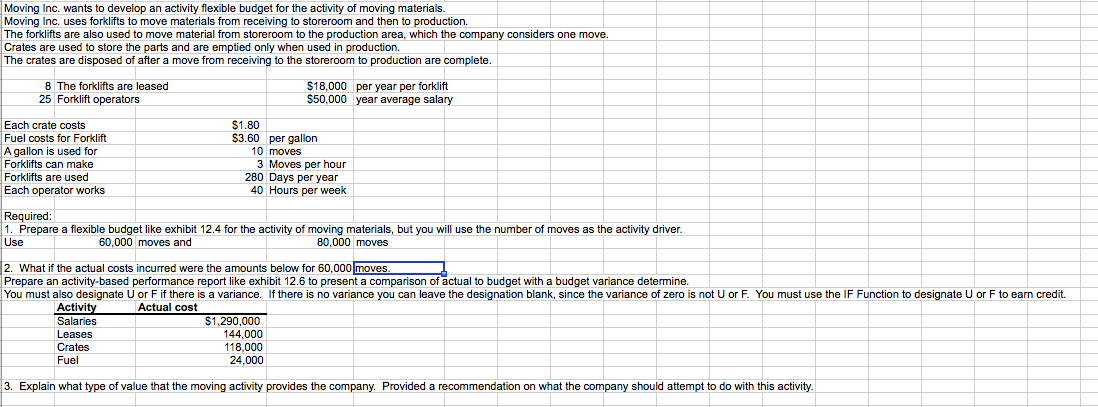

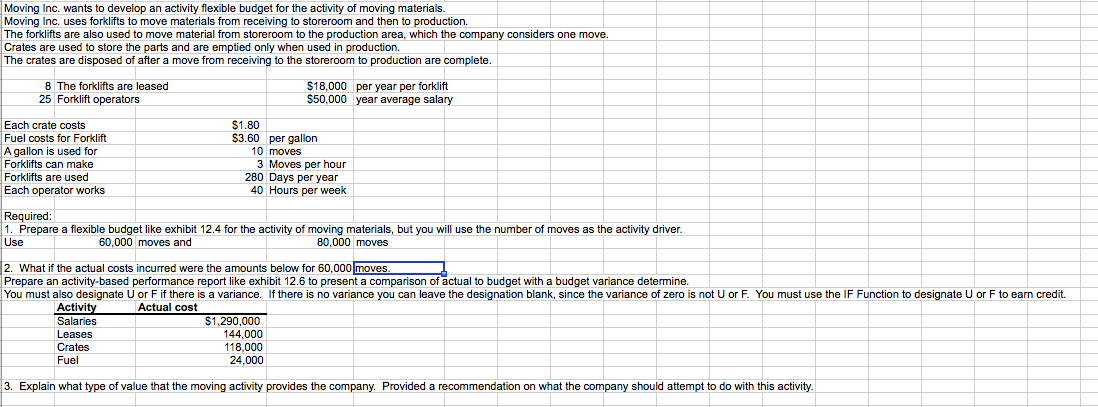

Moving Inc. wants to develop an activity flexible budget for the activity of moving materials. Moving Inc, uses forklifts to move materials from receiving to storeroom and then to production. The forklifts are also used to move material from storeroom to the production area, which the company considers one move. Crates are used to store the parts and are emptied only when used in production. The crates are disposed of after a move from receiving to the storeroom to production are complete. 8 The forklifts are leased 25 Forklift operators $18,000 per year per forklift $50,000 year average salary Each crate costs Fuel costs for Forklift Agallon is used for Forklifts can make Forklifts are used Each operator works $1.80 $3.60 per gallon 10 moves 3 Moves per hour 280 Days per year 40 Hours per week Required: 1. Prepare a flexible budget like exhibit 12.4 for the activity of moving materials, but you will use the number of moves as the activity driver. Use 60,000 moves and 80,000 moves 2. What if the actual costs incurred were the amounts below for 60,000 moves. Prepare an activity-based performance report like exhibit 12.6 to present a comparison of actual to budget with a budget variance determine. You must also designate U or F if there is a variance. If there is no variance you can leave the designation blank, since the variance of zero is not U or F. You must use the IF Function to designate U or F to earn credit. Activity Actual cost Salaries $1.290,000 Leases 144,000 Crates 118,000 Fuel 24,000 3. Explain what type of value that the moving activity provides the company. Provided a recommendation on what the company should attempt to do with this activity. Moving Inc. wants to develop an activity flexible budget for the activity of moving materials. Moving Inc, uses forklifts to move materials from receiving to storeroom and then to production. The forklifts are also used to move material from storeroom to the production area, which the company considers one move. Crates are used to store the parts and are emptied only when used in production. The crates are disposed of after a move from receiving to the storeroom to production are complete. 8 The forklifts are leased 25 Forklift operators $18,000 per year per forklift $50,000 year average salary Each crate costs Fuel costs for Forklift Agallon is used for Forklifts can make Forklifts are used Each operator works $1.80 $3.60 per gallon 10 moves 3 Moves per hour 280 Days per year 40 Hours per week Required: 1. Prepare a flexible budget like exhibit 12.4 for the activity of moving materials, but you will use the number of moves as the activity driver. Use 60,000 moves and 80,000 moves 2. What if the actual costs incurred were the amounts below for 60,000 moves. Prepare an activity-based performance report like exhibit 12.6 to present a comparison of actual to budget with a budget variance determine. You must also designate U or F if there is a variance. If there is no variance you can leave the designation blank, since the variance of zero is not U or F. You must use the IF Function to designate U or F to earn credit. Activity Actual cost Salaries $1.290,000 Leases 144,000 Crates 118,000 Fuel 24,000 3. Explain what type of value that the moving activity provides the company. Provided a recommendation on what the company should attempt to do with this activity