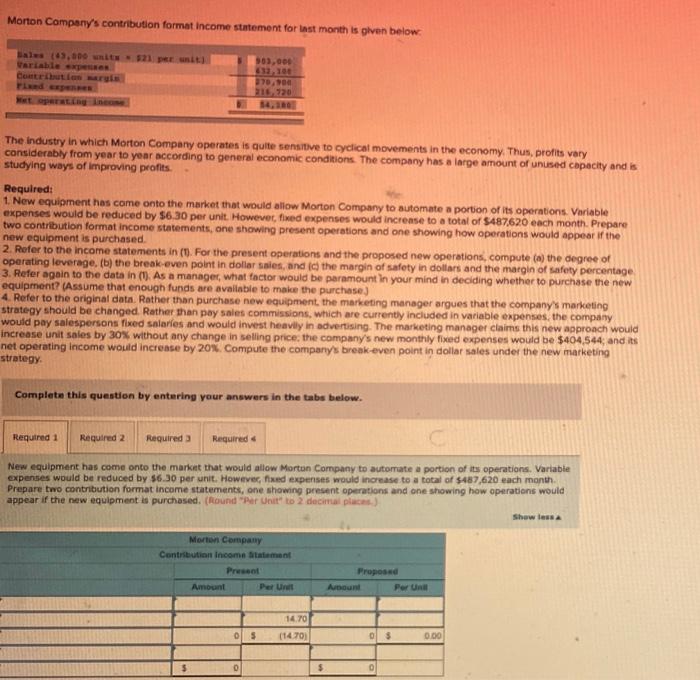

Morton Company's contribution format income statement for the last month is given below

