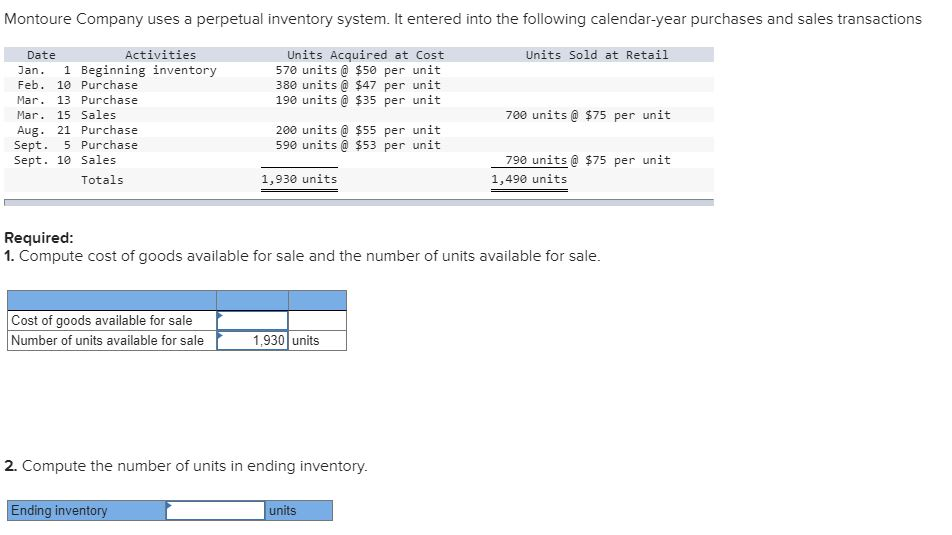

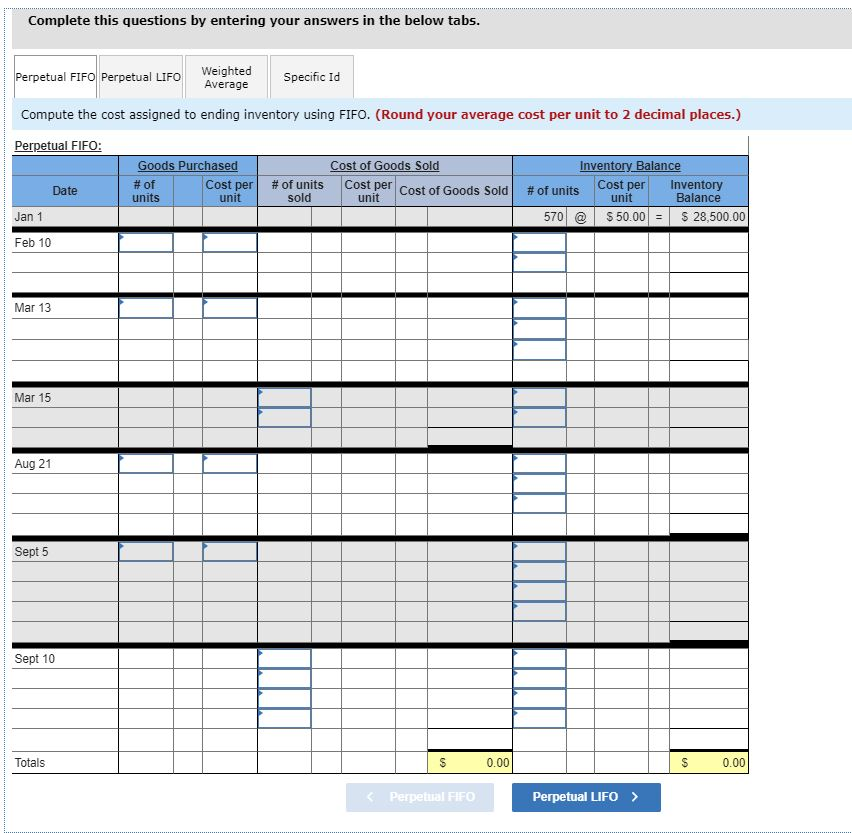

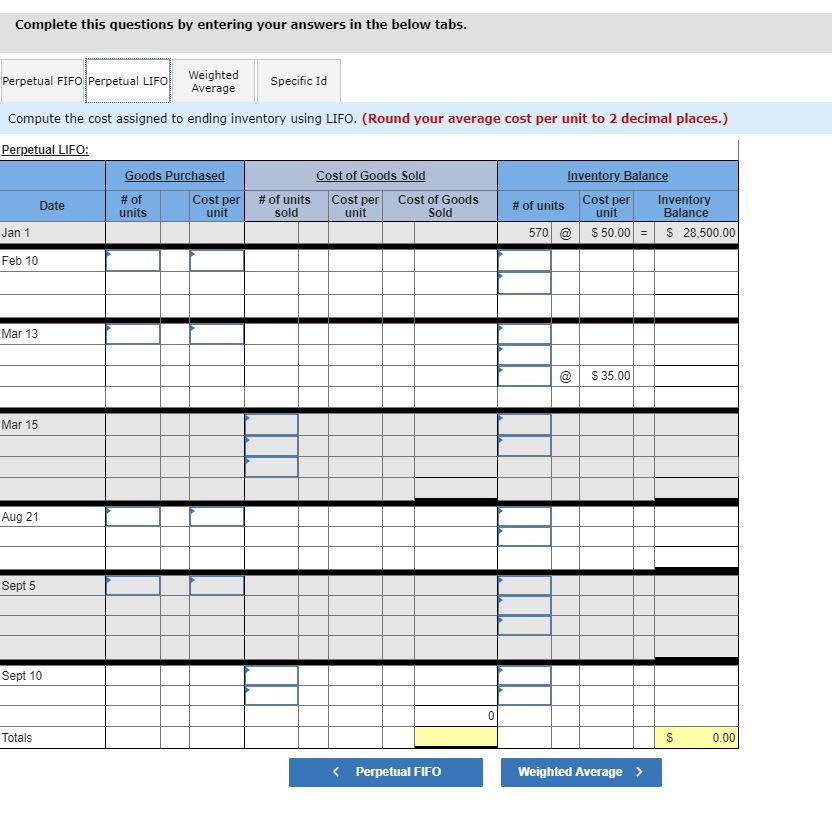

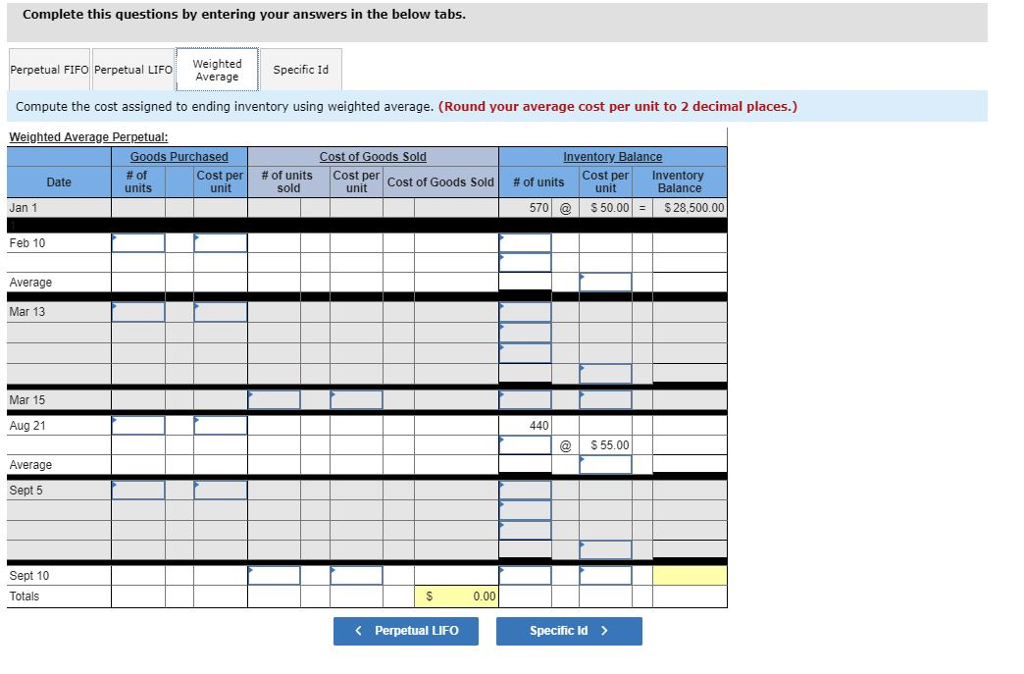

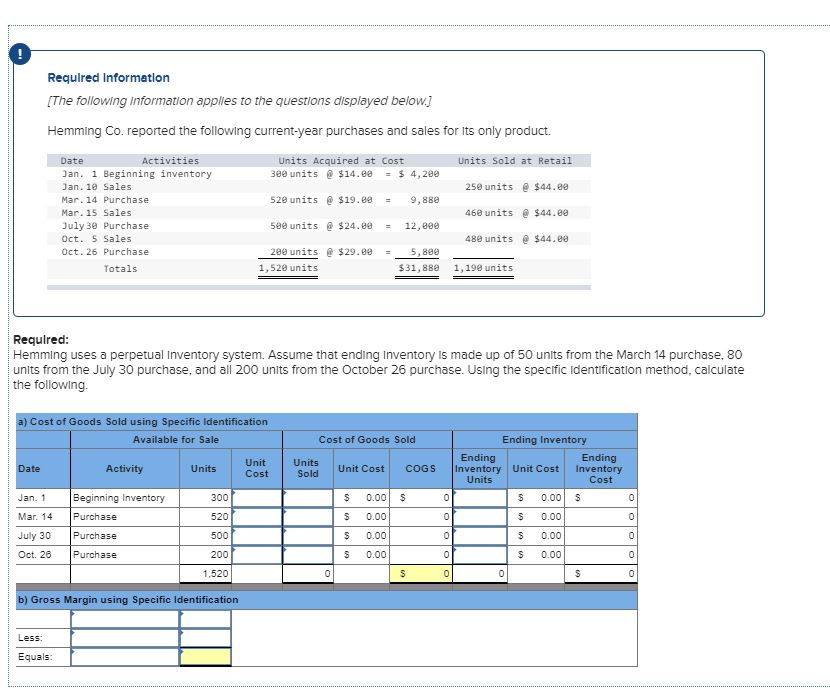

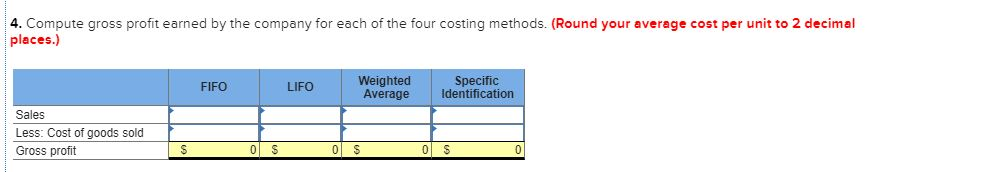

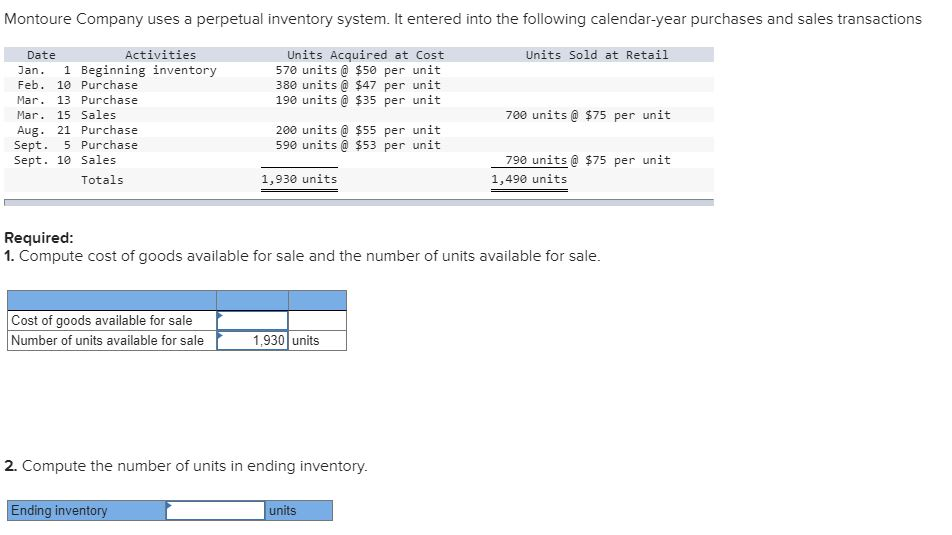

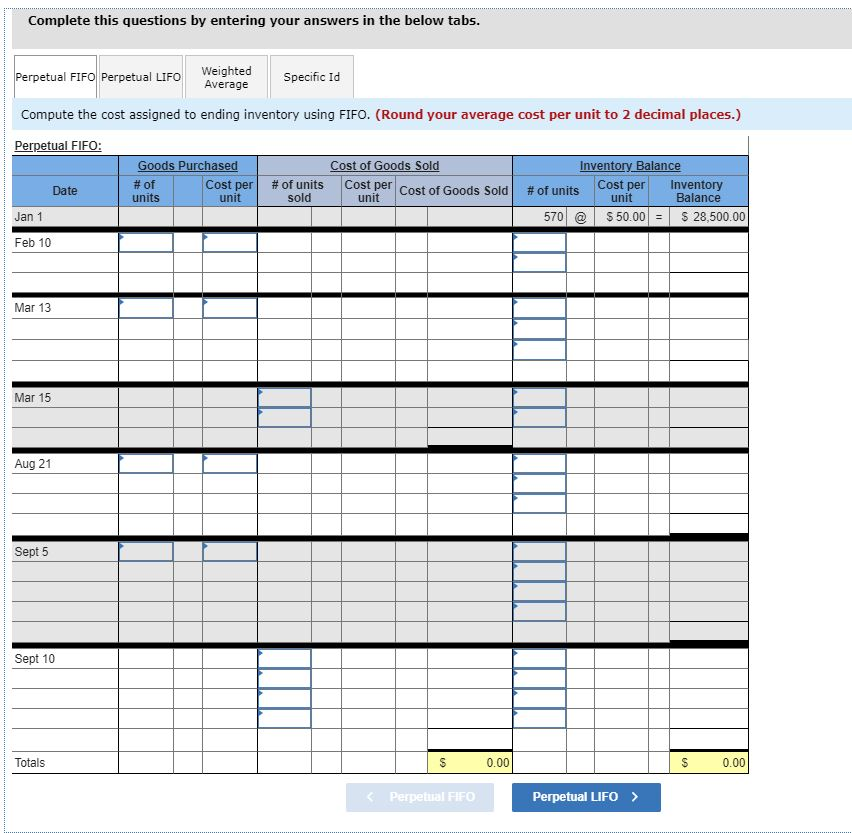

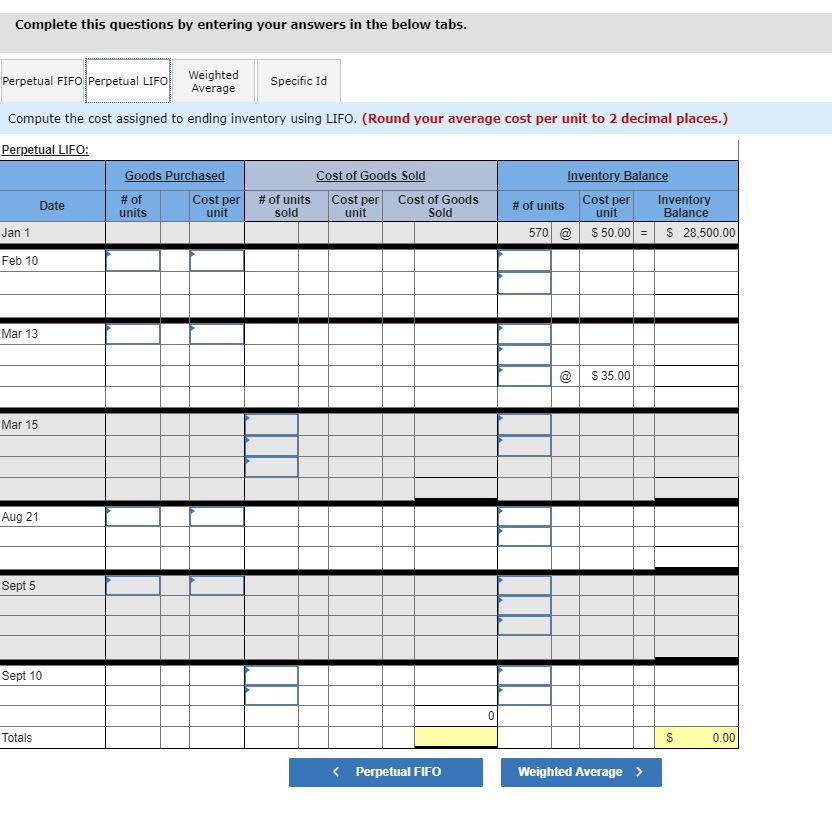

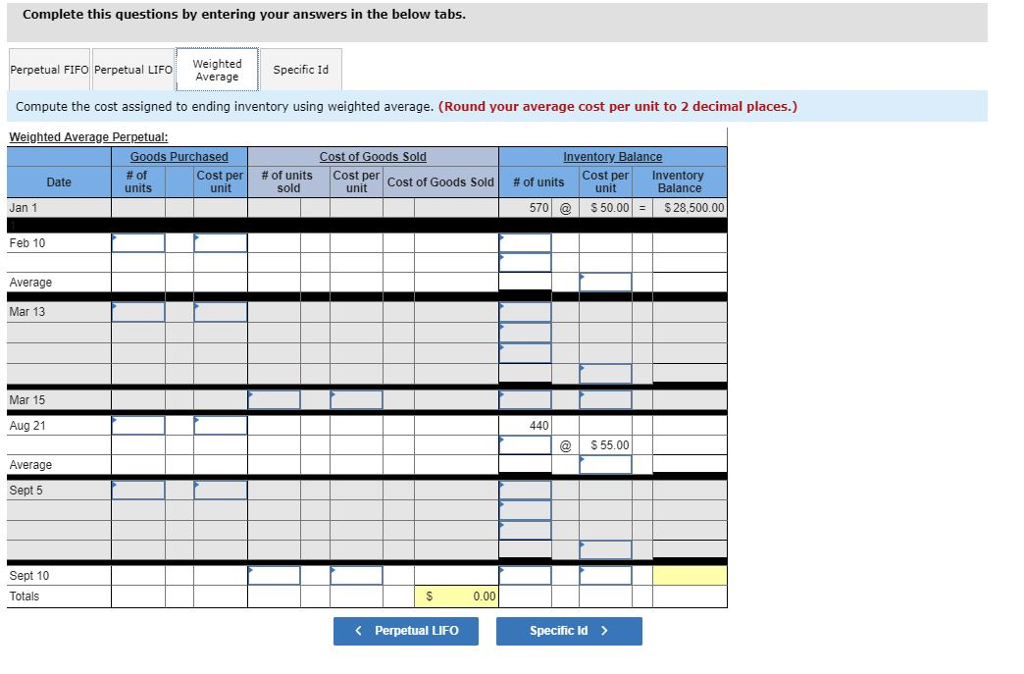

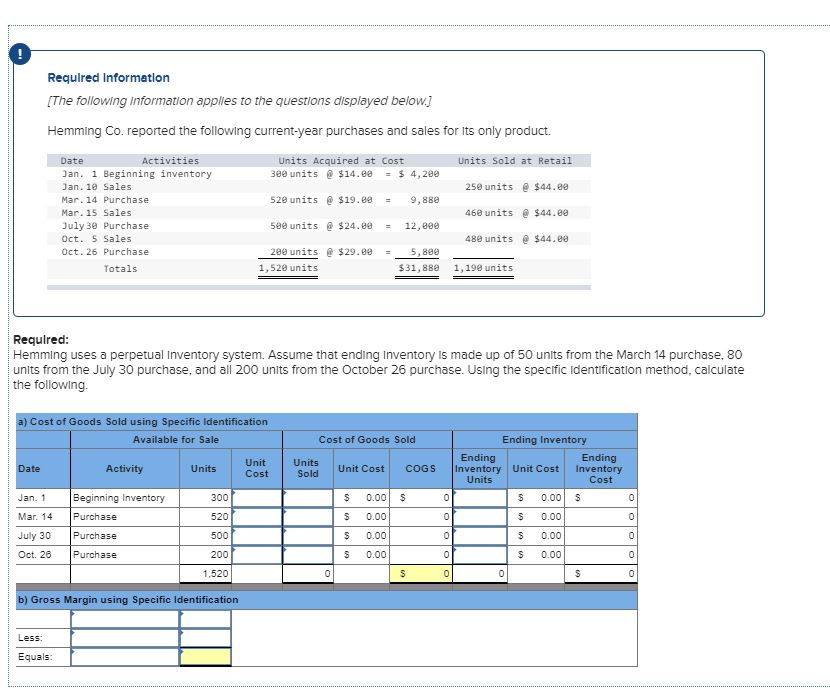

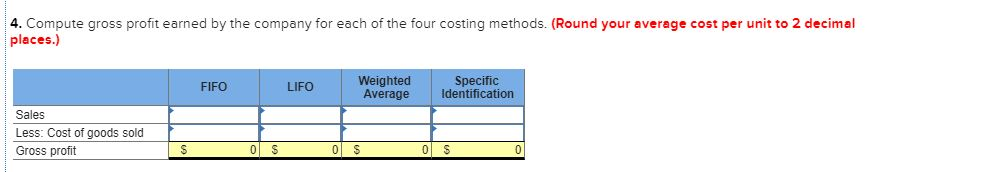

Montoure Company uses a perpetual inventory system. It entered into the following calendar-year purchases and sales transactions Activities Date Jan. 1 Beginning inventory Feb. 10 Purchase Mar. 13 Purchase Mar. 15 Sales