Answered step by step

Verified Expert Solution

Question

1 Approved Answer

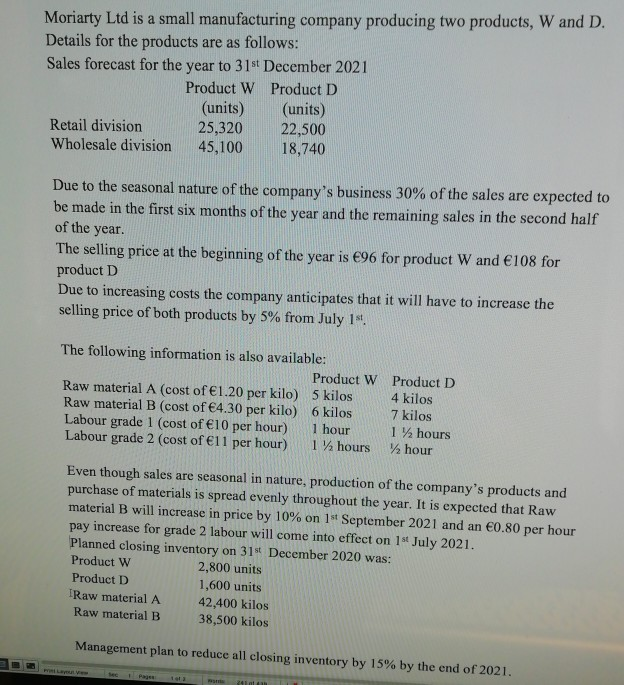

Moriarty Ltd is a small manufacturing company producing two products, W and D. Details for the products are as follows: Sales forecast for the year

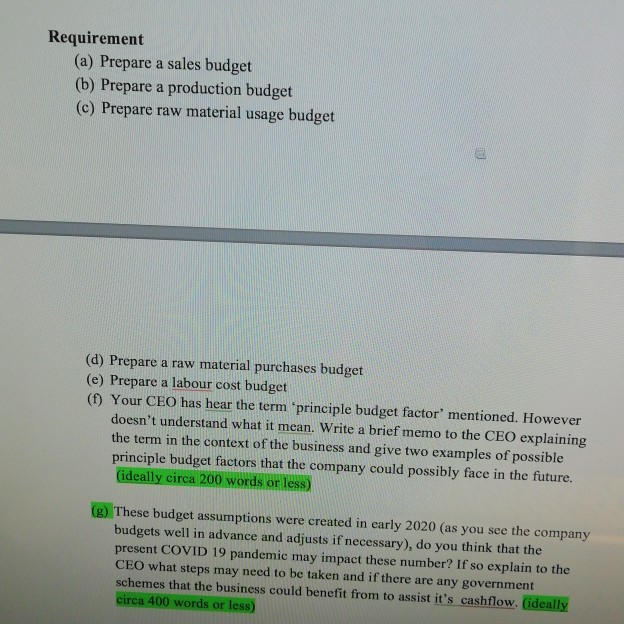

Moriarty Ltd is a small manufacturing company producing two products, W and D. Details for the products are as follows: Sales forecast for the year to 31st December 2021 Product W Product D (units) (units) Retail division 25,320 22,500 Wholesale division 45,100 18,740 Due to the seasonal nature of the company's business 30% of the sales are expected to be made in the first six months of the year and the remaining sales in the second half of the year. The selling price at the beginning of the year is 96 for product W and 108 for product D Due to increasing costs the company anticipates that it will have to increase the selling price of both products by 5% from July 14 The following information is also available: Product W Raw material A (cost of 1.20 per kilo) 5 kilos Raw material B (cost of 4.30 per kilo 6 kilos Labour grade 1 (cost of 10 per hour) 1 hour Labour grade 2 (cost of 1l per hour) 17 hours Product D 4 kilos 7 kilos 12 hours 2 hour Even though sales are seasonal in nature, production of the company's products and purchase of materials is spread evenly throughout the year. It is expected that Raw material B will increase in price by 10% on 1st September 2021 and an 0.80 per hour pay increase for grade 2 labour will come into effect on 1st July 2021. Planned closing inventory on 31 December 2020 was: Product W 2,800 units Product D 1,600 units IRaw material A 42,400 kilos Raw material B 38,500 kilos Management plan to reduce all closing inventory by 15% by the end of 2021. BD Page 1 Requirement (a) Prepare a sales budget (b) Prepare a production budget (c) Prepare raw material usage budget (d) Prepare a raw material purchases budget (e) Prepare a labour cost budget (1) Your CEO has hear the term "principle budget factor' mentioned. However doesn't understand what it mean. Write a brief memo to the CEO explaining the term in the context of the business and give two examples of possible principle budget factors that the company could possibly face in the future. (ideally circa 200 words or less) () These budget assumptions were created in early 2020 (as you see the company budgets well in advance and adjusts if necessary), do you think that the present COVID 19 pandemic may impact these number? If so explain to the CEO what steps may need to be taken and if there are any government schemes that the business could benefit from to assist it's cashflow. (ideally circa 400 words or less)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started