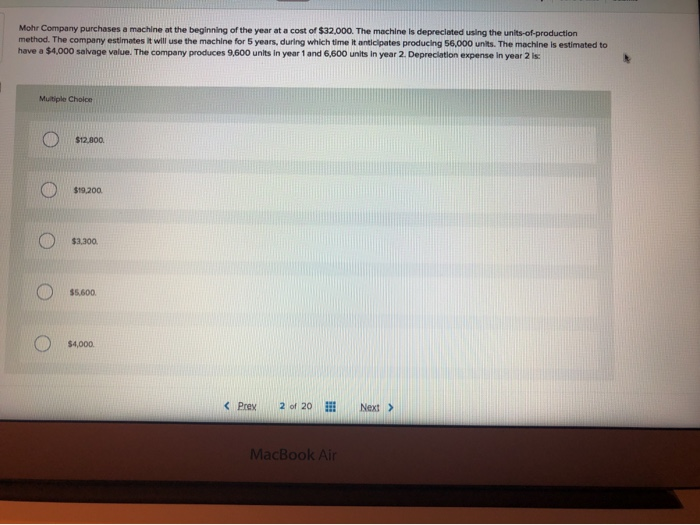

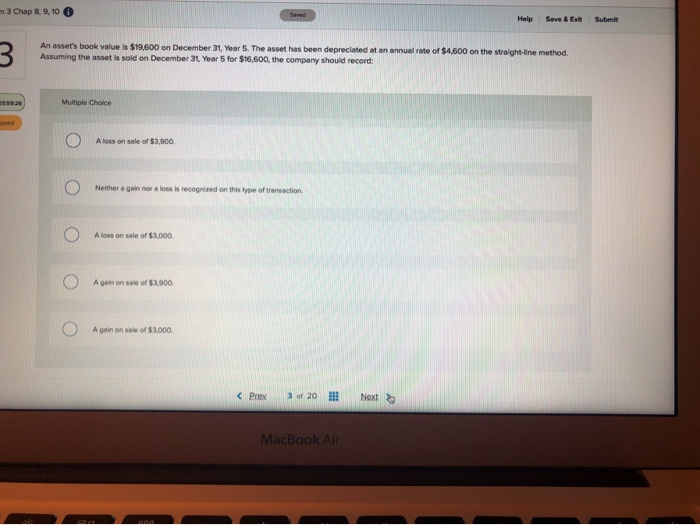

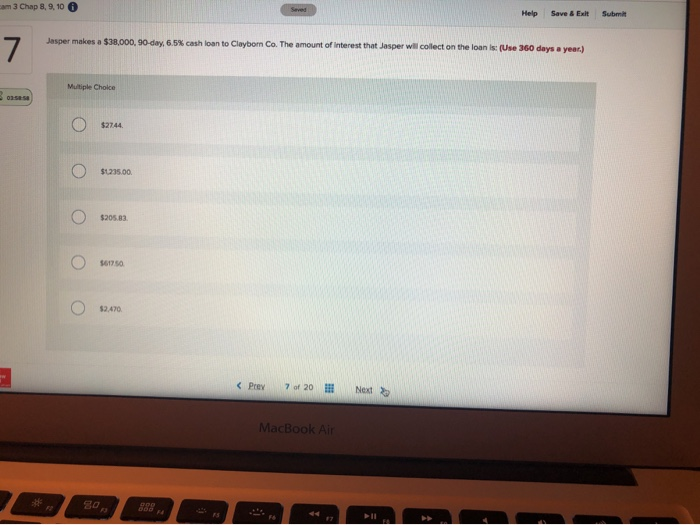

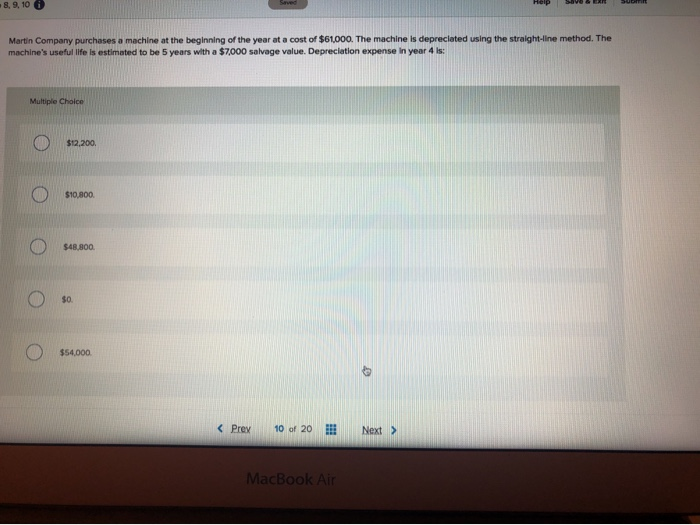

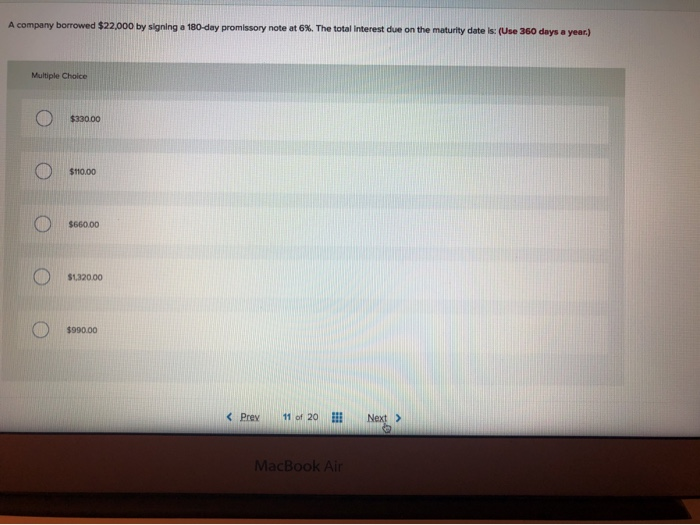

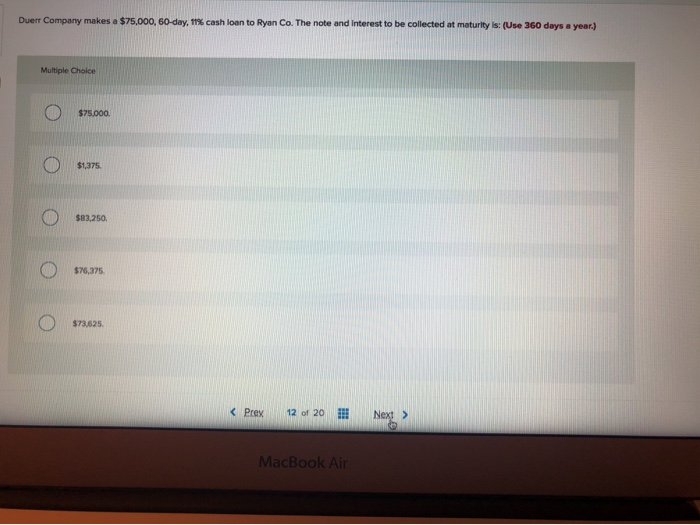

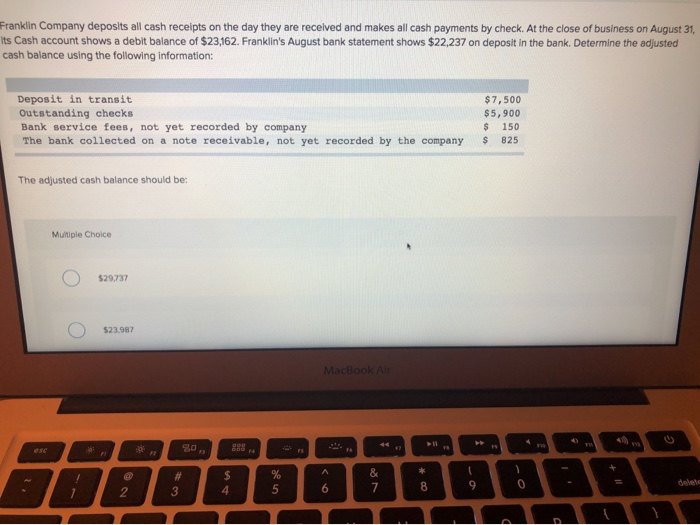

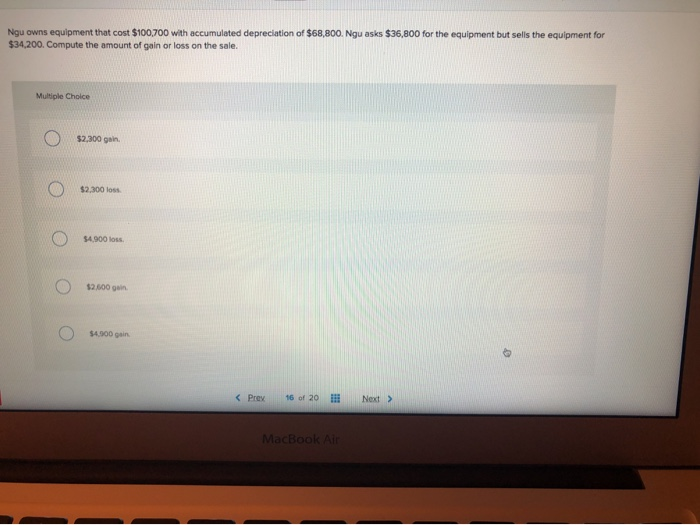

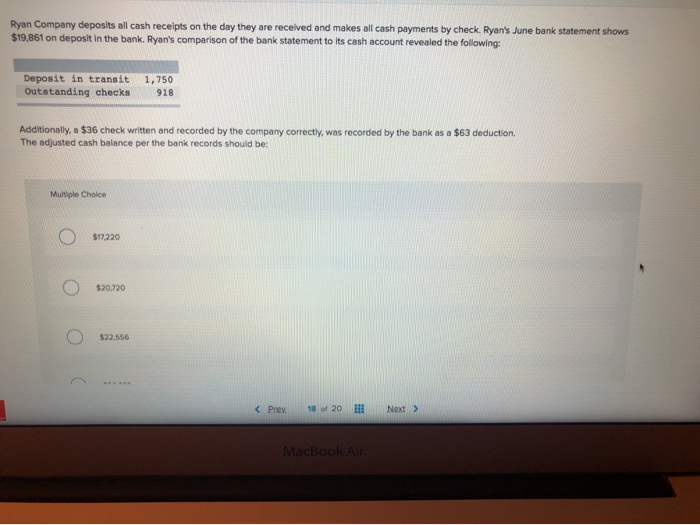

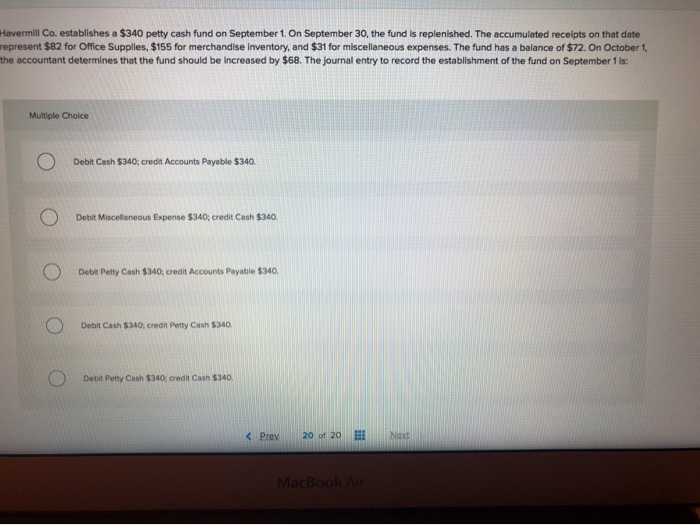

Mohr Company purchases a machine at the beginning of the year at a cost of $32,000. The machine is depreciated using the units of production method. The company estimates it will use the machine for 5 years, during which time it anticipates producing 56,000 units. The machine is estimated to have a $4,000 salvage value. The company produces 9,600 units in year 1 and 6,600 units in year 2. Depreciation expense in year 2 Multiple Choice $12.800 $19,200 Oo ooo $2,200 O $5.600 $4,000 MacBook Air 43 Chap 8, 9, 10 6 Help Sever Submit An asser's book value is $19,600 on December 31, Year 5. The asset has been deprecated at an annual rate of $4,600 on the straight-line method. Assuming the