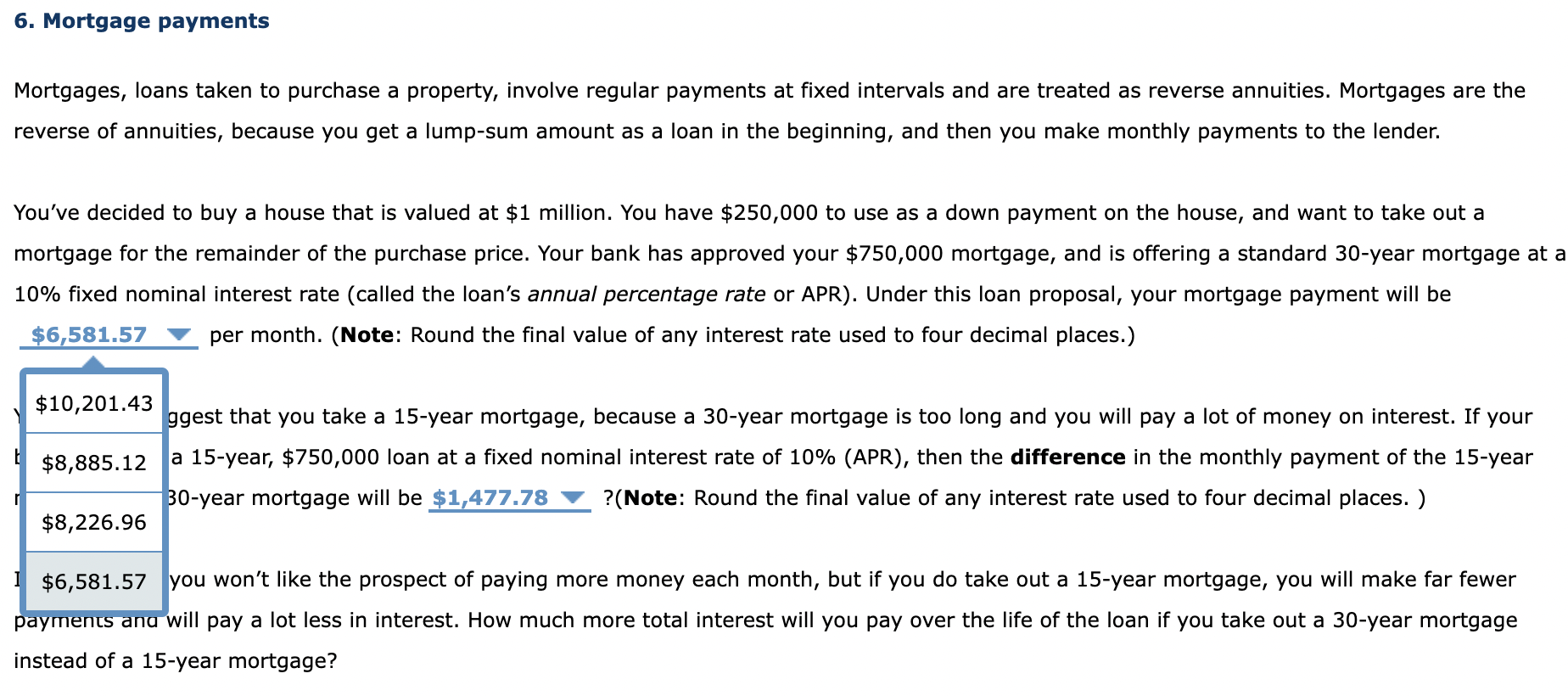

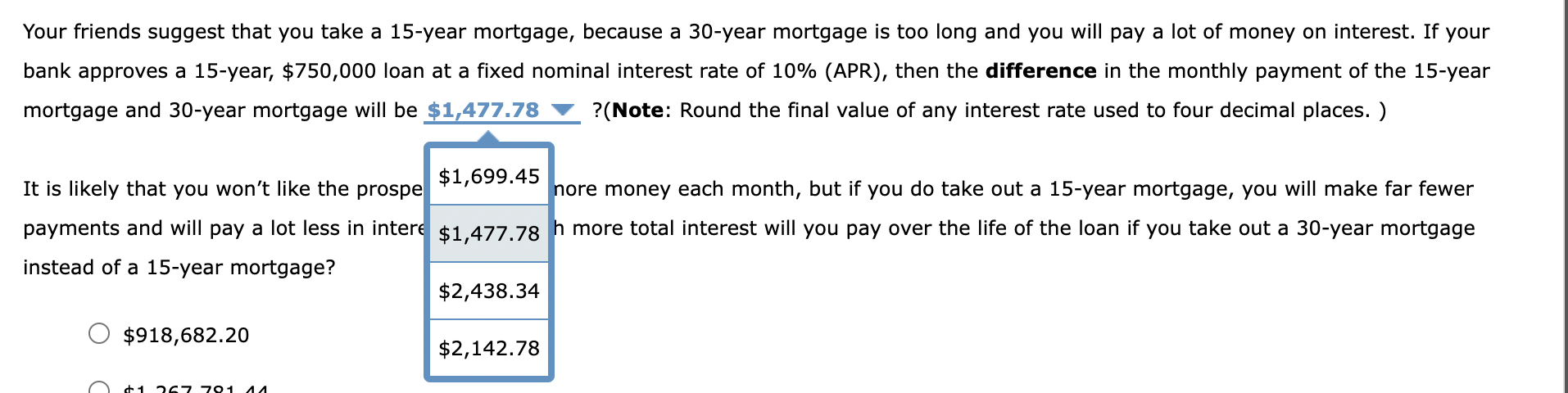

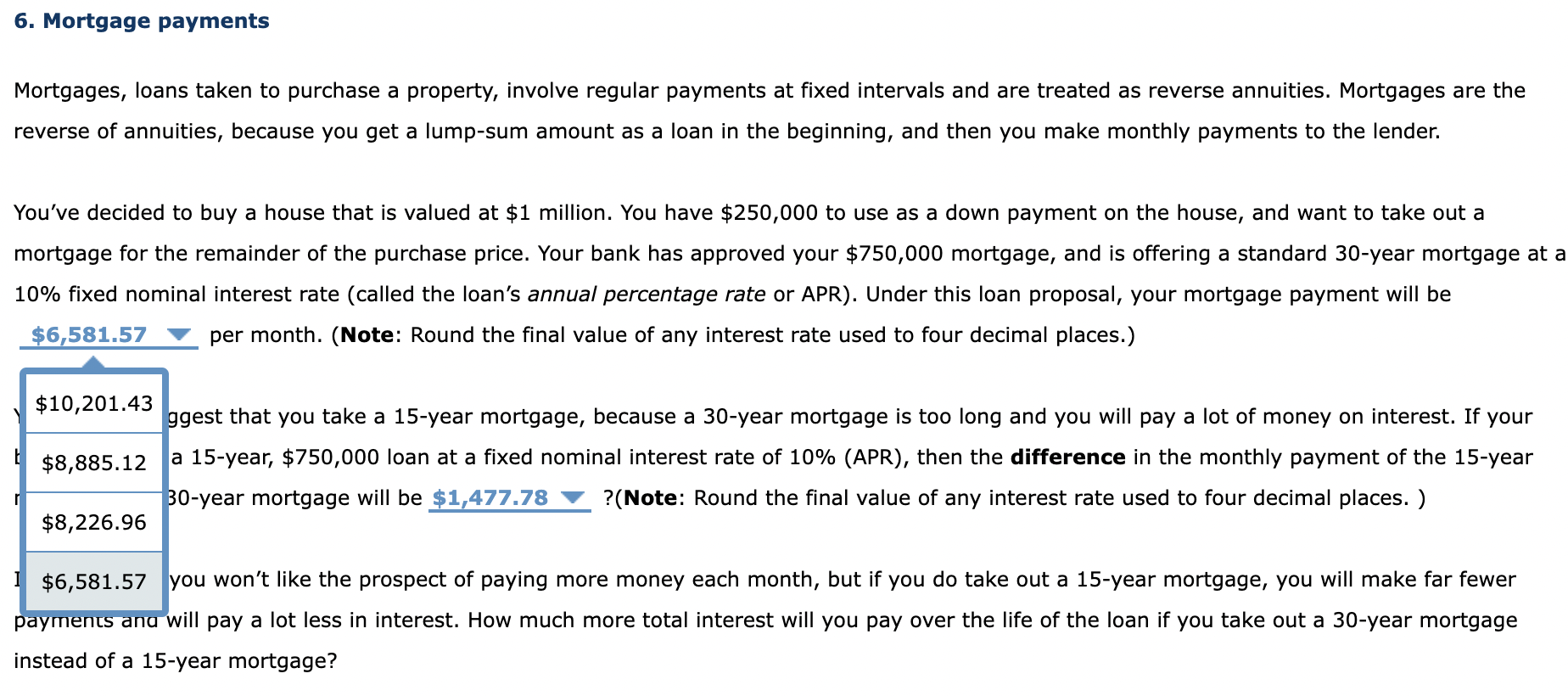

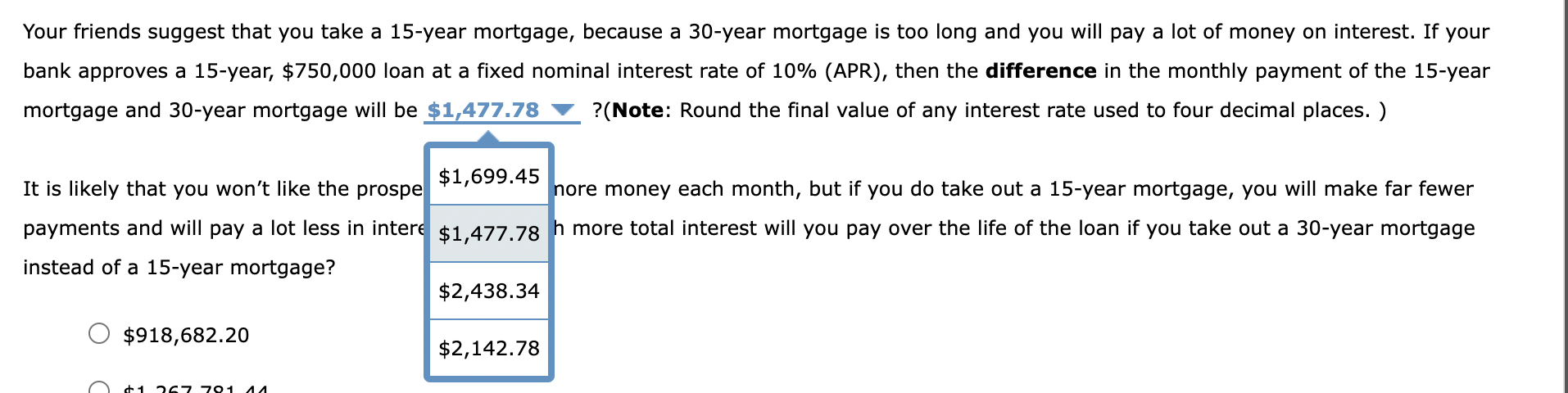

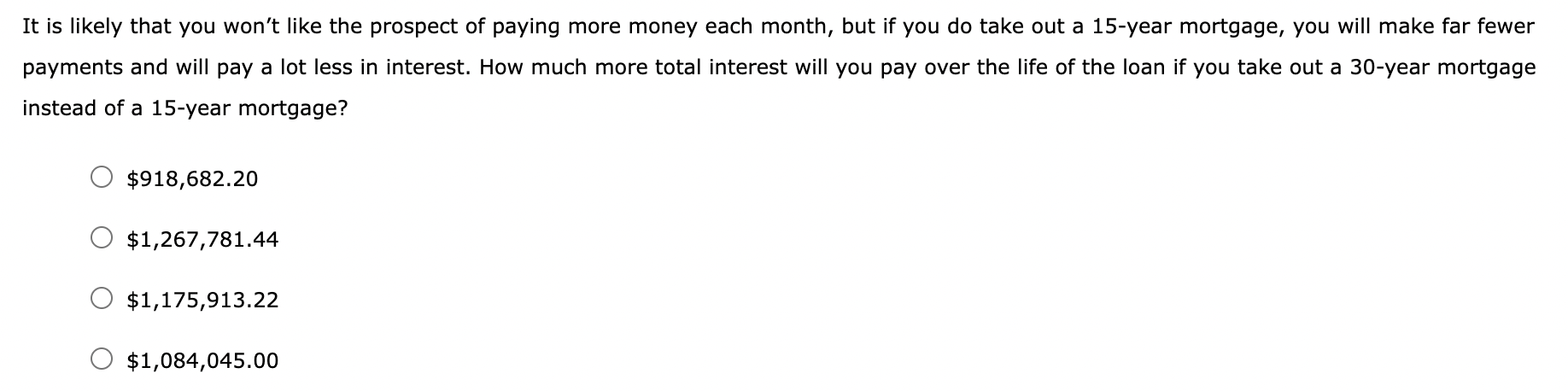

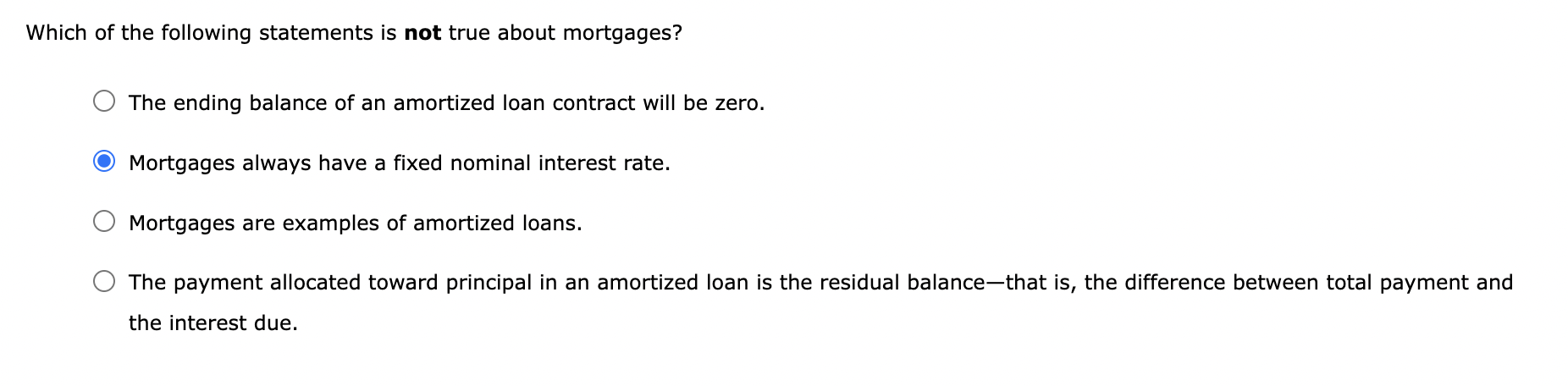

Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are treated as reverse annes reverse of annuities, because you get a lump-sum amount as a loan in the beginning, and then you make monthly payments to the You've decided to buy a house that is valued at $1 million. You have $250,000 to use as a down payment on the house, and want to take out mortgage for the remainder of the purchase price. Your bank has approved your $750,000 mortgage, and is offering a standard 30 -year mortgage