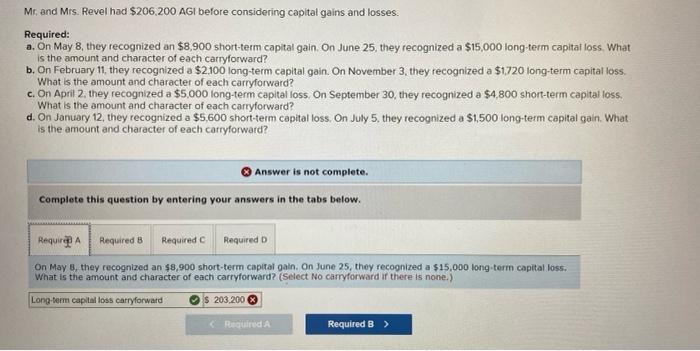

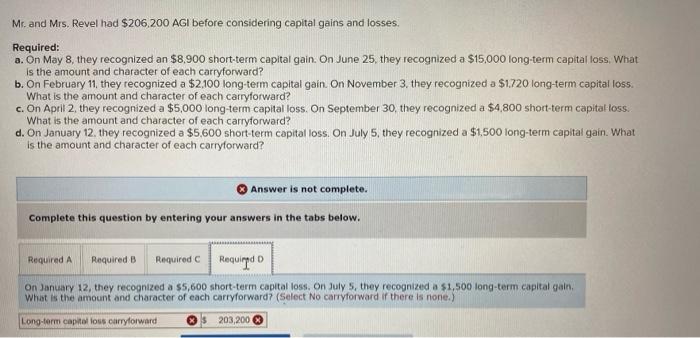

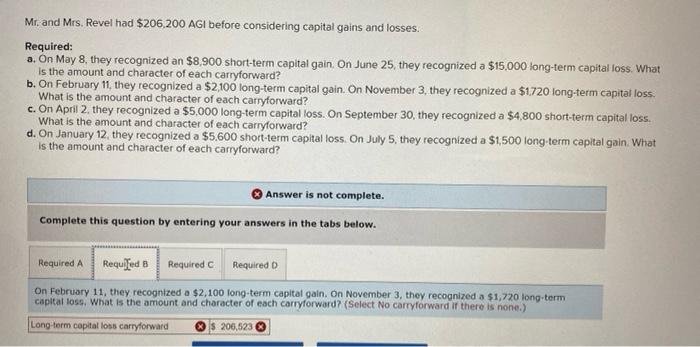

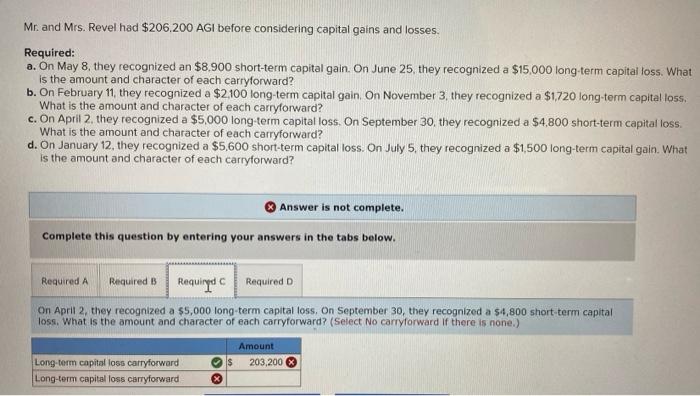

Mr and Mrs. Revel had $206,200 AGI before considering capital gains and losses. Required: a. On May 8, they recognized an $8,900 short-term capital gain. On June 25, they recognized a $15,000 long-term capitat loss What is the amount and character of each carryforward? b. On February 11, they recognized a $2.100 long-term capital gain. On November 3, they recognized a $1720 long-term capital loss What is the amount and character of each carryforward? c. On April 2. they recognized a $5,000 long-term capital loss. On September 30, they recognized a $4,800 short-term capital loss. What is the amount and character of each carryforward? d. On January 12, they recognized a $5,600 short-term capital loss. On July 5, they recognized a $1.500 long-term capital gain. What is the amount and character of each carryforward? Answer is not complete. Complete this question by entering your answers in the tabs below. Required Required B Required Required D On May 8, they recognized an $8,900 short-term capital gain. On June 25, they recognized a $15,000 long term capital loss. What is the amount and character of each carryforward? (Select No carryforward if there is none.) Long-term capital loss carryforward $ 203.2003 Red A Required B > Mr. and Mrs. Revel had $206,200 AGI before considering capital gains and losses. Required: a. On May 8, they recognized an $8,900 short-term capital gain. On June 25, they recognized a $15,000 long-term capital loss. What is the amount and character of each carryforward? b. On February 11, they recognized a $2,100 long-term capital gain. On November 3, they recognized a $1.720 long-term capital loss. What is the amount and character of each carryforward? c. On April 2, they recognized a $5,000 long-term capital loss. On September 30, they recognized a $4,800 short-term capital loss. What is the amount and character of each carryforward? d. On January 12, they recognized a $5.600 short-term capital loss. On July 5, they recognized a $1.500 long-term capital gain. What is the amount and character of each carryforward? Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required On January 12, they recognized a $5,600 short-term capital loss. On July 5, they recognized a $1.500 long-term capital gain, What is the amount and character of each carryforward? (Select No carryforward if there is none.) Long-term capital loss carryforward 3 203,2003 Mr. and Mrs. Revel had $206,200 AGI before considering capital gains and losses. Required: a. On May 8, they recognized an $8,900 short-term capital gain On June 25, they recognized a $15,000 long-term capital loss. What is the amount and character of each carryforward? b. On February 11, they recognized a $2,100 long-term capital gain. On November 3, they recognized a $1720 long-term capital loss. What is the amount and character of each carryforward? c. On April 2. they recognized a $5,000 long-term capital loss. On September 30, they recognized a $4,800 short-term capital loss. What is the amount and character of each carryforward? d. On January 12, they recognized a $5,600 short-term capital loss. On July 5, they recognized a $1,500 long-term capital gain. What Is the amount and character of each carryforward? Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required Required D On February 11, they recognized a $2,100 long-term capital gain. On November 3, they recognized a $1,720 long-term capital loss. What is the amount and character of each carryforward? (Select No carryforward if there is none.) Long term capital loss carryforward 206,523 Mr. and Mrs. Revel had $206,200 AGI before considering capital gains and losses. Required: a. On May 8, they recognized an $8.900 short-term capital gain. On June 25, they recognized a $15,000 long-term capital loss. What is the amount and character of each carryforward? b. On February 11, they recognized a $2.100 long-term capital gain On November 3, they recognized a $1,720 long-term capital loss. What is the amount and character of each carryforward? c. On April 2, they recognized a $5,000 long-term capital loss. On September 30, they recognized a $4,800 short-term capital loss. What is the amount and character of each carryforward? d. On January 12, they recognized a $5,600 short-term capital loss. On July 5, they recognized a $1,500 long-term capital gain. What is the amount and character of each carryforward? Answer is not complete. Complete this question by entering your answers in the tabs below. C Required A Required B Required Required D On April 2, they recognized a $5,000 long-term capital loss. On September 30, they recognized a $4,800 short-term capital loss. What is the amount and character of each carryforward? (Select No carryforward if there is none.) Amount 203,200 $ Long-term capital loss carryforward Long-term capital loss carryforward