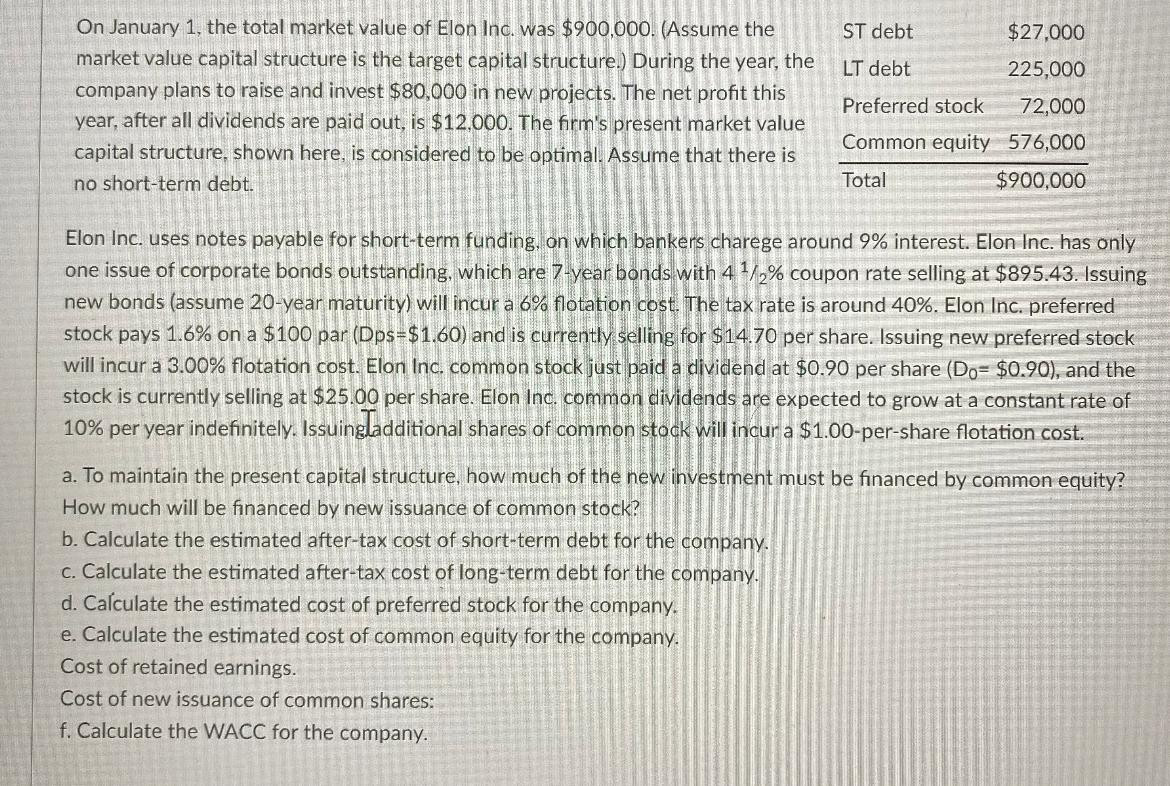

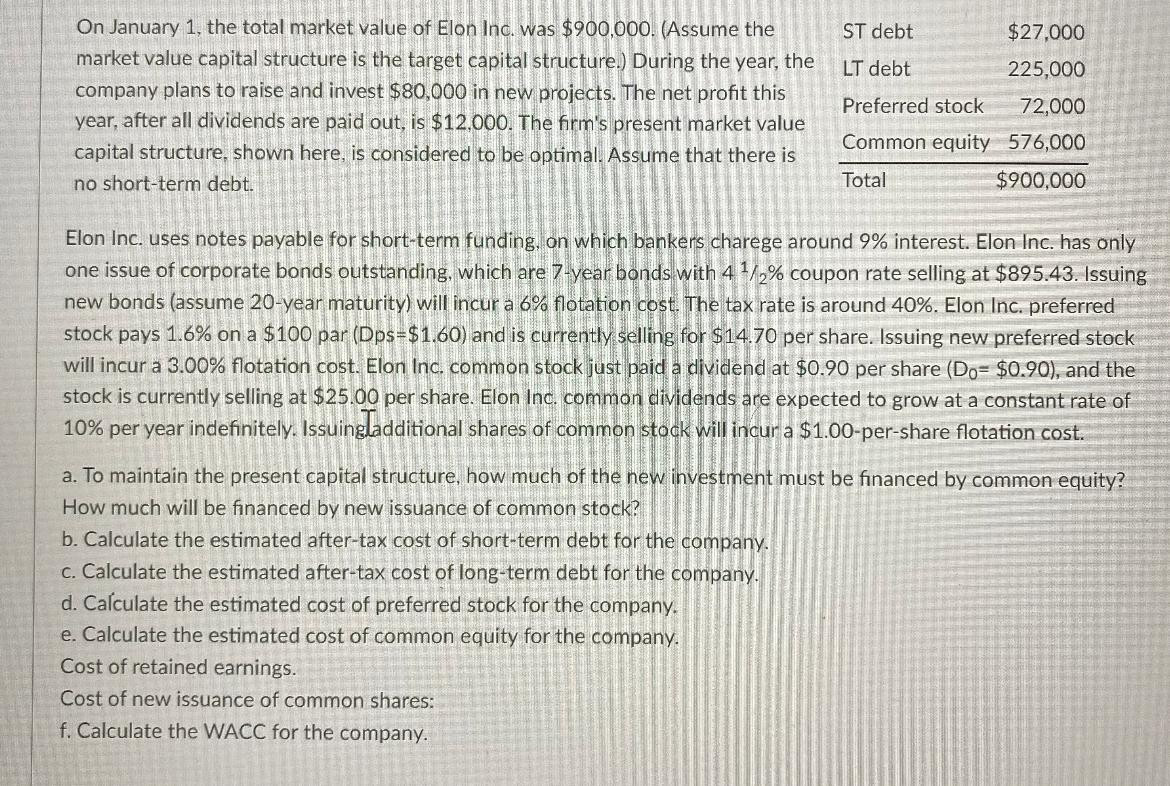

ST debt $27,000 LT debt 225,000 On January 1, the total market value of Elon Inc. was $900,000. (Assume the market value capital structure is the target capital structure.) During the year, the company plans to raise and invest $80,000 in new projects. The net profit this year, after all dividends are paid out, is $12,000. The firm's present market value capital structure, shown here, is considered to be optimal. Assume that there is no short-term debt. Preferred stock 72,000 Common equity 576,000 Total $900,000 Elon Inc. uses notes payable for short-term funding, on which bankers charege around 9% interest. Elon Inc. has only one issue of corporate bonds outstanding, which are 7-year bonds with 41/% coupon rate selling at $895.43. Issuing new bonds (assume 20-year maturity) will incur a 6% flotation cost. The tax rate is around 40%. Elon Inc. preferred stock pays 1.6% on a $100 par (Dps=$1.60) and is currently selling for $14.70 per share. Issuing new preferred stock will incur a 3.00% flotation cost. Elon Inc. common stock just paid a dividend at $0.90 per share (Do= $0.90), and the stock is currently selling at $25.00 per share. Elon Inc. common dividends are expected to grow at a constant rate of 10% per year indefinitely. Issuingladditional shares of common stock will incur a $1.00-per-share flotation cost. a. To maintain the present capital structure, how much of the new investment must be financed by common equity? How much will be financed by new issuance of common stock? b. Calculate the estimated after-tax cost of short-term debt for the company. C. Calculate the estimated after-tax cost of long-term debt for the company. d. Calculate the estimated cost of preferred stock for the company. e. Calculate the estimated cost of common equity for the company. Cost of retained earnings. Cost of new issuance of common