at 10% fixed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal, your mortgage payment will be per month. (Note: Round the final value of any interest rate used to four decimal places.) Jgest that you take a 15-year mortgage, because a 30-year mortgage is too long and you will pay a lot of money on interest. If your a 15-year, $750,000 loan at a fixed nominal interest rate of 10% (APR), then the difference in the monthly payment of the 15year 30 -year mortgage will be ?(Note: Round the final value of any interest rate used to four decimal places. ) you won't like the prospect of paying more money each month, but if you do take out a 15-year mortgage, you will make far fewer fuyum, wo un will pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30 -year mortgage instead of a 15-year mortgage? Your friends suggest that you take a 15 -year mortgage, because a 30 -year mortgage is too long and you will pay a lot of money on interest. If your bank approves a 15-year, $750,000 loan at a fixed nominal interest rate of 10% (APR), then the difference in the monthly payment of the 15-year mortgage and 30-year mortgage will be ?(Note: Round the final value of any interest rate used to four decimal places. ) It is likely that you won't like the prospe ore money each month, but if you do take out a 15-year mortgage, you will make far fewer payments and will pay a lot less in intert 7 more total interest will you pay over the life of the loan if you take out a 30 -year mortgat instead of a 15-year mortgage? $918,682.20 It is likely that you won't like the prospect of paying more money each month, but if you do take out a 15y=ar mortgage, you will make far fewer payments and will pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30 -year mortgage instead of a 15-year mortgage? $918,682.20$1,267,781.44$1,175,913.22$1,084,045.00 Which of the following statements is not true about mortgages? The ending balance of an amortized loan contract will be zero. Mortgages always have a fixed nominal interest rate. Mortgages are examples of amortized loans. The payment allocated toward principal in an amortized loan is the residual balance-that is, the difference between total payment and the interest due