asset is sold on December 31, Year 5 for $16,600, the company should record: Multiple Choice O Alors on sale of $3.900 O Neither again or loss is recognized on this type of transac O O Aloss on sale of $3,000 O O Again on sale of $3,900. O ) Again one of $3.000 O Prex 3 of 20 Next > MacBook Air cam 8, 9, 10 0 Help Save & Exit Submit Jasper makes a $38,000, 90-day, 6.5% cash loan to Claybon Co. The amount of Interest that Jasper will collect on the loan is: (Use 360 days a year.) Multiple Choice o 32744. o O sas . o . . o 42 A70. MacBook Air 4 10 0 Martin Company purchases a machine at the beginning of the year at a cost of $61000. The machine is depreciated using the straight-line method. The machine's useful life is estimated to be 5 years with a $7,000 salvage value. Depreciation expense in year 4 is: Multiple Choice o O snoo. o 10 . o O SA, . o o O ssApoo. A company borrowed $22,000 by signing a 180-day promissory note at 6%. The total interest due on the maturity date is: (Use 360 days a year.) Multiple Choice ! o O soo oo o O snooo o o o sooooo Prev 20 Next Duerr Company makes a $75,000, 60-day, 17% cash loan to Ryan Co. The note and interest to be collected at maturity is: (Use 360 days a year) Multiple Choice o O srspoo. o . o O saasa. o 76, 376 o Osmas. Franklin Company deposits all cash receipts on the day they are received and makes all cash payments by check. At the close of business on August 31 its Cash account shows a debit balance of $23,162. Franklin's August bank statement shows $22,237 on deposit in the bank. Determine the adjusted cash balance using the following information: Deposit in transit Outstanding checks Bank service fees, not yet recorded by company The bank collected on a note receivable, not yet recorded by the company $ 7,500 $5,900 $ 150 $ 825 The adjusted cash balance should be: Multiple Choice O $29,737 O $23,987 Ngu owns equipment that cost $100,700 with accumulated depreciation of $68,800. Ngu asks $36,800 for the equipment but sells the equipment for $34,200. Compute the amount of gain or loss on the sale. Multiple Choice o o . o 4000 . o gen o gain Ryan Company deposits all cash receipts on the day they are received and makes all cash payments by check. Ryan's June bank statement shows $19,861 on deposit in the bank. Ryan's comparison of the bank statement to its cash account revealed the following: Deposit in transit Outstanding checks 1,750 918 Additionally, a $36 check written and recorded by the company correctly, was recorded by the bank as a $63 deduction The adjusted cash balance per the bank records should be: Multiple Choice O $220 0 $20,720 O $22,556 Havermill Co. establishes a $340 petty cash fund on September 1. On September 30, the fund is replenished. The accumulated receipts on that date represent $82 for Office Supplies, $155 for merchandise Inventory, and $31 for miscellaneous expenses. The fund has a balance of $72. On October 1. the accountant determines that the fund should be increased by $68. The journal entry to record the establishment of the fund on September 1 is: Multiple Choice O Debit Cash $340, credit Accounts Payable $340. Debit Miscellaneous Expense $340; credit Cash $340, O Debit Petty Cash $340, credit Accounts Payable $340, O Debit Cash $340, crech Petty Cash $340, O Debit Petty Cash $340, credit Cash $340