Answered step by step

Verified Expert Solution

Question

1 Approved Answer

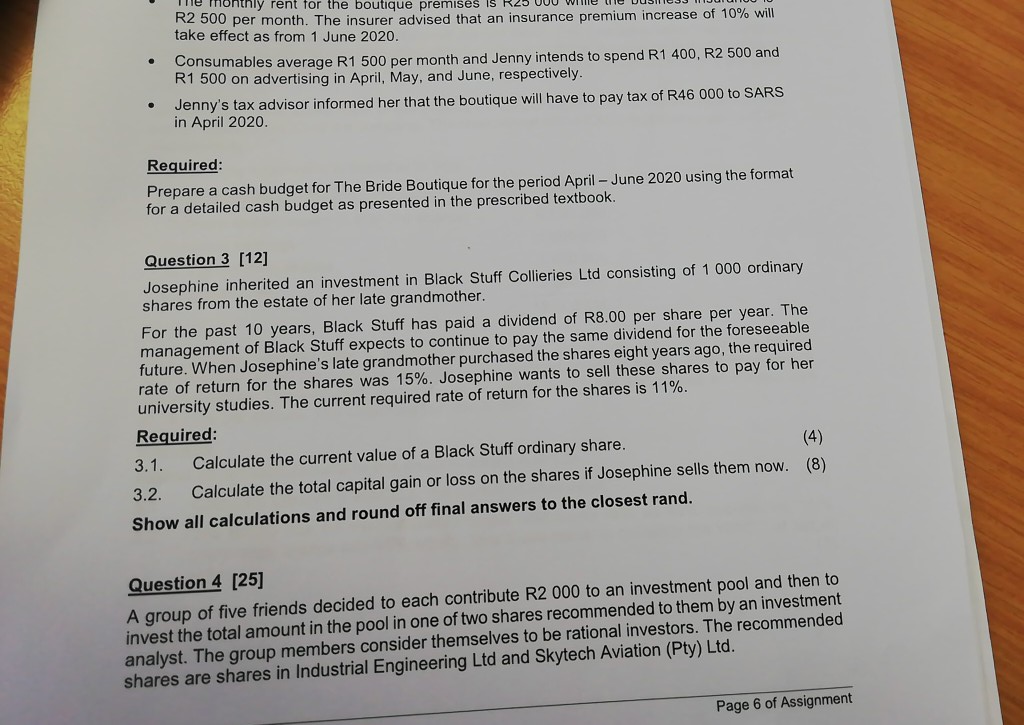

monthly rent for the boutique premises is R25 000 we R2 500 per month. The insurer advised that an insurance premium increase of 10% will

monthly rent for the boutique premises is R25 000 we R2 500 per month. The insurer advised that an insurance premium increase of 10% will take effect as from 1 June 2020. Consumables average R1 500 per month and Jenny intends to spend R1 400, R2 500 and R1 500 on advertising in April, May, and June, respectively. Jenny's tax advisor informed her that the boutique will have to pay tax of R46 000 to SARS in April 2020. . Required: Prepare a cash budget for The Bride Boutique for the period April - June 2020 using the format for a detailed cash budget as presented in the prescribed textbook. Question 3 [12] Josephine inherited an investment in Black Stuff Collieries Ltd consisting of 1 000 ordinary shares from the estate of her late grandmother. For the past 10 years, Black Stuff has paid a dividend of R8.00 per share per year. The management of Black Stuff expects to continue to pay the same dividend for the foreseeable future. When Josephine's late grandmother purchased the shares eight years ago, the required rate of return for the shares was 15%. Josephine wants to sell these shares to pay for her university studies. The current required rate of return for the shares is 11%. Required: 3.1. Calculate the current value of a Black Stuff ordinary share. (4) 3.2. Calculate the total capital gain or loss on the shares if Josephine sells them now. (8) Show all calculations and round off final answers to the closest rand. Question 4 [25] A group of five friends decided to each contribute R2 000 to an investment pool and then to invest the total amount in the pool in one of two shares recommended to them by an investment analyst. The group members consider themselves to be rational investors. The recommended shares are shares in Industrial Engineering Ltd and Skytech Aviation (Pty) Ltd. Page 6 of Assignment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started