Answered step by step

Verified Expert Solution

Question

1 Approved Answer

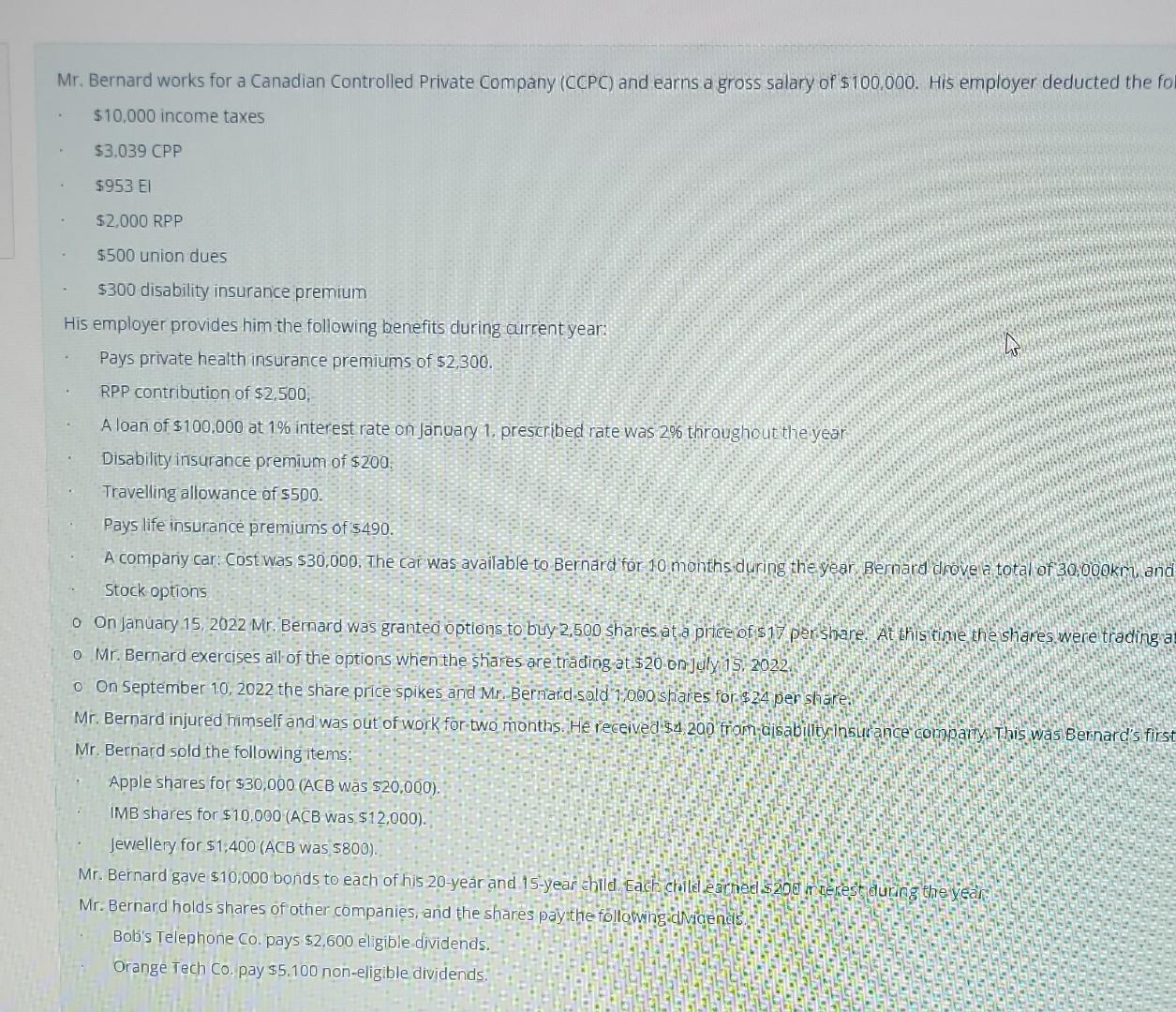

Mr. Bernard works for a Canadian Controlled Private Company (CCPC) and earns a gross salary of $100,000. His employer deducted the fo $10,000 income taxes

Mr. Bernard works for a Canadian Controlled Private Company (CCPC) and earns a gross salary of $100,000. His employer deducted the fo $10,000 income taxes $3,039CPP $953El $2,000RPP $500 union dues $300 disability insurance premium His employer provides him the following benefits during aurrent year: Pays private health insurance premiums of $2,300. RPP contribution of $2,500; A loan of $100,000 at 1% interest rate on Jancary 1. prescribed rate was 20% throughout the year Disability insurance premium of $200 : Travelling allowance of 5500 . Pays life insurance premiums of 5490 . A company car: Cost was $30,000. The car was available to Bernard for 10 months during the year Bernard drovela total of 30,000omm anc Stock options - On January 15, 2022 Mir. Bernard was granted options to buy 2,500 shares at a price of 15 parishare. At thisitime tha shares were trading a Mr. Bernard exercises all- of the options when the stiares are trading at $20 on d dy 5.2022 On september 10,2022 the share price spikes and Mr Bernard-sold 1000 shares for $24 per share: Mr. Bernard injured himself and was out of work for two months He received $4,200 from-Gisability insurance company This was Bernard's firs Mr. Bernard sold the following items: Apple shares for $30,000(ACB ws $20,000). IMB shares for $10,000 (ACB was, $12,000). Jewellery for $1,400 (ACB was $800). Mr. Bernard holds shares of other companies, and the shares paythe fltowing:inigen Bob's Telephone Co. pays $2,600 eligible dividends. Orange Tech Co. pay $5.100 non-eligible dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started