Answered step by step

Verified Expert Solution

Question

1 Approved Answer

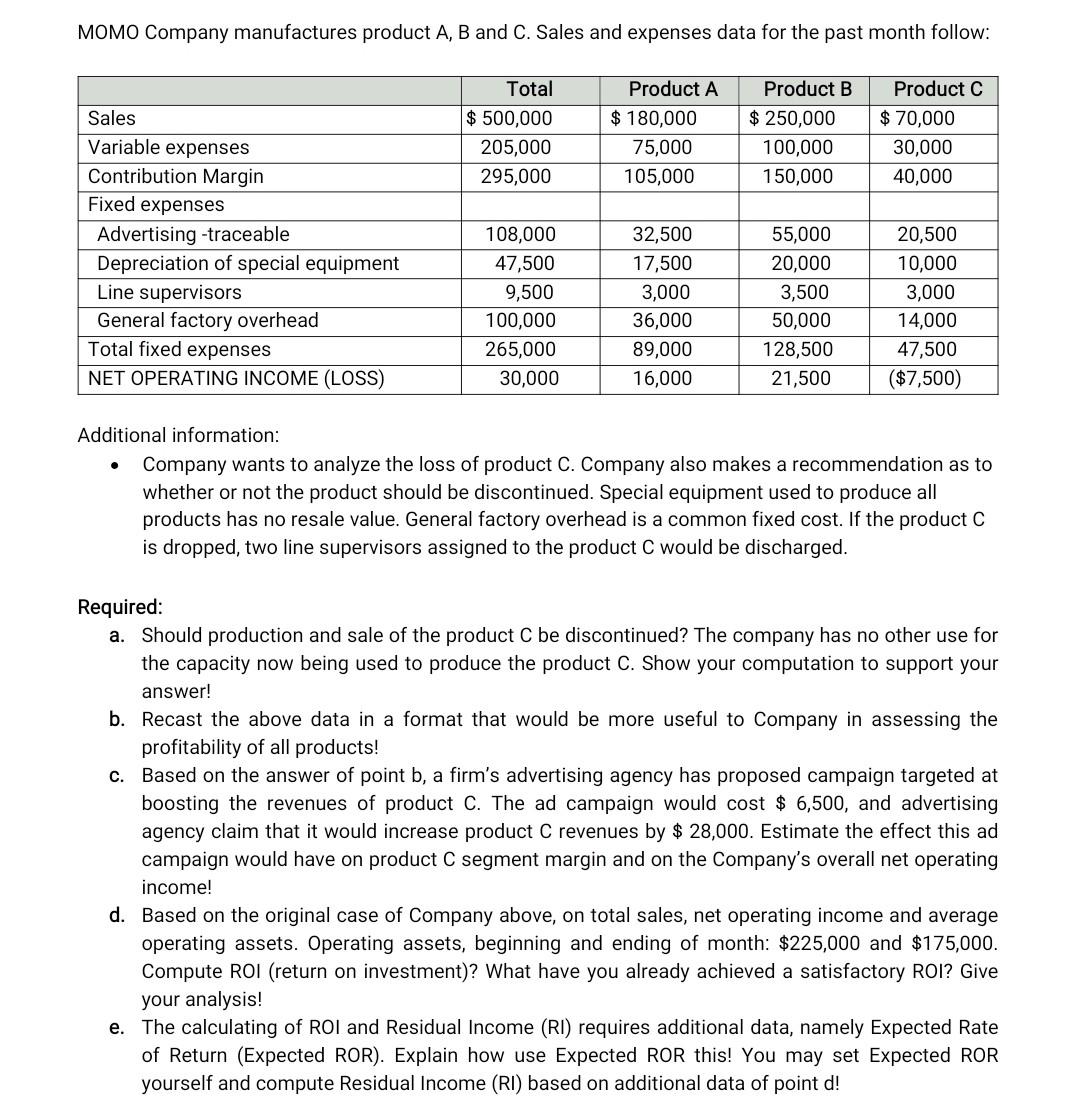

MOMO Company manufactures product A, B and C. Sales and expenses data for the past month follow: Total $ 500,000 205,000 295,000 Product A $

MOMO Company manufactures product A, B and C. Sales and expenses data for the past month follow: Total $ 500,000 205,000 295,000 Product A $ 180,000 75,000 105,000 Product B $ 250,000 100,000 150,000 Product C $ 70,000 30,000 40,000 Sales Variable expenses Contribution Margin Fixed expenses Advertising -traceable Depreciation of special equipment Line supervisors General factory overhead Total fixed expenses NET OPERATING INCOME (LOSS) 108,000 47,500 9,500 100,000 265,000 30,000 32,500 17,500 3,000 36,000 89,000 16,000 55,000 20,000 3,500 50,000 128,500 21,500 20,500 10,000 3,000 14,000 47,500 ($7,500) . Additional information: Company wants to analyze the loss of product C. Company also makes a recommendation as to whether or not the product should be discontinued. Special equipment used to produce all products has no resale value. General factory overhead is a common fixed cost. If the product C is dropped, two line supervisors assigned to the product C would be discharged. Required: a. Should production and sale of the product C be discontinued? The company has no other use for the capacity now being used to produce the product C. Show your computation to support your answer! b. Recast the above data in a format that would be more useful to Company in assessing the profitability of all products! C. Based on the answer of point b, a firm's advertising agency has proposed campaign targeted at boosting the revenues of product C. The ad campaign would cost $ 6,500, and advertising agency claim that it would increase product C revenues by $ 28,000. Estimate the effect this ad campaign would have on product C segment margin and on the Company's overall net operating income! d. Based on the original case of Company above, on total sales, net operating income and average operating assets. Operating assets, beginning and ending of month: $225,000 and $175,000. Compute ROI (return on investment)? What have you already achieved a satisfactory ROI? Give your analysis! e. The calculating of ROI and Residual Income (RI) requires additional data, namely Expected Rate of Return (Expected ROR). Explain how use Expected ROR this! You may set Expected ROR yourself and compute Residual Income (RI) based on additional data of point d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started