Answered step by step

Verified Expert Solution

Question

1 Approved Answer

More and more, businesspeople from many different areas (not only finance and accounting) rely on spreadsheets to do all the different types of calculations that

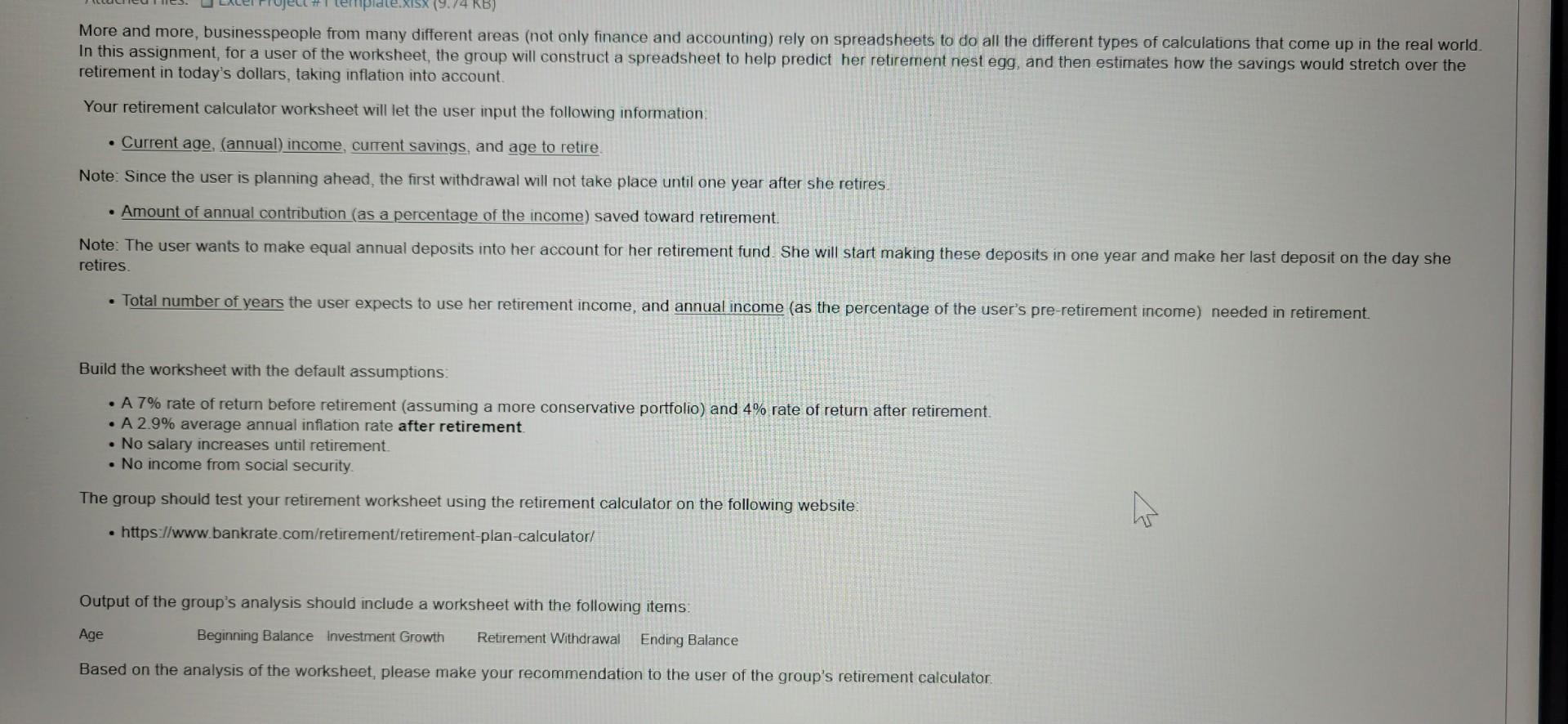

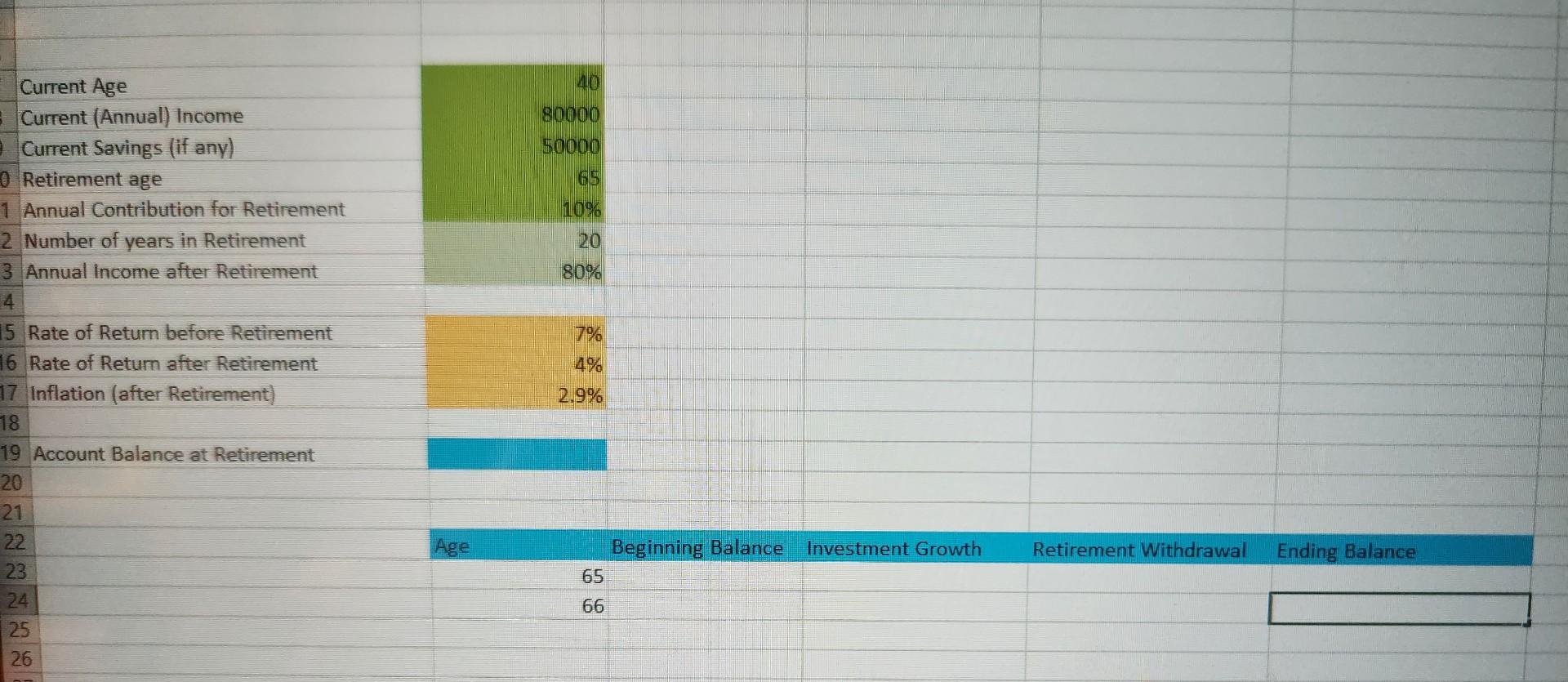

More and more, businesspeople from many different areas (not only finance and accounting) rely on spreadsheets to do all the different types of calculations that come up in the real world. In this assignment, for a user of the worksheet, the group will construct a spreadsheet to help predict her retirement nest egg, and then estimates how the savings would stretch over the retirement in today's dollars, taking inflation into account. Your retirement calculator worksheet will let the user input the following information. - Current age, (annual) income, current savings, and age to retire. Note: Since the user is planning ahead, the first withdrawal will not take place until one year after she retires. - Amount of annual contribution (as a percentage of the income) saved toward retirement. Note: The user wants to make equal annual deposits into her account for her retirement fund. She will start making these deposits in one year and make her last deposit on the day she retires. - Total number of years the user expects to use her retirement income, and annual income (as the percentage of the user's pre-retirement income) needed in retirement. Build the worksheet with the default assumptions: - A 7% rate of return before retirement (assuming a more conservative portfolio) and 4% rate of return after retirement. - A 2.9% average annual inflation rate after retirement - No salary increases until retirement. - No income from social security. The group should test your retirement worksheet using the retirement calculator on the following website: - https://www.bankrate.com/retirement/retirement-plan-calculator/ Output of the group's analysis should include a worksheet with the following items: Age Beginning Balance Investment Growth Retirement Withdrawal Ending Balance Based on the analysis of the worksheet, please make your recommendation to the user of the group's retirement calculator. \begin{tabular}{llr} 5 & Rate of Return before Retirement & 7% \\ 6 & Rate of Return after Retirement & 4% \\ 7 & Inflation (after Retirement) & 2.9% \\ \hline \end{tabular} Account Balance at Retirement \begin{tabular}{|l|l|l|l|} \hline Age Beginning Balance Investment Growth Retirement Withdrawal Ending Balance \\ \hline 65 & & \\ \hline 66 & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started