Question

Monica is the CFO of cooking for friends, CFF, and uses the pecking order hypothesis philosophy when she raises capital for company projects. Currently, she

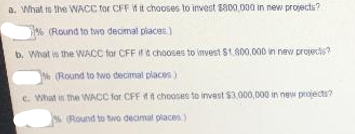

Monica is the CFO of cooking for friends, CFF, and uses the pecking order hypothesis philosophy when she raises capital for company projects. Currently, she can borrow up to $400,000 from her bank at a rate of 7.75%, float a bond for $700,000 at a rate of 9.5%, or issue additional stock for $1,300,000 at a cost of 18%. Chandler has been hired by CFF to raise capital for the company. Chandler increases the funding available from the bank to $1,000,000 but with a new rate of 8.5%. what is the wacc for the following? A. $800,000; B. $1,800,000; C. $3,000,000

Please show all working steps with either formulas or excel.

2. What is tive WACC TO CFF in it chooses to invest $200 do in new projects? 7% (Round to two decimal places) b. What is the WACC for CFF it chooses to invest $1,800,000 in new projects (Round to two decimal places) c. What is the WACC for CFF en chooses to invest $3,000,000 in new projects 36 Round to wo decimal aces)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started