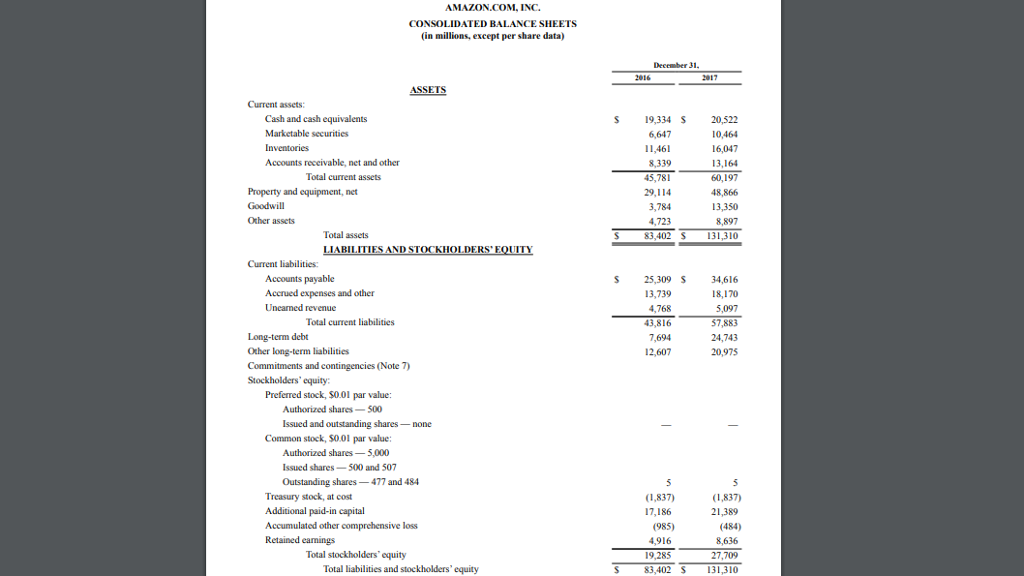

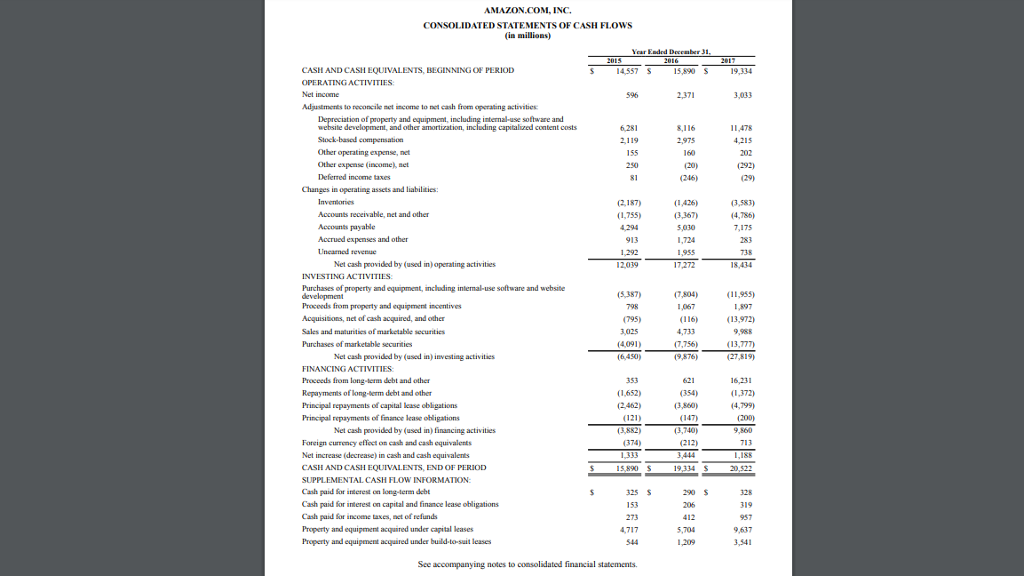

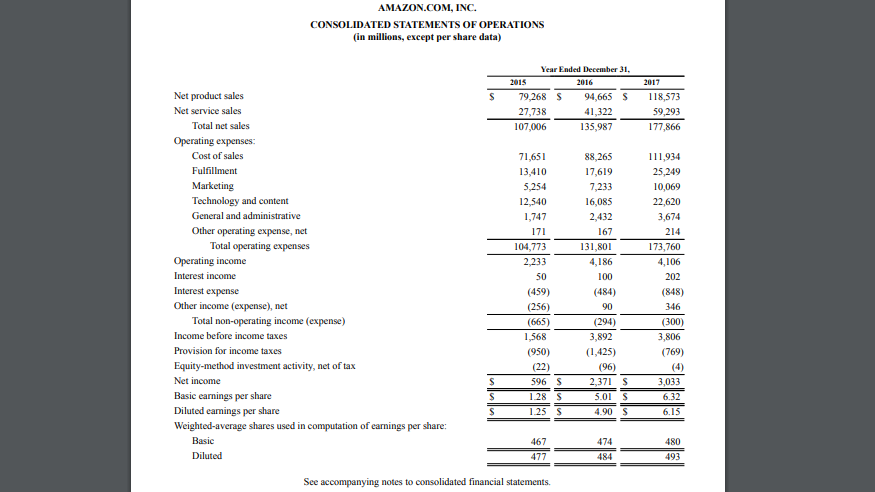

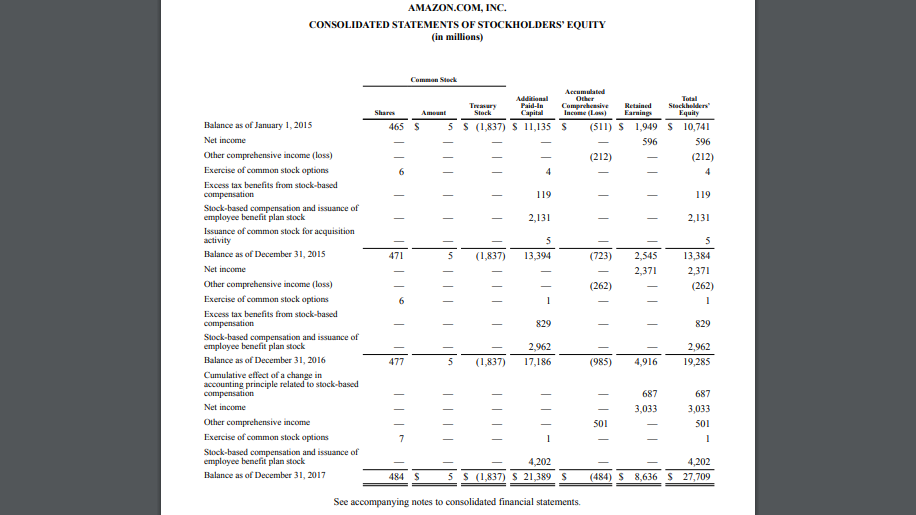

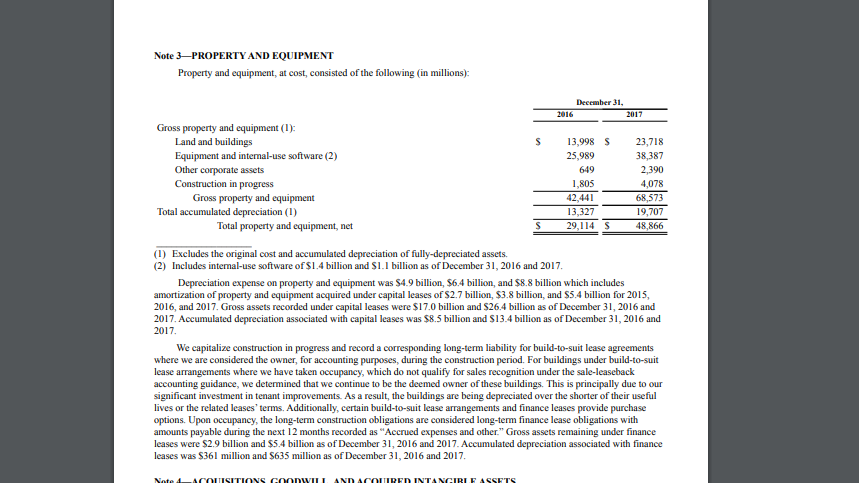

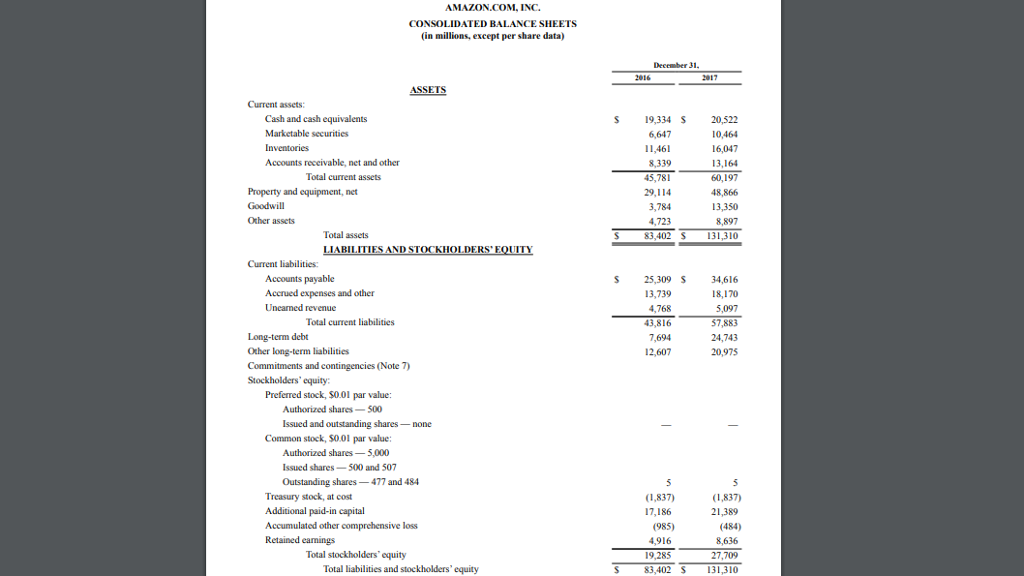

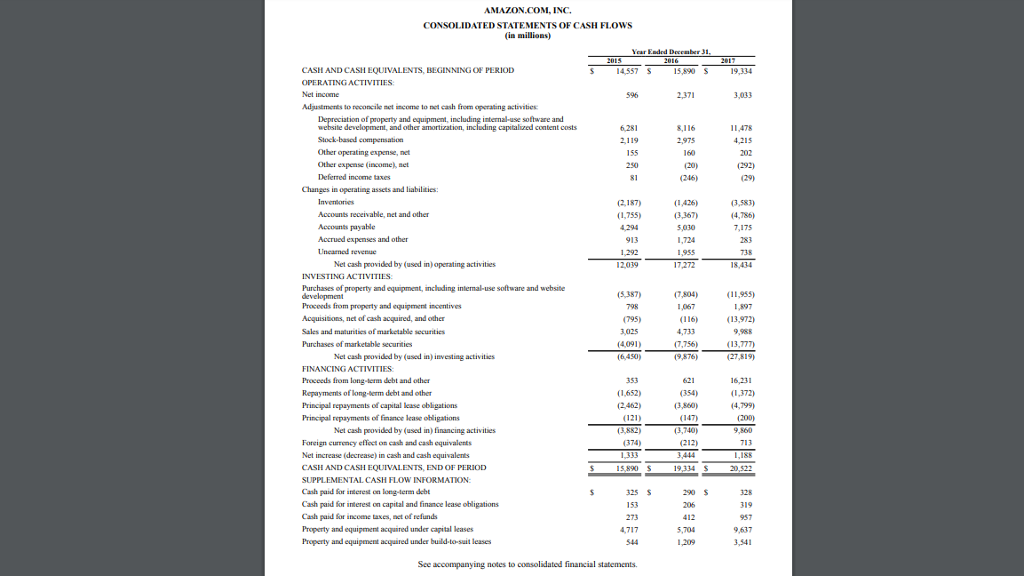

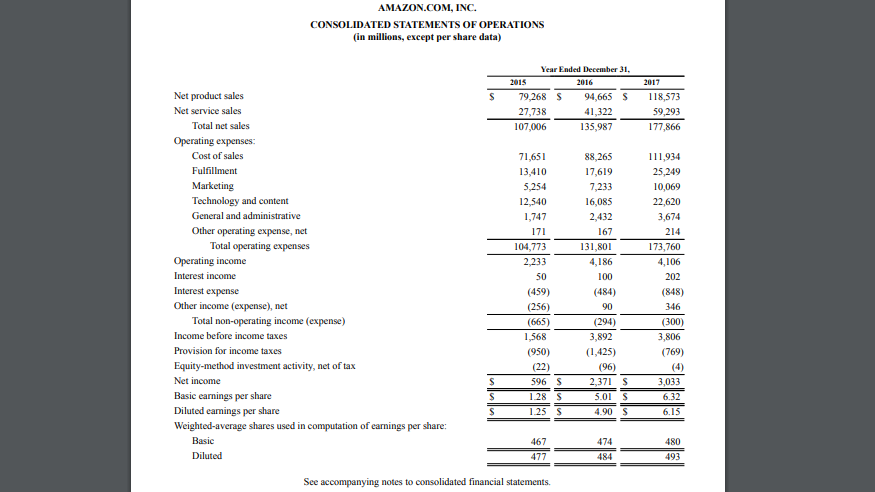

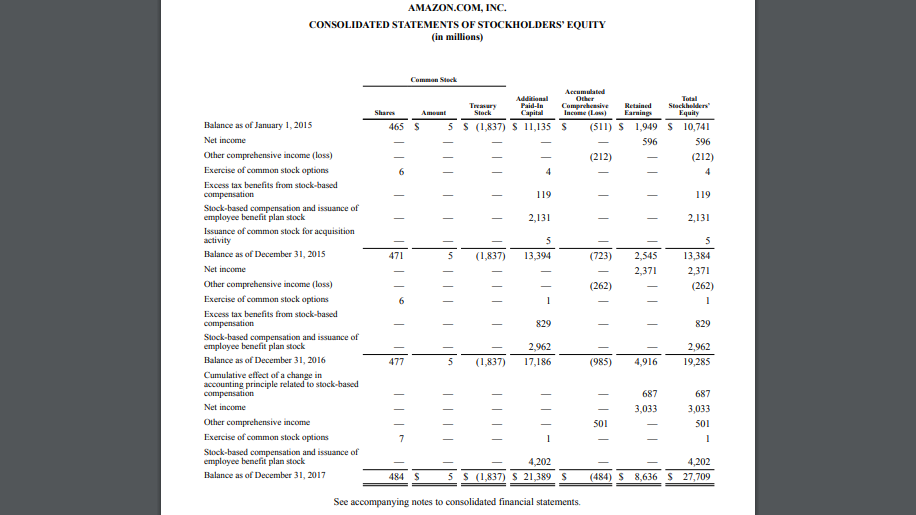

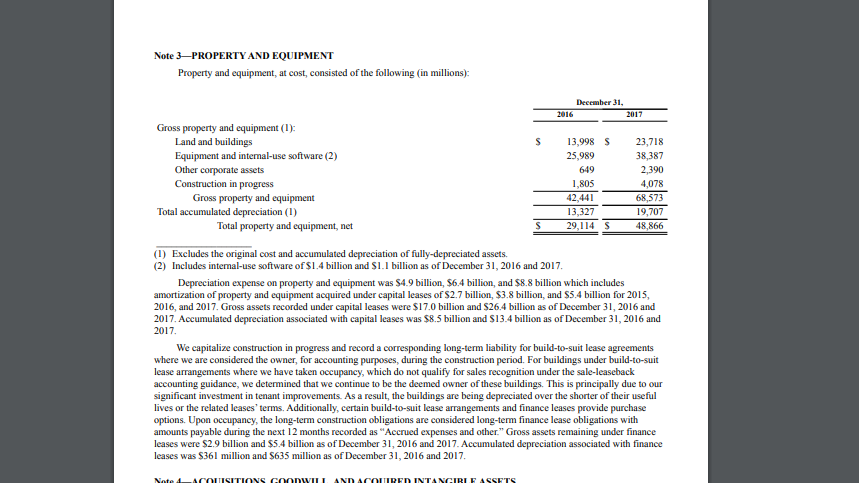

> Moving to another question will save this response. Question 16 The amount of cash dividends declared by Amazon's during the most recent reporting period was $0. True False > Moving to another question will save this response. > Moving to another question will save this response. Question 17 Did Amazon pay cash to repurchase any of its common stock shares during the most recent reporting period? a. Yes b. No Moving to another question will save this response. Question 18 Which of Amazon's financial statements is not accrual-based? a. Income statement O b. Balance sheet c. Statement of comprehensive income O d. Statement of cash flows Moving to another question will save this response. Question 19 For the most recent reporting period, Amazon's largest source of cash was from: o a. Investing activities b. Operating activities Oc. Financing activities Moving to another question will save this response. AMAZON.COM, INC. CONSOLIDATED BALANCE SHEETS (in millions, except per share data) December 31. 