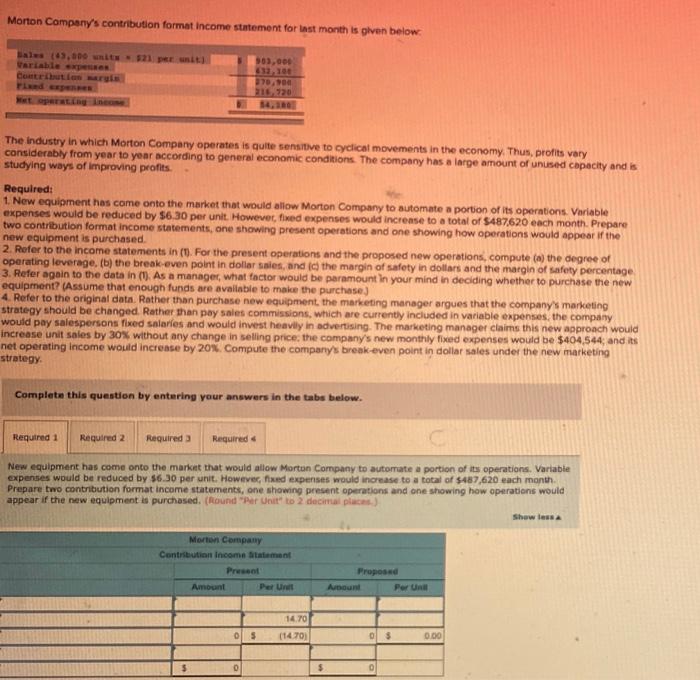

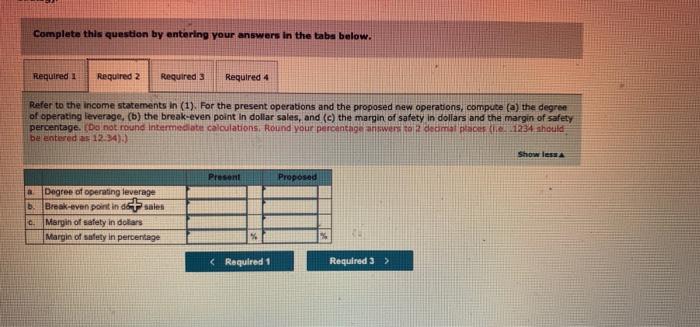

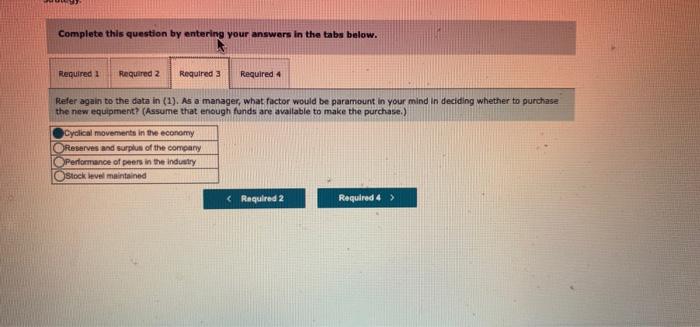

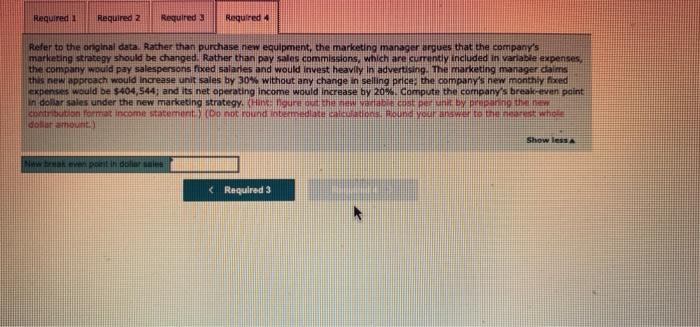

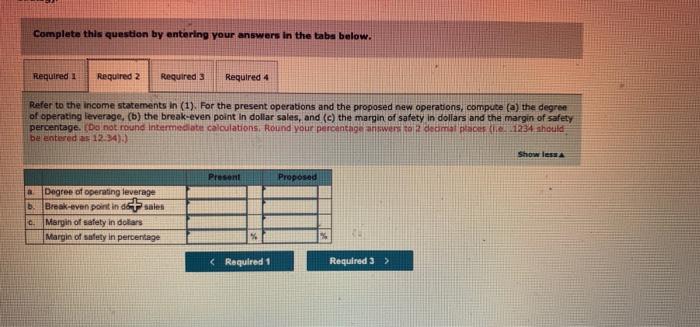

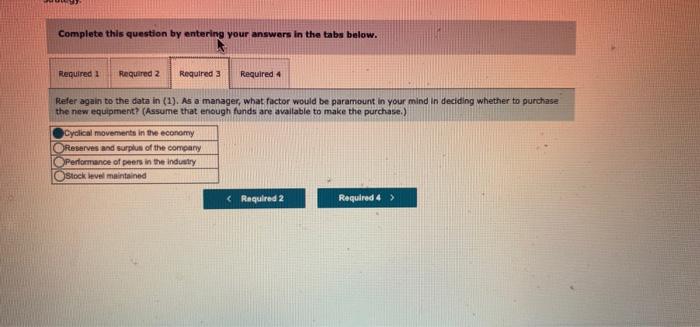

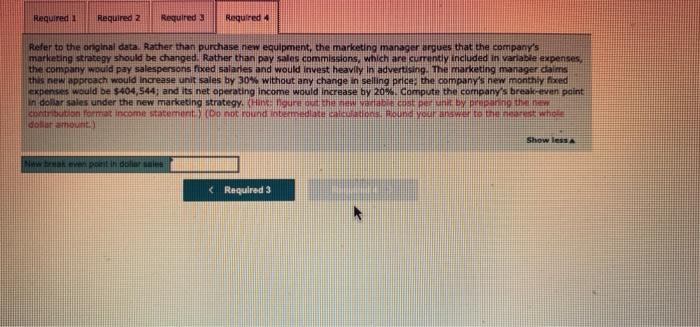

Monton Compeny's contribution format income statement for inst manth is given below: The industry in which Morton Company operates is quite sensitive to cyclical movements in the economy. Thus, profits vary considerably from year to year according to general economic conditions. The company has a large amount of unused capacity and is studying ways of improving profits. Required: 1. New equipment has came onto the market that would allow Morton Company to automate a portion of its operations. Variable expenses would be reduced by $6.30 per unit. Howevet, fixed expenses would increase to a total of $487,620 each month. Prepare two contribution format income statements, one showing present operations and one showing how operations would appeor if the new equipment is purchased. 2. Rofer to the income statements in (7). For the present operations and the proposed new operations, compute (a) the degree of operating leverage, (b) the break-even point in dollar saies, and ic the margin of safety in doperars and the margin of safoty percentage 3. Refer again to the data in (7). As a manager, what tactor would be paramount in your mind in deciding whether to purchase the new equipment? (Assume that enough funds are avaliable to maice the purchase) 4. Refer to the original data. Rather than purchese new equipment, the marketing manager argues that the company's marketing strategy should be changed. Rather than poy saies commissions, which are currently included in variable expenses, the company would pay salespersons fixed salaries and would invest heavily in advertising. The marketing manager claims this new approach would increase unit sales by 30% without any change in selling price, the company's new monthily fixed expenses would be $404,544; and its net operating income would increase by 20%. Compute the comparys break-even point in dollar sales under the new marketing strategy. Complete this question by entering your answers in the tabs below. New equipment has come onto the marknt that would allow Morton Company to automate a portion of its operations. Variable expenses would be reduced by $6.30 per unit. Howevec, fixed expenses would increase to a total of $487,620 each manth. Prepare two contritution format income statements, one showing present operations and one showing how operations would appear if the new equipment is purchased. (hound "Mer Unit" to 2 decitial placet.) Complete this question by entering your answers in the tabs below. Refer to the income statements in (1). For the present operations and the proposed new operations, compute (a) the degree of operating leverage, (b) the break-even point in dollar-sales, and (c) the margin of safety in dollars and the margin of safety belentered as 1234) i) Complete this question by entering your answers in the tabs below. Reefer again to the data in (1). As a manager, what factor would be paramount in your mind in deciding whether to purchase the new equipment? (Assume that enough funds are avaliable to make the purchase.) Refer to the onginal data. Rather than purchase new equipmant, the marketing manager argues that the corripany's marketing sthategy should be changed. Rather than pay salas commissions, which are currinty included in variable expenses. the compary would pay salespersons foced salarles and would invest heavily in advertising. The marketing mamager calms this new approach would increage unit sales by 30 wh whout any change in selling prices the oompany's new monthy foxed expenves would be $404,544, and its net operating income would increase by 20 . Cormpute the cornpany's breakicteven paint