Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Most daily newspapers include mutual fund quotes in the financial section, but not all mutual funds are listed every day. Listings for open-end mutual

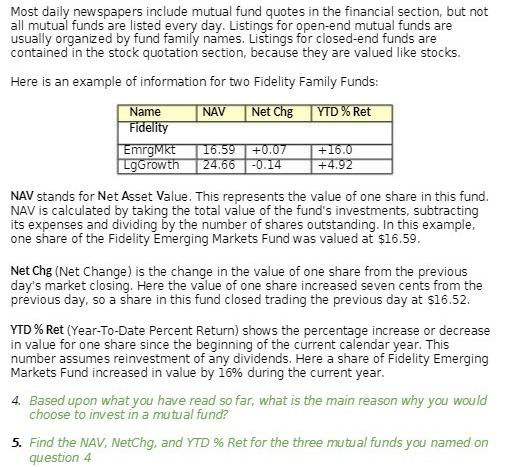

Most daily newspapers include mutual fund quotes in the financial section, but not all mutual funds are listed every day. Listings for open-end mutual funds are usually organized by fund family names. Listings for closed-end funds are contained in the stock quotation section, because they are valued like stocks. Here is an example of information for two Fidelity Family Funds: NAV Net Chg YTD % Ret Name Fidelity EmrgMkt 16.59 +0.07 LgGrowth 24.66 -0.14 +16.0 +4.92 NAV stands for Net Asset Value. This represents the value of one share in this fund. NAV is calculated by taking the total value of the fund's investments, subtracting its expenses and dividing by the number of shares outstanding. In this example, one share of the Fidelity Emerging Markets Fund was valued at $16.59. Net Chg (Net Change) is the change in the value of one share from the previous day's market closing. Here the value of one share increased seven cents from the previous day, so a share in this fund closed trading the previous day at $16.52. YTD % Ret (Year-To-Date Percent Return) shows the percentage increase or decrease in value for one share since the beginning of the current calendar year. This number assumes reinvestment of any dividends. Here a share of Fidelity Emerging Markets Fund increased in value by 16% during the current year. 4. Based upon what you have read so far, what is the main reason why you would choose to invest in a mutual fund? 5. Find the NAV, NetChg, and YTD % Ret for the three mutual funds you named on question 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 4 The main reason one might choose to invest in a mutual fund ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started