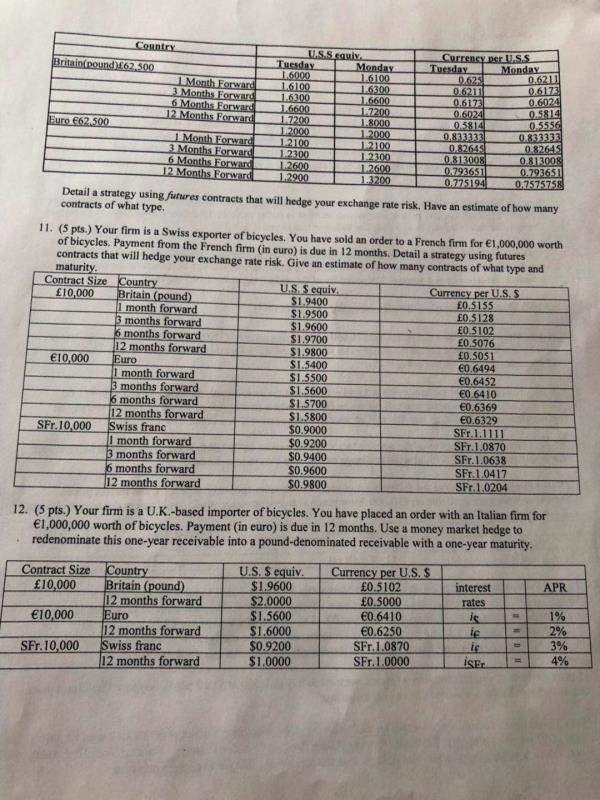

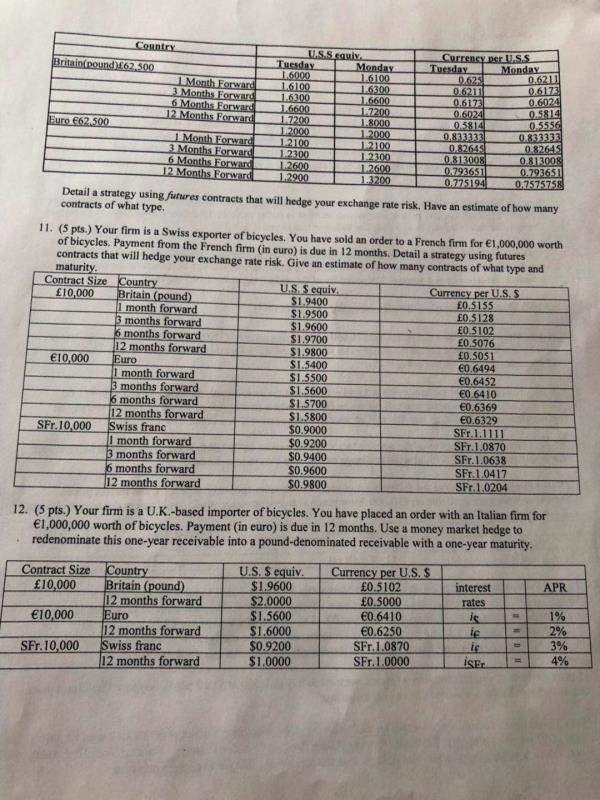

Month Forward16100 Detail a strategy using futures contracts that will hedge your exchange rate risk. Have an estimate of how many contracts of what type 11. (5 pts.) Your firm is a Swiss exporter of bicycles. You have sold an order to a French firm for 1,000,000 worth of bicycles. Payment from the French firm (in euro) is due in 12 months. Detail a strategy using futures contracts that will hedge your exchange rate risk. Give an estimate of how many contracts of what type and maturity Contract Size Country US. S equiv $1.9400 $1.9500 1.9600 10,000 Britain (pound) Currency per US. S l month forward onths forward 12 months forward 0.5076 10,000Euro S1.5400 $15500 month forward months forward months forward 12 months forward E0.6452 0.6410 0.6369 SFr.10,000 Swiss franc 5800 $0.9000 SFr.1.1111 SFr.10870 SFr.1.0638 SFr.1.0417 I month forward months forward months forward 12 months forward 9400 0.9600 12. (5 pts.) Your firm is a U.K.-based importer of bicycles. You have placed an order with an Italian firm for 1,000,000 worth of bicycles. Payment (in euro) is due in 12 months. Use a money market hedge to redenominate this one-year receivable into a pound-denominated receivable with a one-year maturity. Contract Size Country U.S. S equiv. Curency per U.S.S 10,000 tain (pound) 1.9600 2.0000 1.5600 $1,6000 9200 $1.0000 ri 102 interest APR 12 months forward 12 months forward 12 months forward 10,000 0.6410 SFr.10,000 Swiss franc SFr.1.0870 Month Forward16100 Detail a strategy using futures contracts that will hedge your exchange rate risk. Have an estimate of how many contracts of what type 11. (5 pts.) Your firm is a Swiss exporter of bicycles. You have sold an order to a French firm for 1,000,000 worth of bicycles. Payment from the French firm (in euro) is due in 12 months. Detail a strategy using futures contracts that will hedge your exchange rate risk. Give an estimate of how many contracts of what type and maturity Contract Size Country US. S equiv $1.9400 $1.9500 1.9600 10,000 Britain (pound) Currency per US. S l month forward onths forward 12 months forward 0.5076 10,000Euro S1.5400 $15500 month forward months forward months forward 12 months forward E0.6452 0.6410 0.6369 SFr.10,000 Swiss franc 5800 $0.9000 SFr.1.1111 SFr.10870 SFr.1.0638 SFr.1.0417 I month forward months forward months forward 12 months forward 9400 0.9600 12. (5 pts.) Your firm is a U.K.-based importer of bicycles. You have placed an order with an Italian firm for 1,000,000 worth of bicycles. Payment (in euro) is due in 12 months. Use a money market hedge to redenominate this one-year receivable into a pound-denominated receivable with a one-year maturity. Contract Size Country U.S. S equiv. Curency per U.S.S 10,000 tain (pound) 1.9600 2.0000 1.5600 $1,6000 9200 $1.0000 ri 102 interest APR 12 months forward 12 months forward 12 months forward 10,000 0.6410 SFr.10,000 Swiss franc SFr.1.0870