2016 ASSETS Current assets: Cash and cash equivalents Marketable securitics Inventories Accounts receivable, net and other 19,334 S 20,522 6,647 11,461 8,339 16,047 13,164 45,78160,197 48,866 13,350 8,897 S83,402 31,310 Total current assets Property and equipment, net Goodwill Other assets 29,114 3,784 4,723 Total assets ABI AND STOCK HOLDERS Current liabilities: Accounts payable Accrued expenses and other Uneamed revenue 25,309 34,616 18,170 13,739 4,768 5,09 Total current liabilities 43,81657,883 Long-term debt Other long-term liabilities Commitments and contingencies (Note 7) Stockholders' equity 7,694 12,607 20,975 Preferred stock, $0.01 par value: Authorized shares-500 Issued and outstanding shares-none Common stock, $0.01 par value: Authorized shares-5000 Issued shares500 and 507 Outstanding shares-477 and 484 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive loss Retained eamings 1,837) 17,186 (1,837) 21,389 (484) 8,636 27,709 (985) 4,916 Total stockholders equity 19.285 Total liabilities and stockholders' equity S 83,402S S 83,402 131,310 AMAZON COM, INC CONSOLIDATED STATEMENTS OF CASH FLOWs in millioas) Year Ended Deceaber CASH AND CASH EQUIVALENTS BEGINNING OF PERIOD OPERATINGACTIVITIES Net income Adjustments to reconcile net income to net cash from operating activiies 2371 Depreciation of property and equipment, website development, and other amortization, internal-use software and capitalized content costs 6.281 2119 155 8,116 2,975 11,478 4,215 202 (292) Other