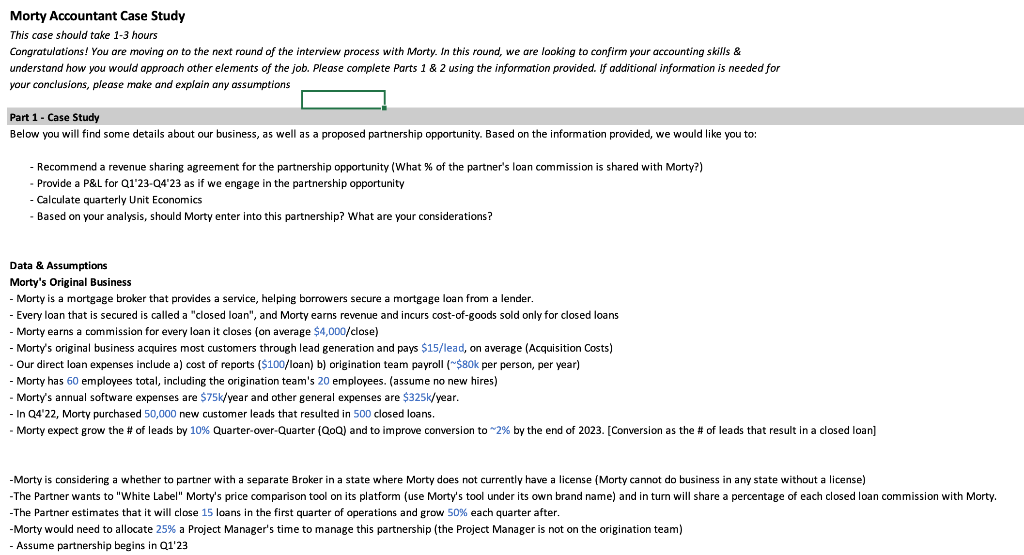

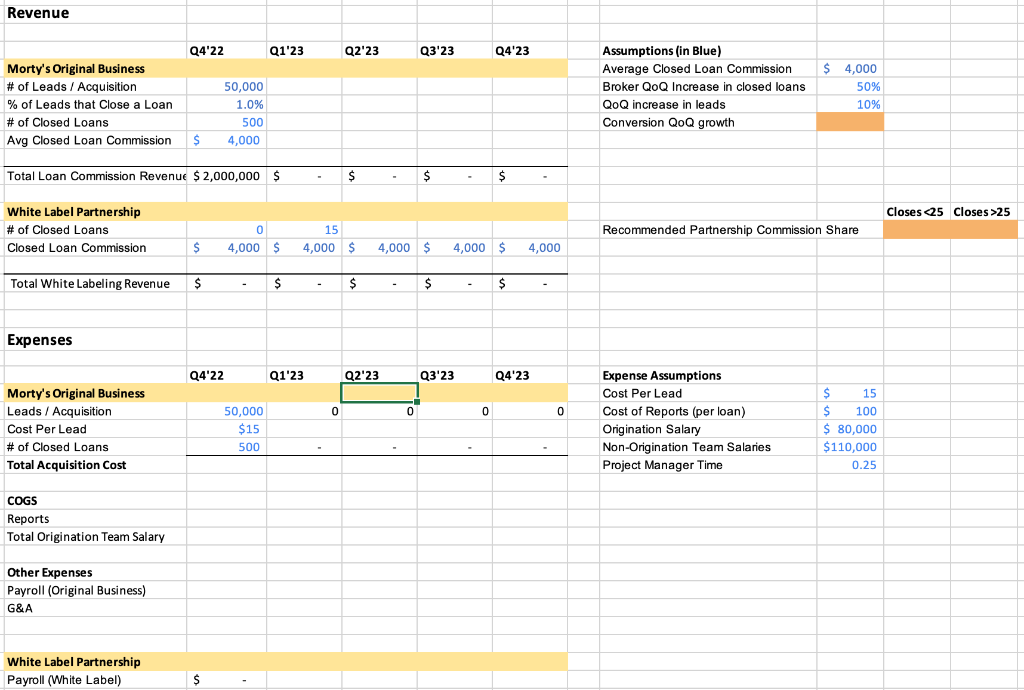

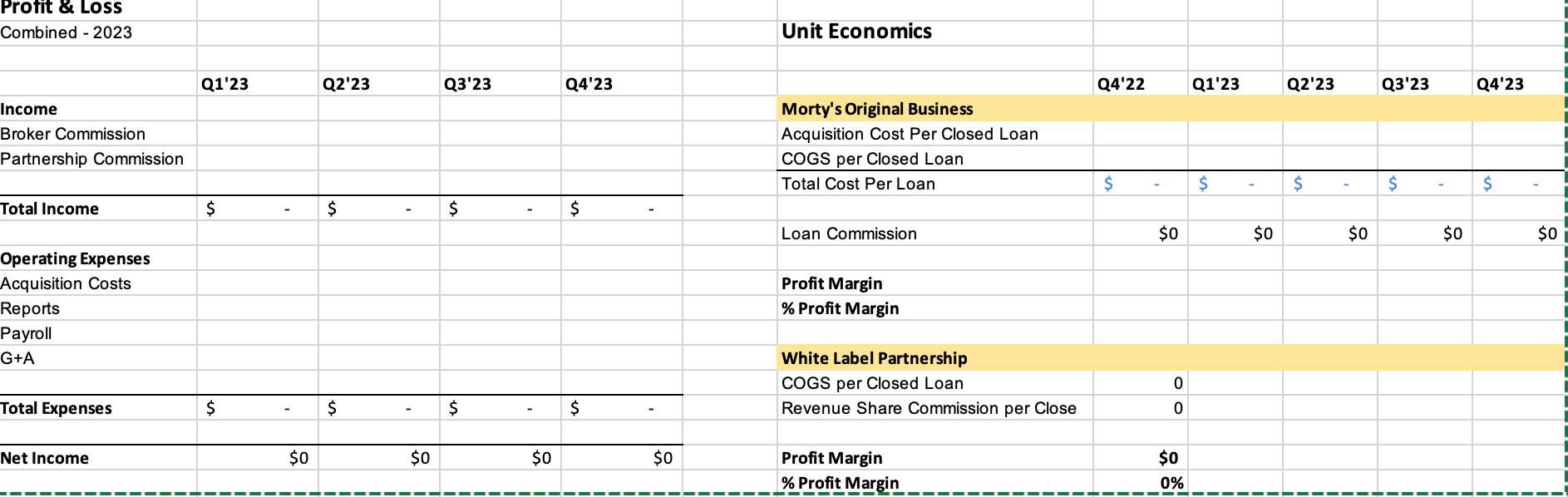

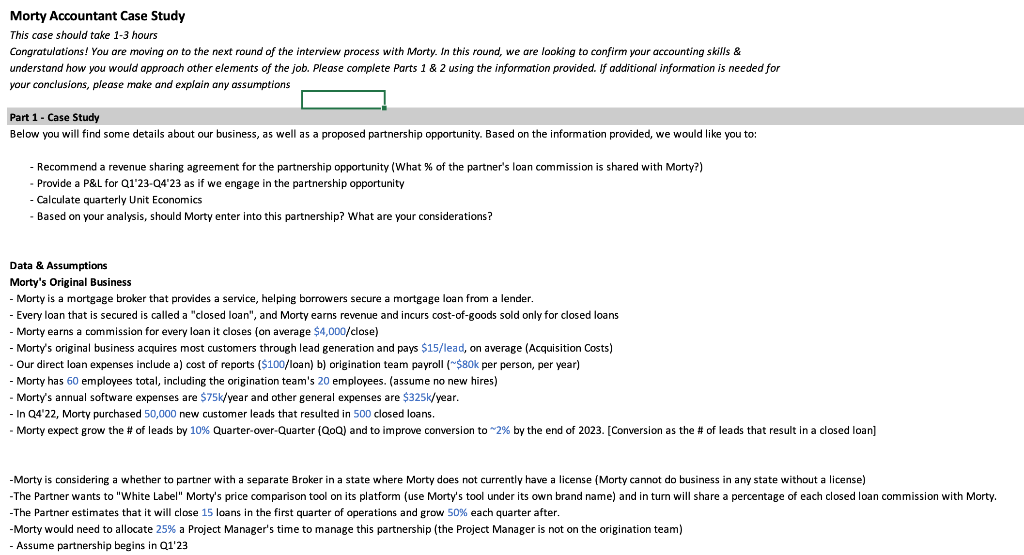

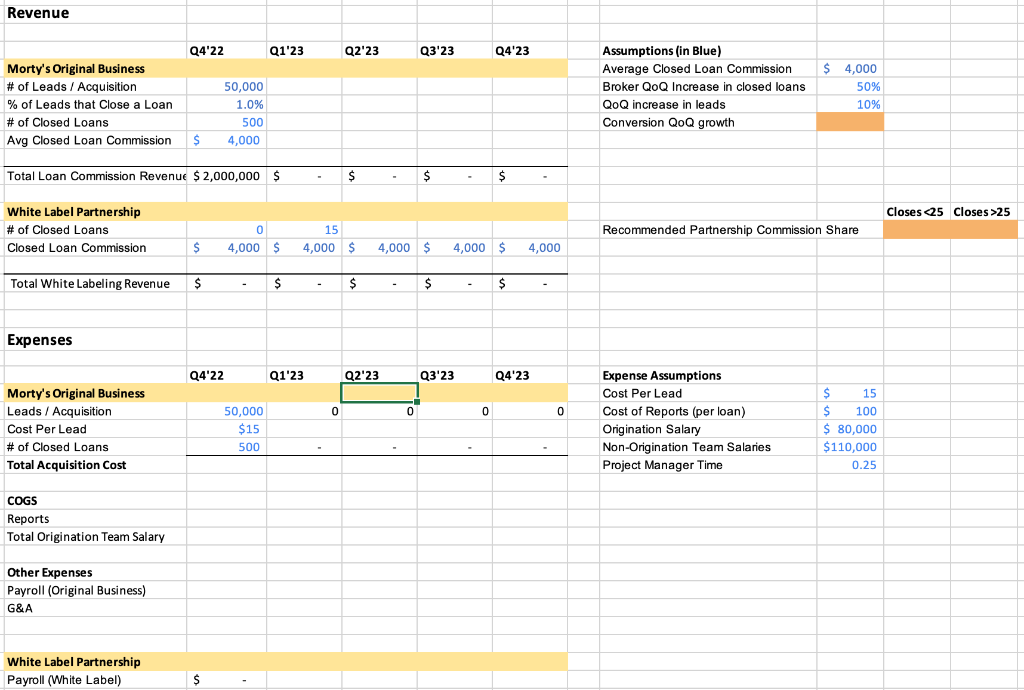

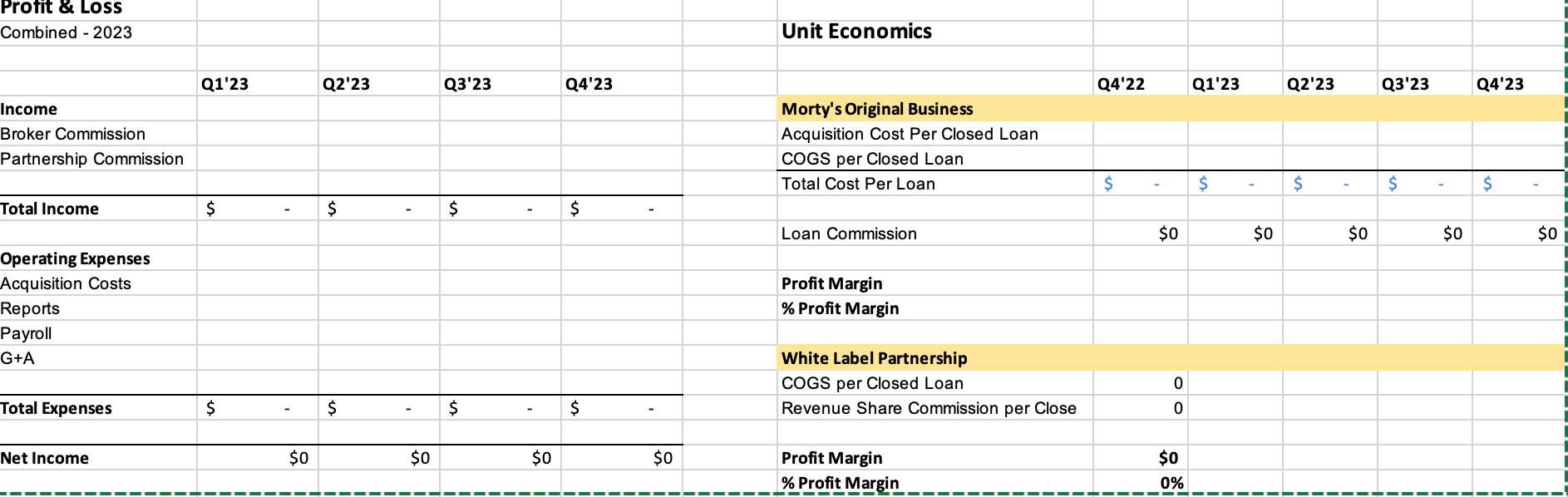

Morty Accountant Case Study This case should take 1-3 hours Congratulations! You are moving on to the next round of the interview process with Morty. In this round, we are looking to confirm your accounting skills & understand how you would approach other elements of the job. Please complete Parts 1 & 2 using the information provided. If additional information is needed for your conclusions, please make and explain any assumptions Part 1 Case Study Below you will find some details about our business, as well as a proposed partnership opportunity. Based on the information provided, we would like you to: - Recommend a revenue sharing agreement for the partnership opportunity (What % of the partner's loan commission is shared with Morty?) - Provide a P&L for Q1'23-Q4'23 as if we engage in the partnership opportunity Calculate quarterly Unit Economics Based on your analysis, should Morty enter into this partnership? What are your considerations? Data & Assumptions Morty's Original Business Morty is a mortgage broker that provides a service, helping borrowers secure a mortgage loan from a lender. Every loan that is secured is called a "closed loan", and Morty earns revenue and incurs cost-of-goods sold only for closed loans Morty earns a commission for every loan it closes (on average $4,000/close) - Morty's original business acquires most customers through lead generation and pays $15/lead, on average (Acquisition Costs) Our direct loan expenses include a) cost of reports ($100/loan) origination team payroll (~$80k per person, per year) - Morty has 60 employees total, including the origination team's 20 employees. (assume no new hires) - Morty's annual software expenses are $75k/year and other general expenses are $325k/year. - In Q4'22, Morty purchased 50,000 new customer leads that resulted in 500 closed loans. - Morty expect grow the # of leads by 10% Quarter-over-Quarter (QoQ) and to improve conversion to ~2% by the end of 2023. [Conversion as the # of leads that result in a closed loan] -Morty is considering a whether to partner with a separate Broker in a state where Morty does not currently have a license (Morty cannot do business in any state without a license) -The Partner wants to "White Label" Morty's price comparison tool on its platform (use Morty's tool under its own brand name) and in turn will share a percentage of each closed loan commission with Morty. -The Partner estimates that it will close 15 loans the first quarter of operations and grow 50% each quarter after. -Morty would need to allocate 25% a Project Manager's time to manage this partnership (the Project Manager is not on the origination team) - Assume partnership begins in Q1'23 Revenue Q3'23 Q4'23 Morty's Original Business # of Leads / Acquisition 50,000 % of Leads that Close a Loan 1.0% # of Closed Loans 500 Avg Closed Loan Commission $ 4,000 Total Loan Commission Revenue $ 2,000,000 $ $ $ White Label Partnership # of Closed Loans 0 15 Closed Loan Commission $ 4,000 $ 4,000 $ 4,000 $ 4,000 $ Total White Labeling Revenue - $ - $ $ $ Expenses Q1'23 Q2'23 Q3'23 Q4'23 Morty's Original Business Leads / Acquisition Cost Per Lead # of Closed Loans Total Acquisition Cost COGS Reports Total Origination Team Salary Other Expenses Payroll (Original Business) G&A White Label Partnership