would like to know where the calculations are coming from/breakdown of calculations.

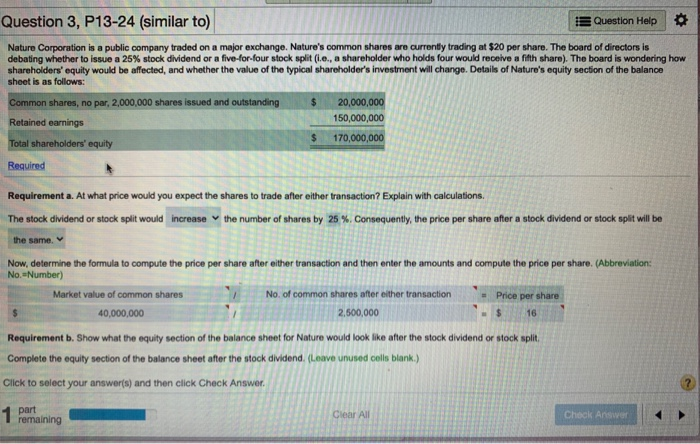

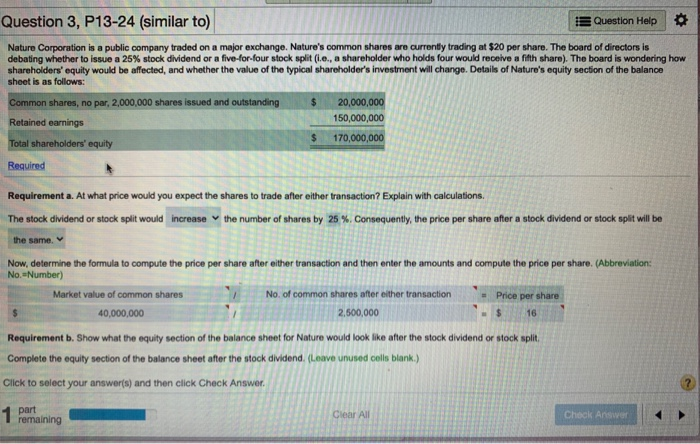

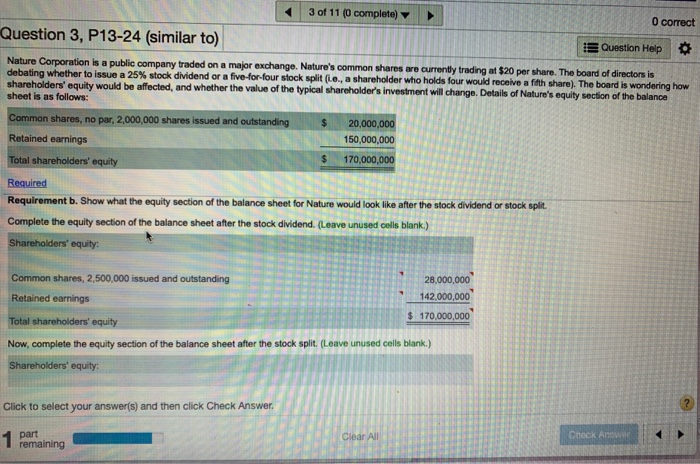

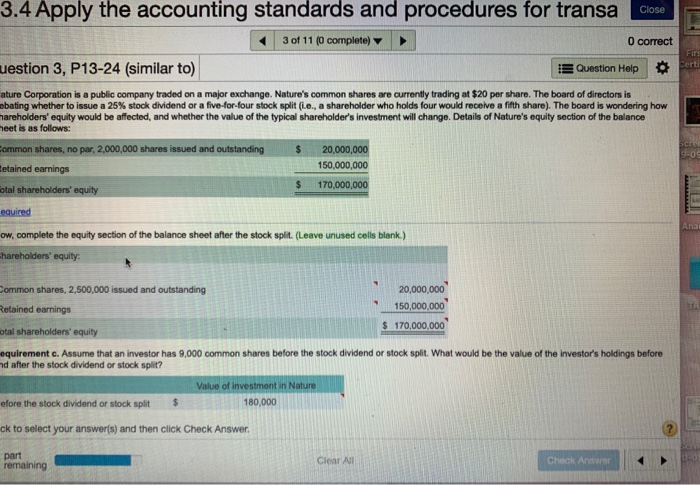

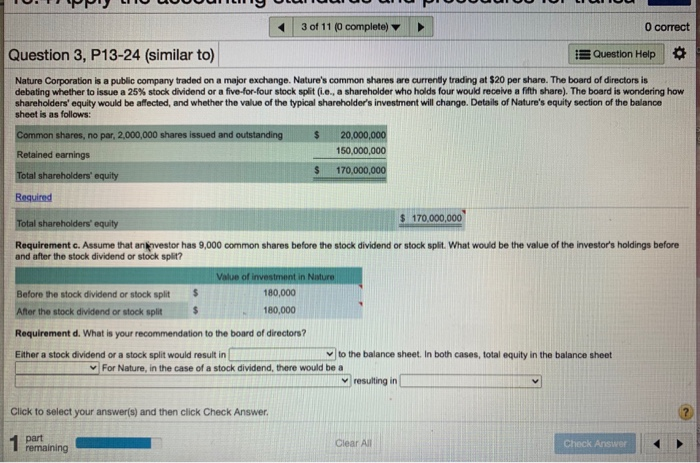

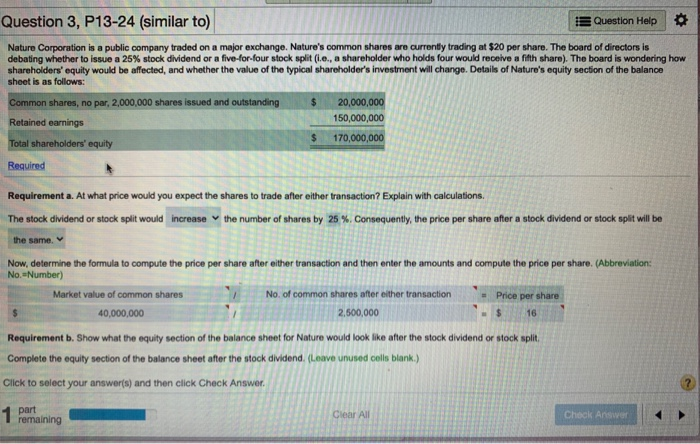

Question 3, P13-24 (similar to) Question Help Nature Corporation is a public company traded on a major exchange. Nature's common shares are currently trading at $20 per share. The board of directors is debating whether to issue a 25% stock dividend or a five-for-four stock split (i.e., a shareholder who holds four would receive a fifth share). The board is wondering how shareholders' equity would be affected, and whether the value of the typical shareholder's investment will change. Details of Nature's equity section of the balance sheet is as follows: Common shares, no par, 2,000,000 shares issued and outstanding $ 20,000,000 Retained earnings 150,000,000 $ Total shareholders' equity 170,000,000 Required Requirement a. At what price would you expect the shares to trade after either transaction? Explain with calculations. The stock dividend or stock split would increase the number of shares by 25 %. Consequently, the price per share after a stock dividend or stock split will be the same 16 Now, determine the formula to compute the price per share after either transaction and then enter the amounts and compute the price per share. (Abbreviation: No.-Number) Market value of common shares No. of common shares after either transaction Price per share 40,000,000 2,600,000 Requirement b. Show what the equity section of the balance sheet for Nature would look like after the stock dividend or stock split Complete the equity section of the balance sheet after the stock dividend. (Leave unused cells blank.) Click to select your answer(s) and then click Check Answer. part remaining Clear All Check Answer 3 of 11 (0 complete) O correct Question 3, P13-24 (similar to) Question Help Nature Corporation is a public company traded on a major exchange. Nature's common shares are currently trading at $20 per share. The board of directors is debating whether to issue a 25% stock dividend or a five-for-four stock split fie., a shareholder who holds four would receive a fifth share). The board is wondering how shareholders' equity would be affected, and whether the value of the typical shareholder's investment will change. Details of Nature's equity section of the balance sheet is as follows: Common shares, no par, 2,000,000 shares issued and outstanding $ 20,000,000 Retained earnings 150,000,000 $ Total shareholders' equity 170,000,000 Required Requirement b. Show what the equity section of the balance sheet for Nature would look like after the stock dividend or stock split. Complete the equity section of the balance sheet after the stock dividend. (Leave unused cells blank.) Shareholders' equity: Common shares, 2,500,000 issued and outstanding 28,000,000 Retained earnings 142,000,000 $ 170,000,000 Total shareholders' equity Now, complete the equity section of the balance sheet after the stock split. (Leave unused cells blank.) Shareholders' equity: Click to select your answer(s) and then click Check Answer. 