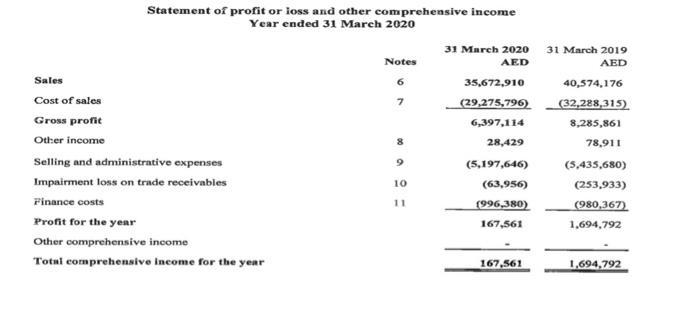

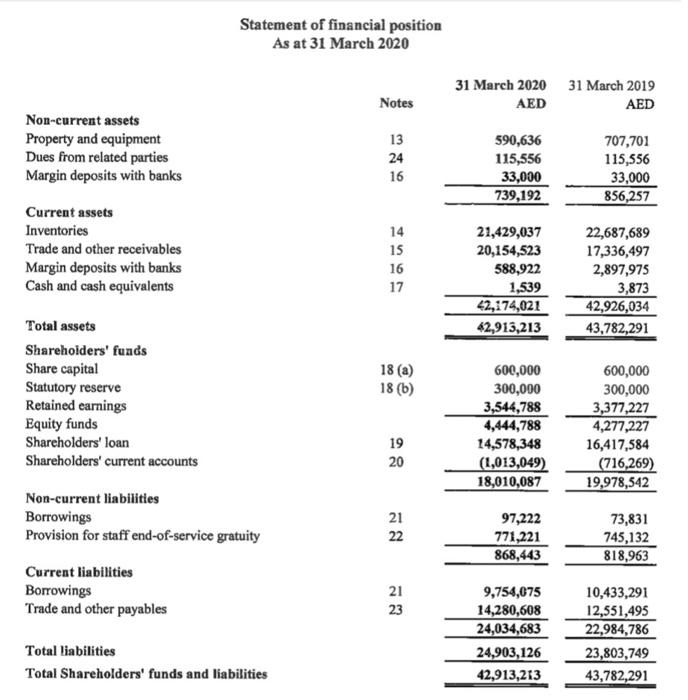

Mohammed & Co. is a Corporation with a focus on Food and Beverage manufacturing in the UAE. They are now looking to finance their new project, a restaurant chain. To raise funds they will issue shares to the public. You are required to calculate, interpret and analyze the following ratios for two years: a) Total Asset turnover b) Fixed Asset turnover c) Price to Earnings Ratio d) Market to Book Ratio e) Net Profit Margin f) Gross Profit Margin g) Dividends per share h) Operating Return on Assets [16+8+4] Mohammed & Co. currently has 60,000 shares outstanding with the dividend announced for the current year (2020) at AED 49,000 and last year (2019) the dividend announced was at AED 52,000 for the entire group The opening share price of Mohammed & Co. on 30th of March 2020 was AED156.7 and AED104.8 on 30th March 2019. Based on the ratios calculated above, Can you conclude if Mohammed & Co. is a good investment opportunity for the prospective Shareholder? [2] Statement of profit or loss and other comprehensive income Year ended 31 March 2020 31 March 2020 31 March 2019 AED Notes AED Sales 6 35,672,910 40,574,176 Cost of sales 7 (29,275,796) (32,288,315) Gross profit 6,397,114 8,285,861 Other income 8 28,429 78.911 Selling and administrative expenses 9 (5,197,646) (5,435,680) Impairment loss on trade receivables 10 (63,956) (253,933) Finance costs 11 1996,380) (980,367) Profit for the year 167,561 1,694,792 Other comprehensive income Total comprehensive Income for the year 167,561 1,694,792 Statement of financial position As at 31 March 2020 31 March 2020 31 March 2019 AED AED Notes 13 Non-current assets Property and equipment Dues from related parties Margin deposits with banks 24 16 590,636 115,556 33,000 739,192 707,701 115,556 33,000 856,257 14 Current assets Inventories Trade and other receivables Margin deposits with banks Cash and cash equivalents 15 16 21,429,037 20,154,523 588,922 1,539 42,174,021 42,913,213 22,687,689 17,336,497 2,897,975 3,873 42,926,034 43,782,291 17 Total assets 18 (a) 18 (b) Shareholders' funds Share capital Statutory reserve Retained earnings Equity funds Shareholders' loan Shareholders' current accounts 600,000 300,000 3,544,788 4,444,788 14,578,348 (1,013,049) 18,010,087 600,000 300,000 3,377,227 4,277,227 16,417,584 (716,269) 19,978,542 19 20 Non-current liabilities Borrowings Provision for staff end-of-service gratuity 21 22 97,222 771,221 868,443 73,831 745,132 818,963 Current liabilities 21 Borrowings Trade and other payables 23 9,754,075 14,280,608 24,034,683 10,433,291 12,551,495 22,984,786 Total liabilities 24,903,126 42,913,213 23,803,749 43,782,291 Total Shareholders' funds and liabilities