Payroll (White Label) Q4'22 $ Q4'22 $ 50,000 $15 500 Q1'23 . - 0 Q2'23 $ 0 0 4,000 0 Assumptions (in Blue) Average Closed Loan Commission Broker QoQ Increase in closed loans QoQ increase in leads Conversion QoQ growth Recommended Partnership Commission Share Expense Assumptions Cost Per Lead $ 15 Cost of Reports (per loan) $ Origination Salary Non-Origination Team Salaries Project Manager Time 100 $ 80,000 $110,000 0.25 $ 4,000 50% 10% Closes 25 Profit & Loss Combined - 2023 Income Broker Commission Partnership Commission Total Income Operating Expenses Acquisition Costs Reports Payroll G+A Total Expenses Net Income Q1'23 $ $ $0 Q2'23 $ $ $0 Q3'23 $ $ $0 Q4'23 $ $ $0 Unit Economics Morty's Original Business Acquisition Cost Per Closed Loan COGS per Closed Loan Total Cost Per Loan Loan Commission Profit Margin % Profit Margin White Label Partnership COGS per Closed Loan Revenue Share Commission per Close Profit Margin % Profit Margin Q4'22 $ $0 0 0 $0 0% Q1'23 $ $0 Q2'23 $ $0 Q3'23 $ $0 Q4'23 $ $0 Morty Accountant Case Study This case should take 1-3 hours Congratulations! You are moving on to the next round of the interview process with Morty. In this round, we are looking to confirm your accounting skills & understand how you would approach other elements of the job. Please complete Parts 1 & 2 using the information provided. If additional information is needed for your conclusions, please make and explain any assumptions Part 1 Case Study Below you will find some details about our business, as well as a proposed partnership opportunity. Based on the information provided, we would like you to: - Recommend a revenue sharing agreement for the partnership opportunity (What % of the partner's loan commission is shared with Morty?) - Provide a P&L