operating expense, net Other expense (income), net Deferred income taxes (20) Changes in operating assets and liabilaties 2,187) (1,755) (1,426) (3,367) 3,583) (4,786) 7,175 283 738 18,434 Accounts receivable, net and other Accounts payable 913 1,724 1,955 7,272 expenses and other Uncarnod revenue Net cash peovided by (used in) operating activities INVESTING ACTIVITIES Purchases of property and equipment, including intermal-use software and website Proceeds from property and equigment incentives Acquisitions, net of cash acquired, and other Sales and maturities of marketable secunities Purchases of marketable securities 795 3,025 (4091) (6450) (7,804) 1,067 (116) 4,733 7,756) (9,876) (11,955) 1,897 (13,972) ,988 13,777 27,819) Net cash peovided by (used in) investing activities FINANCING ACTIVITIES Proceeds from long-term debt and other Repayments of kong-erm debt and other Principal repayments of capital lease obligations Principal repayments of Einance lease obligations 353 16,231 1,372) (4,799) (1,652 (354) 147 (3,740 Net cash provided by( used in) financing activities 713 Foreign currency effect on eash and cash equivalents Net increase (decrease) in cash and cash equivalents CASH AND CASH EQUIVALENTS, END OF PERIOD SUPPLEMENTAL CASH FLOW INFORMATION Cash paid Sor interest on long-term deb Cash paid Sor interest on capital and finance lease obligations Cash paid Sor income taxes, net of refunds Property and equipment acquired under