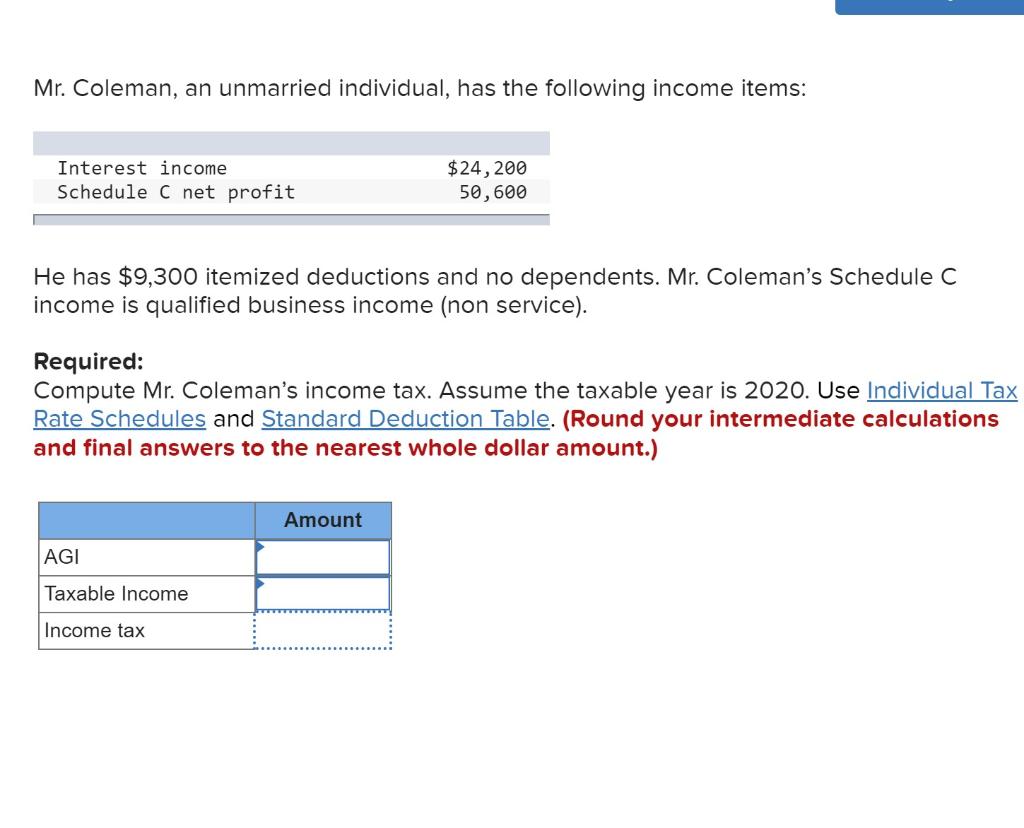

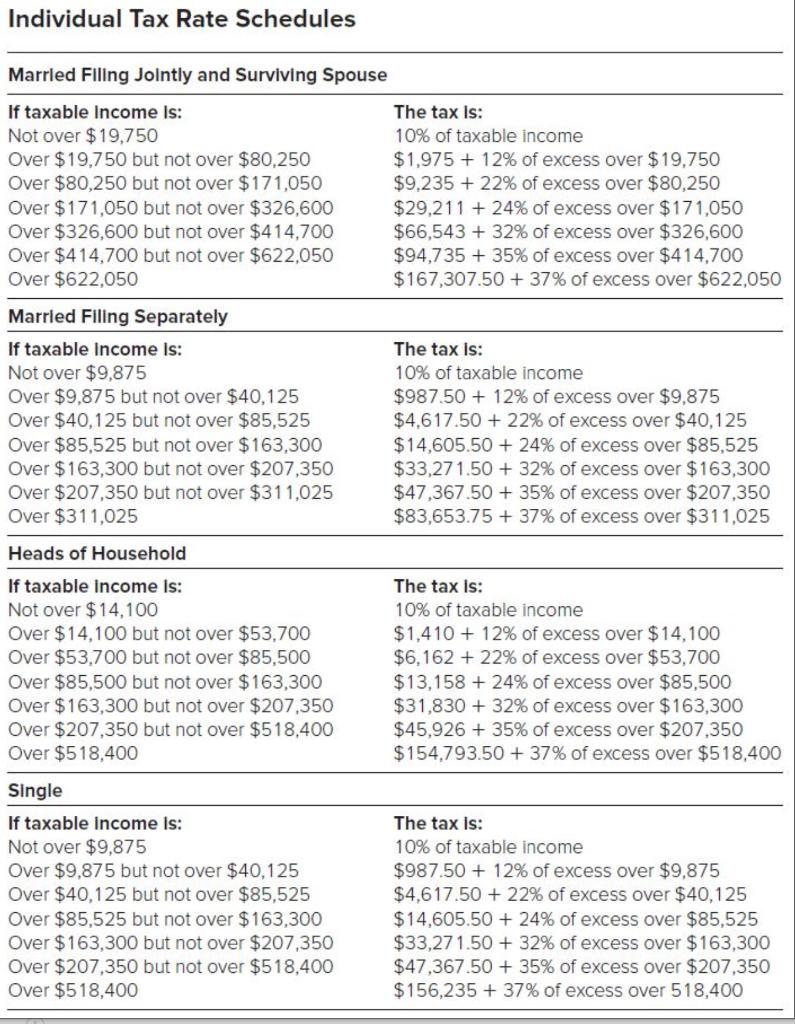

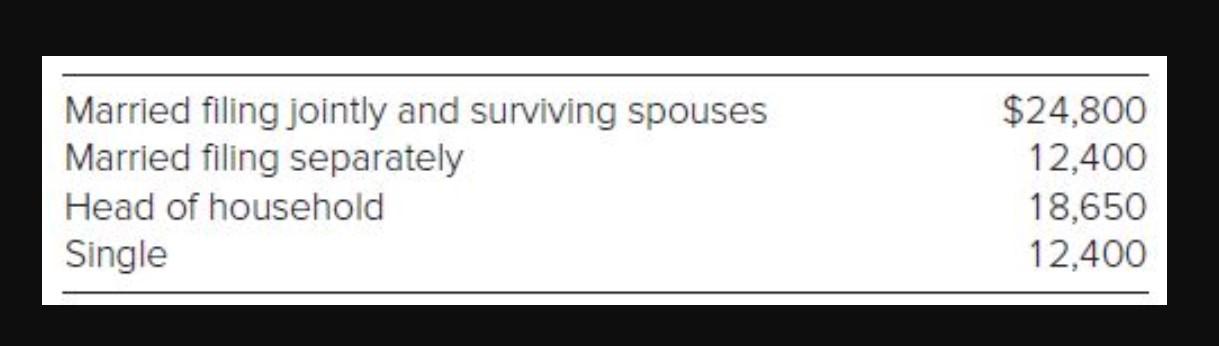

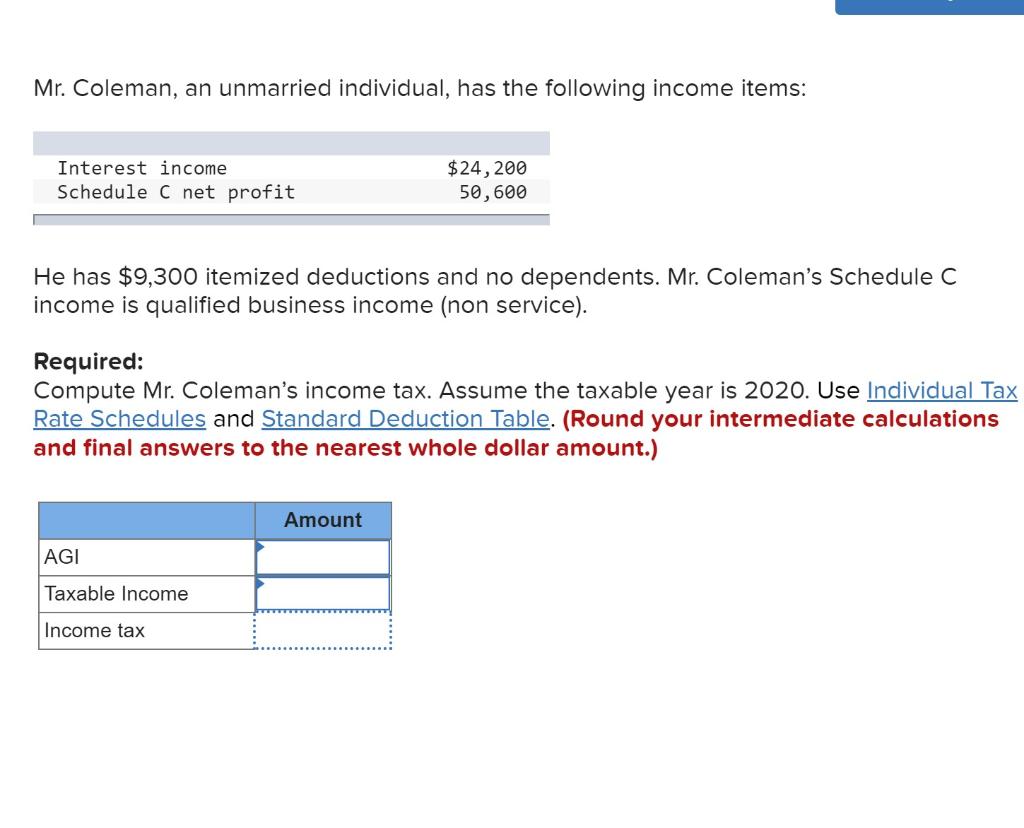

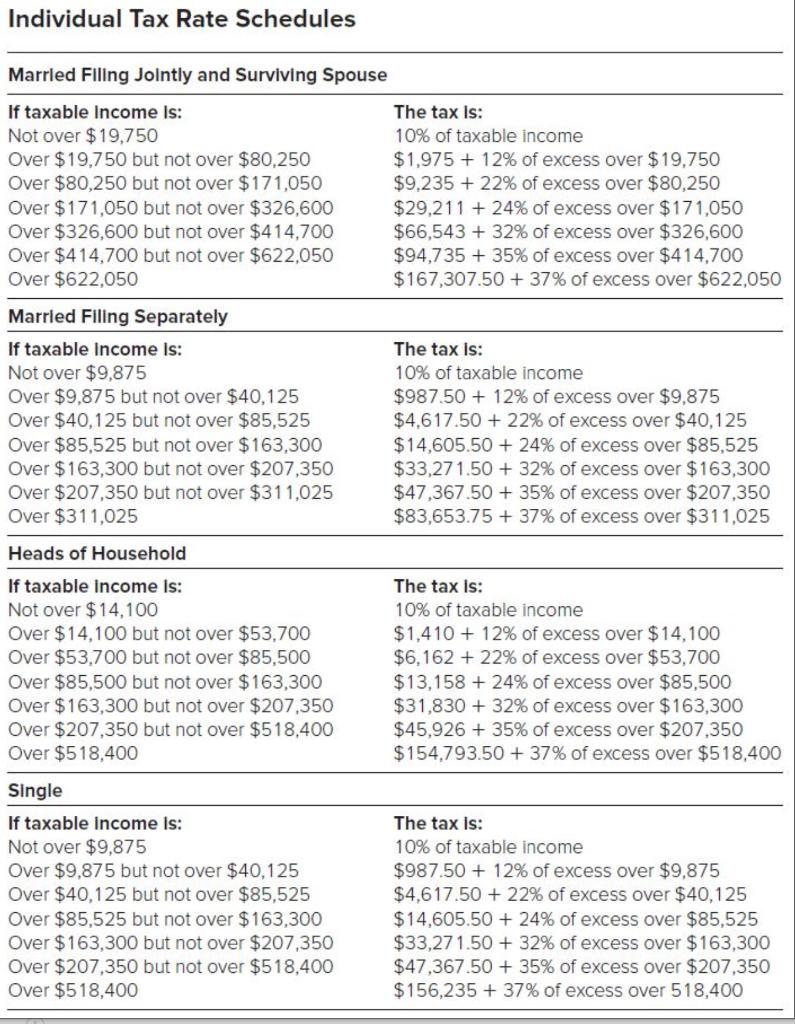

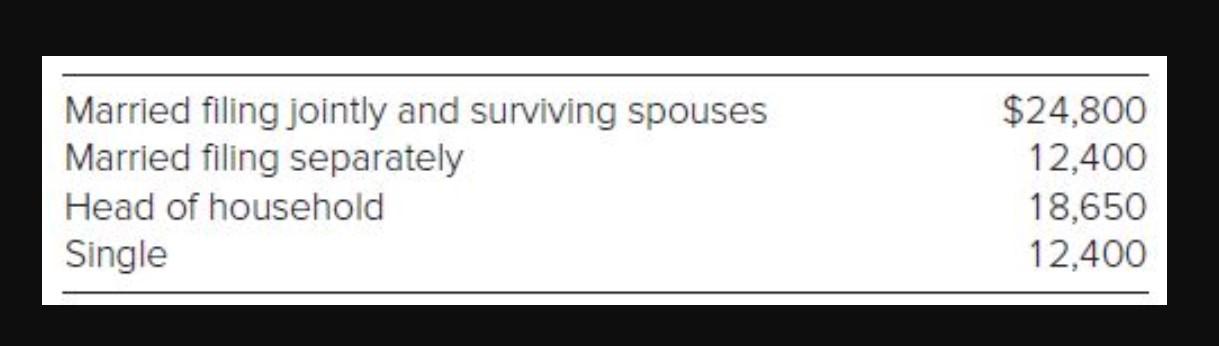

Mr. Coleman, an unmarried individual, has the following income items: Interest income Schedule C net profit $24, 200 50,600 He has $9,300 itemized deductions and no dependents. Mr. Coleman's Schedule C income is qualified business income (non service). Required: Compute Mr. Coleman's income tax. Assume the taxable year is 2020. Use Individual Tax Rate Schedules and Standard Deduction Table. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) Amount AGI Taxable Income Income tax Individual Tax Rate Schedules Married Filing Jointly and Surviving Spouse The tax is: 10% of taxable income $1,975 + 12% of excess over $19,750 $9,235 + 22% of excess over $80,250 $29,211 + 24% of excess over $171,050 $66,543 + 32% of excess over $326,600 $94,735 + 35% of excess over $414,700 $167,307.50 + 37% of excess over $622,050 If taxable income is: Not over $19,750 Over $19,750 but not over $80,250 Over $80,250 but not over $171,050 Over $171,050 but not over $326,600 Over $326,600 but not over $414,700 Over $414,700 but not over $622,050 Over $622,050 Married Filing Separately If taxable income is: Not over $9,875 Over $9,875 but not over $40,125 Over $40,125 but not over $85,525 Over $85,525 but not over $163,300 Over $163,300 but not over $207,350 Over $207,350 but not over $311,025 Over $311,025 The tax is: 10% of taxable income $987.50 + 12% of excess over $9,875 $4,617.50 + 22% of excess over $40,125 $14,605.50 + 24% of excess over $85,525 $33,271.50 + 32% of excess over $163,300 $47,367.50 + 35% of excess over $207,350 $83,653.75 + 37% of excess over $311,025 Heads of Household If taxable income is: Not over $14,100 Over $14,100 but not over $53,700 Over $53,700 but not over $85,500 Over $85,500 but not over $163,300 Over $163,300 but not over $207,350 Over $207,350 but not over $518,400 Over $518,400 The tax is: 10% of taxable income $1,410 + 12% of excess over $14,100 $6,162 + 22% of excess over $53,700 $13,158 + 24% of excess over $85,500 $31,830 + 32% of excess over $163,300 $45,926 + 35% of excess over $207,350 $154,793.50 + 37% of excess over $518,400 Single If taxable income is: Not over $9,875 Over $9,875 but not over $40,125 Over $40,125 but not over $85,525 Over $85,525 but not over $163,300 Over $163,300 but not over $207,350 Over $207,350 but not over $518,400 Over $518,400 The tax is: 10% of taxable income $987.50 + 12% of excess over $9,875 $4,617.50 + 22% of excess over $40,125 $14,605.50 + 24% of excess over $85,525 $33,271.50 + 32% of excess over $163,300 $47,367.50 + 35% of excess over $207,350 $156,235 + 37% of excess over 518,400 Married filing jointly and surviving spouses Married filing separately Head of household Single $24.800 12,400 18,650 12,400