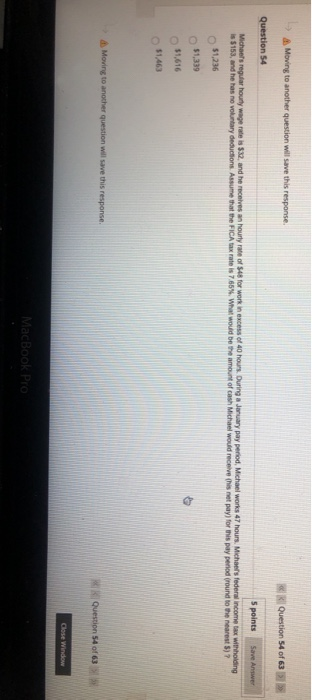

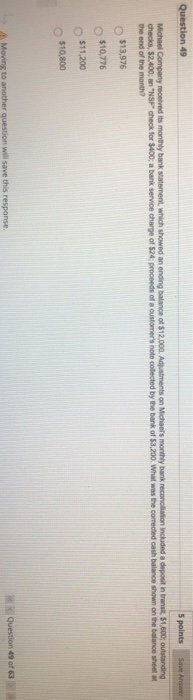

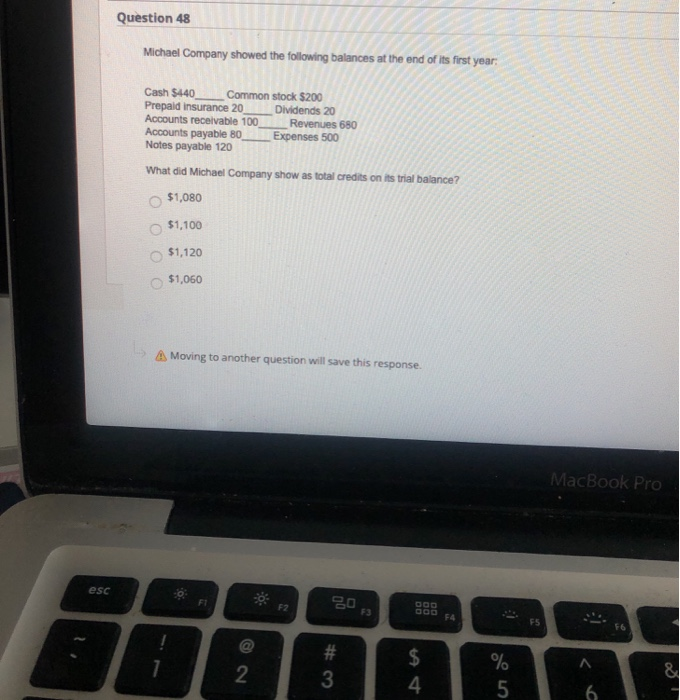

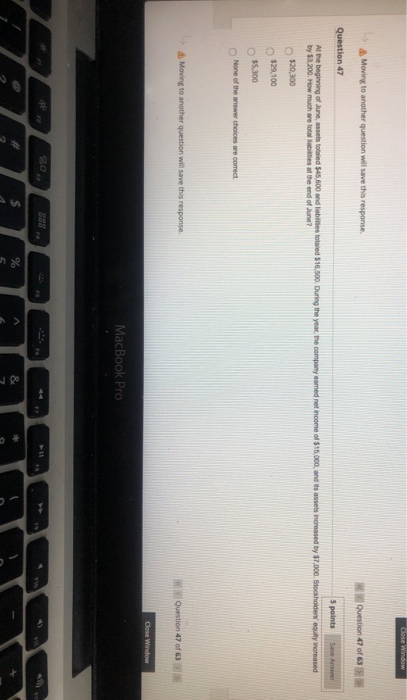

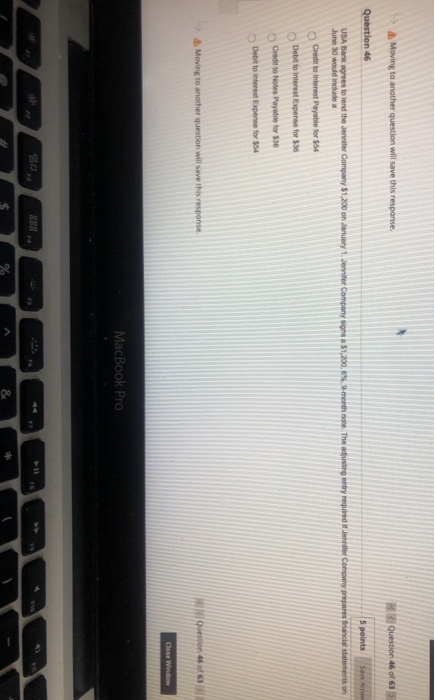

Moving to another question will save this response. Question 54 of 63 Question 54 5 points Save Answer Michael's regular hourly wage rate is $32, and he receives an hourly rate of 548 for work in excess of 40 hours. During a January pay period, Michael works 47 hours. Michaels federal income tax withholding is $153, and he has no voluntary deductions. Assume that the FICA tax rate is 760%. What would be the amount of cash Michael would receive this not pay for this pay period ground to the nearest 3)? $1,236 $1,339 51.463 Moving to another question will save this response Question 54 of 63 Close Window MacBook Pro Question 49 5 points Save Answer Michael Company received its monthly bank statement, which showed an ending balance of $12.000. Adjustments on Michael's monthly bank reconciliation included a deposit intrant 51.600; outstanding checks, $2.400; an NSP check for $400, a bank service charge of $24 proceeds of a customer's note collected by the bank of $3,200. What was the corrected cash balance shown on the balance sheet the end of the month? $13.976 $10,776 $11,200 $10,800 Moving to another question will save this response Question 49 of 3 Question 48 Michael Company showed the following balances at the end of its first year Cash $440 Common stock $200 Prepaid insurance 20 Dividends 20 Accounts receivable 100 Revenues 680 Accounts payable 80 Expenses 500 Notes payable 120 What did Michael Company show as total credits on its trial balance? $1,080 $1,100 $1,120 $1,060 Moving to another question will save this response. MacBook Pro esc FI F2 30 F3 F4 2 # 3 $ 4 % 5 6. 5 WOW Moving to another question will save this response. Question 47 of Question 47 5 points Save Answer At the beginning of June, sed $45.600 and liabilities totaled 516,500. During the year, the company named net income of $15.000, and its assets increased by $7.000 Stockholders guity increased by $3,200. How much are to be at the end of June? $20,300 $29.100 55,300 None of the answer choices are correct Moving to another question will save this response Question 47 of 63 Close Window MacBook Pro 80 $ % & Moving to another question will save this response. Question 46 of 63 Question 46 5 points Save A USA Bank agrees to lend the Jennifer Company $1,200 on January 1, Jennifer Company signs a 1,200,6% 9 monthne. The adusing entry required It Jennifer Company prepares financial statements on June 30 would include a Credit to interest Payable for $54 Debit to interest Expense for $36 Credit to Notes Payable for $36 Debit to interest Expense for $54 Moving to another question will save this response Question 46 of 6 Cose Window MacBook Pro SO 888 % A &