Question

Morton Companys budgeted variable manufacturing overhead is $2.50 per direct labor-hour and its budgeted fixed manufacturing overhead is $330,000 per year. The company manufactures a

Morton Companys budgeted variable manufacturing overhead is $2.50 per direct labor-hour and its budgeted fixed manufacturing overhead is $330,000 per year. The company manufactures a single product whose standard direct labor-hours per unit is 3.5 hours. The standard direct labor wage rate is $20 per hour. The standards also allow 4 feet of raw material per unit at a standard cost of $4 per foot. Although normal activity is 75,000 direct labor-hours each year, the company expects to operate at a 60,000-hour level of activity this year.

Required:

1. Assume that the company chooses 60,000 direct labor-hours as the denominator level of activity. Compute the predetermined overhead rate, breaking it down into variable and fixed cost elements.

2. Assume that the company chooses 75,000 direct labor-hours as the denominator level of activity. Compute the predetermined overhead rate, breaking it down into variable and fixed cost elements.

3. Complete two standard cost cards for 60,000 & 75,000 DLHs.

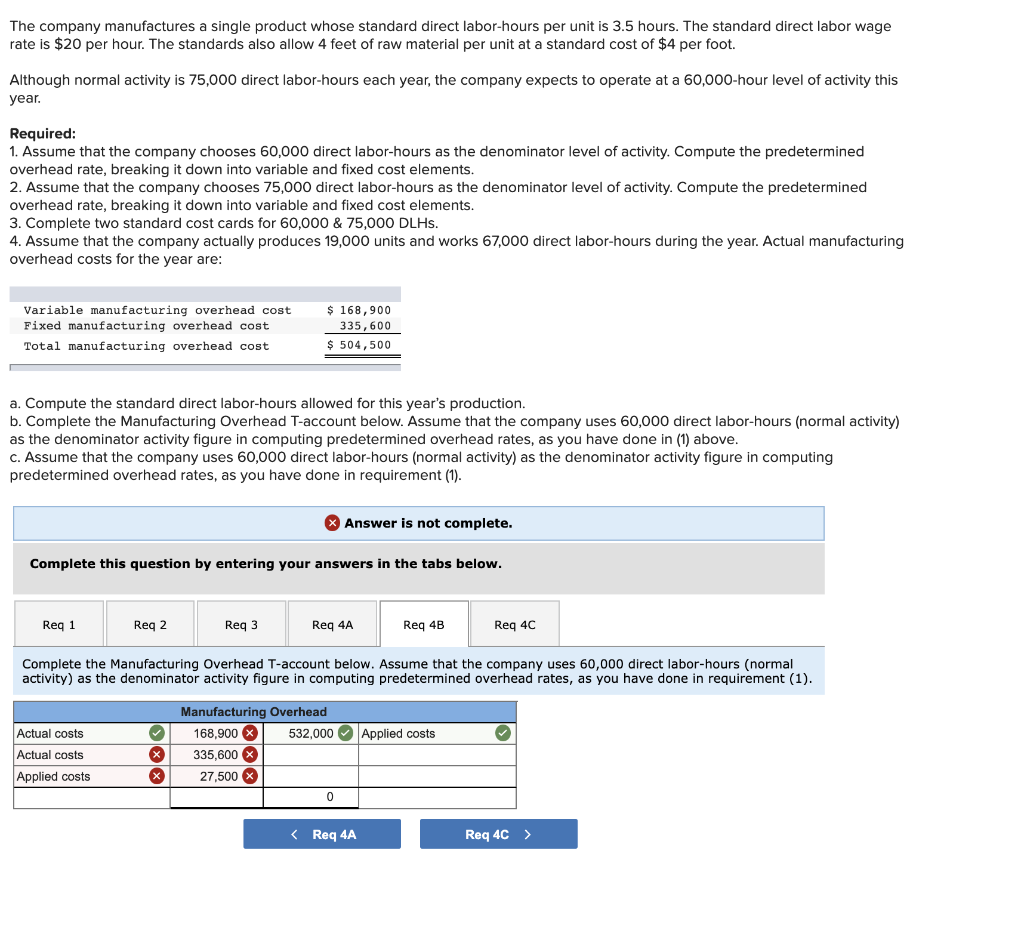

4. Assume that the company actually produces 19,000 units and works 67,000 direct labor-hours during the year. Actual manufacturing overhead costs for the year are: Variable manufacturing overhead cost $ 168,900 Fixed manufacturing overhead cost 335,600 Total manufacturing overhead cost $ 504,500

a. Compute the standard direct labor-hours allowed for this years production.

b. Complete the Manufacturing Overhead T-account below. Assume that the company uses 60,000 direct labor-hours (normal activity) as the denominator activity figure in computing predetermined overhead rates, as you have done in (1) above.

c. Assume that the company uses 60,000 direct labor-hours (normal activity) as the denominator activity figure in computing predetermined overhead rates, as you have done in requirement (1).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started