More Questions = More Rates

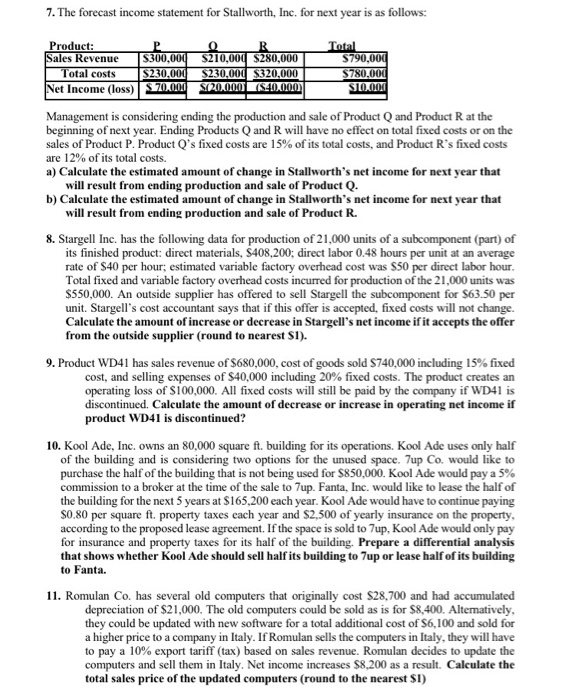

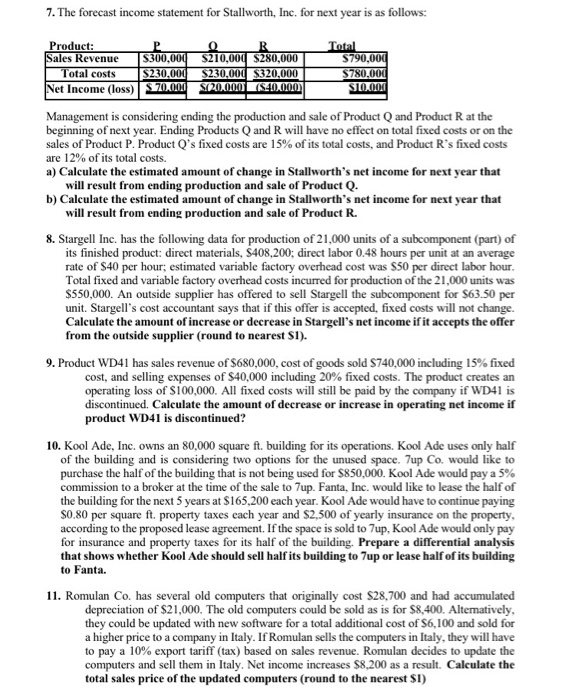

7. The forecast income statement for Stallworth, Inc. for next year is as follows: Product: Total Sales Revenue $300,000 210,00 ,000 $280,000 $790,000 Total costs $230,000 $230,000 $320,000 $780.000 Net Income (loss) 370.00 120.000 $40.000 $10.000 Management is considering ending the production and sale of Product Q and Product Rat the beginning of next year. Ending Products Q and R will have no effect on total fixed costs or on the sales of Product P. Product Q's fixed costs are 15% of its total costs, and Product R's fixed costs are 12% of its total costs. a) Calculate the estimated amount of change in Stallworth's net income for next year that will result from ending production and sale of Product Q. b) Calculate the estimated amount of change in Stallworth's net income for next year that will result from ending production and sale of Product R. 8. Stargell Inc. has the following data for production of 21,000 units of a subcomponent (part) of its finished product: direct materials, $408,200; direct labor 0.48 hours per unit at an average rate of $40 per hour; estimated variable factory overhead cost was $50 per direct labor hour. Total fixed and variable factory overhead costs incurred for production of the 21,000 units was $550,000. An outside supplier has offered to sell Stargell the subcomponent for $63.50 per unit. Stargell's cost accountant says that if this offer is accepted, fixed costs will not change. Calculate the amount of increase or decrease in Stargell's net income if it accepts the offer from the outside supplier (round to nearest SI). 9. Product WD41 has sales revenue of $680,000, cost of goods sold 9740,000 including 15% fixed cost, and selling expenses of $40,000 including 20% fixed costs. The product creates an operating loss of S100,000. All fixed costs will still be paid by the company if WD41 is discontinued. Calculate the amount of decrease or increase in operating net income if product WD41 is discontinued? 10. Kool Ade, Inc. owns an 80,000 square ft. building for its operations. Kool Ade uses only half of the building and is considering two options for the unused space. Tup Co. would like to purchase the half of the building that is not being used for $850,000. Kool Ade would pay a 5% commission to a broker at the time of the sale to 7up. Fanta, Inc. would like to lease the half of the building for the next 5 years at $165,200 each year. Kool Ade would have to continue paying $0.80 per square ft. property taxes each year and $2,500 of yearly insurance on the property, according to the proposed lease agreement. If the space is sold to 7up, Kool Ade would only pay for insurance and property taxes for its half of the building. Prepare a differential analysis that shows whether Kool Ade should sell half its building to 7up or lease half of its building to Fanta. 11. Romulan Co. has several old computers that originally cost $28,700 and had accumulated depreciation of $21,000. The old computers could be sold as is for $8,400. Alternatively, they could be updated with new software for a total additional cost of $6,100 and sold for a higher price to a company in Italy. If Romulan sells the computers in Italy, they will have to pay a 10% export tariff (tax) based on sales revenue. Romulan decides to update the computers and sell them in Italy. Net income increases $8,200 as a result. Calculate the total sales price of the updated computers (round to the nearest SI)

More Questions = More Rates

More Questions = More Rates