shares: f. Calculate the WACC for the company. ST debt $27,000 LT debt 225,000 On January 1, the total market value of Elon Inc. was $900,000. (Assume the market value capital structure is the target capital structure.) During the year, the company plans to raise and invest $80,000 in new projects. The net profit this year, after all dividends are paid out, is $12,000. The firm's present market value capital structure, shown here, is considered to be optimal. Assume that there is no short-term debt. Preferred stock 72,000 Common equity 576,000 Total $900,000 Elon Inc. uses notes payable for short-term funding, on which bankers charege around 9% interest. Elon Inc. has only one issue of corporate bonds outstanding, which are 7-year bonds with 41/% coupon rate selling at $895.43. Issuing new bonds (assume 20-year maturity) will incur a 6% flotation cost. The tax rate is around 40%. Elon Inc. preferred stock pays 1.6% on a $100 par (Dps=$1.60) and is currently selling for $14.70 per share. Issuing new preferred stock will incur a 3.00% flotation cost. Elon Inc. common stock just paid a dividend at $0.90 per share (Do= $0.90), and the stock is currently selling at $25.00 per share. Elon Inc. common dividends are expected to grow at a constant rate of 10% per year indefinitely. Issuingladditional shares of common stock will incur a $1.00-per-share flotation cost. a. To maintain the present capital structure, how much of the new investment must be financed by common equity? How much will be financed by new issuance of common stock? b. Calculate the estimated after-tax cost of short-term debt for the company. C. Calculate the estimated after-tax cost of long-term debt for the company. d. Calculate the estimated cost of preferred stock for the company. e. Calculate the estimated cost of common equity for the company. Cost of retained earnings. Cost of new issuance of common shares: f. Calculate the WACC for the company