Answered step by step

Verified Expert Solution

Question

1 Approved Answer

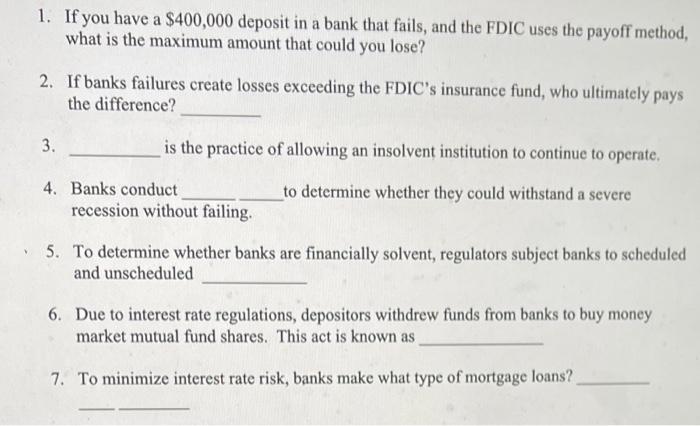

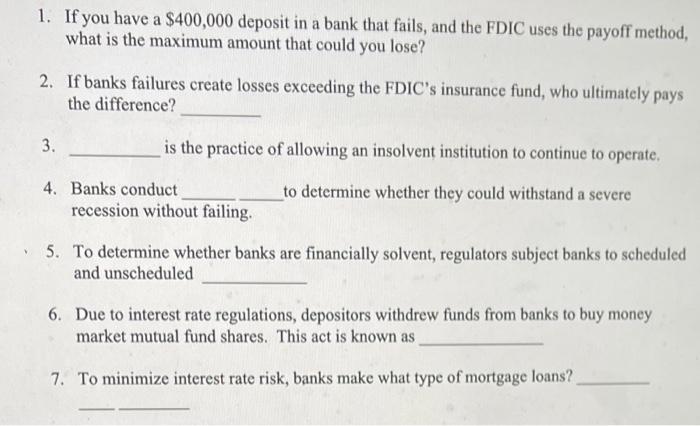

mostly just need help with 1, 6 and 7! 1. If you have a $400,000 deposit in a bank that fails, and the FDIC uses

mostly just need help with 1, 6 and 7!

1. If you have a $400,000 deposit in a bank that fails, and the FDIC uses the payoff method, what is the maximum amount that could you lose? 2. If banks failures create losses exceeding the FDIC's insurance fund, who ultimately pays the difference? 3. is the practice of allowing an insolvent institution to continue to operate. 4. Banks conduct to determine whether they could withstand a severe recession without failing. 5. To determine whether banks are financially solvent, regulators subject banks to scheduled and unscheduled 6. Due to interest rate regulations, depositors withdrew funds from banks to buy money market mutual fund shares. This act is known as 7. To minimize interest rate risk, banks make what type of mortgage loans

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started