Share Price (p) 359 259 189 Dividend Yield 3.25% 1.80% 5.26% Fixed Interest Nominal Securities Value 5% Treasury Bond 200,000 4.75 Treasury 750,000 Stock Market Price 110.05 87.00 Focus a MODULE CODE: 44-700131-BF-2020 QUESTION 6 (6 MARKS) Efficient Market Hypothesis (EMH) is a controversial financial theory. Explain the three forms of EMH and their significance to an investor. D. Focus > O i a ? MODULE CODE: 44-700131-BF-2020 QUESTION 7 ( 4 MARKS) An investor is proposing to invest in an individual Company share and is considering the Companies listed below. Assuming that the average market return is 10% and the return on a short dated GILT is 3%, calculate the investors required rate of return on each of the Company shares: Company B PIC C PIC D PIC Beta 0.8 1.7 0.3 2.4 D Focus ED o 3 MODULE CODE: 44-700131-BF-2020 QUESTION 8 ( 4 MARKS) Using the FCA ( Financial Conduct Authority ) formula, calculate the maximum Offer price and the minimum Bid price of the units in a fund, given the following information Market price of Offer Units 5.25 million Market price of Bid units 5.0 million Assumed broker fees (for both bid/offer) 0.25% Accrued Income 425p Total number of Units in circulation 2,500,000 Initial Charge 7% Focus O i a MODULE CODE: 44-700131-BF-2020 QUESTION 9 ( 6 MARKS) Identify two comparative advantages in investing in each of the following: Investment trusts a b. Open-end investment funds: Individual stocks and bonds: C Focus o * a MODULE CODE: 44-700131-BF-2020 Question 10 (3 marks ) Explain what is systernatic risk and unsystematic risk and which of the two risks can be mitigated by diversification? D. Focus @ a o * Question 11 (2 marks) The nominal rate of return of an account is 3% and the annual rate of inflation during the same period is 1.1%. Calculate an accurate measure of the real rate of return. Page 11 of 18 MODULE CODE: 44-700131-BF-2020 D. Focus MODULE CODE: 44-700131-BF-2020 Question 12 (4 marks) Explain what is the difference between Fundamental analysis and Technical analysis? 1 Focus MODULE CODE: 44-700131-BF-2020 Question 13 (2 Marks ) A company share has a spot price of 200p today and an "over the counter" Forward Contract is to be arranged for the purchase of the company share in 1 year's time. Assuming that the applicable rate of interest is 5%, inflation is currently 2.5% and that there is an anticipated dividend of 3p payable within the next year, what would be the likely Forward price of the company share? Focus 3D a & Question 14 ( 4 Marks ) Briefly explain the meaning of "behavioural finance", giving two examples. Focus a MODULE CODE: 44-700131-BF-2020 Question 15 (3 marks) A UK Fund Manager wishes to stabilise the performance of his equity portfolio which is currently valued at 7.3 million, prior to the date of the next quarterly revaluation The revaluation will be based on the value of the portfolio on 21 May 2016. The portfolio is made up of 30 shares which are all constituents of the FTSE All Share Index Show by calculation what the net value of the fund would be on 21 May 2016, if the fund manager sold all the shares in the portfolio for cash on 21 April 2016, Assume that today is the 21st April 2016 Assume the cash would have been invested for one month (which can be taken as 30 days) Assume an annual interest rate of 3% per annum for cash holdings is achievable D Focus a