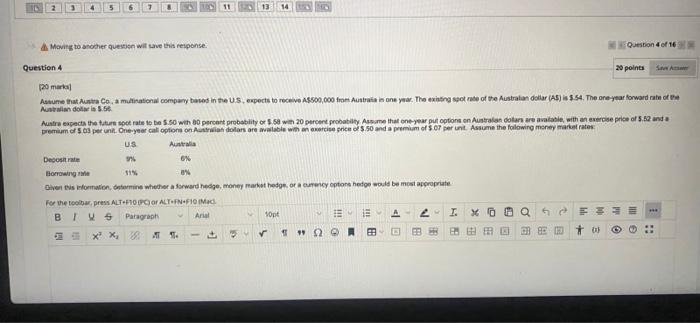

Moving to another question will save this response. Question 4 of 16 20 points Save As [20 marks] Assume that Austra Co, a multinational company based in the US, expects to receive A$500,000 from Australia in one year. The existing spot rate of the Australian dollar (AS) is $.54. The one-year forward rate of the Australian dollar in 5.56 Austra expects the future spot rate to be 5.50 with 80 percent probability or 5.58 with 20 percent probability Assume that one-year put options on Australian dollars are available, with an exercise price of 5.52 and a premium of 5.03 per unit. One-year call options on Australian dollars are available with an exercise price of $.50 and a premium of $.07 per unit. Assume the following money market rates Australia U.S. 97% 6% Deposit rate Borrowing rate 8% Given this information, determine whether a forward hedge, money market hedge, or a curency options hedge would be most appropriate For the toolbar, press ALT+F10 (PC) or ALT-FN-F10 (Mad IVS B Paragraph Arial 10pt M EE 20 I. XQ xx. "S2 89 B Question 4 4 11 381 bh F M 00 Moving to another question will save this response. Question 4 of 16 20 points Save As [20 marks] Assume that Austra Co, a multinational company based in the US, expects to receive A$500,000 from Australia in one year. The existing spot rate of the Australian dollar (AS) is $.54. The one-year forward rate of the Australian dollar in 5.56 Austra expects the future spot rate to be 5.50 with 80 percent probability or 5.58 with 20 percent probability Assume that one-year put options on Australian dollars are available, with an exercise price of 5.52 and a premium of 5.03 per unit. One-year call options on Australian dollars are available with an exercise price of $.50 and a premium of $.07 per unit. Assume the following money market rates Australia U.S. 97% 6% Deposit rate Borrowing rate 8% Given this information, determine whether a forward hedge, money market hedge, or a curency options hedge would be most appropriate For the toolbar, press ALT+F10 (PC) or ALT-FN-F10 (Mad IVS B Paragraph Arial 10pt M EE 20 I. XQ xx. "S2 89 B Question 4 4 11 381 bh F M 00