Aug. 21 Purchase Sept. 5 Purchase Sept. 10 Sales Units Acquired at Cost 570 units $50 per unit 380 units $47 per unit 190 units$35 per unit Units Sold at Retail 700 units $75 per unit 200 units $55 per unit 590 units $53 per unit 790 units$75 per unit 1,490 units Totals 1,930 units Required 1. Compute cost of goods available for sale and the number of units available for sale Cost of goods available for sale Number of units available for sale 1,930 units 2. Compute the number of units in ending inventory Ending invento units Complete this questions by entering your answers in the below tabs. Weighted Specific Id Perpetual FIFO| Perpetual LlFO Average Compute the cost assigned to ending inventory using FIFO. (Round your average cost per unit to 2 decimal places.) Perpetual FIFO ds Purchase ost of old Inventory Balance #of units Cost per| Costper|Cost of Goods Sold! #of units Cost per Inventory Balance Date # of units unit sold unit unit Jan 1 570| @ | $ 50.001 = | $28.500.00 Feb 10 Mar 13 Mar 15 Aug 21 Sept 5 Sept 10 Totals 0.00 0.00 Perpetual FIFO Perpetual LIFO> Complete this questions by entering your answers in the below tabs. Weighted Perpetual FIFO Perpetual LIFO Compute the cost assigned to ending inventory using LIFO. (Round your average cost per unit to 2 decimal places.) Perpetual LIFO: Specific Id oods Purchase st Inventory Balance #of units Cost per | unit # of units sold cost per unit Cost of Goods Sold Inventory