for Q1'23-Q4'23 as if we engage in the partnership opportunity Calculate quarterly Unit Economics Based on your analysis, should Morty enter into this partnership? What are your considerations? Data & Assumptions Morty's Original Business Morty is a mortgage broker that provides a service, helping borrowers secure a mortgage loan from a lender. Every loan that is secured is called a "closed loan", and Morty earns revenue and incurs cost-of-goods sold only for closed loans Morty earns a commission for every loan it closes (on average $4,000/close) - Morty's original business acquires most customers through lead generation and pays $15/lead, on average (Acquisition Costs) Our direct loan expenses include a) cost of reports ($100/loan) origination team payroll (~$80k per person, per year) - Morty has 60 employees total, including the origination team's 20 employees. (assume no new hires) - Morty's annual software expenses are $75k/year and other general expenses are $325k/year. - In Q4'22, Morty purchased 50,000 new customer leads that resulted in 500 closed loans. - Morty expect grow the # of leads by 10% Quarter-over-Quarter (QoQ) and to improve conversion to ~2% by the end of 2023. [Conversion as the # of leads that result in a closed loan] -Morty is considering a whether to partner with a separate Broker in a state where Morty does not currently have a license (Morty cannot do business in any state without a license) -The Partner wants to "White Label" Morty's price comparison tool on its platform (use Morty's tool under its own brand name) and in turn will share a percentage of each closed loan commission with Morty. -The Partner estimates that it will close 15 loans the first quarter of operations and grow 50% each quarter after. -Morty would need