Question

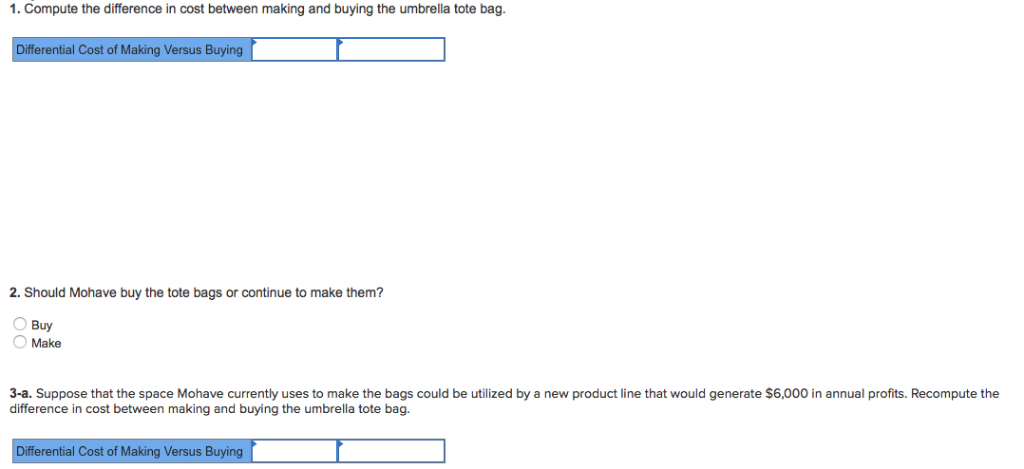

Mohave Corp. is considering outsourcing production of the umbrella tote bag included with some of its products. The company has received a bid from a

Mohave Corp. is considering outsourcing production of the umbrella tote bag included with some of its products. The company has received a bid from a supplier in Vietnam to produce 9,800 units per year for $9.00 each. Mohave has the following information about the cost of producing tote bags:

| Direct materials | $ | 5 | |

| Direct labor | 2 | ||

| Variable manufacturing overhead | 1 | ||

| Fixed manufacturing overhead | 2.00 | ||

| Total cost per unit | $ | 10.00 | |

Mohave has determined that all variable costs could be eliminated by outsourcing the tote bags, while 75 percent of the fixed overhead cost is unavoidable. At this time, Mohave has no specific use in mind for the space currently dedicated to producing the tote bags.

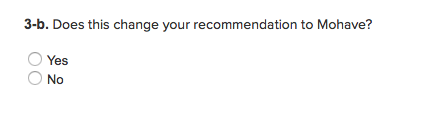

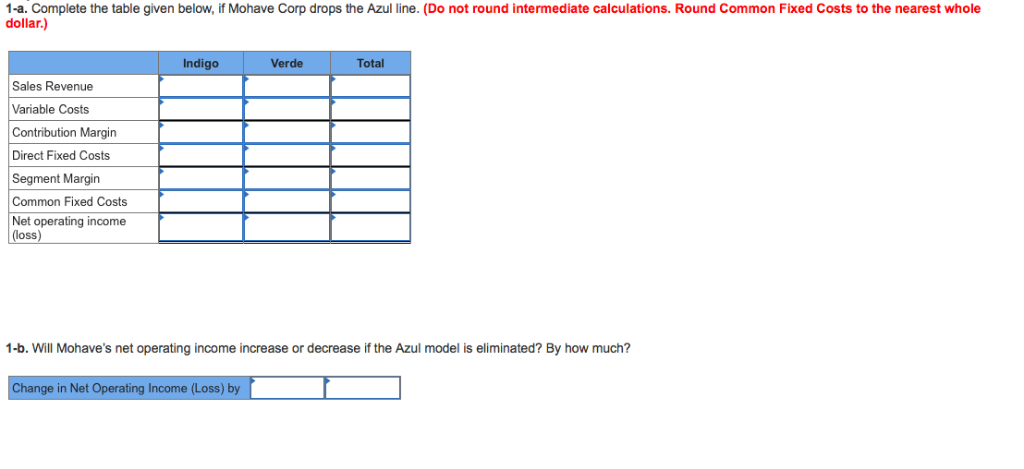

Mohave Corp. is considering eliminating a product from its Sand Trap line of beach umbrellas. This collection is aimed at people who spend time on the beach or have an outdoor patio near the beach. Two products, the Indigo and Verde umbrellas, have impressive sales. However, sales for the Azul model have been dismal. Mohaves information related to the Sand Trap line is shown below.

