Answered step by step

Verified Expert Solution

Question

1 Approved Answer

What would the completed 1020S and K-1's for John Parsons and George Smith be? John Parsons (123-45-6781) and George Smith (125-45-6782) are 70% and 30%

What would the completed 1020S and K-1's for John Parsons and George Smith be?

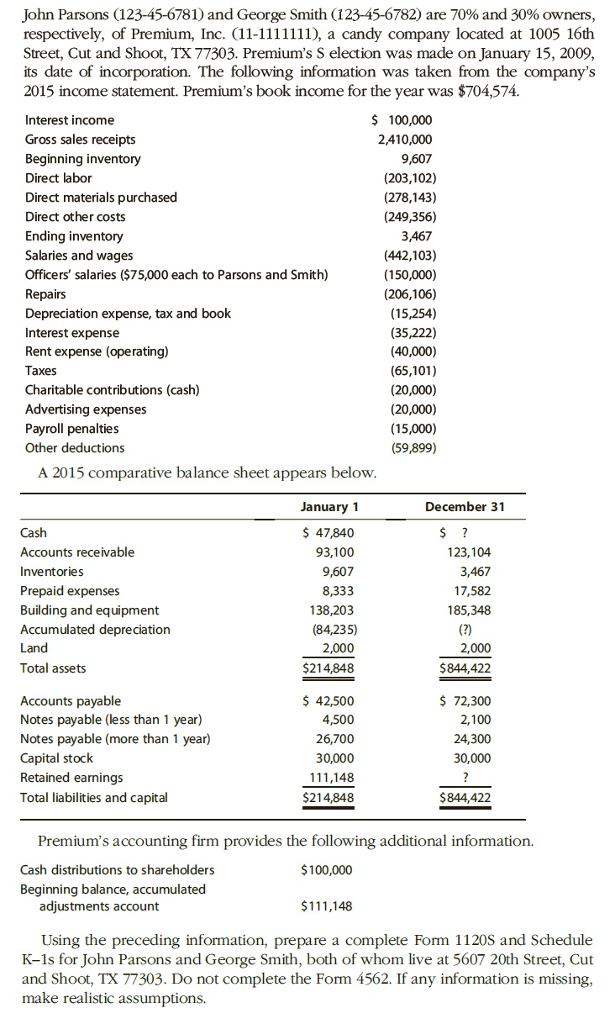

John Parsons (123-45-6781) and George Smith (125-45-6782) are 70% and 30% owners, respectively, of Premium, Inc. (11-1111111), a candy company located at 1005 16th Street, Cut and Shoot, TX 77303- Premium's S election was made on January 15, 2009, its date of incorporation. The following information was taken from the company's 2015 income statement. Premium's book income for the year was $704, 574. A 2015 comparative balance sheet appears below. Premium's accounting firm provides the following additional information. Using the preceding information, prepare a complete Form 1120S and Schedule K-1s for John Parsons and George Smith, both of whom live at 5607 20th Street, Cut and Shoot, TX 77303. Do not complete the Form 4562. If any information is missing, make realistic assumptionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started