to allocate 25% a Project Manager's time to manage this partnership (the Project Manager is not on the origination team) - Assume partnership begins in Q1'23 Revenue Q3'23 Q4'23 Morty's Original Business # of Leads / Acquisition 50,000 % of Leads that Close a Loan 1.0% # of Closed Loans 500 Avg Closed Loan Commission $ 4,000 Total Loan Commission Revenue $ 2,000,000 $ $ $ White Label Partnership # of Closed Loans 0 15 Closed Loan Commission $ 4,000 $ 4,000 $ 4,000 $ 4,000 $ Total White Labeling Revenue - $ - $ $ $ Expenses Q1'23 Q2'23 Q3'23 Q4'23 Morty's Original Business Leads / Acquisition Cost Per Lead # of Closed Loans Total Acquisition Cost COGS Reports Total Origination Team Salary Other Expenses Payroll (Original Business) G&A White Label Partnership Payroll (White Label) Q4'22 $ Q4'22 $ 50,000 $15 500 Q1'23 . - 0 Q2'23 $ 0 0 4,000 0 Assumptions (in Blue) Average Closed Loan Commission Broker QoQ Increase in closed loans QoQ increase in leads Conversion QoQ growth Recommended Partnership Commission Share Expense Assumptions Cost Per Lead $ 15 Cost of Reports (per loan) $ Origination Salary Non-Origination Team Salaries Project Manager Time 100 $ 80,000 $110,000 0.25 $ 4,000 50% 10% Closes 25 Profit & Loss Combined - 2023 Income Broker Commission Partnership Commission Total Income Operating Expenses Acquisition Costs Reports Payroll G+A Total Expenses Net Income Q1'23 $ $ $0 Q2'23 $ $ $0 Q3'23 $ $ $0 Q4'23 $ $ $0 Unit Economics Morty's Original Business Acquisition Cost Per Closed Loan COGS per Closed Loan Total Cost Per Loan Loan Commission Profit Margin % Profit Margin White Label Partnership COGS per Closed Loan Revenue Share Commission per Close Profit Margin % Profit Margin Q4'22 $ $0 0 0 $0 0% Q1'23 $ $0 Q2'23 $ $0 Q3'23 $ $0 Q4'23 $ $0