More Questions=More Rates!!!

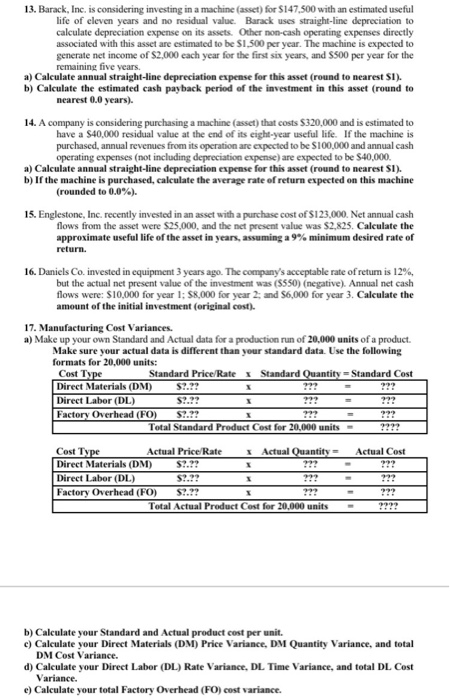

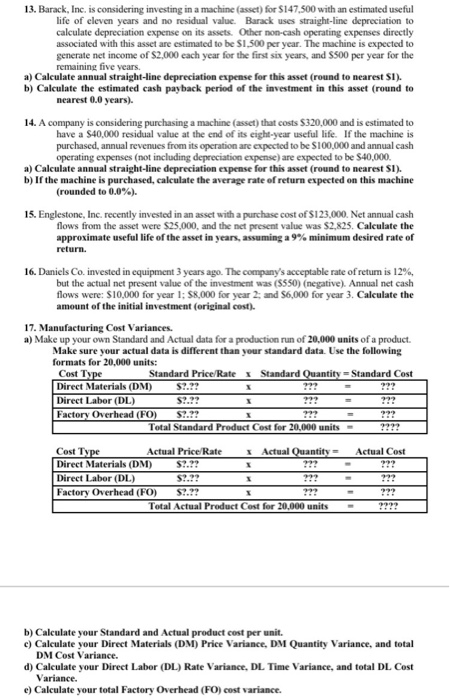

13. Barack, Inc. is considering investing in a machine (asset) for S147,500 with an estimated useful life of eleven years and no residual value. Barack uses straight-line depreciation to calculate depreciation expense on its assets. Other non-cash operating expenses directly associated with this asset are estimated to be $1,500 per year. The machine is expected to generate net income of $2,000 each year for the first six years, and $500 per year for the remaining five years. a) Calculate annual straight-line depreciation expense for this asset (round to nearest I). b) Calculate the estimated cash payback period of the investment in this asset (round to nearest 0.0 years). 14. A company is considering purchasing a machine (asset) that costs $320,000 and is estimated to have a $40,000 residual value at the end of its eight-year useful life. If the machine is purchased, annual revenues from its operation are expected to be $100,000 and annual cash operating expenses (not including depreciation expense) are expected to be $40,000. a) Calculate annual straight-line depreciation expense for this asset (round to nearest SI). b) If the machine is purchased, calculate the average rate of return expected on this machine (rounded to 0.0%). 15. Englestone, Inc. recently invested in an asset with a purchase cost of $123,000. Net annual cash flows from the asset were $25,000, and the net present value was $2,825. Calculate the approximate useful life of the asset in years, assuming a 9% minimum desired rate of return. 16. Daniels Co. invested in equipment 3 years ago. The company's acceptable rate of retum is 12%, but the actual net present value of the investment was (5550) (negative). Annual net cash flows were: $10,000 for year 1: 58,000 for year 2, and $6,000 for year 3. Calculate the amount of the initial investment (original cost). 17. Manufacturing Cost Variances. a) Make up your own Standard and Actual data for a production run of 20,000 units of a product. Make sure your actual data is different than your standard data. Use the following formats for 20,000 units: Cost Type Standard Price Rate Standard Quantity = Standard Cost Direct Materials (DM) Direct Labor (DL) $?.?? Factory Overhead (FO) S?.?? Total Standard Product Cost for 20,000 units Actual Cost Cost Type Actual Price/Rate I Actual Quantity = Direct Materials (DM) $7.99 ??? Direct Labor (DL) $?.?? Factory Overhead (FO) S?.?? Total Actual Product Cost for 20,000 units 1 ???? b) Calculate your Standard and Actual product cost per unit. c) Calculate your Direct Materials (DM) Price Variance, DM Quantity Variance, and total DM Cost Variance. d) Calculate your Direct Labor (DL) Rate Variance, DL Time Variance, and total DL Cost Variance. c) Calculate your total Factory Overhead (FO) cost variance

More Questions=More Rates!!!

More Questions=More Rates!!!