1 part Clear All Check Ang remaining 3.4 Apply the accounting standards and procedures for transa Close 3 of 11 (0 complete) O correct Firs COS uestion 3, P13-24 (similar to) Question Help ature Corporation is a public company traded on a major exchange. Nature's common shares are currently trading at $20 per share. The board of directors is ebating whether to issue a 25% stock dividend or a five-for-four stock split (i.e., a shareholder who holds four would receive a fifth share). The board is wondering how hareholders' equity would be affected, and whether the value of the typical shareholder's investment will change. Details of Nature's equity section of the balance heet is as follows: common shares, no par, 2,000,000 shares issued and outstanding $ 20,000,000 Betained earnings 150,000,000 Rotal shareholders' equity 170,000,000 equired ow.complete the equity section of the balance sheet after the stock split. (Leave unused cells blank.) hareholders' equity: ELET Anal Common shares, 2,500,000 issued and outstanding 20,000,000 Retained earnings 150,000,000 $ 170,000,000 otal shareholders' equity equirement c. Assume that an investor has 9,000 common shares before the stock dividend or stock split. What would be the value of the investor's holdings before nd after the stock dividend or stock split? Value of Investment in Nature efore the stock dividend or stock split $ 180,000 ck to select your answer(s) and then click Check Answer. part remaining Clear All Check Answer 3 of 11 (0 complete) O correct Question 3, P13-24 (similar to) Question Help Nature Corporation is a public company traded on a major exchange. Nature's common shares are currently trading at $20 per share. The board of directors is debating whether to issue a 25% stock dividend or a five-for-four stock split (i.e., a shareholder who holds four would receive a fifth share). The board is wondering how shareholders' equity would be affected, and whether the value of the typical shareholder's investment will change. Details of Nature's equity section of the balance sheet is as follows: Common shares, no par, 2,000,000 shares issued and outstanding $ 20,000,000 Retained earnings 150,000,000 $ 170,000,000 Total shareholders' equity Required $ 170,000,000 Total shareholders' equity Requirement c. Assume that an envestor has 9,000 common shares before the stock dividend or stock split. What would be the value of the investor's holdings before and after the stock dividend or stock split? Value of investment in Nisture Before the stock dividend or stock split $ 180,000 After the stock dividend or stock split $ 180,000 Requirement d. What is your recommendation to the board of directors? Either a stock dividend or a stock split would result in to the balance sheet. In both cases, total equity in the balance sheet For Nature, in the case of a stock dividend, there would be a resulting in Click to select your answer(s) and then click Check Answer. 