cagital leases Property and equipement acquired under build-to-suit leases 1,333 3.444 890 S 325 S 153 319 9,637 ,541 5,704 See accompanying notes to consolidated financial statements. AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in millions, except per share data) Year Ended December 31 79,268 94,665 S 118,573 Net service sales Total net sales 177,866 Operating expenses: Cost of sales Fulfillment Marketing Technology and content General and administrative Other operating expense, net 13,410 17,619 10,069 Total operating expenses 131,801 Operating income 4,106 (484) Interest expense Other income (expense), net 459) 346 Total non-operating income (expense) (950) ,425) Equity-method investment activity, net of tax Net income Basic earnings per shane Diluted eamings per share Weighted-average shares used in computation of carnings per share: 13% s 125 S 467 Diluted See accompanying notes to consolidated financial statements. AMAZON.COM, INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (in millions) Capital Incume (LasEarning Balance as of January 1,2015 Net income 465 S 5 S (1,837) S11,135 (511) 1,949 10,741 Other comprehensive income (loss) Exercise of common stock options Excess tax benefits from stock-based (212) (212) 119 Stock-based compensation emplayee benefit plan stock Issuance of common stock for -2,131 acquisition Balance as of December 31, 2015 Net income Other comprehensive income (loss) Exercise of common stock options