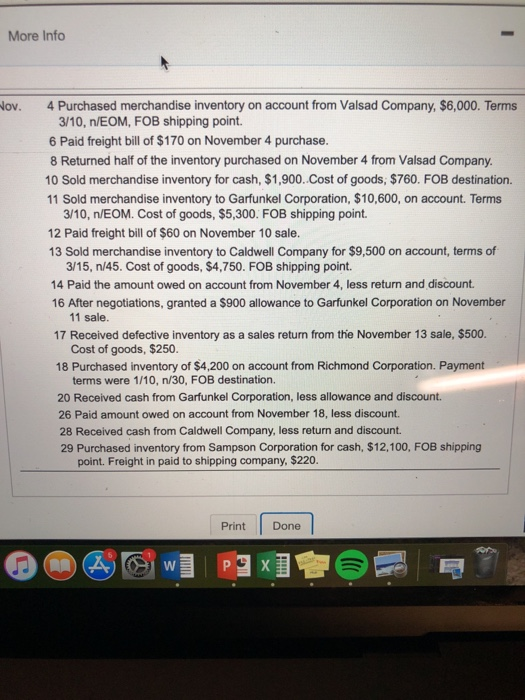

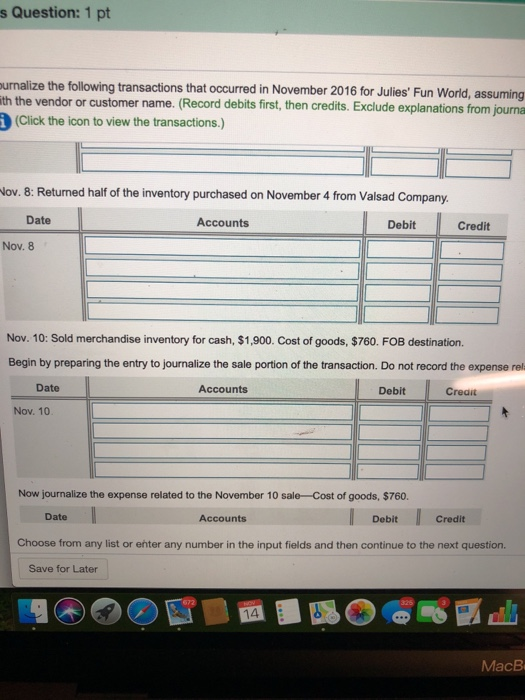

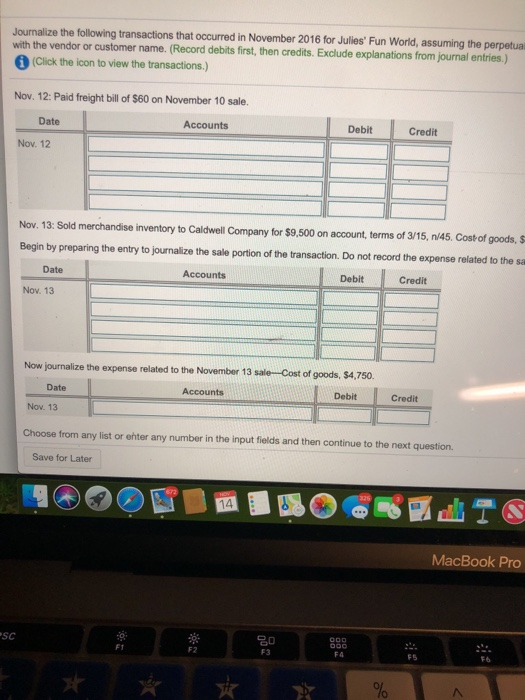

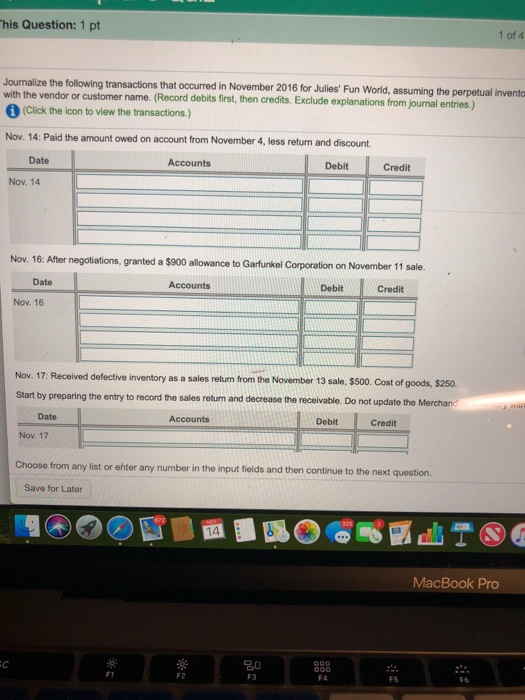

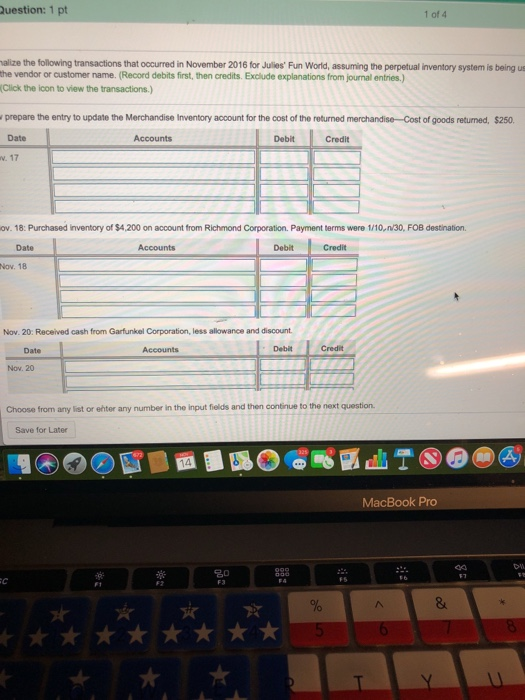

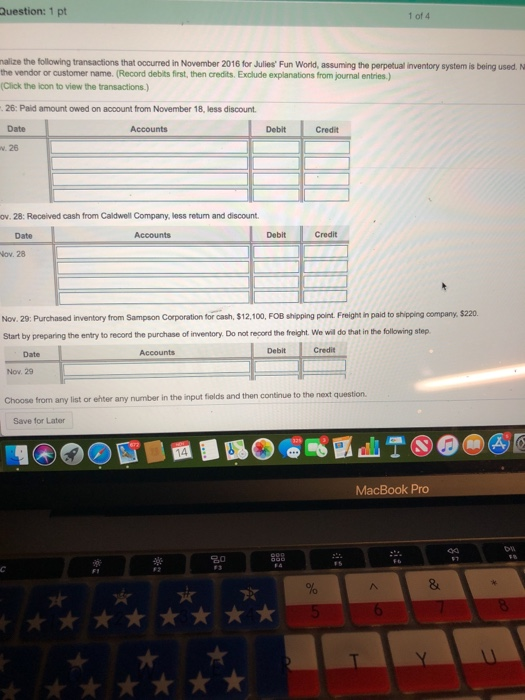

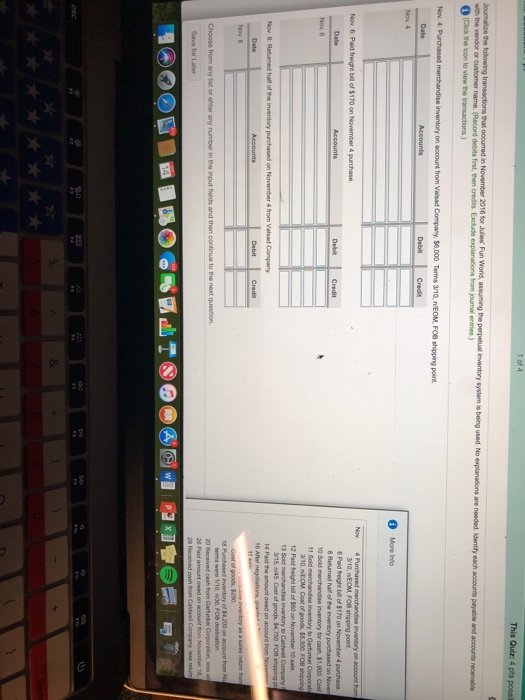

More Info Wov. 4 Purchased merchandise inventory on account from Valsad Company, $6,000. Terms 3/10,n/EOM, FOB shipping point. 6 Paid freight bill of $170 on November 4 purchase. 8 Returned half of the inventory purchased on November 4 from Valsad Company. 10 Sold merchandise inventory for cash, $1,900..Cost of goods, $760. FOB destination. 11 Sold merchandise inventory to Garfunkel Corporation, $10,600, on account. Terms 3/10, n/EOM. Cost of goods, $5,300. FOB shipping point. 12 Paid freight bill of $60 on November 10 sale. 13 Sold merchandise inventory to Caldwell Company for $9,500 on account, terms of 3/15, n/45. Cost of goods, $4,750. FOB shipping point. 14 Paid the amount owed on account from November 4, less return and discount. 16 After negotiations, granted a $900 allowance to Garfunkel Corporation on November 11 sale 17 Received defective inventory as a sales return from the November 13 sale, $500. Cost of goods, $250. 18 Purchased inventory of $4,200 on account from Richmond Corporation. Payment terms were 1/10, n/30, FOB destination. 20 Received cash from Garfunkel Corporation, less allowance and discount. 26 Paid amount owed on account from November 18, less discount. 28 Received cash from Caldwell Company, less return and discount. 29 Purchased inventory from Sampson Corporation for cash, $12,100, FOB shipping point. Freight in paid to shipping company, $220. Print Done = Question: 1 pt urnalize the following transactions that occurred in November 2016 for Julies' Fun World, assuming ith the vendor or customer name. (Record debits first, then credits. Exclude explanations from journa (Click the icon to view the transactions.) Nov. 8: Retured half of the inventory purchased on November 4 from Valsad Company Date Accounts Debit Credit Nov. 8 Nov. 10: Sold merchandise inventory for cash, $1,900. Cost of goods, $760. FOB destination. Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense rell Date Accounts Debit Cred Nov. 10 Now journalize the expense related to the November 10 sale Cost of goods. $760. Date Accounts Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question Save for Later Mace Journalize the following transactions that occurred in November 2016 for Julies' Fun World, assuming the perpetua with the vendor or customer name. (Record debits first, then credits. Exclude explanations from journal entries.) (Click the icon to view the transactions.) Nov. 12: Paid freight bill of $60 on November 10 sale. Accounts Debit Credit Date Nov. 12 Nov. 13: Sold merchandise inventory to Caldwell Company for $9,500 on account, terms of 3/15, n/45. Cost of goods, Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sa Date Accounts Debit Credit Nov. 13 Now journalize the expense related to the November 13 sale-Cost of goods, $4,750. Date Accounts Debit Credit Nov. 13 Choose from any list or enter any number in the input fields and then continue to the next question Save for Later MacBook Pro Question: 1 pt 1 of 4 malize the following transactions that occurred in November 2016 for Julies' Fun World, assuming the perpetual inventory system is being us the vendor or customer name. (Record debits first, then credits. Exclude explanations from journal entries.) Click the icon to view the transactions.) prepare the entry to update the Merchandise Inventory account for the cost of the returned merchandise-Cost of goods returned, $250. Date Accounts Debit Credit W. 17 ov. 18: Purchased Inventory of $4,200 on account from Richmond Corporation. Payment terms were 1/10 1/30, FOB destination Date Accounts Debit Credit Nov. 18 Nov. 20: Received cash from Garfunkel Corporation, less allowance and discount Date Accounts Debit Nov. 20 Choose from any list or enter any number in the input fields and then continue to the next question. Save for Later MacBook Pro & # ******* % 5 6 8 Question: 1 pt 1 of 4 nalize the following transactions that occurred in November 2016 for Julies' Fun World, assuming the perpetual inventory system is being used. N the vendor or customer name. (Record debits first, then credits. Exclude explanations from journal entries.) (Click the icon to view the transactions.) 