1 part remaining Clear All Check Answer Question 3, P13-24 (similar to) Question Help Nature Corporation is a public company traded on a major exchange. Nature's common shares are currently trading at $20 per share. The board of directors is debating whether to issue a 25% stock dividend or a five-for-four stock split (i.e., a shareholder who holds four would receive a fifth share). The board is wondering how shareholders' equity would be affected, and whether the value of the typical shareholder's investment will change. Details of Nature's equity section of the balance sheet is as follows: Common shares, no par, 2,000,000 shares issued and outstanding $ 20,000,000 Retained earnings 150,000,000 $ Total shareholders' equity 170,000,000 Required Requirement a. At what price would you expect the shares to trade after either transaction? Explain with calculations. The stock dividend or stock split would increase the number of shares by 25 %. Consequently, the price per share after a stock dividend or stock split will be the same 16 Now, determine the formula to compute the price per share after either transaction and then enter the amounts and compute the price per share. (Abbreviation: No.-Number) Market value of common shares No. of common shares after either transaction Price per share 40,000,000 2,600,000 Requirement b. Show what the equity section of the balance sheet for Nature would look like after the stock dividend or stock split Complete the equity section of the balance sheet after the stock dividend. (Leave unused cells blank.) Click to select your answer(s) and then click Check Answer. part remaining Clear All Check Answer 3 of 11 (0 complete) O correct Question 3, P13-24 (similar to) Question Help Nature Corporation is a public company traded on a major exchange. Nature's common shares are currently trading at $20 per share. The board of directors is debating whether to issue a 25% stock dividend or a five-for-four stock split fie., a shareholder who holds four would receive a fifth share). The board is wondering how shareholders' equity would be affected, and whether the value of the typical shareholder's investment will change. Details of Nature's equity section of the balance sheet is as follows: Common shares, no par, 2,000,000 shares issued and outstanding $ 20,000,000 Retained earnings 150,000,000 $ Total shareholders' equity 170,000,000 Required Requirement b. Show what the equity section of the balance sheet for Nature would look like after the stock dividend or stock split. Complete the equity section of the balance sheet after the stock dividend. (Leave unused cells blank.) Shareholders' equity: Common shares, 2,500,000 issued and outstanding 28,000,000 Retained earnings 142,000,000 $ 170,000,000 Total shareholders' equity Now, complete the equity section of the balance sheet after the stock split. (Leave unused cells blank.) Shareholders' equity: Click to select your answer(s) and then click Check Answer. 