Balance Date # of units Cost unit Jan 1 57050.00 28,500.00 Feb 10 Mar 13 35.00 Mar 15 Aug 21 Sept 5 Sept 10 Totals 0.00 Perpetual FIFO Weighted Average > Complete this questions by entering your answers in the below tabs. tual FIFO Perpetual LIFoWeighted Average Specific Id Compute the cost assigned to ending inventory using weighted average. (Round your average cost per unit to 2 decimal places.) Weighted Average Perpetual: 0S Inventory Balance #of units Cost perl Costper Cost of Goods Sold! #ofuits Cost per Inventory Balance Date #Of units unit sold unit unit Jan 1 570 @ | $50.00!=| $28.500.00 Feb 10 Average Mar 13 Mar 15 Aug 21 440 $55.00 Average Sept 5 Sept 10 Totals 0.00 Requlred Information The following information applies to the questions displayed below Hemming Co. reported the following current-year purchases and sales for its only product. nits Acquired at Cost Date Jan. 1 Beginning inventory Jan. 18 Sales Mar.14 Purchase Mar. 15 Sales July 38 Purchase Oct. 5 Sales Oct. 26 Purchase Activities 380 units $14.8 4,280 520 units @ $19.ee 9, 88 588 units $24.812,88e 290 units $29.85,88 its Sold at Retai 250 units $44 468 units $44.88 488 units $44.88 Totals 1.528 units 531,888 1,198 units Required Hemming uses a perpetual Inventory system. Assume that ending Inventory is made up of 50 units from the March 14 purchase, 80 units from the July 30 purchase, and all 200 units from the October 26 purchase. Using the specific Identification method, calculate the following. a) Cost of Goods Sold using Specific Identification Available for Sale Cost of Goods Sold Ending Inventory Ending Unit Cost Units Sold Ending Unit Cost COGS Inventory Unit Cost Inventory Units ate Activity Units Cost Jan. 1 Beginning Inventory Mar. 14 Purchase July 30 Purchase Oct. 26Purchase 300 520 500 200 1,520 0.00 S 5 0.00 5 0.00 5 0.00 S 0.00 S 5 0.00 5 0.00 S 0.00 b) Gross Margin using Specific Identification Less Equals 4. Compute gross profit earned by the company for each of the four costing methods. (Round your average cost per unit to 2 decimal places.) WeightedSpecific Average FIFO LIFO identification Sales Less: Cost of goods sold Gross profit 0 S 0 S