26: Paid amount owed on account from November 18, less discount Date Accounts Debit Credit w. 26 ov.28: Received cash from Caldwell Company, less retum and discount Date Accounts Debit Credit Nov. 28 Nov. 29: Purchased inventory from Sampson Corporation for cash, $12,100, FOB shipping point. Freight in paid to shipping company, $220. Start by preparing the entry to record the purchase of inventory. Do not record the freight. We will do that in the following step Date Accounts Debit Credit Nov. 29 Choose from any list or her any number in the input fields and then continue to the next question Save for Later MacBook Pro * * * 5 6 8 1 of 4 This Quir: 4 pts possil Journalize the following transactions that occurred in November 2016 for Jes Fun World assuming the perpetual inventory system is being used. No explanations are needed. Identity each accounts payable and accounts recevable with the vendor or customer rame (Record debits first, then credits. Exclude explanations from ouma ties) Click the loon to view the transactions) Nov. 4. Purchased merchandise inventory on account from Visad Company. 56.000. Terms 3/10, NEOM, FOB shipping point Date Accounts Debit Credit 0 More Info Nov 6: Paid freibl of $170 on November 4 purchase 4 Purchased merchande inventory on account from 3/10, VEOM FOB shipping point 6 Paidrige bill of $170 on November 4 purchase 8 Returned half of the inventory purchased on Nove 10 Sold merchandise Inventory for cash. $1,900. Coat 11 Sold merchandise inventory to Garfunkel Corporate 110. COM Cost of goods, 35.300. FOB shipping 12 Paid freight bill of 500 on November to sale 13 Sold merchandise inventory to Caldwell Company 315, :45. Coat of goods. 4.750 Ft hipping og 14 Paid the amount owed on account from Nove Nov. 8: Retured half of the inventory purchased on November 4 from Valsad Company Debit Credit - ce inventory as a sales retum from Cost of goods, 250 18 Purchased inventory of $4.200 on account from forms were 1/10, 130, FOB destination 20 Meceived cash from Cartel Corporations 26 Paid amount owed on count on November 18 28 Received from Caldel Company losseum Choose from any sorter any number in the input fields and then continue to the next question Save for Later