1 part Clear All Check Ang remaining 3.4 Apply the accounting standards and procedures for transa Close 3 of 11 (0 complete) O correct Firs COS uestion 3, P13-24 (similar to) Question Help ature Corporation is a public company traded on a major exchange. Nature's common shares are currently trading at $20 per share. The board of directors is ebating whether to issue a 25% stock dividend or a five-for-four stock split (i.e., a shareholder who holds four would receive a fifth share). The board is wondering how hareholders' equity would be affected, and whether the value of the typical shareholder's investment will change. Details of Nature's equity section of the balance heet is as follows: common shares, no par, 2,000,000 shares issued and outstanding $ 20,000,000 Betained earnings 150,000,000 Rotal shareholders' equity 170,000,000 equired ow.complete the equity section of the balance sheet after the stock split. (Leave unused cells blank.) hareholders' equity: ELET Anal Common shares, 2,500,000 issued and outstanding 20,000,000 Retained earnings 150,000,000 $ 170,000,000 otal shareholders' equity equirement c. Assume that an investor has 9,000 common shares before the stock dividend or stock split. What would be the value of the investor's holdings before nd after the stock dividend or stock split? Value of Investment in Nature efore the stock dividend or stock split $ 180,000 ck to select your answer(s) and then click Check Answer. part remaining Clear All Check Answer 3 of 11 (0 complete) O correct Question 3, P13-24 (similar to) Question Help Nature Corporation is a public company traded on a major exchange. Nature's common shares are currently trading at $20 per share. The board of directors is debating whether to issue a 25% stock dividend or a five-for-four stock split (i.e., a shareholder who holds four would receive a fifth share). The board is wondering how shareholders' equity would be affected, and whether the value of the typical shareholder's investment will change. Details of Nature's equity section of the balance sheet is as follows: Common shares, no par, 2,000,000 shares issued and outstanding $ 20,000,000 Retained earnings 150,000,000 $ 170,000,000 Total shareholders' equity Required $ 170,000,000 Total shareholders' equity Requirement c. Assume that an envestor has 9,000 common shares before the stock dividend or stock split. What would be the value of the investor's holdings before and after the stock dividend or stock split? Value of investment in Nisture Before the stock dividend or stock split $ 180,000 After the stock dividend or stock split $ 180,000 Requirement d. What is your recommendation to the board of directors? Either a stock dividend or a stock split would result in to the balance sheet. In both cases, total equity in the balance sheet For Nature, in the case of a stock dividend, there would be a resulting in Click to select your answer(s) and then click Check Answer. 1 part remaining Clear All Check