Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. Moose Jaw Marketplace Company's bookkeeper is off sick, and they need you to prepare their bank reconciliation for the month of February, 2025.

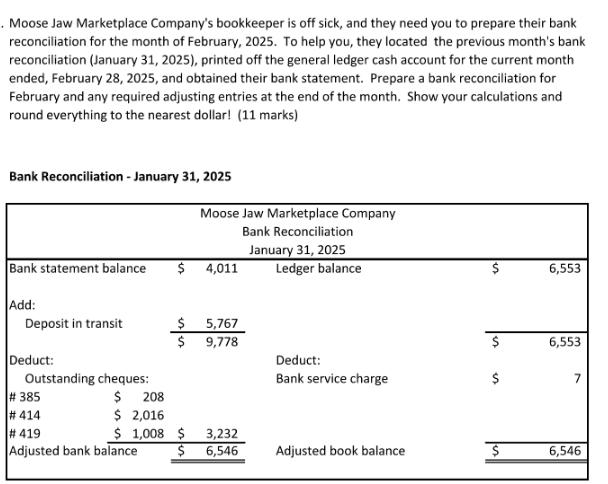

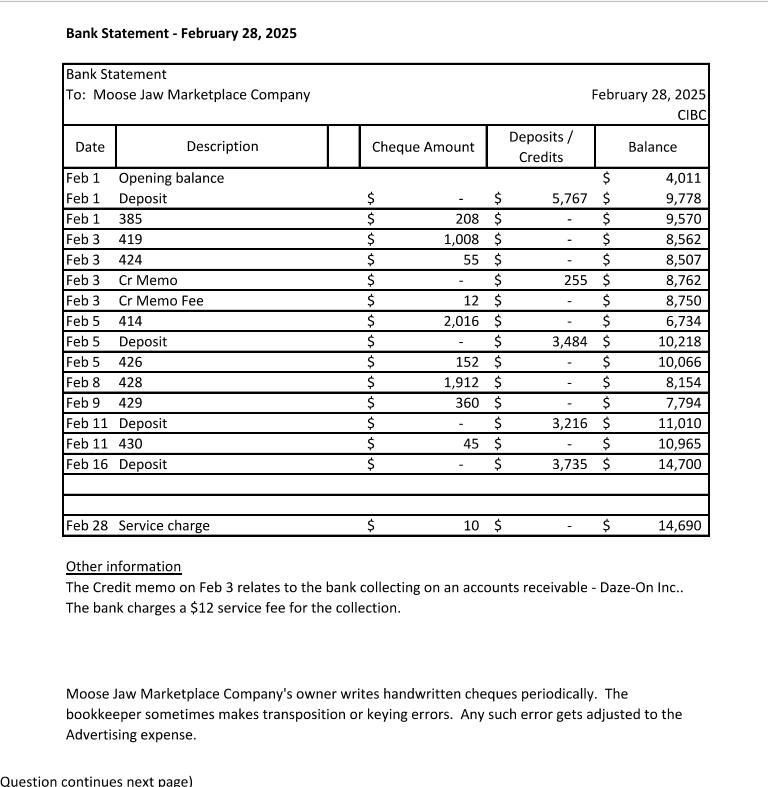

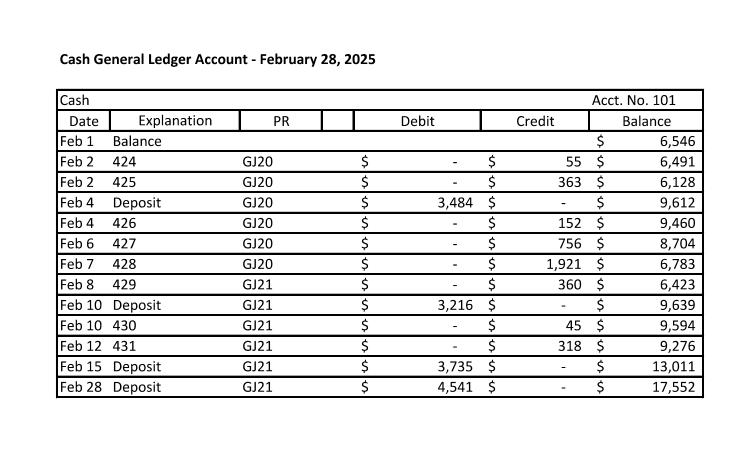

. Moose Jaw Marketplace Company's bookkeeper is off sick, and they need you to prepare their bank reconciliation for the month of February, 2025. To help you, they located the previous month's bank reconciliation (January 31, 2025), printed off the general ledger cash account for the current month ended, February 28, 2025, and obtained their bank statement. Prepare a bank reconciliation for February and any required adjusting entries at the end of the month. Show your calculations and round everything to the nearest dollar! (11 marks) Bank Reconciliation -January 31, 2025 Bank statement balance Add: Deposit in transit Deduct: Outstanding cheques: # 385 #414 #419 Moose Jaw Marketplace Company Bank Reconciliation Adjusted bank balance $ 4,011 $ 5,767 $ 9,778 $ 208 $ 2,016 $ 1,008 $ 3,232 $ 6,546 January 31, 2025 Ledger balance Deduct: Bank service charge Adjusted book balance $ $ $ 6,553 6,553 6,546 Bank Statement - February 28, 2025 Bank Statement To: Moose Jaw Marketplace Company Date Description Feb 1 Feb 1 Feb 1 Feb 3 Feb 3 Feb 3 Feb 3 Feb 5 Feb 5 Deposit Feb 5 426 Feb 8 428 Feb 9 429 Feb 11 Deposit Feb 11 430 Feb 16 Deposit Opening balance Deposit 385 419 424 Cr Memo Cr Memo Fee 414 Feb 