Question

Moran owns a building he bought during year 0 for $150,000. He sold the building in year 6. During the time he held the

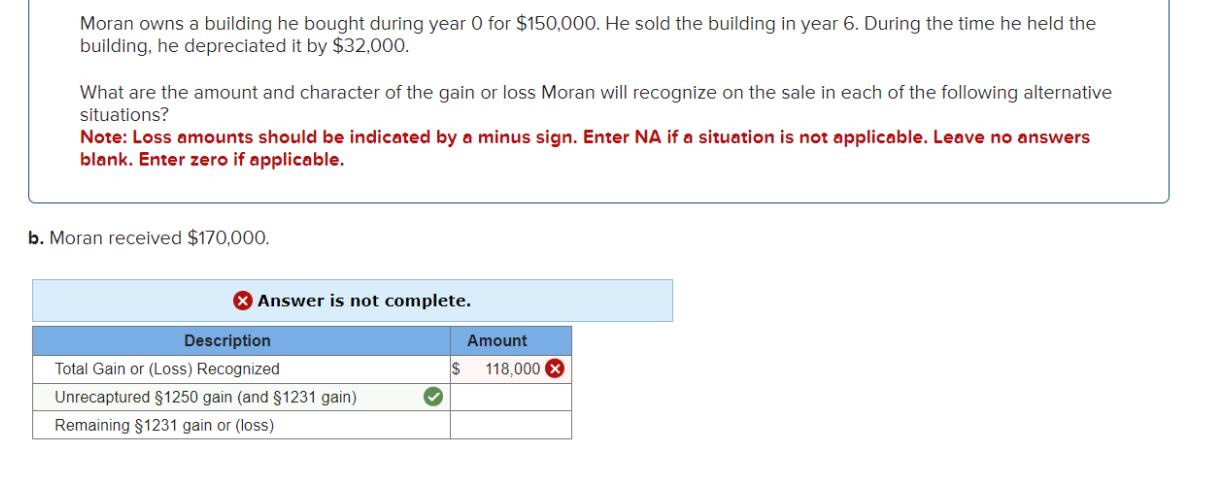

Moran owns a building he bought during year 0 for $150,000. He sold the building in year 6. During the time he held the building, he depreciated it by $32,000. What are the amount and character of the gain or loss Moran will recognize on the sale in each of the following alternative situations? Note: Loss amounts should be indicated by a minus sign. Enter NA if a situation is not applicable. Leave no answers blank. Enter zero if applicable. b. Moran received $170,000. Answer is not complete. Description Amount Total Gain or (Loss) Recognized Remaining $1231 gain or (loss) $ 118,000 Unrecaptured $1250 gain (and $1231 gain)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER To calculate the gain or loss recognized by Moran on the sale of the building in this scenari...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation Of Individuals And Business Entities 2015

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

6th Edition

978-1259206955, 1259206955, 77862368, 978-0077862367

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App