| Segmented Income Statement for Mohaves | ||||||||||||||||||

| Sand Trap Beach Umbrella Products | ||||||||||||||||||

| Indigo | Verde | Azul | Total | |||||||||||||||

| Sales revenue | $ | 60,000 | $ | 60,000 | $ | 30,000 | $ | 150,000 | ||||||||||

| Variable costs | 34,000 | 31,000 | 26,000 | 91,000 | ||||||||||||||

| Contribution margin | $ | 26,000 | $ | 29,000 | $ | 4,000 | $ | 59,000 | ||||||||||

| Less: Direct Fixed costs | 1,900 | 2,500 | 2,000 | 6,400 | ||||||||||||||

| Segment margin | $ | 24,100 | $ | 26,500 | $ | 2,000 | $ | 52,600 | ||||||||||

| Common fixed costs* | 17,840 | 17,840 | 8,920 | 44,600 | ||||||||||||||

| Net operating income (loss) | $ | 6,260 | $ | 8,660 | $ | (6,920 | ) | $ | 8,000 | |||||||||

*Allocated based on total sales revenue

Mohave has determined that eliminating the Azul model would cause sales of the Indigo and Verde models to increase by 10 percent and 15 percent, respectively. Variable costs for these two models would increase proportionately. Although the direct fixed costs could be eliminated, the common fixed costs are unavoidable. The common fixed costs would be redistributed to the remaining two products.

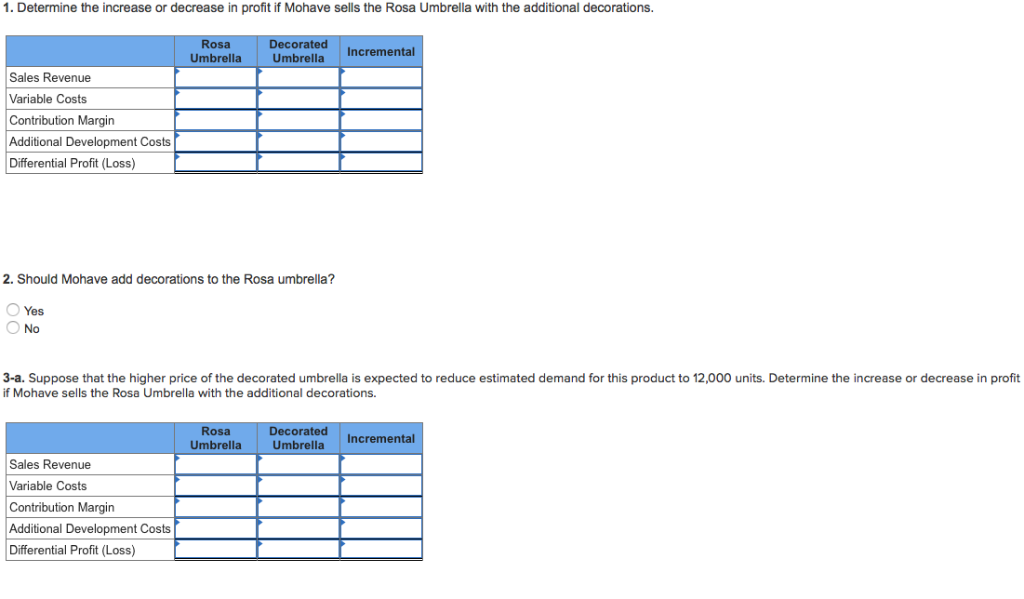

The Rosa model of Mohave Corp. is currently manufactured as a very plain umbrella with no decoration. The company is considering changing this product to a much more decorative model by adding a silk-screened design and embellishments. A summary of the expected costs and revenues for Mohaves two options follows:

