Answered step by step

Verified Expert Solution

Question

1 Approved Answer

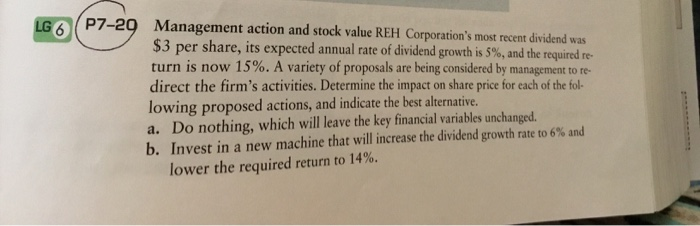

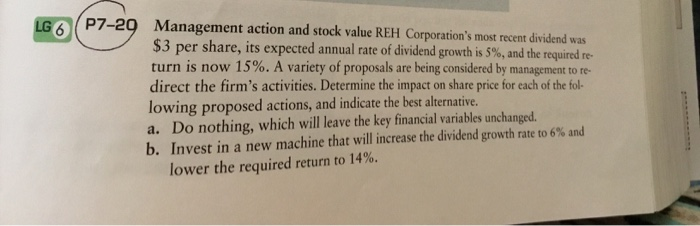

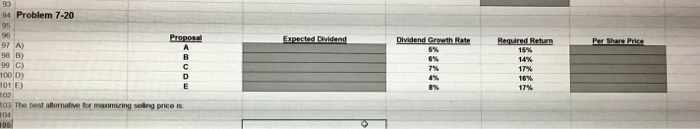

please show work in cells. P7-20 Management action and stock value REH Corporation's $3 per share, its expected annual turn is now 15%. A variety

please show work in cells.

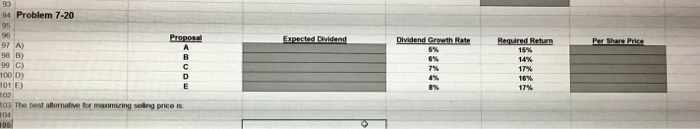

P7-20 Management action and stock value REH Corporation's $3 per share, its expected annual turn is now 15%. A variety of proposals are being considered by management to re- direct the firm's activities. Determine the impact on share price for each of the fol- lowing proposed actions, and indicate the best alternative. a. Do nothing, which will leave the key financial variables unchanged. b. Invest in a new machine that will increase the dividend growth rate to 6% and lower the required return to 14 %. LG6 most recent dividend was rate of dividend growth is 5%, and the required re- 93 94 Problem 7-20 95 96 97 A Proposal Dividend Growth Rate 5 % Expected Dividend Required Return 15 % 14 % Per Share Price 98 B) 99 CI 100 D) t01 EX 02 03 The best alternative for maximizing selng price is 6% 7% C 17% 4% 8% 16% 17 % 104 05

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started