Question

This week's homework will have you putting together both an income statement along with a cash flow statement. Why do organizations need cash flow statements

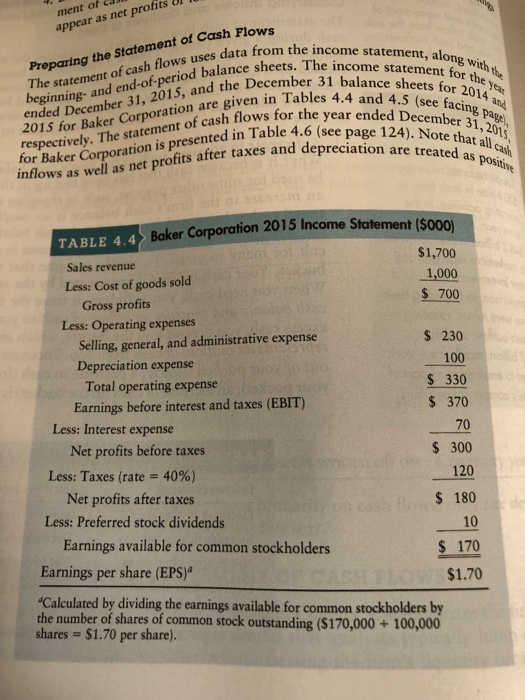

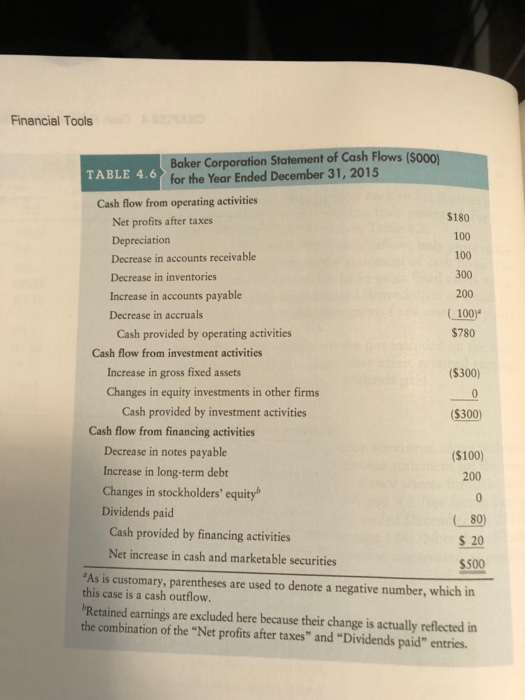

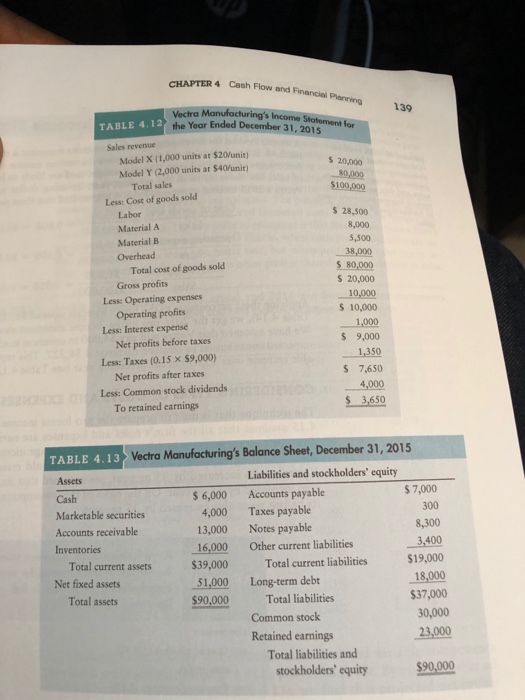

This week's homework will have you putting together both an income statement along with a cash flow statement. Why do organizations need cash flow statements in addition to income statements? What makes cash flow statements important? Please take a look at the income statement and Statement of Cash Flows below and talk about why the a company needs both. Share any thoughts you have about specific things covered in the statement of cash flows that are not covered in the income statment and balance sheet. You may find the additional online resources below helpful. Be sure to share thoughts you have about operating, investing and financing activities and how they are different.

https://youtu.be/38WcNba0Ic0

https://youtu.be/KAOrqyzgYzA

https://youtu.be/Dt6ClHG34RM

https://youtu.be/TXmm2EV2QWg

https://youtu.be/xdCIksxKUdQ

https://youtu.be/jVdL_mVyJFQ

https://youtu.be/yTpHTQal8d4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started