28 Service charge Cheque Amount $ $ $ $ $ $ $ $ es Question continues next page) $ $ $ $ $ $ $ $ 208 $ 1,008 $ 55 $ $ 12 $ 2,016 $ $ 152 $ 1,912 $ 360 $ $ 45 $ $ 10 $ Deposits / Credits February 28, 2025 CIBC $ 5,767 $ $ $ $ 255 $ $ $ 3,484 $ $ $ $ 3,216 $ $ 3,735 $ $ Balance 4,011 9,778 9,570 8,562 8,507 8,762 8,750 6,734 10,218 10,066 8,154 7,794 11,010. 10,965 14,700 14,690 Other information The Credit memo on Feb 3 relates to the bank collecting on an accounts receivable - Daze-On Inc.. The bank charges a $12 service fee for the collection. Moose Jaw Marketplace Company's owner writes handwritten cheques periodically. The bookkeeper sometimes makes transposition or keying errors. Any such error gets adjusted to the Advertising expense. Cash General Ledger Account - February 28, 2025 Cash Date Feb 1 Feb 2 Feb 2 Feb 4 Feb 4 Feb 6 Feb 7 Explanation Balance 424 425 Deposit 426 427 428 429 Deposit Feb 8 Feb 10 Feb 10 430 431 Feb 12 Feb 15 Deposit Feb 28 Deposit PR GJ20 GJ20 GJ20 GJ20 GJ20 GJ20 GJ21 GJ21 GJ21 GJ21 GJ21 GJ21 $ $ $ $ $ $ $ $ $ $ $ $ Debit $ $ 3,484 $ $ $ $ $ 3,216 $ $ $ 3,735 $ 4,541 $ Credit 55 363 Acct. No. 101 Balance . $ $ $ $ 152 $ 756 $ 1,921 $ 360 $ $ 45 $ 318 $ $ $ 6,546 6,491 6,128 9,612 9,460 8,704 6,783 6,423 9,639 9,594 9,276 13,011 17,552

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the bank reconciliation for February 2025 well follow these steps Compare the bank statement balance and the ledger balance from the previo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started