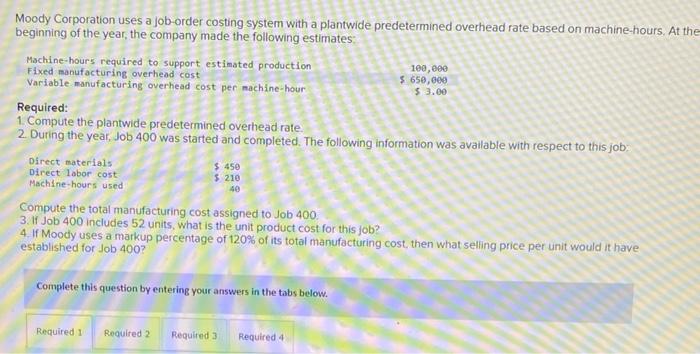

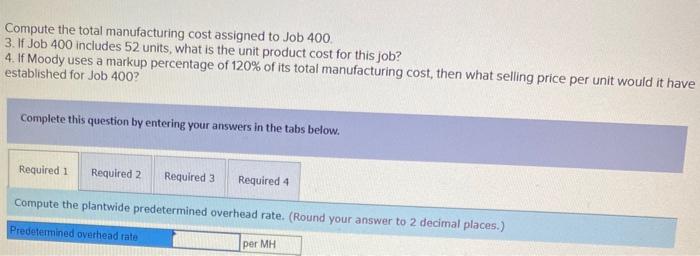

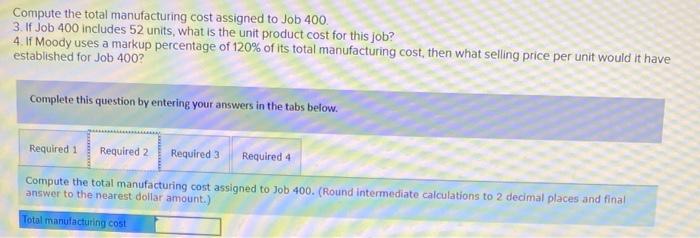

Moody Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, the company made the following estimates Machine-hours required to support estimated production 1 100,000 Fixed manufacturing overhead cost $ 650,000 Variable manufacturing overhead cost per machine-hour $ 3.00 Required: 1. Compute the plantwide predetermined overhead rate 2. During the year, Job 400 was started and completed. The following information was available with respect to this job Direct materials $ 450 Direct labor cost $ 210 Machine hours used Compute the total manufacturing cost assigned to Job 400 3. If Job 400 includes 52 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 120% of its total manufacturing cost, then what selling price per unit would it have established for Job 400? 40 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the total manufacturing cost assigned to Job 400. 3. If Job 400 includes 52 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 120% of its total manufacturing cost, then what selling price per unit would it have established for Job 4002 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the plantwide predetermined overhead rate. (Round your answer to 2 decimal places.) Predetermined overhead rate per MH Compute the total manufacturing cost assigned to Job 400. 3. If Job 400 includes 52 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 120% of its total manufacturing cost, then what selling price per unit would it have established for Job 400? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the total manufacturing cost assigned to Job 400. (Round intermediate calculations to 2 decimal places and final answer to the nearest dollar amount.) Total manufacturing cost Compute the total manufacturing cost assigned to Job 400. 3. If Job 400 includes 52 units, what is the unit product cost for this job? 4. If Moody uses a markup percentage of 120% of its total manufacturing cost, then what selling price per unit would it have established for Job 400? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 If Job 400 includes 52 units, what is the unit product cost for this job? (Round your intermediate calculations and final answer to the nearest whole dollar) Unit product cost