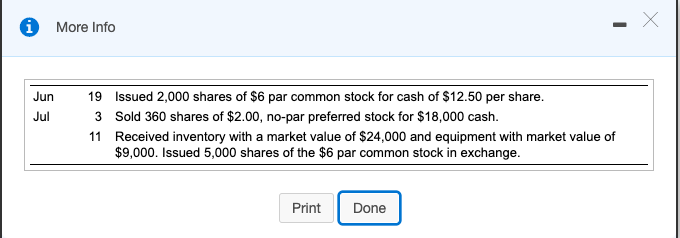

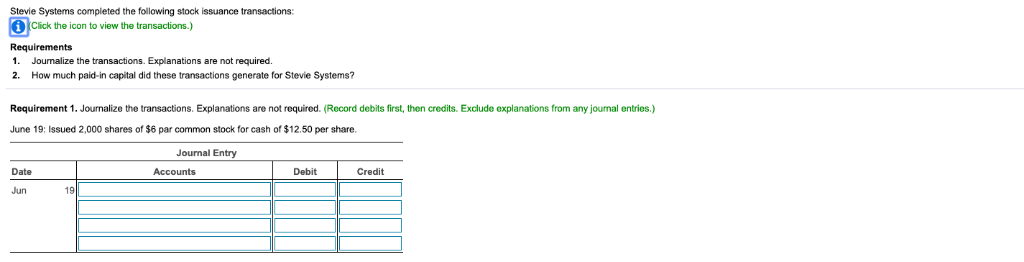

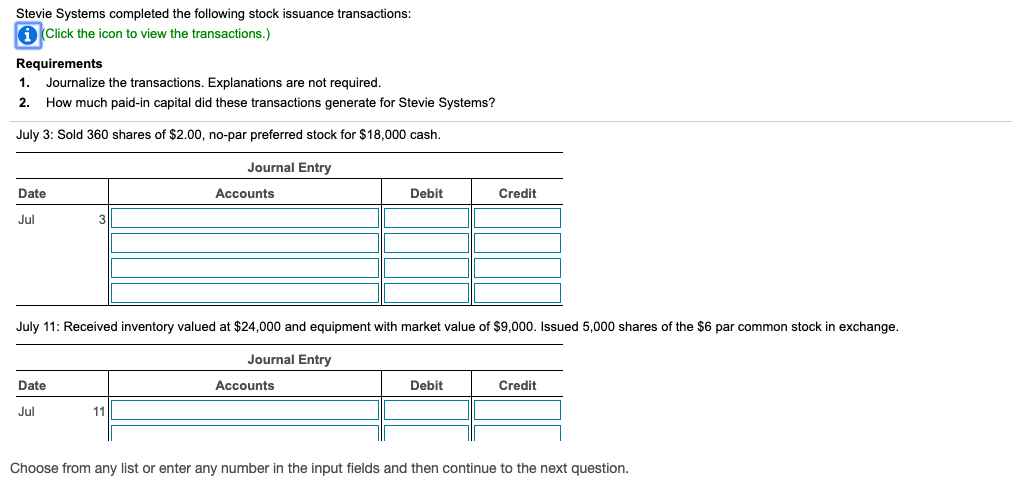

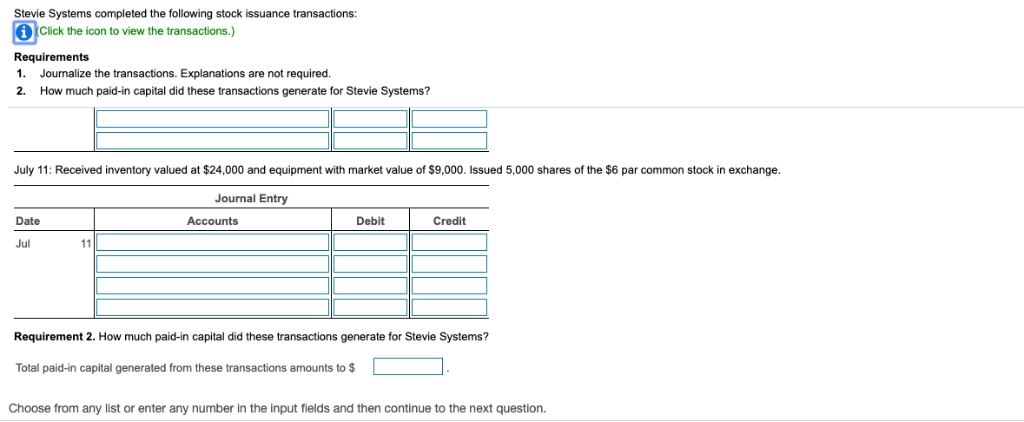

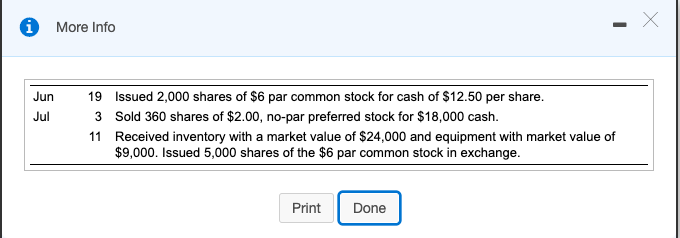

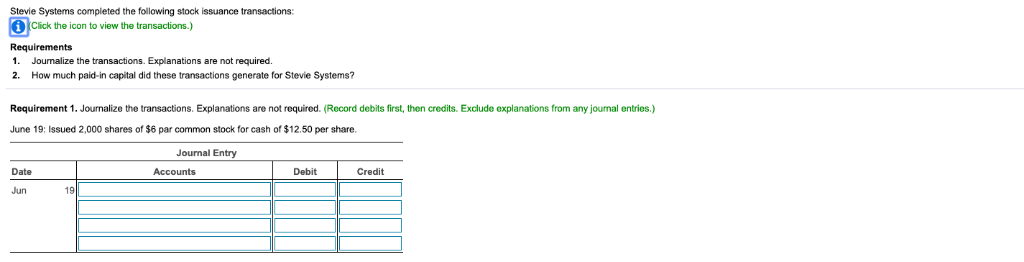

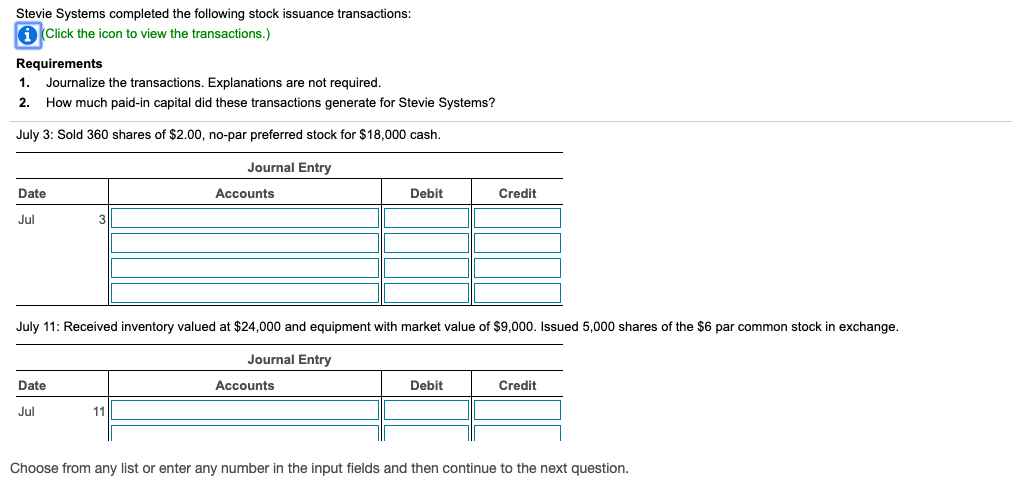

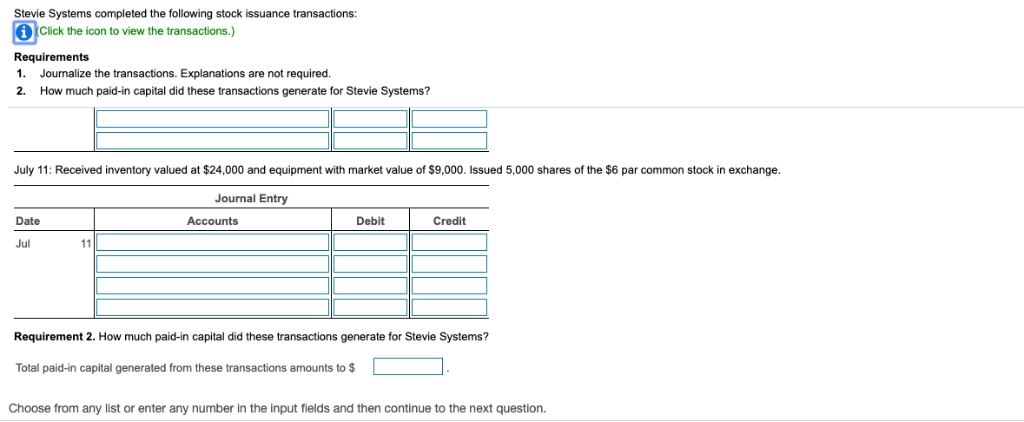

More Info Jun Jul 19 Issued 2,000 shares of $6 par common stock for cash of $12.50 per share. 3 Sold 360 shares of $2.00, no-par preferred stock for $18,000 cash. 11 Received inventory with a market value of $24,000 and equipment with market value of $9,000. Issued 5,000 shares of the $6 par common stock in exchange. Print Done Stevie Systems completed the following stock issuance transactions: Click the icon to view the transactions.) Requirements 1. Joumalize the transactions. Explanations are not required. 2. How much paid-in capital did these transactions generate for Stevie Systems? Requirement 1. Journalize the transactions. Explanations are not required. (Record debits first, then credits. Exclude explanations from any journal entries.) June 19: Issued 2,000 shares of $6 par common stock for cash of $12.50 per share. Journal Entry Accounts Debit Credit Date Jun 19 Stevie Systems completed the following stock issuance transactions: i (Click the icon to view the transactions.) Requirements 1. Journalize the transactions. Explanations are not required. 2. How much paid-in capital did these transactions generate for Stevie Systems? July 3: Sold 360 shares of $2.00, no-par preferred stock for $18,000 cash. Journal Entry Date Accounts Debit Jul 31 Credit July 11: Received inventory valued at $24,000 and equipment with market value of $9,000. Issued 5,000 shares of the $6 par common stock in exchange. Journal Entry Accounts Debit Credit Date Jul Choose from any list or enter any number in the input fields and then continue to the next question. Stevie Systems completed the following stock issuance transactions: Click the icon to view the transactions.) Requirements 1. Journalize the transactions. Explanations are not required 2. How much paid-in capital did these transactions generate for Stevie Systems? July 11: Received inventory valued at $24,000 and equipment with market value of $9,000. Issued 5,000 shares of the $6 par common stock in exchange. Journal Entry Accounts Date Debit Credit Requirement 2. How much paid-in capital did these transactions generate for Stevie Systems? Total paid-in capital generated from these transactions amounts to $ Choose from any list or enter any number in the input fields and then continue to the next