| Rosa Umbrella | Decorated Umbrella | ||||||

| Estimated demand | 14,000 | units | 14,000 | units | |||

| Estimated sales price | $ | 12.00 | $ | 23.00 | |||

| Estimated manufacturing cost per unit | |||||||

| Direct materials | $ | 6.50 | $ | 8.50 | |||

| Direct labor | 1.50 | 4.00 | |||||

| Variable manufacturing overhead | 0.50 | 2.50 | |||||

| Fixed manufacturing overhead | 3.00 | 3.00 | |||||

| Unit manufacturing cost | $ | 11.50 | $ | 18.00 | |||

| Additional development cost | $ | 14,000 | |||||

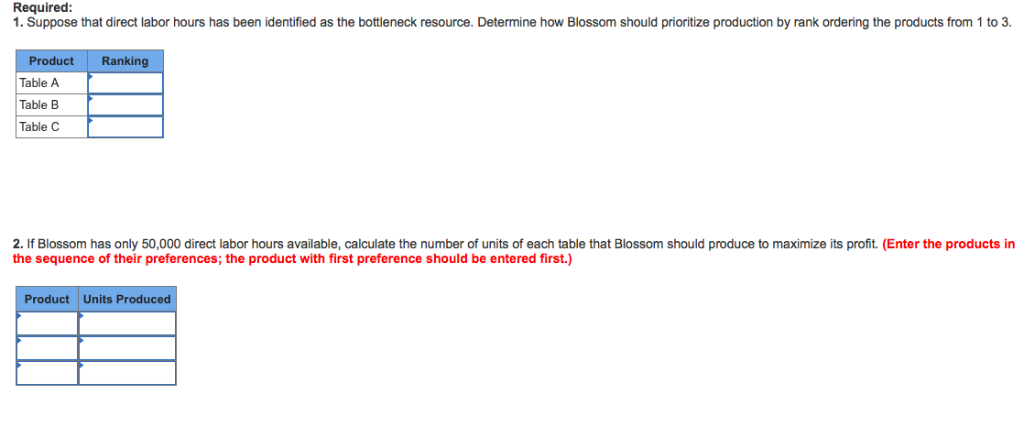

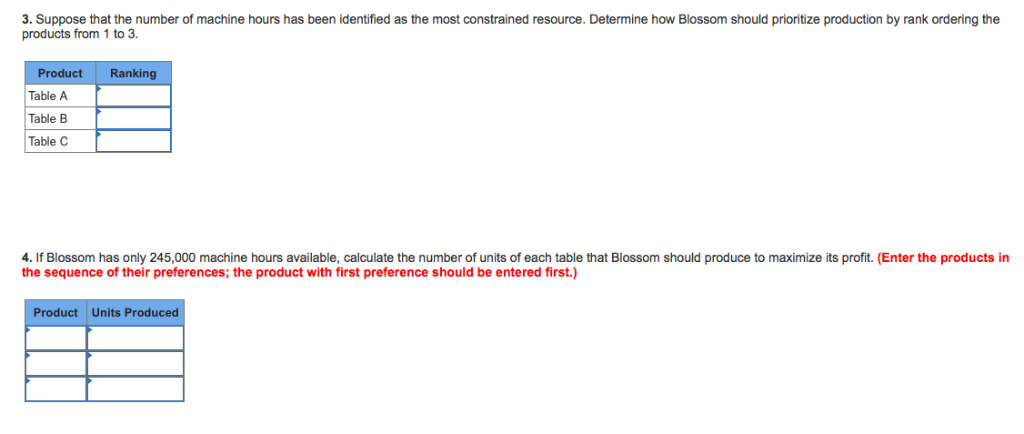

Blossom, Inc., is a small company that manufactures three versions of patio tables. Unit information for its products follows:

| Table A | Table B | Table C | |||||||

| Sales price | $ | 53 | $ | 57 | $ | 71 | |||

| Direct materials | 11 | 12 | 13 | ||||||

| Direct labor | 2 | 4 | 8 | ||||||

| Variable manufacturing overhead | 5 | 5 | 5 | ||||||

| Fixed manufacturing overhead | 6 | 6 | 6 | ||||||

| Required number of labor hours | 0.5 | 0.5 | 1.0 | ||||||

| Required number of machine hours | 4.0 | 2.50 | 2.0 | ||||||

Blossom has determined that it can sell a limited number of each table in the upcoming year. Expected demand for each model follows:

| Table A | 50,000 | units | |

| Table B | 25,000 | units | |

| Table C | 25,000 | units | |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started