Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Treatment of profit given to workers under profit-sharing scheme in cost accounts r4 Strictly speaking profit-sharing means appropriation of profit and therefore such amount should

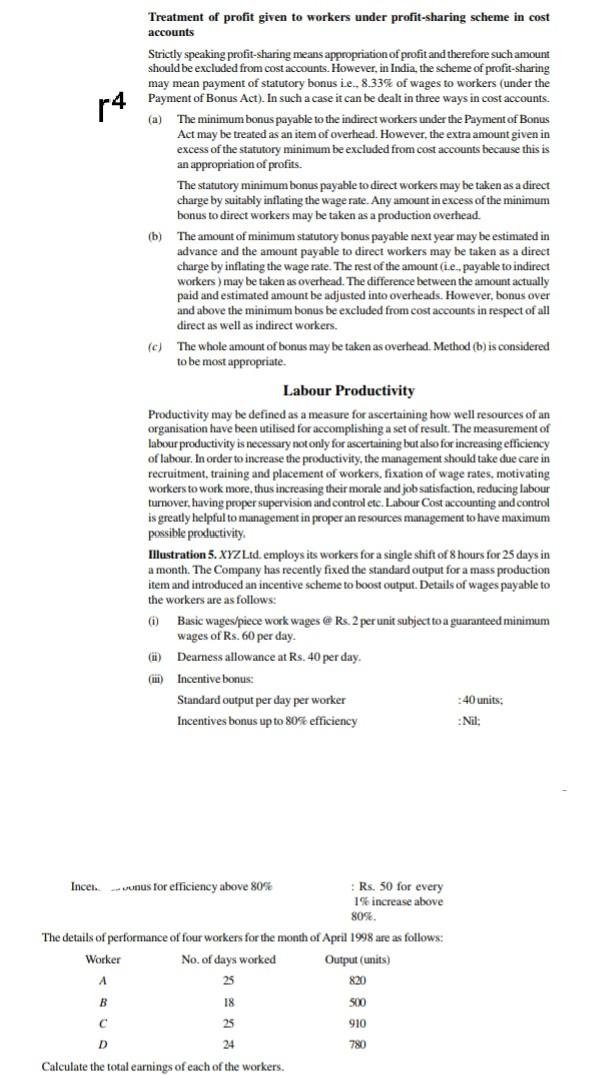

Treatment of profit given to workers under profit-sharing scheme in cost accounts r4 Strictly speaking profit-sharing means appropriation of profit and therefore such amount should be excluded from cost accounts. However, in India, the scheme of profit-sharing may mean payment of statutory bonus i.e., 8.33% of wages to workers (under the Payment of Bonus Act). In such a case it can be dealt in three ways in cost accounts. (a) The minimum bonus payable to the indirect workers under the Payment of Bonus Act may be treated as an item of overhead. However, the extra amount given in excess of the statutory minimum be excluded from cost accounts because this is an appropriation of profits. The statutory minimum bonus payable to direct workers may be taken as a direct charge by suitably inflating the wage rate. Any amount in excess of the minimum bonus to direct workers may be taken as a production overhead. (b) The amount of minimum statutory bonus payable next year may be estimated in advance and the amount payable to direct workers may be taken as a direct charge by inflating the wage rate. The rest of the amount (i.e-payable to indirect workers) may be taken as overhead. The difference between the amount actually paid and estimated amount be adjusted into overheads. However, bonus over and above the minimum bonus be excluded from cost accounts in respect of all direct as well as indirect workers. (c) The whole amount of bonus may be taken as overhead. Method (b) is considered to be most appropriate. Labour Productivity Productivity may be defined as a measure for ascertaining how well resources of an organisation have been utilised for accomplishing a set of result. The measurement of labour productivity is necessary not only for ascertaining but also for increasing efficiency of labour. In order to increase the productivity, the management should take due care in recruitment, training and placement of workers, fixation of wage rates, motivating workers to work more, thus increasing their morale and job satisfaction, reducing labour turnover, having proper supervision and control ete. Labour Cost accounting and control is greatly helpful to management in proper an resources management to have maximum possible productivity Illustration 5. XYZ Ltd. employs its workers for a single shift of 8 hours for 25 days in a month. The Company has recently fixed the standard output for a mass production item and introduced an incentive scheme to boost output. Details of wages payable to the workers are as follows: (1) Basic wages/piece work wages @ Rs. 2 per unit subject to a guaranteed minimum wages of Rs. 60 per day. (i) Deamess allowance at Rs. 40 per day Incentive bonus: Standard output per day per worker :40 units: Incentives bonus up to 80% efficiency Nil; (mm) Incen. sonus for efficiency above 80% Rs. 50 for every 1% increase above 80% The details of performance of four workers for the month of April 1998 are as follows: Worker No. of days worked Output (units) A 25 820 B 18 SOD 25 910 D 24 780 Calculate the total earnings of each of the workers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started