Excess tax benefits from stock-based 471 5 (1,837) 13,394 (723) 2,545 13,384 2,371 (262) Stock-based compensation emplayee benefit plan stock Balance as of December 31, 2016 Cumulative effect of a change in accounting principle related to stock-based 2,962 5 (1,837) 17,186 2,962 477 (985 4,916 19285 687 3,033 501 Net income -3,033 501 Other comprehensive income Exercise of common stock options Stock-based compensation emplayee benefit plan stock Balance as of December 31, 2017 and issuance of 4,202 484 S 5 S (1,837) S 21,389 S (484) S 8,636 S 27,709 See accompanying notes to consolidated financial statements. Note 3-PROPERTYAND EQUIPMENT Property and equipment, at cost, consisted of the following in millions): December 31 Gross property and equipment (1): Land and buildings Equipment and intemal-use software (2) Other corporate assets Construction in progress S 13,998 S23,718 38,387 2,390 4,078 68,573 13.327 19,707 48,866 25,989 649 1,805 42,441 Gross property and equipment Total accumulated depreciation (1) Total property and equipment, net 29,114 S (1) Excludes the original cost and accumulated depreciation of fully-depreciated assets. (2) Includes internal-use software of $1.4 billion and $1.1 billion as of December 31, 2016 and 2017 Depreciation expense on property and equipment was $4.9 billion, $6.4 billion, and $8.8 billion which includes amortization of property and equipment acquired under capital leases of $2.7 billion, $3.8 blion, and S5.4 billion for 2015, 2016, and 2017. Gross assets recorded under capital leases were $17.0 billion and $26.4 billion as of December 31, 2016 and 2017. Accumulated depreciation associated with capital leases was $8.5 billion and S13.4 billion as of December 31, 2016 and 2017 We capitalize construction in progress and record a corresponding long-term liability for build-to-suit lease agreements where we are considered the owner, for accounting purposes, during the construction period. For buildings under build-to-suit lease arrangements where we have taken occupancy, which do not qualify for sales recognition under the sale-leaseback accounting guidance, we determined that we continue to be the deemed owner of these buildings. This is principally due to our significant investment in tenant improvements. As a result, the buildings are being depreciated over the shorter of their useful lives or the related leases' terms. Additionally, certain build-to-suit lease arrangements and finance leases provide purchase options. Upon occupancy, the long-term construction obligations are considered long-term finance lease obligations with amounts payable during the next 12 months recorded as "Accrued expenses and other." Gross assets remaining under finance leases were $2.9 billion and $5.4 billion as of December 31, 2016 and 2017. Accumulated depreciation associated with finance leases was $361 million and $635 million as of December 31, 2016 and 2017